Everyday, 99.co takes a piece of property jargon and demystifies it. Today, we’re looking at the Rest of Central Region (RCR), the sandwiched area of Singapore property.

What is the RCR?

While HDB flats are commonly classified by their individual HDB estates, private properties fall under three regions:

- Core Central Region (CCR)

- Rest of Central Region (RCR)

- Outside of Central Region (OCR)

According to the Urban Redevelopment Authority (URA), the Rest of Central Region (RCR) refers to areas within the Central Region outside postal districts 9, 10, 11, Downtown Core and Sentosa.

To give you more detail, the RCR consists of Districts 3, 8 and 12, as well as certain areas of 1, 2, 4, 5, 6, 7, 13, 14, 15 and 20.

| District | Area |

| 1 (Part) | Boat Quay / Raffles Place / Marina |

| 2 (Part) | Chinatown / Tanjong Pagar |

| 3 | Alexandra / Commonwealth |

| 4 (Part) | Harbourfront / Telok Blangah |

| 5 (Part) | Buona Vista / West Coast / Clementi |

| 6 (Part) | City Hall / Clarke Quay |

| 7 (Part) | Beach Road / Bugis / Rochor |

| 8 | Farrer Park / Serangoon Rd |

| 12 | Balestier / Toa Payoh |

| 13 (Part) | Macpherson / Potong Pasir |

| 14 (Part) | Eunos / Geylang / Paya Lebar |

| 15 (Part) | East Coast / Marine Parade |

| 20 (Part) | Ang Mo Kio / Bishan / Thomson |

How much do Rest of Central Region properties cost?

Sandwiched between the OCR and CCR properties, RCR properties are considered mid-tier when it comes to pricing.

It nestles between the more affordable mass-market properties in the OCR and the higher-end luxury condos in the CCR, with an average price psf of 85.54% appreciation over 15 years.

However, there’s a narrowing gap in prices between CCR and RCR properties, which we cover in-depth in this article.

Average property prices in the RCR have increased by 39.97% over the past decade, from S$1.38 million (S$1,330 psf) in 2012 to S$1.93 million (S$1,886 psf) in 2022.

There was a minor drop of 0.31% in 2019, but the RCR market made a swift recovery of 25.87% between 2020 to 2022.

The recovery may be due to border restrictions lifting after the pandemic, allowing more foreign property investors to resume property purchases in Singapore.

Decentralisation

A case for the increasing property prices in the RCR can be attributed to decentralisation. The government’s active focus on developing separate business hubs such as the Jurong Lake District (JLD) into Singapore’s second CBD has led more people to consider residing outside the CCR.

With the development of JLD slated to be completed by 2040, private properties in the western region have already experienced a 40% boom in prices.

Paya Lebar Central and the Bishan Sub-Regional Centre are also undergoing a significant transformation.

With more businesses moving their offices out of the CBD into other precincts, there’ll definitely be a knock-on effect on housing prices as employees secure jobs in areas outside the CBD.

Another area undergoing a facelift is the Greater Southern Waterfront (GSW), with Keppel Golf Club being redeveloped into approximately 3,000 private and 6,000 public residential homes.

Improved infrastructure

More are choosing to reside in the RCR over the CCR as Singapore’s infrastructure and connectivity continue to improve and evolve.

With the Land Transport Authority (LTA) ramping up more connections via rail, bus and road, it drastically reduces the daily commuting time for people to travel to work.

LTA’s rail expansion projects aim to connect eight in 10 households within 10 minutes of a train station by 2030.

MRT lines such as the fully-underground, 33-station Circle Line (CCL) serve to connect the north, east and west regions of Singapore.

When Stage 6 of the CCL is completed by 2026, commuters will be able to travel from Harbourfront to Marina Bay in three stops, bypassing the busy interchanges of City Hall and Raffles Place.

Future stations are also in the works, connecting the Bukit Brown MRT station between Caldecott and Botanic Gardens stations.

Once more MRT lines have been established, and more of the workforce can get to their offices within a couple of stops, there’s no reason to pay exorbitant prices to continue living within the CCR anymore.

RCR vs CCR

It’s well known that living anywhere outside the CCR is more affordable than staying within the city centre itself.

If you’re wondering whether you should spring the extra cash and purchase a condo in the CCR, you might want to consider why you should pick the RCR instead and get more bang for your buck.

1-bedder

Looking at 1-bedroom condos in the RCR and CCR over the past five years, there’s been a 14.63% increase in average price psf for 1-bedder units in the RCR versus a 13.01% increase in the CCR.

Currently, you would be paying S$1,921 psf for a 1-bedder unit in the RCR and S$2,415 psf for a similarly-sized unit in the CCR.

We haven’t taken into consideration the condo’s facilities, but seeing as most condos come with pretty standard facilities, you can find a similar development in either region.

2-bedder and 3-bedder units fare similarly, with 3-bedroom units fetching a slightly lower price psf than 2-bedroom units.

A deeper analysis of condo prices in the RCR has been done, where we examine whether freehold condos perform better than leasehold condos. Check out that article here.

Rental in the RCR

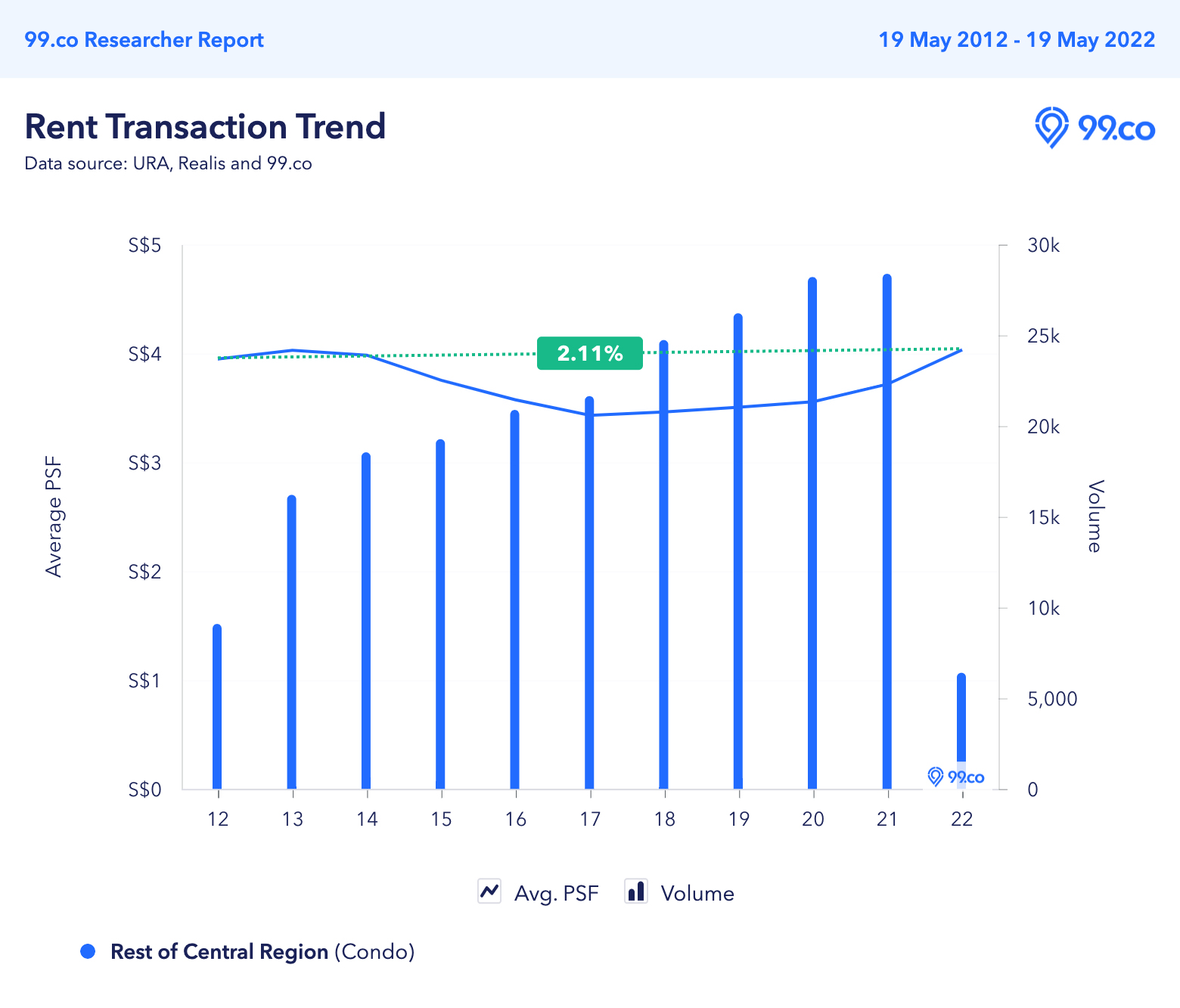

Here’s a look at the rental chart for condos in the RCR over the last ten years.

Although it’s remained pretty flat, there’s been a slow year on year growth in rental prices in the RCR since 2017. The current average price psf is back to 2013 levels, at S$4.03 psf.

Although it’s remained pretty flat, there’s been a slow year on year growth in rental prices in the RCR since 2017. The current average price psf is back to 2013 levels, at S$4.03 psf.

| Average price (S$) psf | |||||||||||

| 2011 | 2013 | 2014 | 2015 | 2016 | 2017 | 2018 | 2019 | 2020 | 2021 | 2022 | |

| RCR | S$3.95 | S$4.03 | S$3.98 | S$3.75 | S$3.57 | S$3.43 | S$3.46 | S$3.51 | S$3.56 | S$3.72 | S$4.03 |

With the increased number of MRT stations and heightened connectivity, this region is becoming increasingly popular as a rental option for those choosing homes in the RCR zone over the CCR zone.

Homes in the RCR strike the perfect balance of being affordable yet still relatively near the CBD.

In Q1 2022, prices of non-landed properties in the RCR decreased by 2.7%, while rental jumped by 4.7%.

This presents a win-win situation where you can purchase an RCR property for lesser while netting a higher rental yield.

Conclusion

Still not convinced why living in the RCR is great? Here’s a roundup of reasons.

- Cheaper rental. Condos in the CCR are at least 15% more expensive than those in the RCR. With extensive decentralisation efforts underway, such as new MRT lines and a shorter commute, you can enjoy living relatively near the CBD without paying through the nose.

- More value. You can get a larger living space in the RCR for the same price of a condo in the CCR.

- Cheaper amenities. With companies moving out of the CBD into the RCR, more retail options at a lower price point will also become available for residents living in the area.

What piece of property jargon mystifies you? Let us know in the comments section below or on our Facebook post.

If you found this article helpful, check out Property Jargon of the day: Core Central Region and What’s narrowing the gap between CCR and RCR prices?

Looking for a property? Find the home of your dreams today on Singapore’s fastest-growing property portal 99.co! If you would like to estimate the potential value of your property, check out 99.co’s Property Value Tool for free. Also, don’t forget to join our Facebook community page or Telegram chat group! Meanwhile, if you have an interesting property-related story to share with us, drop us a message here — and we’ll review it and get back to you.

The post Property Jargon of the Day: Rest of Central Region (RCR) appeared first on 99.co.