Recently, the issue of resale levy was thrown into the spotlight. Earlier in May, TODAY had published an opinion letter by a reader urging the HDB to relook at the resale levy.

He explained that he has been living in his HDB flat for nearly 40 years, and is interested in buying another flat. But as a second-timer, he would have to pay the resale levy.

He argued that given the decaying lease of his flat, his net sales proceeds would be lower. On top of that, the resale levy would eat into it. Hence, he urged that HDB consider reviewing the resale levy, by either reducing or waiving it for second-timers who intend to sell the flat after living in it for years.

This letter sparked a lot of debate online, with some even writing to TODAY. Some have sided with the reader, while others argued that he should not enjoy more subsidies.

What is the resale levy?

Essentially, the resale levy is a fee you’d have to pay if you buy a second subsidised flat.

The flat is considered a subsidised flat if it’s one of the following:

- A flat bought directly from HDB (eg. BTO, SBF or open booking)

- A resale flat bought with the CPF housing grant

- A DBSS flat bought from a developer

- An EC bought from a developer

- Or enjoyed other forms of housing subsidy, eg. from Selective En bloc Redevelopment Scheme (SERS), privatisation of HUDC estate, etc.

According to HDB, the purpose of the resale levy is to reduce the amount of subsidy a buyer would receive on their second subsidised flat, given that they’ve already received a subsidy on their first flat. This helps to ensure a fair distribution of subsidies.

When to pay for it depends on when you sell the first subsidised flat. If you sell it after collecting the keys to your second subsidised flat, the resale levy would be deducted from the net proceeds of the sale of the first flat.

Otherwise, the resale levy is paid when you get the keys to your second flat.

How much to pay for the resale levy depends on the flat type of your first subsidised flat.

| Flat type of first subsidised flat | Resale levy amount | |

| Households | Recipient of CPF Housing Grant (Singles) | |

| 2-room/ 2-room Flexi | S$15,000 | S$7,500 |

| 3-room | S$30,000 | S$15,000 |

| 4-room | S$40,000 | S$20,000 |

| 5-room | S$45,000 | S$22,500 |

| Executive flat | S$50,000 | S$25,000 |

| EC | S$55,000 | NA |

So if you’re not buying a subsidised flat, for instance, buying a resale flat without any grant, you don’t have to pay the resale levy.

Why the resale levy shouldn’t be waived

There’s some truth to the first opinion writer’s argument. As older flats depreciate and suffer lease decay, they will fetch a lower selling price. This also means that if you plan to sell it in future, the later you sell it, the more likely you’ll receive lower sale proceeds.

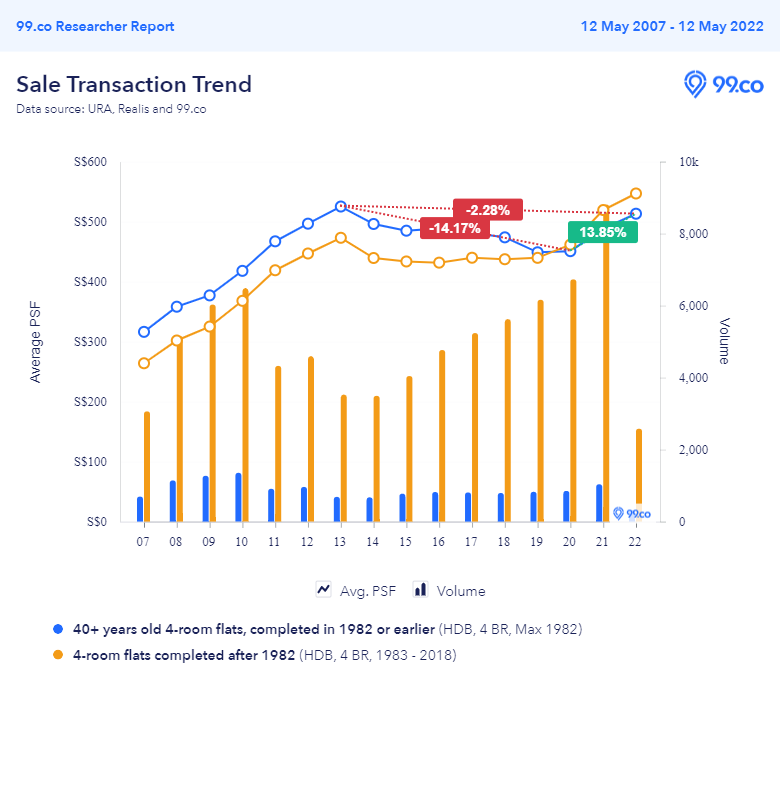

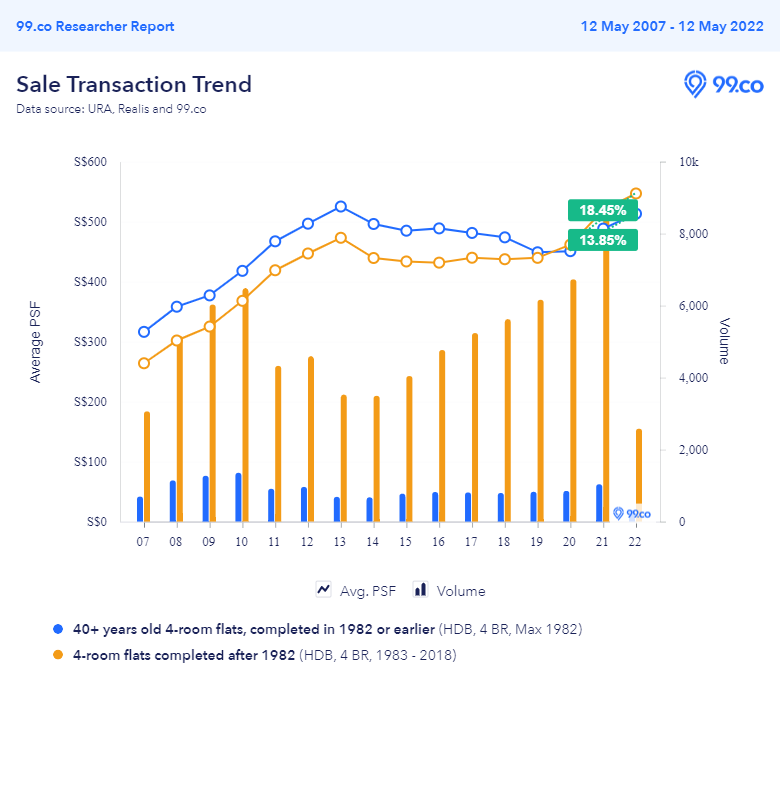

Looking at the resale transactions in the past 15 years for 4-room HDB flats at least 40 years old (completed in 1982 or earlier), the average price psf has decreased from its peak in 2013. More specifically, it has dropped by 14.17% from 2013 to 2020.

And while the average price psf has since increased by 13.85% between 2020 and 2022, this is mostly due to the robust resale property market. Despite the increase in the past two years, the average price psf for these flats is 2.28% below the peak in 2013.

In comparison, newer 4-room flats less than 40 years old (completed from 1983 onwards) have been appreciating faster. After a drop in prices between 2014 and 2018, prices started increasing again for these newer flats from 2019 onwards. And in the red hot property market for the last two years, these flats have been recording higher price psf than the older flats.

As of writing, the price psf for newer 4-room flats is S$547, higher than the S$513 psf for the older flats. Prices have since increased by 18.45% for newer flats in the past two years, compared to the 13.85% for older flats.

So it’s valid to say that the sales proceeds will be lower, given the lower selling price that an older flat can fetch and the resale levy that would eat into the proceeds.

What we disagree with is the suggestion that the resale levy should be waived. After all, this is the public housing we’re talking about. Subsidised flats should be for those who need help to afford a home. It’s also why there’s an income ceiling for BTO flats and CPF housing grants, which is to help those who don’t earn as much to afford a home.

Those buying a subsidised flat the second time have already enjoyed a subsidy the first time around. So it’s only fair that they get fewer subsidies the second time around.

These subsidies, in the form of the flats sold by HDB and grants, are a limited resource meant for those who need help more. So to suggest waiving off the resale levy would mean depriving those who need them of more of these subsidies.

Why the resale levy shouldn’t be reduced for older flats either

Due to the lease decay, older flats generally fetch a lower price psf than the newer flats. This is why some people argue that the resale levy should be reduced instead so that it won’t eat too much into the net sale proceeds.

On the other hand, we have to keep in mind that these flats were sold at a way cheaper price 40 plus years ago. For instance, 4-room flats had an average price of around S$80,000 in the 1980s. Prices of these flats have since risen not only due to capital appreciation but also to inflation and developments in the area.

And while these older flats may have started depreciating, especially when compared to the newer flats, the potential selling price is still way higher than the initial purchase price. In fact, 4-room flats at least 40 years old currently have an average transacted price of S$507,627.

This price is actually higher than the new 4-room flats in non-mature estates launched in the Feb 2022 BTO exercise. In the non-mature estates, these flats had median prices of around S$350,000 in Tengah and around S$320,000 in Yishun.

On the other hand, the median prices of 4-room flats in the mature estates of Geylang and Kallang/Whampoa were higher at S$605,000 and S$581,500. While these prices are higher than the potential selling price of a 40-plus-year-old flat, owners could still use the sale proceeds to cover the main bulk of the purchase price of the newer flat.

Given that the potential selling price would be higher than the initial purchase price, as well as inflation that’s driving this increase, it wouldn’t make sense to reduce the subsidy clawback.

What are your thoughts on the resale levy? Should it be waived or reduced? Let us know in the comments section below or on our Facebook post.

If you found this article helpful, 99.co recommends What an HDB second-timer must know before deciding to sell and 5 scenarios that can disqualify you from getting HDB BTO first-timer applicant benefits.

Looking for a property? Find the home of your dreams today on Singapore’s fastest-growing property portal 99.co! If you would like to estimate the potential value of your property, check out 99.co’s Property Value Tool for free. Also, don’t forget to join our Facebook community page or Telegram chat group! Meanwhile, if you have an interesting property-related story to share with us, drop us a message here — and we’ll review it and get back to you.

The post Here’s why the resale levy shouldn’t be waived or reduced appeared first on 99.co.