A few months ago, someone asked if it’s possible to get a new housing loan or refinance his existing home loan if he’s:

a) Retired, or

b) Living off passive income (ie. unemployed)

By passive income, he means adopting the FIRE lifestyle.

FIRE stands for Financial Independence, Retire Early, which is a movement by individuals to save, invest and retire much earlier than traditional retirement plans.

For example, a FIRE proponent usually plans to retire much earlier than Singapore’s CPF withdrawal age (55), retirement age (currently 62) or CPF monthly payout age (65).

Note that MOM will be revising the retirement/re-employment ages from the current 62/68 to 63/69 on 1 July 2022, with the option to further revise them to 65/70 by 2030.

So, all the more reason to have a backup FIRE plan, right?

The term, which originated from the 1992 book Your Money or Your Life by Vicki Robin and Joe Dominguez, means you’re able to save (usually up to 70% of your annual income), and invest in interest-bearing instruments while being extremely calculative over every expense until you reach your goal.

It usually means living off a small budget daily and being as frugal as possible until the plan is complete. So no IMAX screenings, fancy steak-and-wine restaurants or frequent holidays, but more economy rice (chap chye peng), JB-shopping and riding the bicycle until then.

This “plan”, which has become a popular thing among a select group of millennials, usually means quitting their jobs earlier and living off small withdrawals from their investments and savings portfolios decades before they’re 65.

But going back to the question, what if the individual suddenly decides to apply for a BTO, buy a resale home or needs to refinance an existing one? Will his unemployed status automatically cancel him out from being eligible for a loan?

The short answer – it depends on the mortgage specialist.

HDB Loan

While you can apply for a BTO or buy an HDB resale flat even if you’re unemployed (as long as you have sufficient cash and/or CPF savings), you will not be eligible for an HDB loan or housing grants if you do not have a steady income to show.

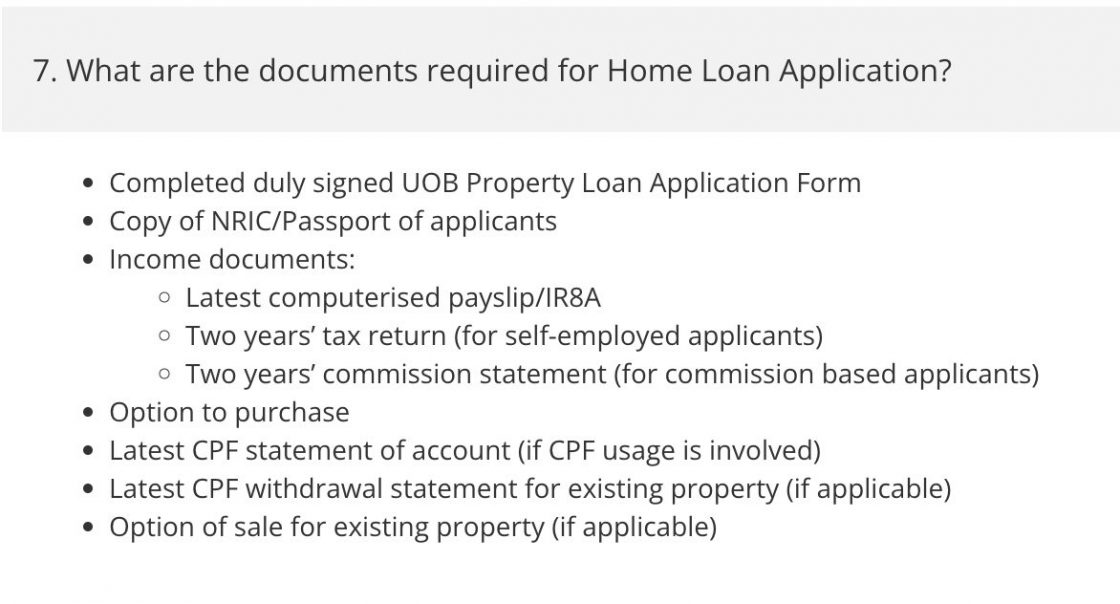

Depending on your nature of employment (eg. employed, self-employed, commission-based, etc.), this “proof” involves submitting Notice of Income Tax Assessments, computerised payslips and CPF statements, usually for the past 12 months.

You’ll also need to be gainfully employed during the month of application and until the Housing Loan Eligibility (HLE) Letter is approved and the loan is disbursed.

You’ll also need to take note of the Mortgage Servicing Ratio (MSR), which applies to housing loans for HDB flats and non-privatised executive condominiums. MSR refers to a borrower’s gross monthly income towards repaying all property loans and is capped at 30%.

If you’re applying as a student or National Serviceman (NSman), you can apply to have your no-income status “postponed” till the key collection period (Deferred Income Assessment) but you will first need to fulfil the following eligibility criteria:

- You are applying with your significant other as a couple

- One of you has to be at least 30 years old or below

- You are already married or applying under the Fiancé/ Fiancée Scheme

- One of you has to be a first-timer applicant

- You are applying as full-time students or National Servicemen (NSF); and/ or

- You have completed full-time studies or National Service (NS) within the last 12 months prior to the flat application

Still, this also means you’ll need to show proof of past employment by the time of income assessment.

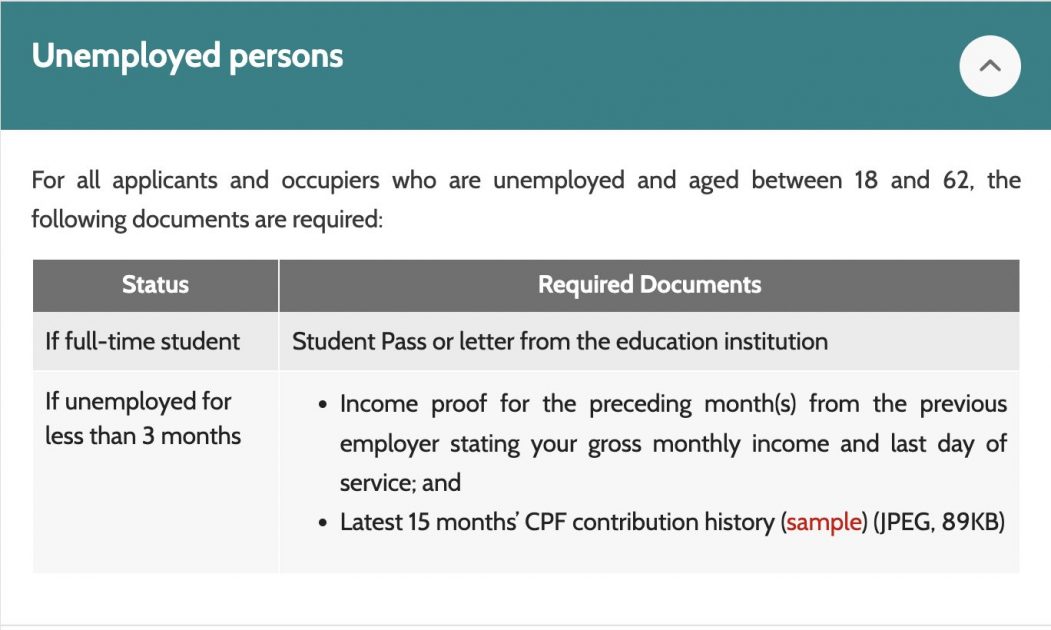

If you’re only recently unemployed (eg. you resigned or have been let go) and aged between 18 and 62, you can still show proof of previous employment by submitting past salary slips and your CPF statement showing contributions for the past 15 months.

So, if you’re a post-FIRE or retired homebuyer in need of a home loan from HDB, and you’ve been unemployed for some time (more than 3 months), chances are you will not be eligible for a home loan or housing grants.

Bank Loan

When it comes to securing a home loan or refinancing through a bank, some post-FIRE or retired homebuyers have managed to get them approved.

Chances are higher if you’re an accredited investor or have priority banking status with the bank. This means investing a minimum (usually S$200k-S$350k) with the financial institution.

Others shared that having substantial cash from years of dedicated savings and pledging them in a fixed deposit for say, 4 years (at not-so-great interest) may help.

Even so, the loan quantum the bank may offer could be 50 to 60% lower compared to someone who is gainfully employed and able to show a steady annual income stream.

Under MAS rules, there’s also the Total Debt Servicing Ratio (TDSR), where your monthly debt cannot exceed 55% of your monthly income. If the sum total of your monthly debt (car loan, student loan, unsecured credit card debt, etc.) exceeds 55% of your monthly income, you will most likely not be able to secure the bank loan.

In the case of post-FIRE home buyers or retirees, this “monthly income” could likely be your monthly rental income, commissions, regular interest or dividend payouts (from principal-guaranteed financial savings) and other forms of secured investments.

If you own several properties, including overseas ones, you may also have to submit your rental agreements with your tenants (minimum 6-month contracts – the higher the better) to the bank, at least to assure it of this steady stream of income. This may be reviewed again once the contracts expire or are renewed.

If you own several properties, including overseas ones, you may also have to submit your rental agreements with your tenants (minimum 6-month contracts – the higher the better) to the bank, at least to assure it of this steady stream of income. This may be reviewed again once the contracts expire or are renewed.

Some banks may require you to submit your NOA, or Notice of Assessment from IRAS, as proof of declared income stability. You may also need to submit your Credit Score from the Credit Bureau of Singapore – which assesses your financial ability to repay your loans.

Several may also accept pledged assets that could serve as collateral for the loan.

More importantly, when applying for or refinancing a home loan from a bank, pay critical attention to the monthly interest rate. With the recent interest rate hike from the US, it is far more prudent to go with a fixed-rate loan.

–

Are you a post-FIRE home buyer or retiree stuck in a similar predicament? Let us know in the comments section below or on our Facebook post.

If you found this article helpful, check out Singaporeans are Ditching Their Flats Earlier, with Good Reason and Can Downsizing Your Home Give You $1,379 Per Month After Retirement?

Looking for a property? Find the home of your dreams today on Singapore’s fastest-growing property portal 99.co! If you would like to estimate the potential value of your property, check out 99.co’s Property Value Tool for free. Also, don’t forget to join our Facebook community page or Telegram chat group! Meanwhile, if you have an interesting property-related story to share with us, drop us a message here — and we’ll review it and get back to you.

The post Post-FIRE homebuyer unable to secure home loan or refinance because he’s only earning passive income appeared first on 99.co.