Those seeking property purchase opportunities in the Core Central Region (CCR) can rejoice – the price gap for new private homes in the prime districts and those outside of them continues to narrow.

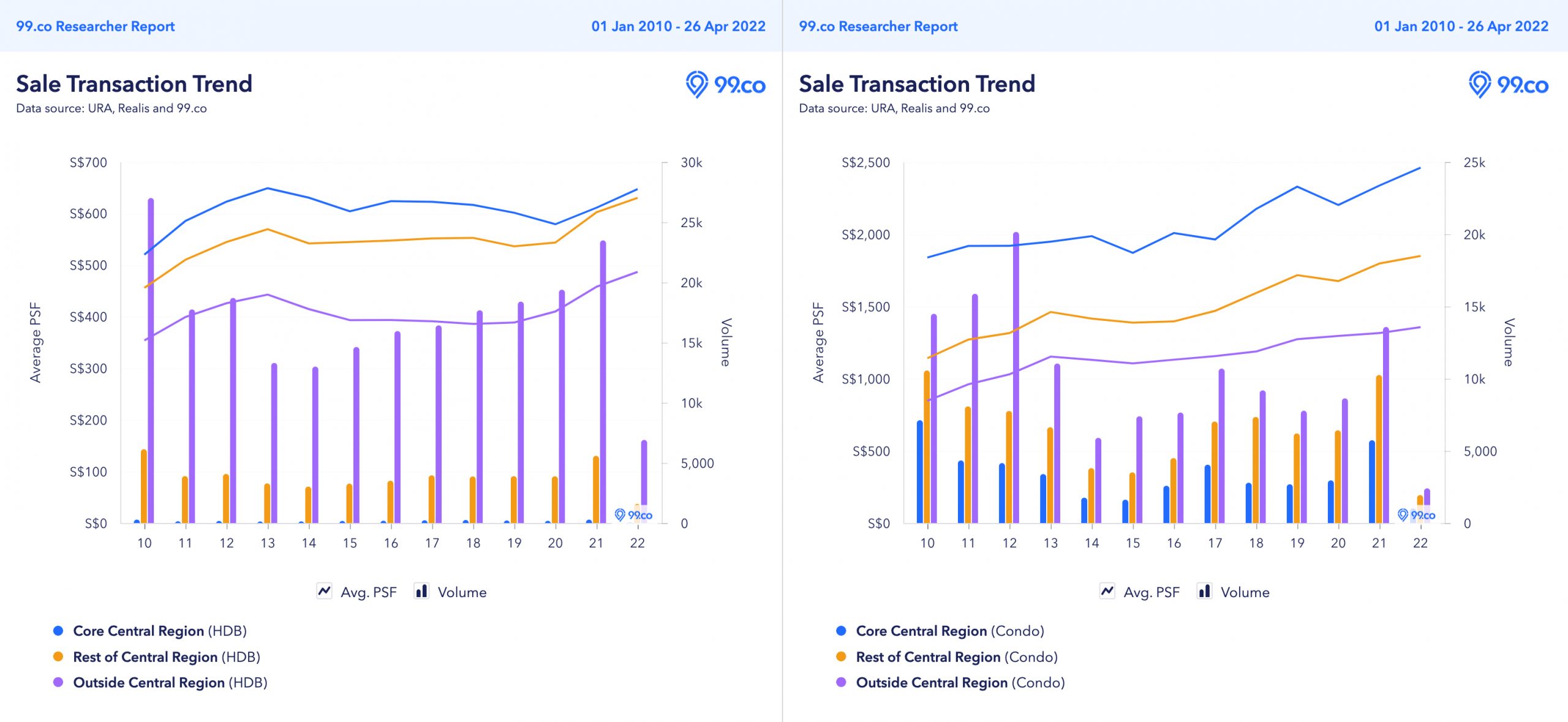

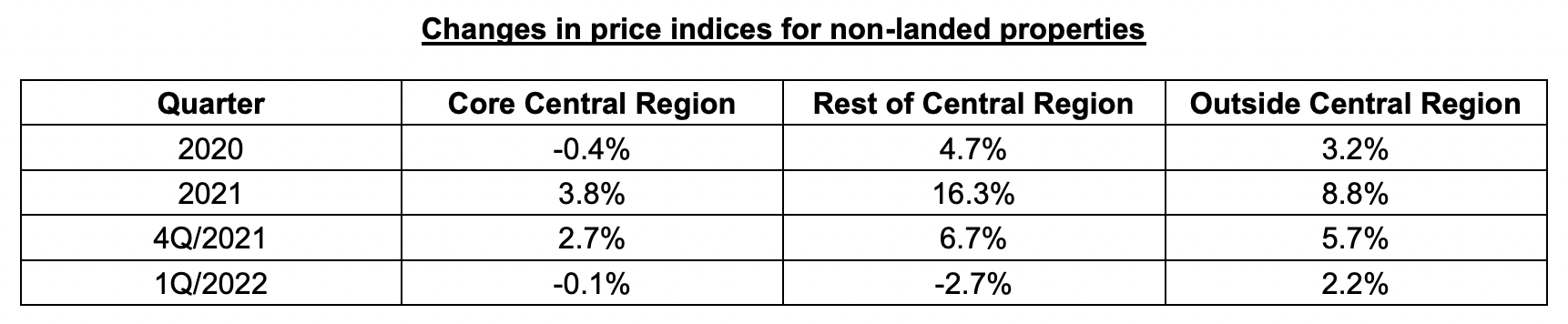

In 2021, the prices of CCR homes rose by 3.8%, paling against the 16.3% increase in RCR homes and the 8.8% increase in OCR homes.

According to URA’s flash estimate of the price index for Q1 2022, prices of non-landed properties declined by 0.3% quarter-on-quarter, from a 5.3% gain in Q4 2021.

The drop came from the prices of homes in the CCR falling by 0.1% and prices in the Rest of Central Region (RCR) retreating by 2.7%, giving back some gains from the 6.7% increase in the preceding quarter.

However, the Outside of Central Region (OCR) prices increased by 2.2%, adding to the 5.7% hike in the previous quarter. This can be attributed to the owner-occupier demand from HDB resale market, which increased by 2.4% in Q1 2022.

Historically, the OCR has maintained a lower average price psf compared to property in the CCR and RCR.

In the condo market, the gap between OCR and CCR is rapidly narrowing. In 2017, it stood at 59.3%. Fast forward to 2022, it currently stands at 33%, a whopping 26.3% decrease.

It reflects the total unsold stock, with OCR having just 705 units of unsold inventory – the fewest number of units among the three market segments since Q4 2020.

| Condos | Q4 2021 | Q1 2022 |

| CCR | 1,671 | 1,490 |

| RCR | 1,544 | 1,009 |

| OCR | 1,051 | 705 |

For Q1 2022, the CCR makes up for the most significant portion of unsold private residential units, representing 46.5% of all unsold units over all regions.

When comparing the difference in average price psf between RCR and CCR condos, the price gap isn’t narrowing as aggressively as between the OCR and CCR condos. There’s still room for it to close up – there was a difference of 36.6% in 2018, narrowing by 6.5 points to 30.1% in 2021.

Development launches and take-up

613 uncompleted private residential projects (excluding ECs) were launched for sale in Q1 2022, a 73% decrease from the 2,275 units in Q4 2021.

Most of the units were launched in the RCR region with 281 units for sale, followed by 187 units in the OCR and 145 units in the CCR. This is a huge drop from the 1,372 units launched in the RCR in Q4 2021.

Developers managed to sell 1,825 private residential units (excluding executive condos) in the first quarter of 2022, a 39.5% decrease from the 3,018 units sold the previous quarter and 47.8% lower year-on-year.

There were no ECs launched in Q1 2022 and Q4 2021, while 131 and 538 ECs were sold in Q1 2022 and Q4 2021, respectively.

Reasons for the narrowing price gap

There’s a confluence of factors that may give some insight to why more are looking towards the RCR and OCR instead of choosing to purchase property within the CCR.

1. Higher taxes and pandemic restrictions

When the revised additional buyer’s stamp duty (ABSD) rates kicked in on 16 December, it dampened those who were hoping to buy private residential property.

It wasn’t just the recent ABSD hike that killed the voracious appetite of those snapping up private property in Singapore. ABSD was first introduced in 2011 at 10%, which increased to 15% by 2013 and 20% in 2018.

Foreign buyers are hit especially hard by the rate hike to 30%. Foreigners generally prefer living in the central region, making up 9% of CCR transactions in Q2 2021.

When Singapore imposed tight border controls at the start of the pandemic, there were markedly fewer home sales in the private property sector. It fell to a 17-year low, with just 742 properties sold to foreigners – the lowest figure since 2003, according to real estate consultancy firms ERA Realty Network and OrangeTee & Tie.

The deadly combination of higher ABSD plus a worldwide lockdown is a one-two combo that muted the uptake in CCR units over the past years.

On the other hand, owner-occupiers, who make up the majority of homebuyers, are generally unaffected by ABSD.

2. Low supply (Property curbs) and construction delays

The supply of private non-landed homes remained low due to a shortage of major launches during the quarter.

With the pandemic putting a chokehold on manpower and construction materials, developers faced high material costs and significant delays in completing housing projects according to projected timelines.

Q1 2022 experienced a sharp decline in private units launched (79.1% fewer units than in Q1 2021). All three regions had a quarter-on-quarter decrease, with 79.5% in the RCR, followed by 74.4% in the CCR and 44.1% in the OCR.

It remains to see whether this trend will be echoed through the rest of 2022.

Market sales performance could improve in the upcoming quarter with major projects being launched, like the 407-unit Piccadilly Grand and Enchante in the prime district of Novena.

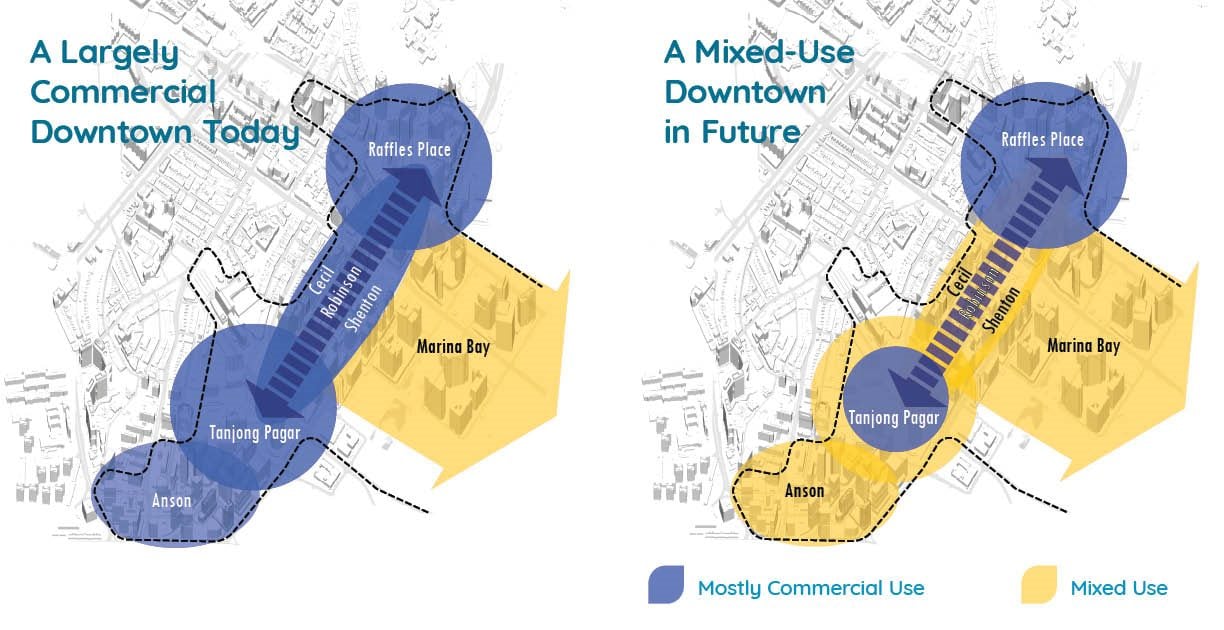

3. Decentralisation

In line with its decentralisation efforts over the past decade, Singapore encourages more employment areas outside the CBD to shorten daily commute and boost work efficiency.

Tech giant Google moved out of the Marina Financial District into Mapletree Business City II, located within the RCR.

Plans for three major economic gateways are in the pipeline, including a second CBD in the Jurong Lake District (JLD). Paya Lebar Central and the Bishan Sub-Regional Centre are undergoing a major transformation.

To encourage developers to inject more vibrancy into the business district, the government is encouraging the redevelopment of older office buildings into mixed-use buildings.

Prior to the pandemic, URA rolled out the CBD Incentive (CBDI) Scheme and Strategic Development Incentive (SDI) Scheme.

This includes converting CBD offices that are at least 20 years old into other forms of commercial real estate such as hotels and retail and dining options and building larger residential units to cater to families.

When the pandemic hit, it accelerated the decentralisation process, with the majority of the workforce adjusting to the new normal of working from home. Remote working has changed people’s attitudes toward living near the city centre, contributing to the price gap between the CCR and the other two regions.

With these changes in progress, there’s been a knock-on effect on the prices of homes, with more favouring living outside the CCR.

Are you looking for a larger HDB flat? Let us know in the comments section below or on our Facebook post.

If you found this article helpful, check out Will Vaccinated Travel Lanes (VTL) invite more foreigners to buy CCR condos? and Jurong: The new CBD? Analysing the Jurong/Lakeside neighbourhood.

Looking for a property? Find the home of your dreams today on Singapore’s fastest-growing property portal 99.co! If you would like to estimate the potential value of your property, check out 99.co’s Property Value Tool for free. Also, don’t forget to join our Facebook community page or Telegram chat group! Meanwhile, if you have an interesting property-related story to share with us, drop us a message here — and we’ll review it and get back to you.

The post What’s narrowing the gap between CCR and RCR prices? appeared first on 99.co.