In Singapore’s rapidly evolving business landscape, industries need to constantly innovate in order to keep up and stay relevant. A company’s core business may no longer be sufficient to sustain a healthy profit margin, and telco companies are no exception.

This one conglomerate is branching out to expand its operations to provide more than just telco services.

On 23 February, Singtel unveiled plans to redevelop its landmark Comcentre headquarters to the tune of S$2 billion, including land costs. The telco company will appoint a joint developer and hold a majority stake in the project.

Redeveloping a landmark building

Located a mere five-minute walk away from Somerset MRT along Exeter Road, Singtel’s Comcentre sits on a sprawling 19,252.6 sqm (207,233 sqft) site.

The telco giant has been calling the iconic building home since 1979.

After the redevelopment, the new Comcentre is expected to have a total gross floor area of over 110,000 sqm (1,184,030 sqft). It will comprise of Grade A office buildings, retail tenants, and Singtel’s Orchard Exchange, which houses its telecom infrastructure.

What are Grade A office buildings?

Grade A office buildings are usually newly-constructed large, well-designed developments mostly found in prime districts like Raffles Place and Marina Bay Financial District (MBFC).

These spaces are easily recognisable by certain characteristics, such as large lobbies, state-of-the-art security and facilities like intelligent access systems.

These prestigious buildings also boast floor to ceiling windows that give their tenants breathtaking panoramic views, especially on the higher floors. Some iconic Grade A office buildings are the Guoco Tower, OUE Bayfront and One Raffles Quay.

Another aspect of a Grade A building is an integrated sheltered or underground connection to an MRT station. An underground link connecting Somerset MRT to the Comcentre is in the pipeline with plans to integrate with the surrounding neighbourhood.

Singtel will occupy 30% of the space as the new building’s anchor tenant and lease out the remaining 70%. Doing so creates a new stream of recurring income by collecting rental from tenants leasing the office and retail spaces.

The Singapore Land Authority (SLA) has given in-principle approval to comprehensively extend all leases on the Comcentre’s tenants to 2089.

The project puts Singtel in the position of a landlord in the prime district of Orchard, where the conglomerate will be able to receive a high rental yield from its tenants.

According to JLL Singapore, there was a 4.2% growth in the rents of Grade A offices in the CBD area for 2021. This may spill over to other prime districts, such as Orchard, especially with the government encouraging the decentralisation of offices.

As of Q2 2021, CBD Grade A office rents stand at S$9.60 psf per month, which is higher than that of decentralised Grade A office rents at S$7.07 psf per month.

Flexible workspaces

At the start of 2022, in a bid to promote better work-life balance, Singtel implemented a hybrid work model of allowing its employees to work remotely for up to two days a week.

To reflect this change, the new building will feature open and digital workspaces with 5G solutions. By keeping up with the new post-pandemic style of working, Singtel hopes to create an inspiring environment that will encourage greater innovation and collaboration.

At the same time, the project enforces its vision of a more sustainable future and efforts to obtain net-zero for Singtel’s own operations.

With dynamic plans in place, it complements URA’s Master Plans to refresh the Orchard Road belt by injecting a range of new retail and F&B offerings.

Main telcos in danger

Taking the landlord route is a strategic move on Singtel’s part. While it still dominates the industry with 50% of the local mobile revenue market, many new telco competitors have entered the scene in the recent years.

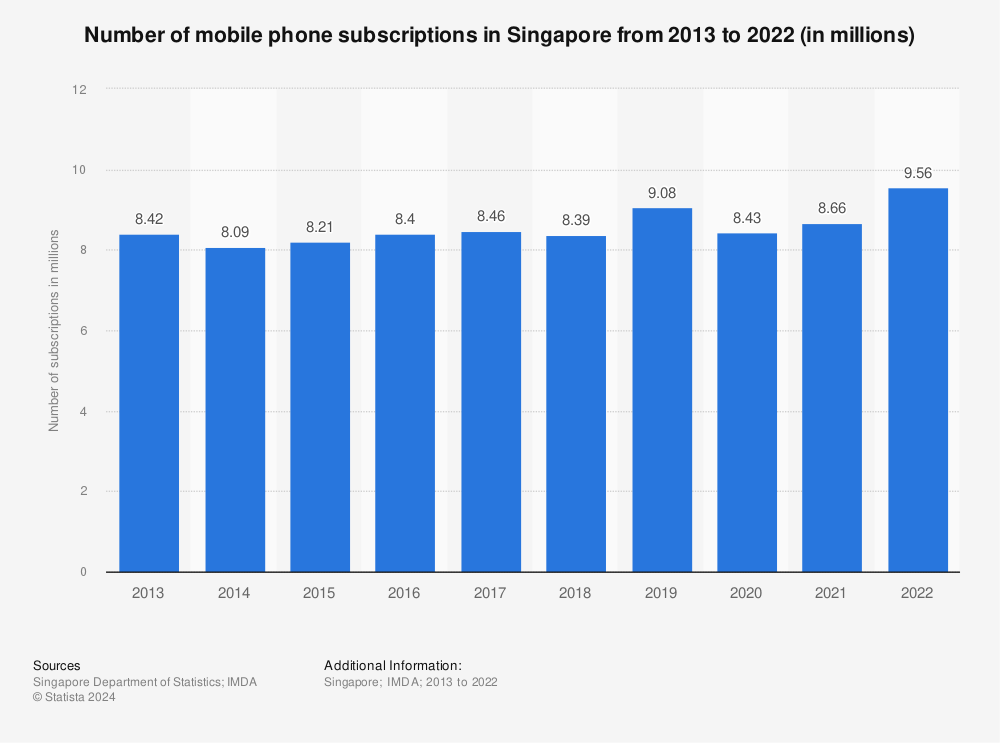

Just six years ago, the three main Singapore telcos monopolised the market – Singtel, StarHub, and M1. Fast forward to today, 11 companies are fighting for a slice of the pie of nine million mobile subscription contracts.

Ever since Australia’s TPG Telecom snagged a license from the Infocomm Media Development Authority (IMDA), it has been a race to the bottom, with major telcos offering highly competitive services and prices to seize market share.

The stiff competition can be seen in Singtel’s profit loss of almost 30%, from S$2.46 billion in 2020 to S$1.73 billion in 2021.

To avoid the chopping block and curb profit erosion, Singtel is taking a leaf from the books of its associates such as Singapore Post and staking a claim in the property market.

SingPost property play

Many may not know this, but the property segment makes up one of the highest operating profit sectors of SingPost. The company holds 18 properties under its belt, comprising commercial property, rental and self-storage businesses with varying leases.

SingPost is constantly seeking to improve its property asset yields. One key example is the redevelopment of its flagship SingPost Centre into a five-story retail mail between 2015 to 2017. S$150 million was sunk into the redevelopment, which doubled its retail space to around 25,000 sqm (269,097 sqft).

Despite the hard-hitting impact of the pandemic on Singapore’s economy, SingPost managed to maintain a 100% tenant occupancy at its SingPost Centre Mall and 98% at its office building.

In the first half of 2021, SingPost netted an operating profit of S$26.6 million, a 13.5% increase from the previous S$23.5 million. Lower rental rebates for eligible tenants and higher car park charges hugely contributed to the overall revenue growth.

This growth helped balance out the losses in the post and parcel segments.

Singapore Press Holdings

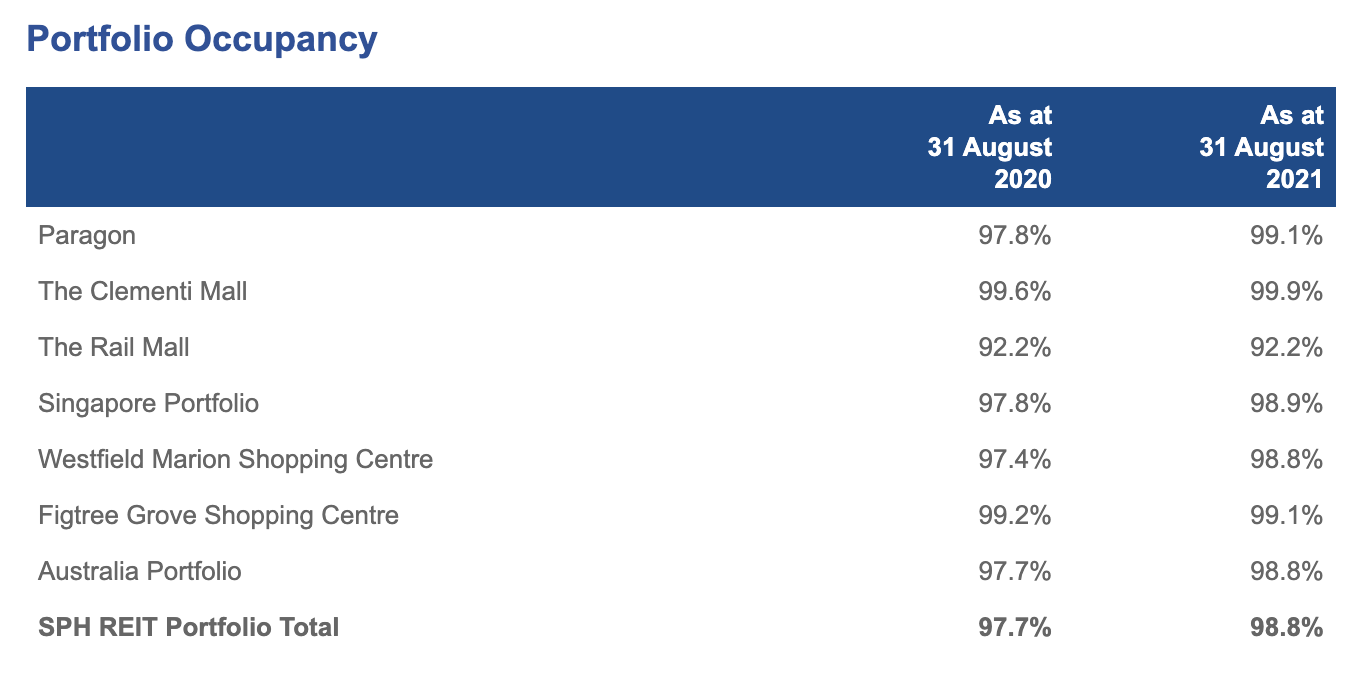

Another surprising company with hands in the property market is Singapore Press Holdings (SPH). Originally a media company, it formed SPH REIT in 2013 to expand and diversify its revenue streams by investing in a real estate portfolio.

Currently, it owns S$3.3 billion worth of properties in Singapore, including Paragon, The Clementi Mall, The Rail Mall, the Figure Grove Shopping Centre and Westfield Marion Shopping Centre in Australia. It has an almost 100% tenant occupancy in most malls, with 864 tenants occupying its properties.

Having stakes in many income-generating properties helped cushion SPH’s losses as it suffered declining revenue and profits in the declining media sector.

Fast food real estate

Mention McDonald’s and the golden arches of the iconic fast-food chain immediately spring to mind. However, the real secret sauce lies in how the fast-food company anchors itself as more of a real estate company than a restaurant chain.

McDonald’s in the United States makes the majority of its revenue not from its franchises but from leasing the physical properties to its franchisees at hefty mark-ups.

These franchisees are usually locked into 20-year term license agreements, which pretty much guarantees McDonald’s a stable stream of recurring rental income. On top of that, the company also takes a percentage of each shop’s fast-food sales.

The company’s long-term goal is to achieve 95% of franchises due to the fact they can pocket around 82% of the revenue generated by its franchisees, compared with just 16% from its company-operated locations. Its current capacity of franchises is 93%, just 2% shy of its goal.

Playing the role of landlord allows McDonald’s to insulate against the volatility of the restaurant industry, something that Singtel, like SPH and SingPost, make a play on as well.

Maintaining a healthy bottom line

With rental yield on the upward trajectory, it’s advantageous for companies to diversify into property or leverage their existing properties to generate more revenue.

According to DBS group research, the divestment and redevelopment of Comcentre could increase Singtel’s earnings by 2-3%. It would also be able to occupy its space for free, thus lowering its financial risk.

The projected completion of the new Comcentre is expected to be in Q4 2028.

Two developers have already been shortlisted in the first phase of the tender based on their track record and the quality of their design concepts. The tender would have already been closed in March, with Singtel making the final decision by May.

What do you think about companies diversifying into the rental market? Let us know in the comments section below or on our Facebook post.

If you found this article helpful, check out 5 things to look for when buying or renting an F&B space and 5 reasons why you shouldn’t rule out investing in commercial property.

Looking for a property? Find the home of your dreams today on Singapore’s fastest-growing property portal 99.co! If you would like to estimate the potential value of your property, check out 99.co’s Property Value Tool for free. Also, don’t forget to join our Facebook community page or Telegram chat group! Meanwhile, if you have an interesting property-related story to share with us, drop us a message here — and we’ll review it and get back to you.

The post Is Singtel’s Comcentre redevelopment similar to what McDonald’s did in the US? appeared first on 99.co.