As the Chinese New Year lull period has passed, developer sales (excluding Executive Condominiums) have increased by 20.7% last month. According to URA’s sales data, 654 new private homes were sold in March, compared to 542 units sold in February.

Nevertheless, new sales excluding ECs declined by 49.5% year-on-year, according to Christine Sun, Senior Vice President of Research and Analytics at OrangeTee & Tie.

Including ECs, 702 units were sold last month, translating to a 22.3% jump from the 574 units sold in February.

Best-selling new projects

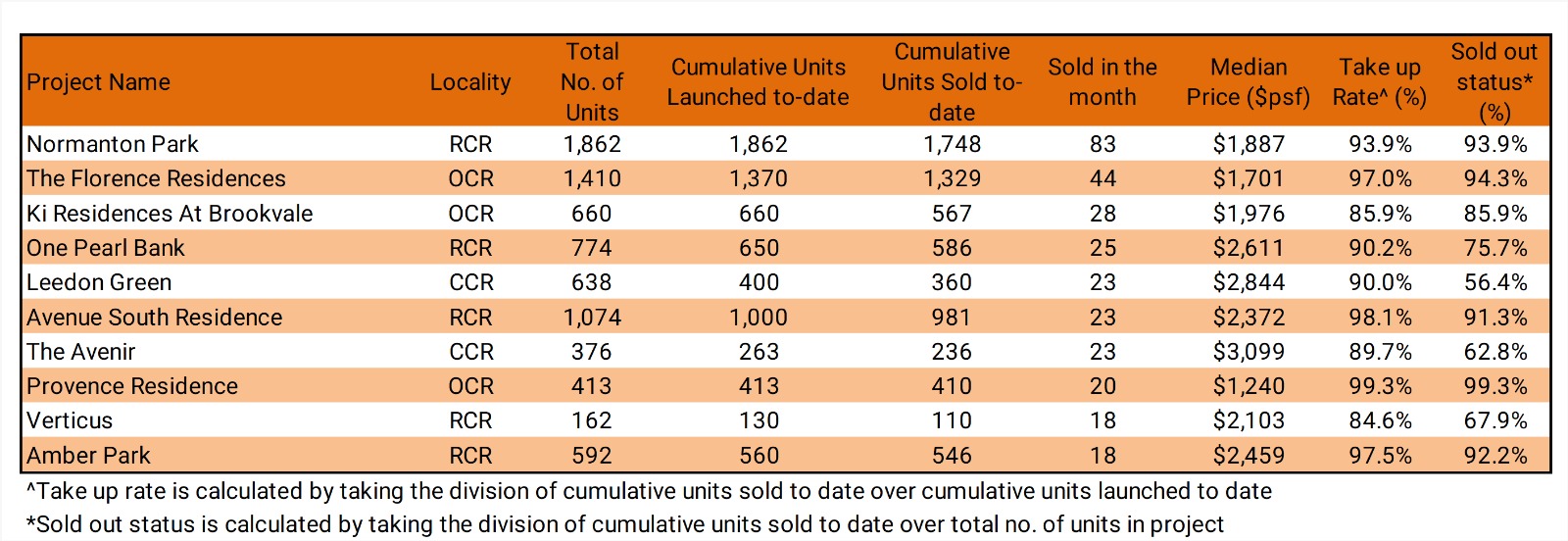

The best-selling new projects last month include Normanton Park, The Florence Residences, Ki Residences at Brookvale, One Pearl Bank, Leedon Green, Avenue South Residence, The Avenir, Provence Residence, Verticus and Amber Park.

Notably, Provence Residence, a new EC launched last May, is 99.3% sold out. According to URA’s monthly data, the development has only three unsold units left.

Given the latest round of cooling measures, ECs are expected to draw even higher demand. One of the most anticipated new launches is North Gaia EC, which is slated to launch on 22 April.

A higher proportion of pricier condos sold

“Despite the cooling measures, pricier condominiums are forming a more significant proportion of transactions,” said Sun.

Citing URA’s Realis data, she pointed out that 75.9% (1,302 units) of the non-landed transactions (excluding EC) were at least S$1.5 million in Q1 2022. In the same quarter, 41.6% (713 units) were sold for at least S$2 million, while 3.1% (53 units) were priced at S$5 million and above.

In contrast, 46.2% (1,567 units) of the total new condominiums were sold for at least S$1.5 million in Q1 2021. In the same period, transactions of at least S$2 million were 17.9% (608 units), and 0.6% (20 units) for those S$5 million and above.

Sun explained that the higher price tags were due to more launches in the CCR and RCR in recent months.

“Prices of homes have also been creeping up over the past year, driven by a shortage of supply.”

At the same time, the interest rate hike by the Feds may also have prompted more to buy property now.

“The upward adjustment of mortgage rates seems to be spurring more buyers to return to the market. Some on-the-fence buyers plan to lock in home loans before they climb higher, as a steep hike in borrowing rates may price some upgraders out of the market.”

Would you buy a new launch or resale condo? Let us know in the comments section below or on our Facebook post.

If you found this article helpful, 99.co recommends Resale condo prices up by 0.8% in March 2022, with the highest price increase in the OCR and Woman denied share in Bukit Timah house when court ruled that it’s not her ‘matrimonial home’.

Looking for a property? Find the home of your dreams today on Singapore’s fastest-growing property portal 99.co! If you would like to estimate the potential value of your property, check out 99.co’s Property Value Tool for free. Also, don’t forget to join our Facebookcommunity page or Telegram chat group! Meanwhile, if you have an interesting property-related story to share with us, drop us a message here — and we’ll review it and get back to you.

The post New private home sales up by 20.7% in March 2022 appeared first on 99.co.