A common financial goal amongst Singaporeans is to become debt-free. It is a deeply-ingrained mentality that having any kind of debt is terrible and should be avoided like the plague.

While becoming debt-free may be a goal worthy of aspiration, many HDB homeowners tend to subscribe to the belief that it is prudent to pay off one’s home loan early – which in reality may not necessarily be true.

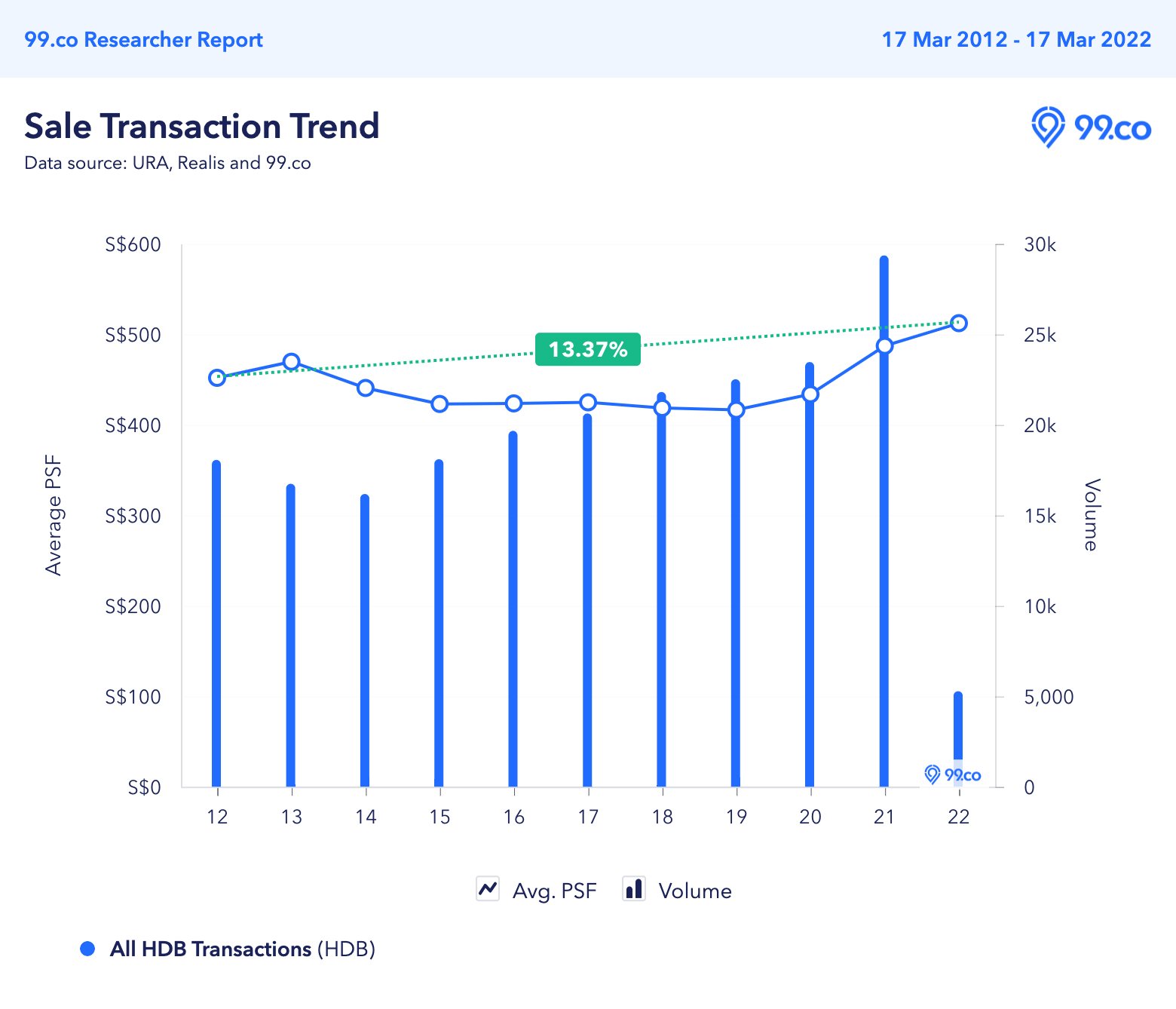

Public housing in Singapore isn’t exactly cheap. The prices of HDB flats have risen 13.37% over the past decade. At the moment of writing, the average cost of a unit is S$530,449, or S$512 psf.

With a median monthly income of S$4,680 in 2021, most Singaporeans take out loans to afford their homes.

There are several reasons why one might choose to redeem their home loan early.

Having peace of mind

Clearing your most significant debt is like removing a heavy boulder from your shoulders. Paying off your loan in full provides peace of mind, knowing that you’ll always have a roof over your head. It gives assurance and frees you from worrying about making monthly payments for years to come.

Taking an interest in your finances

Another common argument for paying off your mortgage as soon as possible is being able to dodge the interest that would otherwise have to be paid, which is 2.6% for HDB loans or about 1.7% for bank loans.

However, many don’t realise that a housing loan is one of the debts with the lowest interest rates, which means you can easily net a return of more than 2.6% if you invested the cash instead.

Let’s assume you had S$100,000 in extra cash saved up, and you’re considering dumping it into your HDB loan to pay it off early. However, let’s see what would happen if you invested it in an S&P 500 index fund instead, which gives an average annualised return of 7%, after adjusting for inflation.

Interest paid to HDB at 2.6%: S$100,000 x 2.6% = S$2,600

Investment returns from the S&P 500 index fund: S$100,000 x 7% = S$7,000

Missed potential gains: S$7,000 – S$2,600 = S$4,400

As we can see from the above calculations, you could lose over S$4,000 annually if you chose to pay off your home loan early instead of investing the extra cash.

Do note that this is an oversimplification and does not consider other factors involved, such as market conditions and other risks associated with investing.

Additionally, by investing the cash, you have the added benefit of liquidity as you can freely cash out and make withdrawals at any time. This is not possible if you choose to redeem your HDB loan, unlike with private properties where you have the option of taking a home equity loan if you need cash.

Not just any ordinary account

In the event that your savings are not in cash but are locked in your CPF Ordinary Account (OA), then investing in the S&P 500 index fund would not be possible. However, in this scenario, you can transfer the amount from your CPF OA into your CPF Special Account (SA), which would yield an annual return of 4%.

Instead of repaying your mortgage early, here’s how much you stand to gain from moving your money into your CPF SA.

Interest paid to HDB at 2.6%: S$100,000 x 2.6% = S$2,600

Returns from CPF SA: S$100,000 x 4% = S$4,000

Missed potential gains: S$4,000 – S$2,600 = S$1,400

The potential gains would be even higher if you have a bank loan or choose to refinance with a bank, as the interest rates are much lower than HDB’s rate of 2.6%.

Interest paid to bank at 1.7%: S$100,000 x 1.7% = S$1,700

Returns from CPF SA: S$100,000 x 4% = S$4,000

Missed potential gains: S$4,000 – S$1,700 = S$2,300

One major downside of transferring your money into your CPF SA is that it is irreversible, which means you cannot move it back to your CPF OA for your housing loan payments if you need to do so in the future.

From the examples above, we can see that it is clearly a better choice to invest your extra cash instead of using it to pay off your home loan early.

Good debt vs bad debt

While our society might have taught us that having any form of debt is a negative thing that we should avoid, it’s essential to understand that not all debts are the same. For example, debts with high-interest rates such as personal loans, credit cards and bank overdrafts could quickly drain your bank account and thus should be avoided at all costs.

On the contrary, housing loans tend to have low interest rates. As shown in the examples above, you could get a higher percentage return on your money if you invested it in other investment vehicles.

Furthermore, if your home loan is from the bank instead of HDB, you will probably incur a prepayment penalty, usually around 1.5% of the prepaid amount. Banks impose this to make up for lost interest.

Consider refinancing

A much better alternative would be to refinance your home loan. Refinancing is quite common amongst homeowners, where you replace your current home loan with a new loan from a different bank after completing the lock-in period.

The benefits of refinancing include shortening your loan tenure and reducing your interest rate. On top of this, many banks provide subsidies to cover any legal costs or valuation fees for you.

Let’s assume you have S$400,000 left in your outstanding HDB loan, with a remaining tenure of 20 years. If you were to continue this current loan, you would be paying S$2,140 in monthly instalments for the next 20 years.

However, should you decide to refinance with a different bank with an interest of 1.65%, your monthly instalments would be reduced to S$1,958, which is a savings of S$182 a month or S$2,184 a year.

With that said, before deciding whether or not to redeem your housing loan, be sure to read our list of the pros and cons of repaying your mortgage before the tenure is up.

Are you considering repaying your mortgage early? Let us know in the comments section below or on our Facebook post.

If you found this article helpful, check out Pros and cons of repaying your mortgage before the loan tenure is up and Deciding between HDB loan vs bank loan? Here’s a quick reference.

Looking for a property? Find the home of your dreams today on Singapore’s fastest-growing property portal 99.co! If you would like to estimate the potential value of your property, check out 99.co’s Property Value Tool for free. Also, don’t forget to join our Facebook community page! Meanwhile, if you have an interesting property-related story to share with us, drop us a message here — and we’ll review it and get back to you.

The post Why you shouldn’t pay off your home loan early appeared first on 99.co.