Since the property cooling measures were announced last December, some prospective homebuyers have been interested in buying properties under their kids’ names.

Buying property in your child’s name is certainly one way to get around the raised ABSD (Additional Buyer Stamp Duty) rates of 17% to 30% per investment property. The rate depends on how many properties you already own and whether you’re a citizen, PR or foreigner… but either way, it’s a tidy sum.

Children can’t own property legally. So parents would buy property in trust (yup, as in trust fund) with their child as the beneficiary. Once she turns 21, she’ll own the home in full.

Why do parents buy properties in trust for their kids?

As mentioned above, it probably means not paying for ABSD (if the parents already own several properties in Singapore). Naturally, the more expensive the property is, the more they stand to pay in taxes if they’re buying under their names.

More importantly, most parents considering buying property in a trust shouldn’t be motivated by financial gain. Instead, they want to protect their kid from having to stress out over mortgage payments.

Given that homes are likely to get more expensive over time, it makes sense to buy a property and lock in today’s price.

Your child wakes up on her 21st birthday with a fully-paid-up roof over her head, and everyone is happy. Right?

Hard to say for now, since we’re still in the early days. But as these trust-beneficiaries come of age 18-21 years down the road, there might be consequences. Here are three potential ones we could think of when buying property in your child’s name.

Consequence #1: You might end up harming your child

Buying an HDB flat, budgeting for mortgage payments, upgrading to a new home are familiar rites of passage for middle-class Singaporeans.

These “struggles”, or so they might seem to overprotective parents, are essential aspects of the Singapore dream and give young adults a sense of pride and accomplishment at these milestones. They’ve worked for it and thus earned it.

As a parent, you probably think it’s great that she didn’t have to lift a finger. But her peers would think otherwise.

Unless she only consorts with fellow heirs and heiresses, be prepared for her old friends to start drifting away from her. After all, she doesn’t have to go through the hits-and-misses in life, like balloting for a flat and applying for a home loan.

The sad thing is that some of her peers might be downright resentful and jealous of her privilege (something she didn’t even have a say in!), and you won’t be able to protect her from that.

So as a parent, you should probably ask yourself whether you might be trading your child’s happiness in exchange for financial comfort — and whether it’s worth it.

Consequence #2: Distorted housing prices across the board

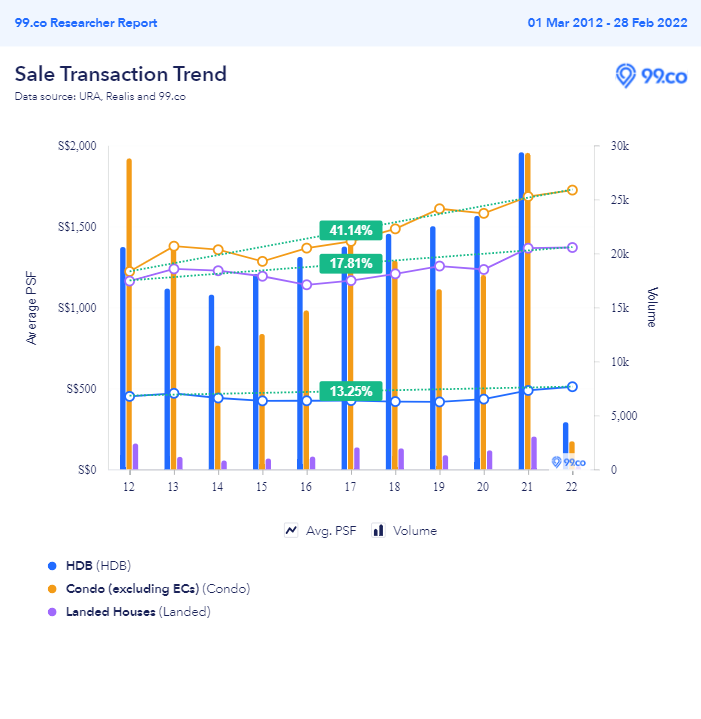

Previously, we talked about several ultra-high-net-worth individuals buying ultra-luxe GCBs or bungalows for their children. If fellow ultra-high-net-worth types follow suit, that will increase demand for luxury properties and thus their prices, perhaps resulting in soaring prices.

If that’s as far as things go, then no big deal. At least we, the 99 per cent, will be somewhat insulated from the madness.

But is this phenomenon likely to be so neatly contained?

Probably not. Wanting to give your kid an edge in life isn’t exclusive to rich people. Parents across class and income levels would do anything to give their children an advantage in life.

If enough UHNWIs buy properties in trust, we bet the trend will trickle down. Soon, the (merely) high net worth individuals will be doing it. Then the masstige crowd. Then anyone who can afford to buy private property in cash. Then one day, some smartypants will realise that you can also buy an HDB flat in trust under your child’s name, with HDB’s approval…

Boom! Another overheated property market is in our hands.

Unless the government steps in, this scenario will make homes even less affordable to entire swathes of society who didn’t do anything to deserve it.

Consequence #3: Widening the rift between haves and have-nots

During Budget 2022, Minister Lawrence Wong, in explaining tax and social spending hikes, invoked the term “social compact”. In essence, it is the idea that every Singaporean has a part to play in society and no one gets left behind.

This leads us to the third harmful consequence of making your toddler a property magnate: it harms Singapore’s fragile social compact.

If left unchecked, buying property in a trust will widen the gap between the haves and the have-nots. On the one hand, you have Singaporeans who work themselves to the bone to afford a home, while on the other, you have privileged young heirs who already own the very asset other people are busting their asses for.

What’s dangerous, though, is that the new elite class becomes property owners through no merit of their own. This is a serious threat to the idea of meritocracy, arguably the foundation of Singapore society. If our starting points are so far apart, how can we believe that everyone has a fair chance of winning?

MAS chief, Ravi Menon, warned about this risk in a 2021 lecture at the NUS Institute of Policy Studies, where he shared the term ‘hereditary meritocracy’ – which means society’s elites reproducing themselves through parents passing on their privileges (income, wealth, properties, education) to their children.

“Those who inherit advantages from their parents run counter to meritocracy,” he said.

As one BT journalist wrote: “Let’s hope wealthy parents can at times exercise restraint and that parental help in private home purchases will not breed resentment among some in the wider community.”

Buying properties in trust might do more harm than good

Parents usually try to transfer wealth to their kids with the best intentions. But it might do more harm than good, even to their child. They don’t need to be a psychologist to see that coming into wealth very suddenly can warp a young person’s worldview and rob her of purpose and drive.

In making major decisions like these, we should consider the consequences of our actions and choose the path to make Singapore a better place. Don’t forget that your toddler will become part of society one day, too.

–

If you found this article helpful, 99.co recommends checking out Singapore Budget 2022: Potential impact on property owners in a post-pandemic world and What’s a ‘fair price’ for HDB to buy back flats constrained by the Ethnic Integration Policy (EIP)?

Looking for a property? Find the home of your dreams today on Singapore’s fastest-growing property portal 99.co! If you would like to estimate the potential value of your property, check out 99.co’s Property Value Tool for free. Also, don’t forget to join our Facebook community page or Telegram chat group! Meanwhile, if you have an interesting property-related story to share with us, drop us a message here — and we’ll review it and get back to you.

The post 3 harmful social consequences of parents buying property in trust appeared first on 99.co.