Patience is a virtue. For many Singaporeans, however, playing the Build-To-Order (BTO) waiting game can be frustrating. This especially applies to soon-to-be-wed or newlywed couples who don’t want to wait for three to five years for their nest to be completed. For couples who do go down the apply-for-BTO route instead of buying an HDB resale flat, living conditions might not be ideal because they would:

- Incur additional costs if they decide to rent a place together till their BTO is completed. And with weddings costing an arm and a leg (sometimes all limbs) these days, this option will create a bigger dent on savings

- Have to endure the scrutiny of their in-laws if one half chooses to move into the other’s familial home

- Have to continue living apart after their marriage until after the renovation of their new unit, which can be a real dampener

For singles, their options are limited. For BTOs, singles aged 35 and above are only eligible for 2-Room Flexi flats in non-mature estates. This is a big push factor for buying resale flats.

As such, it is no surprise that couples are increasingly thinking about buying a resale unit as their first home, same with singles. However, when you decide to buy a resale flat, these are the essential questions you must answer for a home purchase with minimal hassle and no regrets.

1. What is our budget and how are we going to finance our resale flat?

First, understand the grants available to you for buying a resale flat. Grants lower your monthly repayment amount for your mortgage. As a rule of thumb, your budget for the resale flat should not be more than five times your annual income, plus any grants you’re eligible for.

Here’s a quick guide of the grants available for couples. Staying within 4km of your parents also entitles you to the Proximity Housing Grant (PHG).

Next, determine how much home loan you can take — based on your income — using HDB’s calculator and/or affordability calculators that you can find on our portal and local banks, which offer home loans with lower interest rates^.

^Read Deciding between HDB loan vs bank loan? Here’s a quick reference to determine which type of loan you should take. Later on, if you decide to, you can convert your HDB loan to a bank loan, but not the other way round. Also note that the HDB loan option is only available if your combined household income does not exceed S$14,000.

Then take those indicative home loan amounts and input them into HDB’s Enquiry on Monthly Instalment calculator along with your desired length of lease. For example, for a loan amount of S$500k with a tenure of 25 years at the current HDB loan interest rate of 2.6%, the monthly repayment amount is S$2,269 including interest (you can also get the repayment amount through our affordability calculator). For the instalment amount that you come up with, determine if you’re comfortable with paying it and if it fits into your overall longer-term budget, which should include things like renovation costs and costs of having a baby.

2. What is the current condition of the unit and its neighbourhood, and will we be happy staying here?

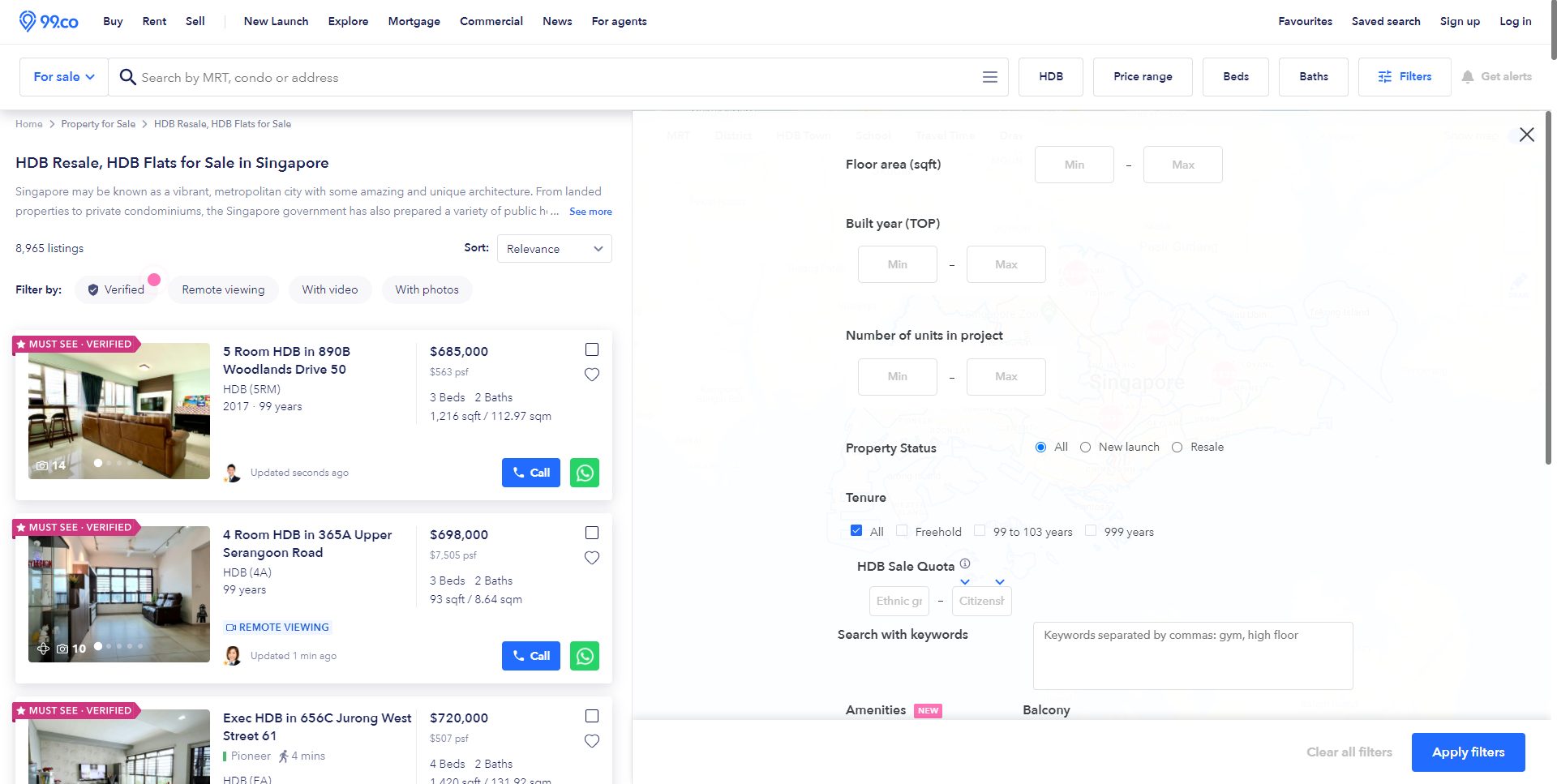

Now that you have calculated your budget, it is time to do the actual groundwork. Shortlist a few neighbourhoods that you want to live in and take some time to explore them. Then, using 99.co‘s location search functions (you can even draw your own area of search), find homes listed for sale in those neighbourhoods.

The portal lets you filter your search by HDB Sale Quota so that, for instance, Chinese buyers won’t waste time shortlisting and enquiring on a flat just to find that the Ethnic Integration Policy (EIP) quota for Chinese has been filled.

Once you’ve arranged for viewings either on your own or via a buyer’s agent, the action begins. The fun and reassuring part of purchasing a resale unit is that you get to see a finished product rather than an artist’s impression, drawing plan or scaled model. This means you can physically examine the layout of the house and ask yourself if the room configuration works for you.

During the viewing, check the unit for visible defects. There’s a chance these might lead to much more severe problems in future. For example, watermarks on the ceiling or walls usually point to water leakage, which is difficult to resolve completely.

You should also note how much renovation is needed should you purchase the unit. Make a list of existing fixtures that are still in good condition, such as the air-conditioning units, kitchen cabinets, flooring, and other built-in wardrobes, and ask yourself if you’re satisfied with them.

Likewise, make a list of things that you’ll definitely need to change, such as bathrooms and rewiring of the house, especially if the house is an older one.

It may be difficult, but don’t judge a flat simply based on the seller’s lack of taste. Sure, wallpapers with a bad print or walls painted in gaudy colours may be a deal-breaker, but do look beyond the ugly and weigh the pros and cons of staying there.

If you’re fortunate to come across a tastefully designed house and it suits your personality, you could probably save a considerable amount on renovation. However, such nicely designed flats will usually command a higher asking price. Nevertheless, you should always do your homework and verify that the renovations done justify the higher asking price. For example, you may want to confirm that the wardrobe is indeed built out of solid wood as the seller claims, and not plywood.

Lastly, don’t forget to survey the surrounding neighbourhood and check out the nearby amenities such as MRT stations, bus stops and supermarkets. Note the distance between the unit and each of these amenities and ask yourself if you’re comfortable as this will directly impact your lifestyle. For example, if you and your spouse eat out a lot but the nearest mall or hawker centre is at least a 20-minute walk away and both do not drive, would living here be enjoyable?

To help you leave no stones unturned during your home viewing, read Home viewing checklist: 9 questions buyers forget to ask.

3. Are we making an informed offer?

It’s important to note that, under HDB’s resale procedures, the buyer (or the buyer’s agent) can only submit a request for valuation after the sellers have granted them the Option to Purchase (OTP). In other words, as the buyer, you’ll have to negotiate on the sale price of the resale flat based on recent transacted prices** alone before paying the option fee.

The Option Fee ranges between S$1 to S$100, which is decided between the buyer and the seller. It will have to be paid to secure the OTP.

The period to exercise the option (i.e. proceed to buy the house by signing the Sales & Purchase Agreement) is 21 days, including Saturdays, Sundays and public holidays.

(If, after the valuation, you don’t wish to exercise the OTP and complete the purchase, the option fee will be forfeited.)

If you intend to use your CPF savings and/or take up an HDB or bank loan to finance the purchase, you’ll need to request for the valuation report from HDB during this period.

(Do note that it is a requirement for all potential HDB buyers to obtain a valid HDB Home Loan Eligibility (HLE) letter before the seller can grant you an OTP. If you decide to get a bank loan, you’ll have to get a Letter of Offer from the bank before you can exercise the OTP.)

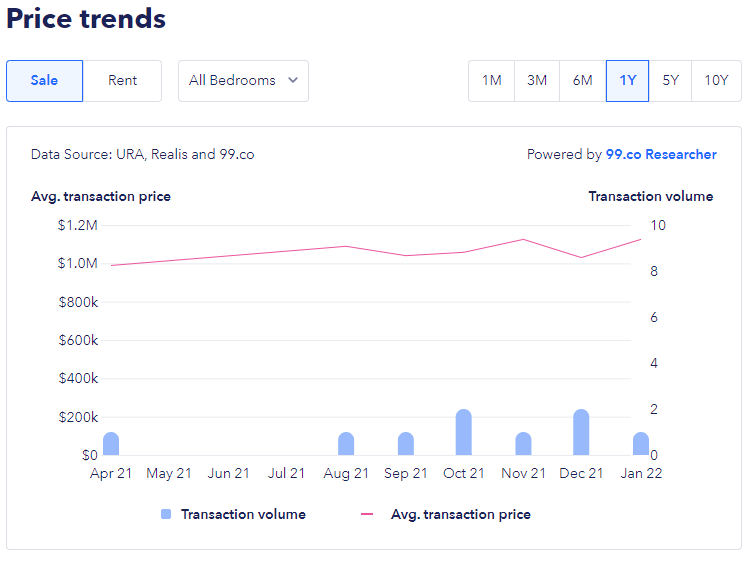

**On each 99.co listing, users can see a list of previous transactions of units within the same block and the price trend in graph form.

So before making an offer for a resale unit, it’s important to get an indication of the past transaction values. This is not just to avoid buyer’s remorse, but also because lenders (i.e. HDB and banks) will only grant loans based on the lower figure of either the sale price or valuation. In other words, if your valuation is lower than the sale price, you will have to fork out the balance in cash (i.e. cash over valuation or COV).

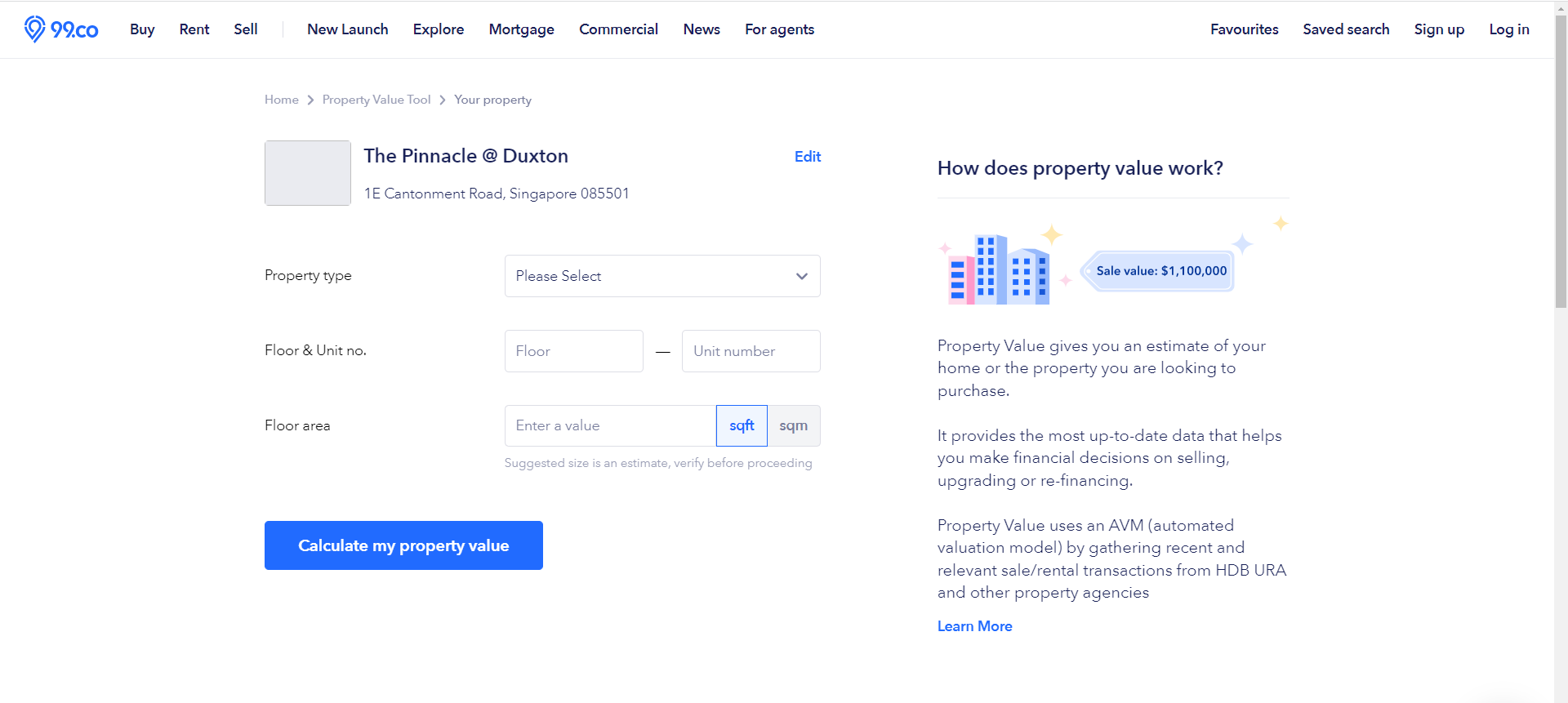

Alternatively, you can use 99.co’s HDB Property Value Tool to get an estimate on the valuation of the flat you plan to buy.

Happy resale flat hunting and wish you all the best in finding your home!

Do you have any other tips to share for buying an HDB resale flat? Let us know in the comments section below or on our Facebook post.

If you found this article helpful, 99.co recommends 3 ways to gauge the cash over valuation (COV) of a resale HDB flat and 5 savvy ways to save on resale flat renovations.

Looking for a property? Find the home of your dreams today on Singapore’s fastest-growing property portal 99.co! If you would like to estimate the potential value of your property, check out 99.co’s Property Value Tool for free. Also, don’t forget to join our Facebook community page or Telegram chat group! Meanwhile, if you have an interesting property-related story to share with us, drop us a message here — and we’ll review it and get back to you.

The post 3 questions first-time HDB resale flat buyers must answer appeared first on 99.co.