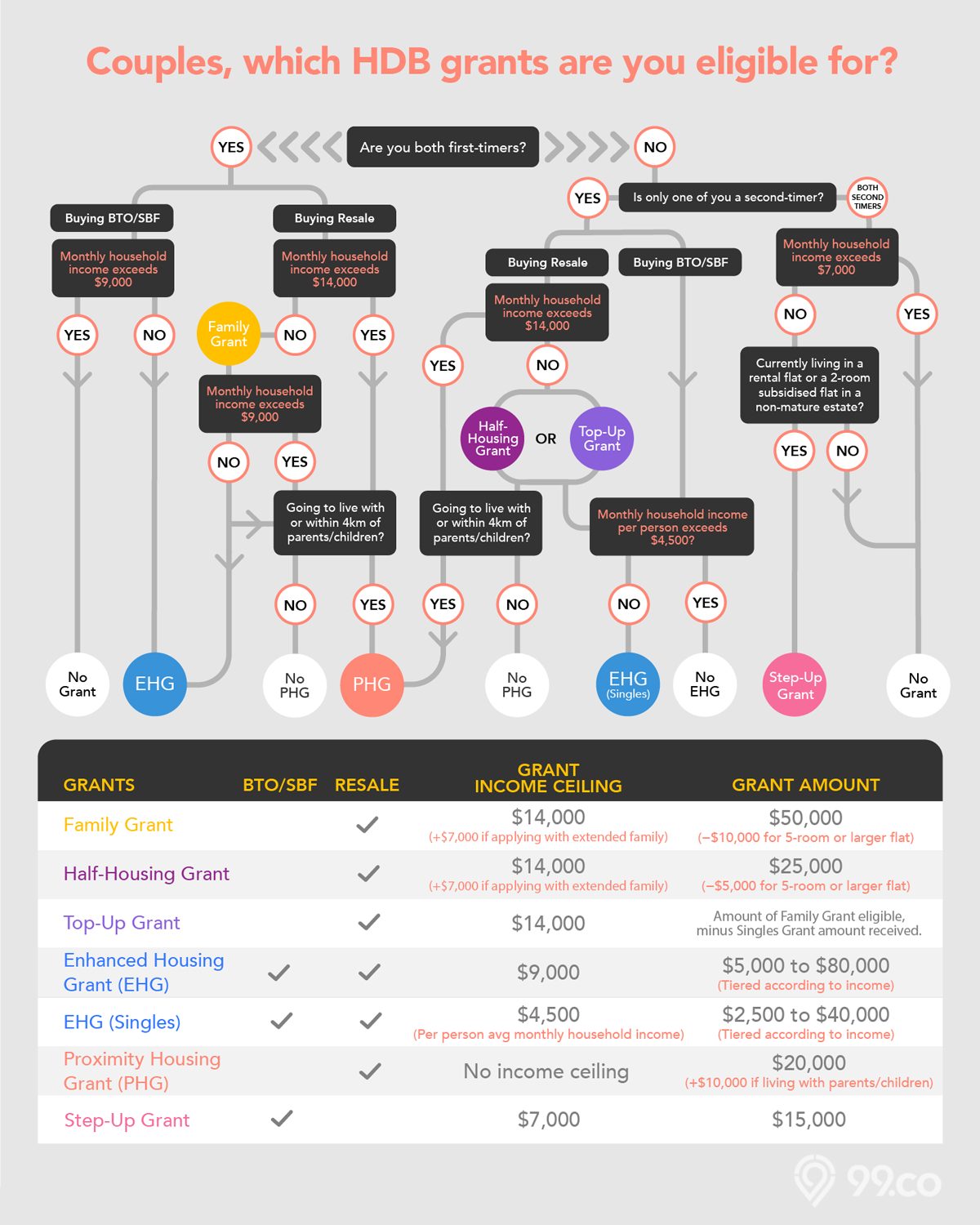

You might already know that there are various housing grants for couples to offset the cost of buying a new flat, be it an HDB BTO flat or HDB resale flat. But it can be confusing trying to figure out which grant you’re eligible for, with different eligibility criteria and all. So here’s our quick-and-easy guide and infographic to help you make sense of grants and budget for your HDB flat.

Various factors — such as household income — determine the HDB grant amount a couple can get. The key thing is that buyers of HDB resale flats are offered more grants than BTO (Build To Order) and SBF (Sale of Balance Flats) applicants. This is because BTO and SBF flats are sold directly by HDB at a subsidised rate. (Open booking flats also fall under the same category as BTO and SBF flats.)

Now, let’s find out which HDB grants you may be eligible for!

(If you’re on a mobile device, use two fingers to zoom in or out.)

(If you’re on a desktop browser, hold down ‘Ctrl’ and ‘+’ on your keyboard to magnify.)

If you’re single, we have another article for you here: Quick Guide to BTO and Resale HDB Grants for Singles.

HDB grants for couples applying for BTO/SBF/Open Booking flats

Technically, only two grants are available for BTO/SBF/Open Booking flats: the Enhanced CPF Housing Grant (EHG) and the Step-Up CPF Housing Grant. (The EHG replaced the Additional CPF Housing Grant (AHG) and Special CPF Housing Grant (SHG) in September 2019.)

The EHG is for first-timers, while the other grant is for second-timers. Specifically, the Step-Up CPF Housing Grant is reserved for those upgrading from a subsidised two-room flat or public rental flat.

So most BTO/SBF/Open Booking flat applicants would be looking at only the EHG, which is tiered according to household income. This means that lower-income households will receive a higher EHG grant.

If both applicants are first-timers

- Enhanced CPF Housing Grant (EHG): up to S$80,000. To qualify, the average gross monthly household income for the 12 months prior to the flat application date must be within S$9,000.

Income criteria for EHG:

To qualify for the EHG, at least one of the applicants must have worked continuously for 12 months prior to the flat application, and must be working at the time of the flat application.

If one applicant is a first-timer, and the other a second-timer

- Enhanced CPF Housing Grant for Singles, EHG (Singles): up to S$40,000. To qualify, half of the average monthly household income for the 12 months prior to the flat application date must be within S$4,500. For example, a couple who earned S$56,000 in the past calendar year will be ineligible for the EHG (Singles), as the average monthly income is S$4,667.

Here’s the table showing how the EHG is tiered for couples and singles:

| Enhanced CPF Housing Grant for Couples | Enhanced CPF Housing Grant for Singles | ||

| Average monthly household income | Grant amount | Half of the average monthly household income | Grant amount |

| Not more than S$1,500 | S$80,000 | Not more than S$750 | S$40,000 |

| S$1,501 – S$2,000 | S$75,000 | S$751 – S$1,000 | S$37,500 |

| S$2,001 – S$2,500 | S$70,000 | S$1,001 – S$1,250 | S$35,000 |

| S$2,501 – S$3,000 | S$65,000 | S$1,251 – S$1,500 | S$32,500 |

| S$3,001 – S$3,500 | S$60,000 | S$1,501 – S$1,750 | S$30,000 |

| S$3,501 – S$4,000 | S$55,000 | S$1,751 – S$2,000 | S$27,500 |

| S$4,001 – S$4,500 | S$50,000 | S$2,001 – S$2,250 | S$25,000 |

| S$4,501 – S$5,000 | S$45,000 | S$2,251 – S$2,500 | S$22,500 |

| S$5,001 – S$5,500 | S$40,000 | S$2,501 – S$2,750 | S$20,000 |

| S$5,501 – S$6,000 | S$35,000 | S$2,751 – S$3,000 | S$17,500 |

| S$6,001 – S$6,500 | S$30,000 | S$3,001 – S$3,250 | S$15,000 |

| S$6,501 – S$7,000 | S$25,000 | S$3,251 – S$3,500 | S$12,500 |

| S$7,001 – S$7,500 | S$20,000 | S$3,501 – S$3,750 | S$10,000 |

| S$7,501 – S$8,000 | S$15,000 | S$3,751 – S$4,000 | S$7,500 |

| S$8,001 – S$8,500 | S$10,000 | S$4,001 – S$4,250 | S$5,000 |

| S$8,501 – S$9,000 | S$5,000 | S$4,251 – S$4,500 | S$2,500 |

| More than S$9,000 | NA | More than S$4,500 | NA |

Source: HDB

If both applicants are second-timers

- Step-Up CPF Housing Grant: S$15,000. This is for couples living in a two-room subsidised flat in a non-mature estate or public rental flat, and wish to apply for a new 3-room flat in a non-mature estate. Those living in a public rental flat applying for a 2-room Flexi flat in a non-mature estate may also be eligible for the grant.

If one applicant is not a Singapore Citizen (Non-Citizen Spouse Scheme)

- Enhanced CPF Housing Grant for Singles, EHG (Singles): up to S$40,000. To qualify, half of the average monthly household income for the 12 months prior to the flat application date must be within S$4,500. For example, a couple who earned S$56,000 in the past calendar year will be ineligible for the EHG (Singles), as the average monthly income is S$4,667.

HDB grants for couples applying for resale flats

If both applicants are first-timers

- Family Grant: S$50,000 for four-room flats or smaller and S$40,000 for five-room flats or larger. To qualify, your monthly household income must not be more than S$14,000 (or S$21,000 for extended family applicants).

- Enhanced CPF Housing Grant (EHG): up to S$80,000. To qualify, the average gross monthly household income for the 12 months prior to the resale flat application date must be within S$9,000.

- Proximity Housing Grant (PHG): S$30,000 (if you’re going to live with your parents/children), or S$20,000 (if you’re going to live within 4km of your parents/children). As for the proximity condition, your parents or children can either be living in public housing or private property. There’s no income ceiling for the PHG.

Income criteria for EHG:

To qualify for the EHG, at least one of the applicants must have worked continuously for 12 months prior to the resale flat application, and must be working at the time of the flat application.

One applicant is a first-timer, and the other is a second-timer

- Half-Housing Grant: up to S$25,000 for four-room flats or smaller and S$20,000 for five-room flats or larger, with monthly household income capped at S$14,000 (or S$21,000 for extended family applicants).

For applicants who have previously received a Singles Grant

- Top-Up Grant: up to the Family Grant amount you are eligible for, minus any previously received grant amounts (e.g. under the Single Singapore Citizen Applicants scheme). Only those with monthly household income capped at S$14,000 are eligible*.

*Exception: For Singapore Citizen/Singapore Permanent Resident (SC/SPR) households with the SPR spouse now obtaining Singapore Citizenship status, they are eligible for a Citizen Top-Up Grant of S$10,000 with no maximum household income restrictions.

On top of either the Half-Housing Grant or the Top-Up Grant, these couples may also be eligible for the Enhanced CPF Housing Grant (EHG) for Singles. The grant amount is based on the income, with the maximum grant amount being S$40,000. Likewise, half of the average gross monthly household income must be within S$4,500.

For applicants buying a resale flat to live with their parents/children or within 4km of their parents/children:

- Proximity Housing Grant (PHG): S$30,000 (if you’re going to live with your parents/children), or S$20,000 (if you’re going to live within 4km of your parents/children).

If both applicants are second-timers

- Step-Up CPF Housing Grant: S$15,000. This is for couples living in a two-room subsidised flat in a non-mature estate or public rental flat, and wish to buy a resale 3-room flat in a non-mature estate. Those living in a public rental flat buying a 2-room resale flat in a non-mature estate may also be eligible for the grant.

For more information about HDB resale grants, check out our detailed article: HDB Resale Grants: How much can you get?

What if one of the applicants has yet to graduate/ORD from National Service?

HDB announced that for BTO applications from May 2018 onwards, the income assessment can be deferred until key collection for full-time National Servicemen (NSFs) and student applicants who are at or above the eligibility age of 21 and above. The deferment of income assessment for these couple applicants still qualifies them to apply for the Enhanced CPF Housing Grant (EHG). You can head over to HDB’s website for more information about the Deferred Income Assessment.

How will the HDB grants for couples be disbursed?

All grants will be credited into the CPF Ordinary Accounts (CPF OA) of eligible Singapore Citizen applicants. For couples, the grant amounts are split equally into the two CPF OA accounts. No cash will be disbursed.

Do take note that when you sell your house, you’ll need to refund the grant amount plus accrued interest back to your own CPF account. This is on top of any CPF savings used to pay for your house.

The first S$60,000 of the housing grants will be credited back to your CPF OA account, while the remaining grant amount will be put into your CPF Special Account / Retirement Account and Medisave Account.

(Single and aged 35 and above? Find out what grants you may be eligible for when buying a BTO or resale HDB flat.)

What do you think about the BTO and resale HDB grants? Let us know in the comments below or on our Facebook post.

If you found this article helpful, 99.co recommends How to get enough money to buy a property in Singapore and Deciding between HDB loan vs bank loan? Here’s a quick reference.

Looking for a property? Find the home of your dreams today on Singapore’s fastest-growing property portal 99.co! If you would like to estimate the potential value of your property, check out 99.co’s Property Value Tool for free. Also, don’t forget to join our Facebook community page! Meanwhile, if you have an interesting property-related story to share with us, drop us a message here — and we’ll review it and get back to you.

Frequently asked questions

What is the Enhanced CPF Housing Grant (EHG)?

The EHG is a housing grant that you can apply for if you’re a first-timer applicant buying a BTO flat or resale flat, with a gross monthly household income of not more than S$9,000.

How much HDB grant can I get?

If you’re a first-timer getting a BTO flat, you can get up to S$80,000 HDB grant. The maximum grant amount is doubled up if you apply for a resale flat.

Do you have to return the HDB grant?

No, you don’t have to return it to HDB or CPF. What you need to do, though, is to refund it back to your own CPF account, plus any other CPF monies used and accrued interest, when you sell your house.

The post Quick guide (with infographic) to BTO and resale HDB Grants for couples appeared first on 99.co.