Property rental prices in Singapore have swelled to a six-year high and are expected to continue rising. Among the most affected by this increase are expatriates, who make up the majority of renters.

According to URA’s Q3 2021 statistics, the prices of private residential properties increased by 1.1% in the third quarter of 2021, compared with the 0.8% increase in the previous quarter.

| URA Rental Index of Private Residential Properties (Q3 2021) | Q1: 106.2 points (+2.2% QoQ) | Q2: 109.3 points (+2.9% QoQ) | Q3: 111.3 points (+1.8% QoQ) |

| Landed property | 0.6% | 1.4% | 4.7% |

| Non-landed property | 2.4% | 3.1% | 1.4% |

| Non-landed property (CCR) | 2.9% | 3.1% | 0.7% |

| Non-landed property (RCR) | 2.0% | 2.8% | 1.6% |

| Non-landed property (OCR) | 2.1% | 3.6% | 2.6% |

(Source: URA 1|2|3)

From the table, it can be observed that every quarter has recorded a quarter on quarter growth in rental rates.

Lack of housing options for foreigners

Unfortunately, there is not much that expats can do to avoid the rental rate hike, as there are not many alternative viable options when it comes to housing. Most prefer to reside in private apartments for the amenities such as swimming pools, gyms, tennis courts, and the proximity to their offices in the city.

Purchasing a home may not be something that many expats could consider due to the high ABSD rates for foreigners, especially with the recently updated cooling measures.

Although the pandemic may have brought fewer foreigners to Singapore’s sunny shores, it also meant that those already living here would probably extend their stay and renew their current leases.

Singapore’s current rental situation

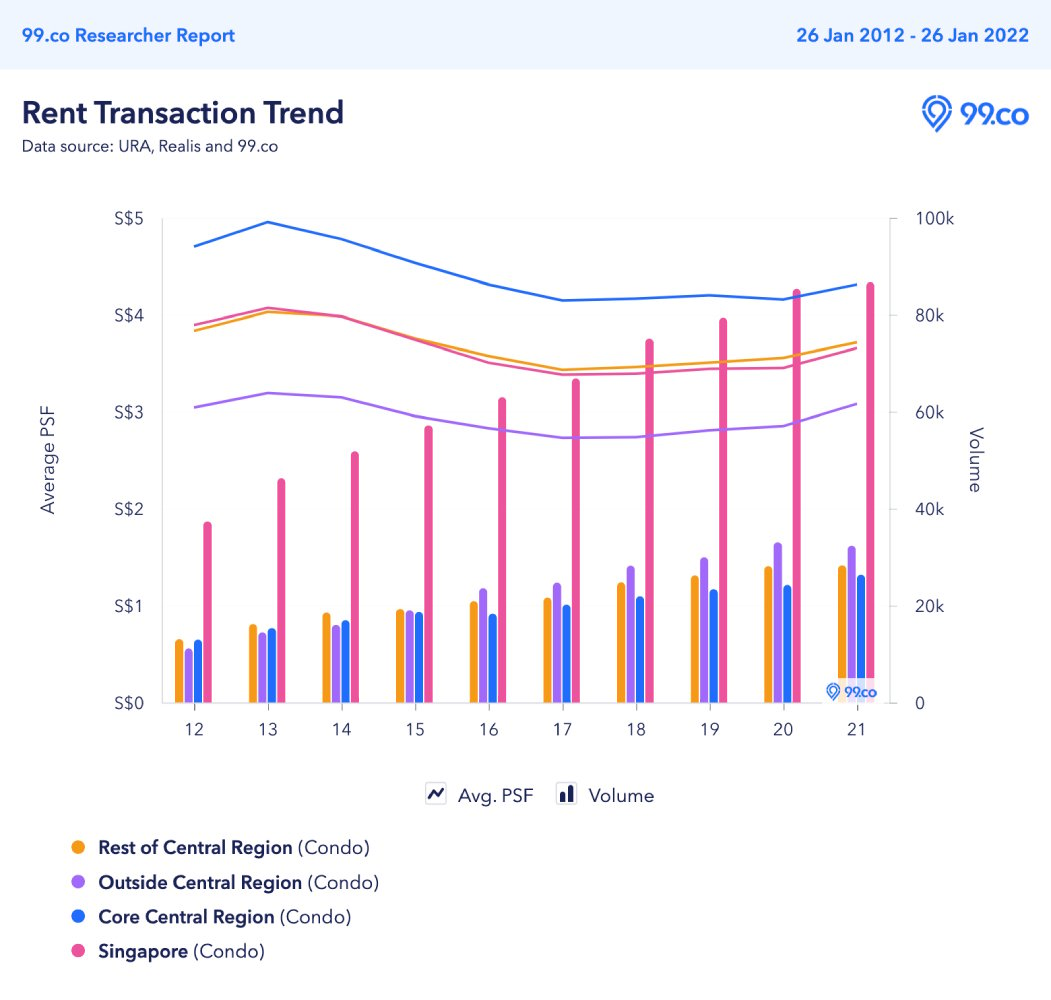

At the time of writing (26 Jan 2022), the average rental rate for condos stands at S$3.65 psf, down from the peak of S$4.07 psf in 2013.

2013 saw the best rental rates for all regions island-wide, with the Core City Region (CCR) topping the board at S$4.95 psf.

| Year | Singapore S$/psf | CCR S$/psf | RCR S$/psf | OCR S$/psf |

| 2013 | 4.07 | 4.95 | 4.03 | 3.19 |

| 2021 | 3.65 | 4.31 | 3.71 | 2.85 |

The volume of rental leases being taken up across different regions has increased for the CCR and slightly for RCR since the start of COVID in 2020.

| Year | CCR | RCR | OCR |

| 2020 | 24,282 | 28,116 | 33,010 |

| 2021 | 26,323 | 28,277 | 32,291 |

Other reasons behind the increase in rental demand

Increase in ABSD

Prior to 16 December before the new cooling measures were introduced, foreigners purchasing a property had to pay 20% in Additional Buyer’s Stamp Duty (ABSD). The amount has since been increased by 10 points to 30%, which could easily mean an additional six-figure sum payable for a prospective foreign buyer.

Taking a S$1.5 million property as an example, here’s how much more money expatriates would need to pay.

| Types of Buyers | ABSD from 6 July 2018 to 15 December 2021 | ABSD on or after 16 December 2021 | Additional ABSD in SGD | |

| Singapore Citizens | First residential property | 0% | 0% | S$0 |

| Second residential property | 12% | 17% (+%5) | +S$75,000 | |

| Third and subsequent residential property | 15% | 25% (+%5) | +S$75,000 | |

| Permanent Residents | First residential property | 5% | 5% (unchanged) | S$0 |

| Second residential property | 15% | 30% (+15%) | +S$225,000 | |

| Third and subsequent residential property | 15% | 30% (+15%) | +S$225,000 | |

| Foreigners | Any residential property | 20% | 30% (+10%) | +S$150,000 |

This might mean that expats who were previously considering purchasing a home would likely reconsider and choose to pivot to the rental market instead to avoid the hefty ABSD tax. This collective choice may drive up demand for rental properties and, in turn, jack up the rental prices.

Apartments that cost between S$2,500 to S$4,000 per month in rental are the ones that are likely to face the highest increase in prices, as they tend to have the most significant demand.

Last year, some units saw an increase in rental costs of between 10% to 15%.

Tightening of TDSR

With the recent tightening of the Total Debt Servicing Ratio (TSDR), borrowers can only have debt payments of up to a maximum of 55% of their combined monthly incomes. This is a 5 point decrease from the previous 60%.

Most Singaporeans tend to have current outstanding debts, such as car loans, student loans or credit card debt. This could mean that those looking to purchase a home may not qualify for an adequate loan under this new requirement as it requires a larger cash outlay.

This may drive potential home buyers to adopt a wait and see approach and consider renting instead, which would ultimately contribute even more demand to an already limited supply of rental homes.

BTO construction delays

On top of this, the pandemic has contributed to the rise in property rentals. One example is the delay in BTO constructions due to a shortage of migrant workers. As a result of the extended wait times, many are forced to turn towards leasing in the interim, while waiting for their apartments to be completed.

In tandem with this is the government’s Safe Management Measures, which requires the bulk of workers to adopt a work from home routine. As a result, many have sought to move out of their family home in search of a more conducive space and increased privacy.

Sky-high property prices

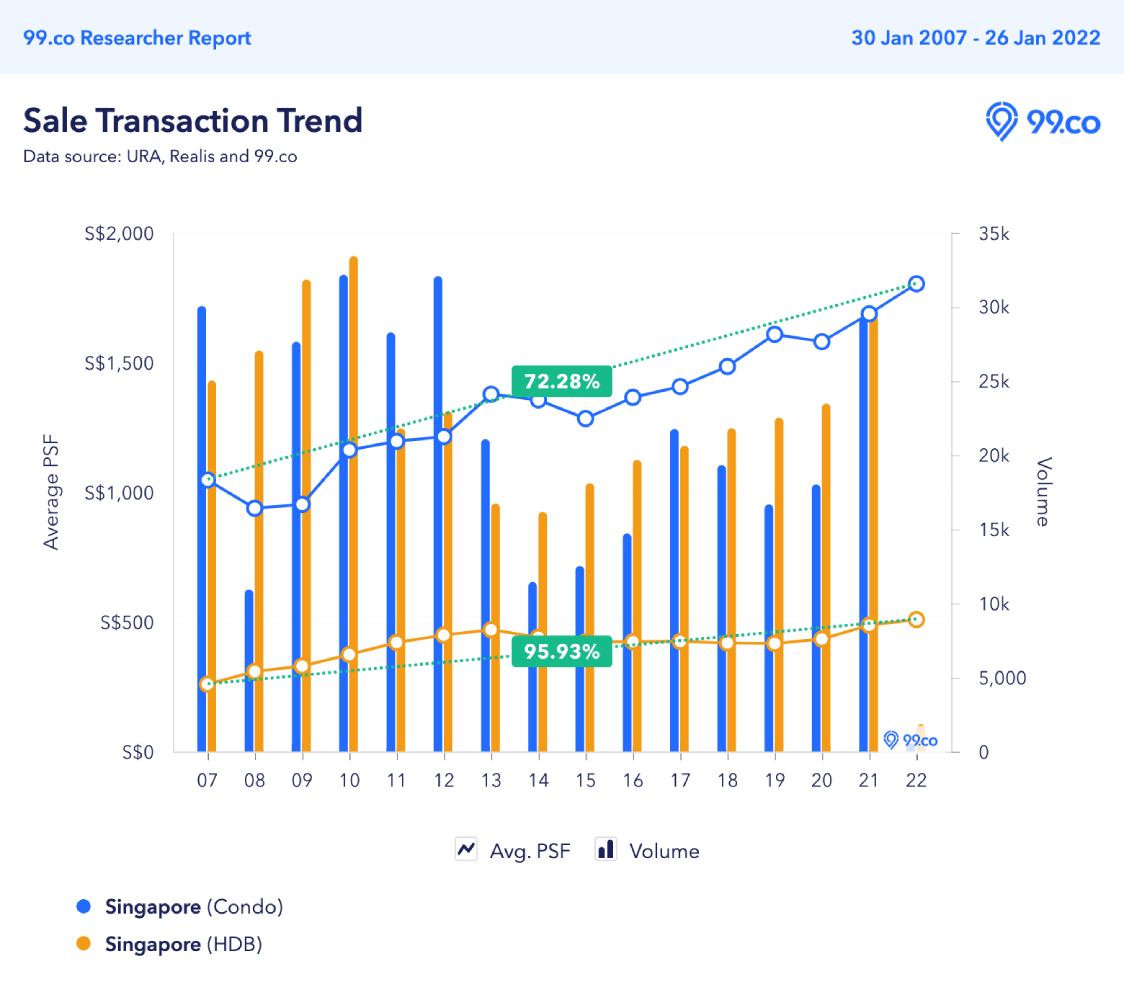

Property prices for both HDB and condos are currently the highest they’ve ever been.

With the deadly one-two combination of delayed BTO waiting times and peak property prices, those who urgently need to find a place to move out to have their backs against the wall. The only option remaining is to rent while they wait for prices to fall or build up their cash reserves to purchase a home.

Finally, as more homeowners return from abroad and take back their units, the supply of rental properties gets even further reduced.

With all of these factors combined, rental prices would likely continue upward as the demand outweighs the dwindling supply.

Are you looking to rent a property? Let us know in the comments section below or on our Facebook post.

If you found this article helpful, check out Housing considerations for foreigners when moving to Singapore and Guide to breaking lease and early termination of tenancy agreement.

Looking for a property? Find the home of your dreams today on Singapore’s fastest-growing property portal 99.co! If you would like to estimate the potential value of your property, check out 99.co’s Property Value Tool for free. Also, don’t forget to join our Facebook community page! Meanwhile, if you have an interesting property-related story to share with us, drop us a message here — and we’ll review it and get back to you.

The post Rental rates peaking at a six-year high – What are the impact of cooling measures? appeared first on 99.co.