When you purchase a HDB flat, you’re required to complete the Minimum Occupation Period (MOP) of 5 years before you’re allowed to sell your flat on the open market.

If you’re a HDB dweller whose flat is up for MOP this year and looking to make the jump to swankier new digs, here are some reasons why you should (or shouldn’t) upgrade.

Why you should not sell your HDB and upgrade

While several recent cooling measures kicked in on 16 Dec, the ones that concern HDB upgraders the most would be the LTV and TDSR changes.

ABSD hike

Depending on your nationality and your significant other’s nationality (if you both co-own your first apartment), it would be prudent to keep in mind the Additional Buyers Stamp Duty (ABSD) hike as well if you’re looking to keep your newly MOP-ed flat and buy a second property. With the 5% increase in ABSD from 12% to 17%, you’ll definitely feel the pinch when buying a second property, if both of you are Singapore citizens, let alone PRs.

If we take the price of a resale condo such as a 2 room condo at The Hillford of S$950,000, here’s how much you would need to pay in ABSD charges.

| Types of Buyers | ABSD on or after 16 December 2021 | ABSD payable | |

| Singapore Citizens | First residential property | 0% | S$0 |

| Second residential property | 17% | S$161,500 | |

| Permanent Residents | First residential property | 5% | S$0 |

| Second residential property | 30% | S$285,000 | |

| Foreigners | Any residential property | 35% | S$332,500 |

LTV tightened

Another significant change is the Loan to Value (LTV) ratio being tightened five points, from 90% to 85%. This new limit only applies to buyers purchasing HDB BTO flats and resale applicants opting for the HDB housing loan after 16 December. If you’re taking up a bank loan, the LTV ratio is still capped at 75%.

So for those opting for an HDB housing loan, this may price out the pool of buyers who might’ve been able to qualify for the 90% loan, but who now cannot afford the additional 5%.

Using a 4-room Sengkang resale flat example, a potential buyer can now only borrow up to 85% of say, the flat’s cost of S$480,000, instead of 90%. The 5% price difference of S$24,000 might make or break the decision to purchase the resale flat, as most buyers would be young couples on a smaller budget.

TDSR tightened

The Total Debt Servicing Ratio (TDSR) was also tightened by five points, from 60% to 55%. This is to prevent individuals from over leveraging and taking on more debt than they can afford.

For the sake of simplicity, let’s say you’re looking to upgrade to a condo or private property. Unless you have the means to expand a bigger cash outlay, the change in TDSR means your loan amount is now smaller.

If you have current loans such as a car loan or student loan, you might find it more of a stretch with the new TDSR change.

Why you should upgrade now

However, notwithstanding these new cooling measures, it could be a good time for you to sell your HDB flat and upgrade now. Here’s why.

While you do face the new challenge of a tighter TDSR, you would likely be profiting from the sale of your HDB. That additional capital can be directed to your downpayment, which may allow you to take on a smaller loan.

Furthermore, due to the pandemic, the construction of new BTOs are being delayed by 6 months to a year, bringing the wait time to around 4-5 years.

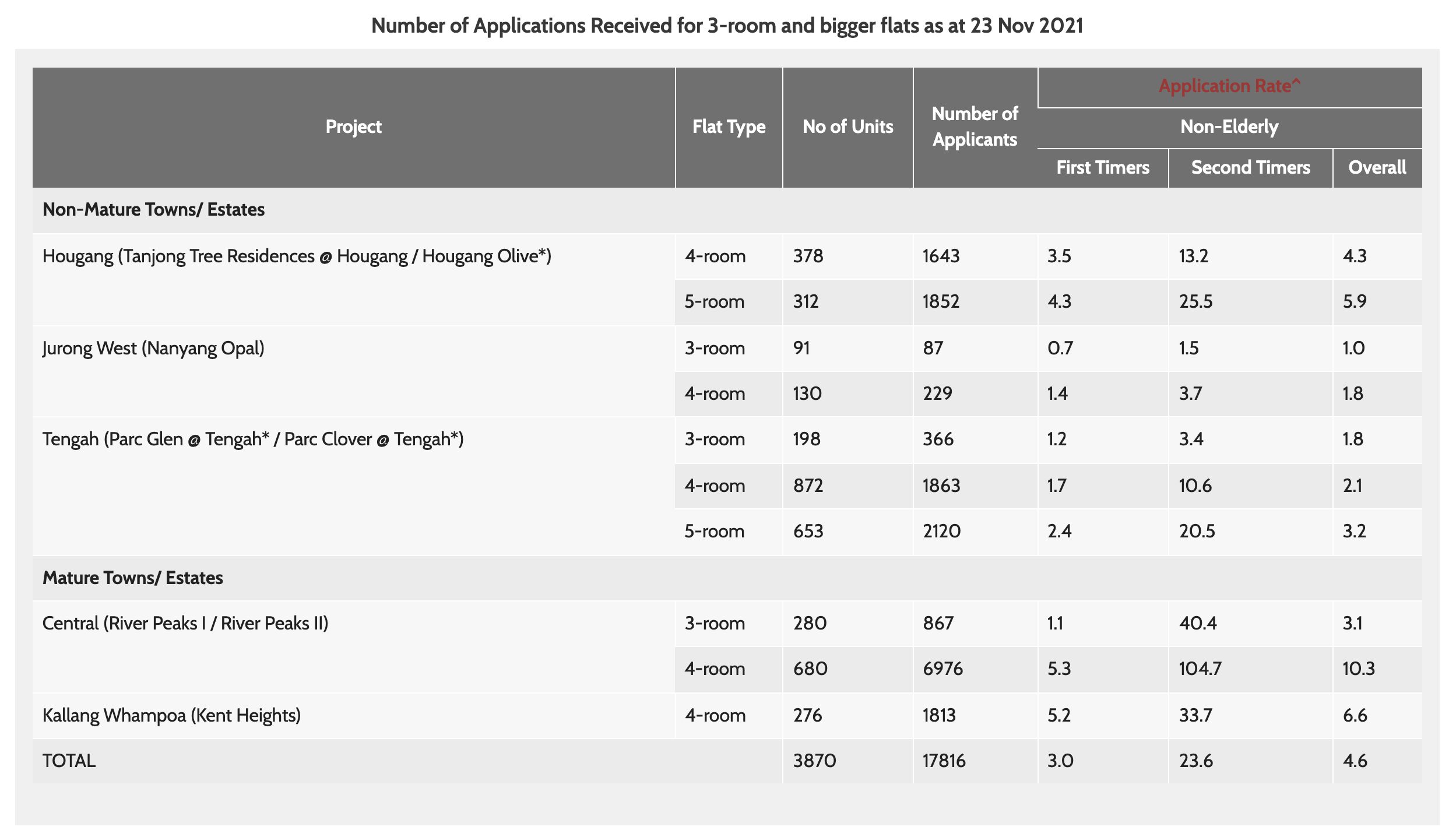

Traditionally, the demand for BTOs has always exceeded the supply. In November 2021, some estates received ten times more applicants than the readily available flats. This means for every 1 HDB flat available; there were 10 applicants vying for it.

Some knock-on effects include potential BTO buyers unwilling to weather the long wait times, turning to the resale market instead.

The government is taking steps to boost the supply of both public and private housing by releasing 40% more units under the confirmed list of the H1 2022 Government Land Sales (GLS) Programme, compared to H2 2021, according to Minister for National Development Desmond Lee. However, these measures will take at least five years to reflect in the property market.

So cooling measure or not, there will always be a market for first-time homebuyers, especially if they’re house-hunting for recently MOP-ed HDB resale flats.

Are you looking to upgrade from your HDB flat? Let us know in the comments section below or on our Facebook post.

If you found this article helpful, check out What to know about upgrading from HDB flat to condo and What can you do with your new MOP-ed flat?

Looking for a property? Find the home of your dreams today on Singapore’s fastest-growing property portal 99.co! If you would like to estimate the potential value of your property, check out 99.co’s Property Value Tool for free. Also, don’t forget to join our Facebook community page! Meanwhile, if you have an interesting property-related story to share with us, drop us a message here — and we’ll review it and get back to you.

The post If your HDB flat is MOP-ing this year, is it still a good time to upgrade? appeared first on 99.co.