Property in Singapore is a prized asset be it for your own stay or as an investment, but there’s no such thing as a free lunch! Owners have to pay their share of property tax in Singapore every year, and the amount of tax depends on whether the property is owner-occupied, rented out or vacant.

How is property tax in Singapore calculated?

If however, you are an inquisitive fellow and aren’t afraid of numbers, then here is how the math goes down.

The annual property tax is calculated by multiplying the Annual Value (AV) of your property by the appropriate property tax rate. The formula looks like this:

Annual Value (AV) ✕ Property tax rate = Property tax payable

The Annual Value (AV)

The Annual Value comprises the sum of money you could earn by renting out your property for a year, minus any furniture rental cost and general maintenance costs. (We explained Annual Value in detail in this article here.)

The AV of a property might vary from year to year, so will your property taxes. It’s worth noting that when areas get new amenities and rental prices go up, so will your AV and property tax. Similarly, when the market is down, your AV will go down too, and along with it the amount of property tax you have to pay.

For instance, in line with the increase in market rentals of HDB flats in 2021, IRAS has revised the AVs of HDB flats on 1 January 2022. The AVs for private residential properties has been increased as well.

(It’s not just property tax that’s increasing this year. PM Lee announced in his New Year message that the government will start moving on the planned GST hike in Budget 2022.)

Whenever your AV has changed, the Inland Revenue Authority of Singapore (IRAS) will send you a notification regarding the revision. You can also log in to the IRAS myTax Portal to check on the AV of your property any time.

If your AV is reassessed, and you disagree with it, you can submit an objection. You should do so within 30 days from the date of the valuation notice. You cannot however object the tax rate itself.

If you wish to view the AV of a property before buying it, you can do so with the Check Annual Value of Property service. Take note that each search costs S$2.50 inclusive of GST.

Property tax rate

Your tax rate is dependent on factors such as your Annual Value and whether you live in the property yourself. Basically, the higher the AV of your home, the higher the tax rate.

In other words, the tax rate is progressively tiered. The higher your property value, the higher your AV would be, and so would be your tax rate.

The idea is to tax the wealthy more. Hence, properties that are not owner-occupied have a higher progressive tax rate. This is logical as those who own property they don’t live in (whether it’s rented out or vacant) are deemed to be wealthier.

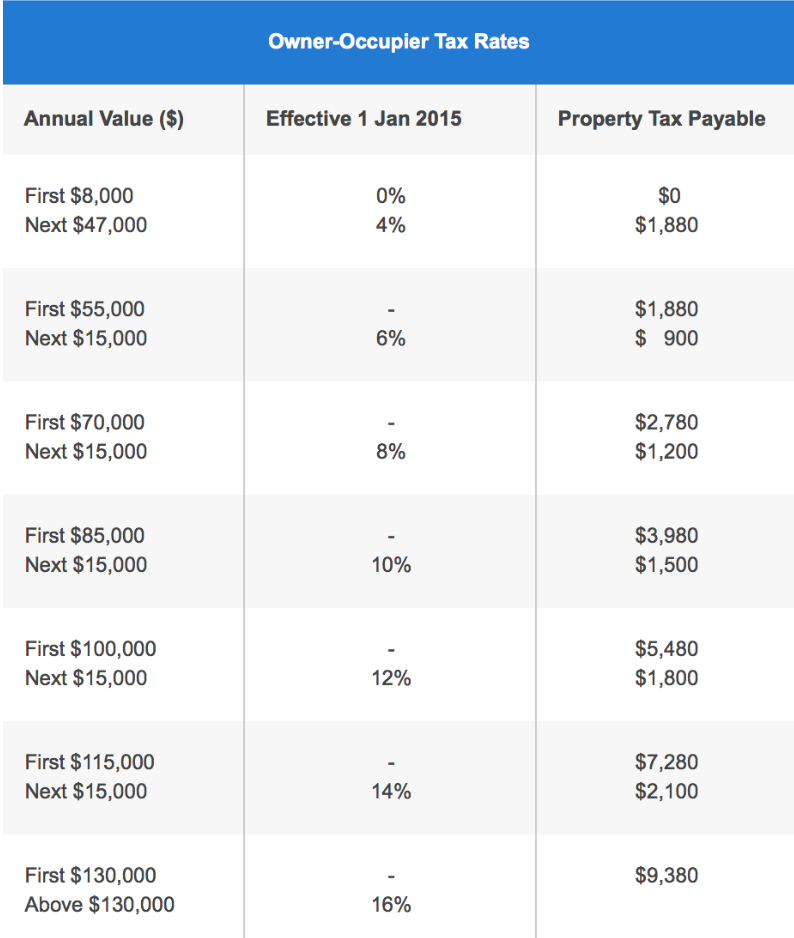

Owner-occupier tax rates

Let’s get down to the numbers. If you are an owner-occupier, the following tax rates apply to you.

In Singapore, owner-occupier property tax rates range from 0 to 16%. If the above table is a bit confusing, let us explain which tax rate you should use as an owner-occupier.

If your property’s AV is S$35,000:

First S$8,000: 0% = S$0

- Remaining AV to be considered: S$27,000

Remaining S$27,000: 4% x S$27,000 = S$1,080

Total property tax payable: S$1,080

If your property’s AV is S$105,000:

First S$8,000: 0% = S$0

- Remaining AV to be considered: S$97,000

Next S$47,000: 4% = S$1,880

- Remaining AV to be considered: S$50,000

Next S$15,000: 6% = S$900

- Remaining AV to be considered: S$35,000

Next S$15,000: 8% = S$1,200

- Remaining AV to be considered: S$20,000

Next S$15,000: 10% = S$1,500

- Remaining AV to be considered: S$5,000

Remaining S$5,000: 12% = S$600

Total property tax payable: S$1,880 + S$900 + S$1,200 + S$1,500 + S$600 = S$6,080

So, based on the above examples, you’ll find that the home that has three times the AV (S$105,000 versus S$35,000) pays about 5.63 times more in property tax.

Owner-occupied homes with an AV of S$8,000 and below are exempted from paying property tax.

Instead of doing manually, you can just use the property tax calculator on IRAS to calculate your property tax.

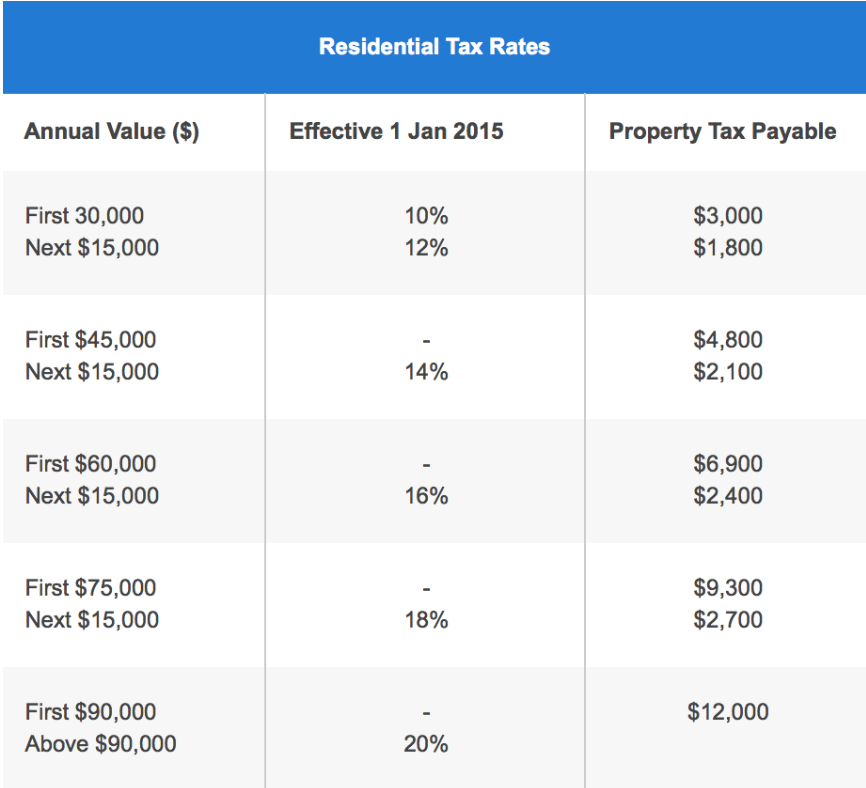

Non-owner-occupier tax rates

If you own property within which you do not reside yourself (be it rented out or vacant), then these higher tax rates apply to you, the non-owner-occupier.

Non-owner-occupier property tax rates range from 10 to 20%. In case you’re wondering if you can be the owner-occupier of two homes, the answer is no, you can only be listed as the owner-occupier in one home.

And don’t try to outsmart IRAS. For a married couple who choose to decouple and own two properties under individual names, the owner-occupier tax rates will still only apply to ONE property.

On a more sombre note, a property owned by a person who is deceased is technically considered a non-owner-occupied property. However, IRAS will apply owner-occupier tax rates for an extended period of up to either two years from the owner’s passing or the date of transfer of the property, whichever is earlier. Further requests for extension may be submitted on appeal.

A person who owns both an HDB and a private property, and rents out the private property while still claiming that they live there as an owner-occupier, may be subject to investigation and prosecution if they are found to be deliberately falsifying information to avoid a higher tax.

In any case, once you have rented out a property, IRAS will know because the stamp duty of the rental has been paid. The owner-occupier tax rates are no longer applicable for that property from the date of rental.

Exceptions to the progressive tax rates

While most types of residential properties fall under these tax schemes, there are a few exceptions where instead of progressive tax rates, a flat tax of 10% is applied.

- Accommodation facilities within any sport and recreational club

- Chalet

- Child care centre, a student care centre, or a kindergarten

- Welfare home

- Hospital, hospice, place for rehabilitation, convalescence, nursing care or any institution aimed at similar purposes

- Hotel, a backpackers’ hostel, a boarding house or guest house

- Serviced apartment

- Staff quarters that are part of any property exempted from tax under S6(6) of the Property Tax Act

- Student’s boarding house or hostel

- Workers’ dormitory

What if I shift house or buy a new property? Must I update IRAS?

According to IRAS, owner-occupier tax rates will automatically apply to the following:

Buyers of HDB, DBSS flats and Executive Condominiums (EC):

- If you buy a new or resale HDB, DBSS flat or new EC, you do not need to apply for the owner-occupier tax rates.

Buyers of private residential property (from 1 January 2011 onwards):

- If you are a Singapore Citizen or Singapore Permanent Resident who has purchased a new or resale private residential property, the owner-occupier tax rates will be automatically applied if you and your spouse are not currently enjoying owner-occupier tax rates on any other residential property.

If the property is not intended for owner-occupation, please notify IRAS to withdraw the owner-occupier tax rates by using the e-Service “Apply/Withdraw for Owner-Occupier Tax Rates”. Penalties may apply for homebuyers who fail to notify IRAS about the non-owner-occupier status of a property purchase.

Is there a quicker way to find out the property tax rates applicable to me?

Yes. Just point your browser to IRAS’s e-Service “View Property Dashboard“. Log in using your SingPass and select the intended property address you wish to check.

Are there any property tax rebates or reliefs?

While IRAS considers the lower tax rate for owner-occupiers a “rebate”, the measures to reduce property taxes over the last two years were mostly for commercial properties from 1 January to 31 December 2020.

A notable property tax rebate applies to those who have recently purchased land for the construction of an owner-occupied house. This is called the “Property Tax Remission for Land Under Development for an Owner-Occupied House”. More details and eligibility criteria is available on this IRAS page. A property tax remission is also available for homeowners who choose to demolish their old home to rebuild a new one.

As property tax rebates or reliefs may change, check out this IRAS page for the latest updates.

When is the deadline to pay your property tax in Singapore?

Property tax in Singapore is due on 31st January every year.

In the event that you are late, a 5% penalty is imposed on the unpaid tax. If you have submitted an objection and are still waiting for the outcome, you’ll still have to pay the tax. If there’s any revision, you’ll be refunded for the excess payment.

In the event that you have failed to pay tax even after the penalty has been issued, IRAS can appoint agents like your bank, employer, tenant or lawyer to recover the overdue tax. Worse still, they may put up your property for auction to recover the unpaid tax.

One final note about property tax in Singapore

Buying a property is always a bit of a leap in financial commitment, and being informed about taxes payable is always vital as it’s part of the cost of property ownership.

So, before buying a property, don’t forget to consider its Annual Value and the property tax to be paid every year.

What do you think of the property tax hike? Let us know in the comments section below or on our Facebook post.

If you found this article helpful, 99.co recommends What is the Annual Value of a property and how do I check mine? and What are the fees you need to pay (besides the home loan) before selling your HDB flat?

Looking for a property? Find the home of your dreams today on Singapore’s fastest-growing property portal 99.co! If you would like to estimate the potential value of your property, check out 99.co’s Property Value Tool for free. Also, don’t forget to join our Facebook community page! Meanwhile, if you have an interesting property-related story to share with us, drop us a message here — and we’ll review it and get back to you.

[Additional reporting by Virginia Tanggono]

Frequently asked questions

How to pay property tax in Singapore?

You can either pay by GIRO or by digital payment methods such as PayNow, AXS, SAM or internet banking.

How to calculate property tax in Singapore?

Property tax is calculated by multiplying the Annual Value (AV) of the property by the applicable property tax rate.

When to pay property tax in Singapore?

Payment for property tax should be done by 31 January of every year.

The post Property tax for homeowners in Singapore: How much to pay + Rebates + Deadline appeared first on 99.co.