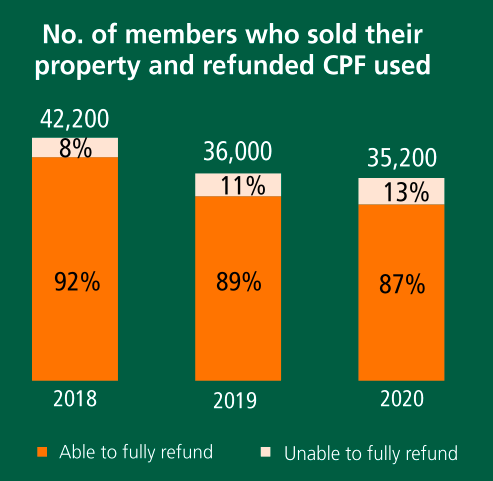

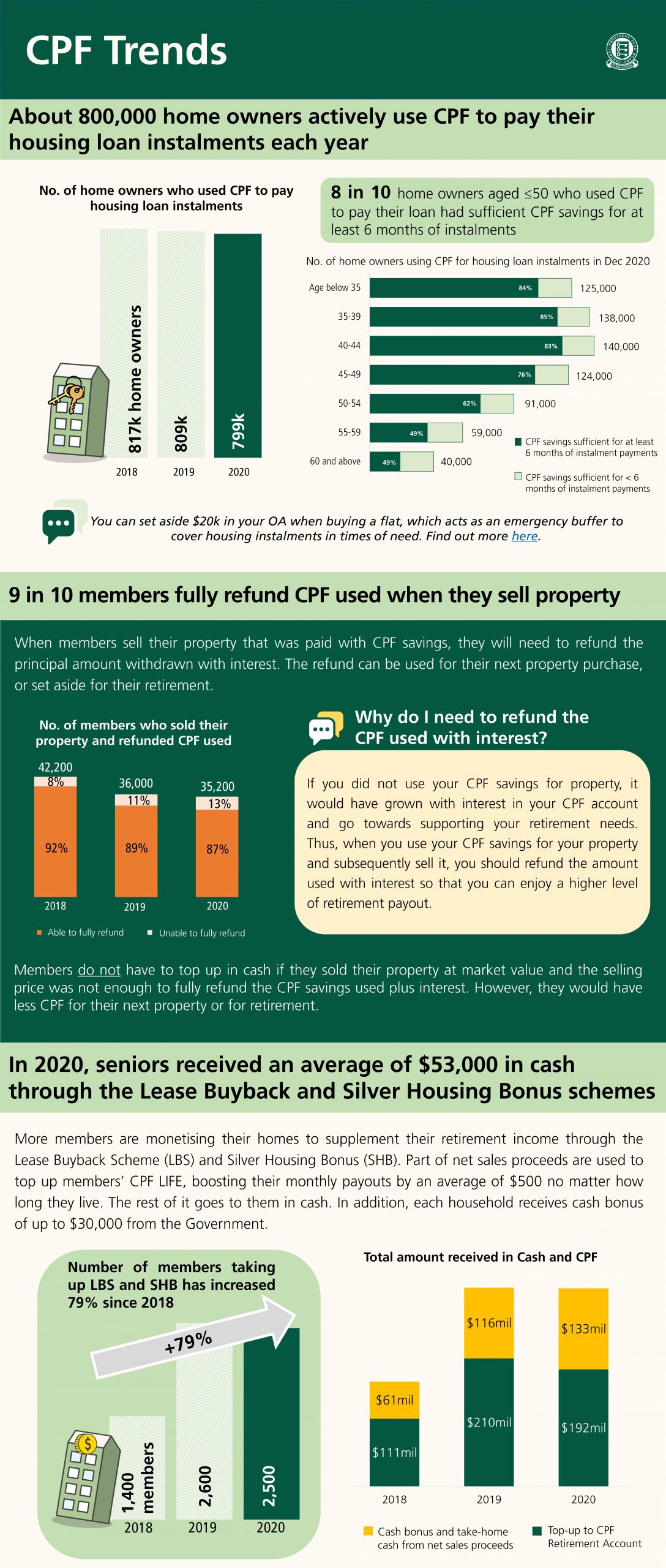

The number of people who could not fully return their CPF monies used for housing after selling their house has increased from about 3,380 in 2018, 3,960 in 2019 to 4,580 in 2020, according to a Lianhe Zaobao report yesterday. Citing a recent CPF report, this translates to an increase of 8% in 2018, 11% in 2019 to 13% in 2020.

CPF savings used have to be returned to the CPF account when the house is sold.

While CPF savings are meant for retirement, members can use their CPF Ordinary Account (OA) savings for housing. This includes paying for the downpayment and monthly instalments of the home loan.

However, the caveat is that they would have to return the amount used, plus the accrued interest to their CPF savings if they sell the property. The accrued interest is the interest members would have earned if the savings were left in the OA instead.

This could leave members with a loss instead, as they would need to top up the difference in cash if the cash proceeds cannot cover the amount required to be returned.

On the other hand, if the property was sold at a market price that is less than the CPF savings to be returned, they would not have to top up the difference in cash.

Fewer people returned their CPF savings after selling their house.

Within the same three-year period, there has been a decrease in the number of people returning their CPF savings after selling their house. The number has gone down from 42,200 in 2018 to 35,200 in 2020.

At the same time, more people have been unable to return their CPF savings in full after selling their house. One possible reason for this is that some may not realise how significant the accrued interest is until they have to sell their house and return it.

(One way to reduce the amount of CPF savings you have to return is to make a voluntary housing refund, which you can read more about here.)

Fewer people used their CPF savings to pay for home loan instalments .

Another trend that the Zaobao report highlighted is that fewer homeowners were using their CPF savings to pay for home loan instalments. The figure has dropped from 817,000 in 2018 to 799,000 in 2020.

This means that more people are using cash to pay for their home loan instalments, which could help reduce the amount of CPF savings needed to be returned should they sell their house.

You can refer to the full CPF trends report here.

What do you think of these CPF trends? Let us know in the comments section below or on our Facebook post.

If you found this article helpful, 99.co recommends How your HDB sale proceeds might get “taken” by CPF and Negative Sale: How selling your HDB/condo could put you in instant debt.

Looking for a property? Find the home of your dreams today on Singapore’s fastest-growing property portal 99.co! If you would like to estimate the potential value of your property, check out 99.co’s Property Value Tool for free. Meanwhile, if you have an interesting property-related story to share with us, drop us a message here — and we’ll review it and get back to you.

The post More people were unable to fully return their CPF monies after selling their house appeared first on 99.co.