Singapore homes are known to be small and expensive, so space is considered a premium. Unfortunately, landed homes and condominiums are too expensive for most. If you’re looking to upgrade to a bigger home without breaking the bank, one type of home to consider is the HDB executive maisonette.

Though they were discontinued in 1995 and thus have shorter remaining leases, executive maisonettes (or EMs) in Singapore are still highly sought-after among home buyers because of their rarity and unique attributes that set them apart from regular HDB flats. In fact, resale executive maisonettes can reach up to $1 million. An executive maisonette at Bishan Street 13 for example, was sold for $1.09 million in 2014. Recently, an executive maisonette in Toh Yi Drive was sold for $1.21 million.

Without further ado, here is what you need to know about HDB maisonette homes in Singapore and what makes them highly desirable.

What are HDB Maisonette Flats?

HDB executive maisonettes (or sometimes pronounced as mansionette) are a type of HDB flat that are no longer in production, and were replaced by the executive condominium (EC) scheme. As such, there is a limited supply of executive maisonettes left in Singapore, mostly in mature estates such as Ang Mo Kio, Bishan, Bedok, Bukit Panjang, Bukit Batok, Choa Chu Kang, Hougang, Pasir Ris, Queenstown, Serangoon and Sembawang.

How are Maisonettes Different from Regular HDB Flats?

|

Typical HDB flats |

HDB executive maisonette flats |

|

One-storey |

Two-storeys |

|

Typical size |

147 to 160 sqm, which is around 1.5 to 2 times the size of typical HDB flats |

|

No/small balcony |

Large balcony space |

|

Two bathrooms |

Up to three bathrooms |

The most notable feature of executive maisonette flats is that they have two floors of space. Yup, that’s right. Executive maisonettes are essentially small, two-storey HDB flats.

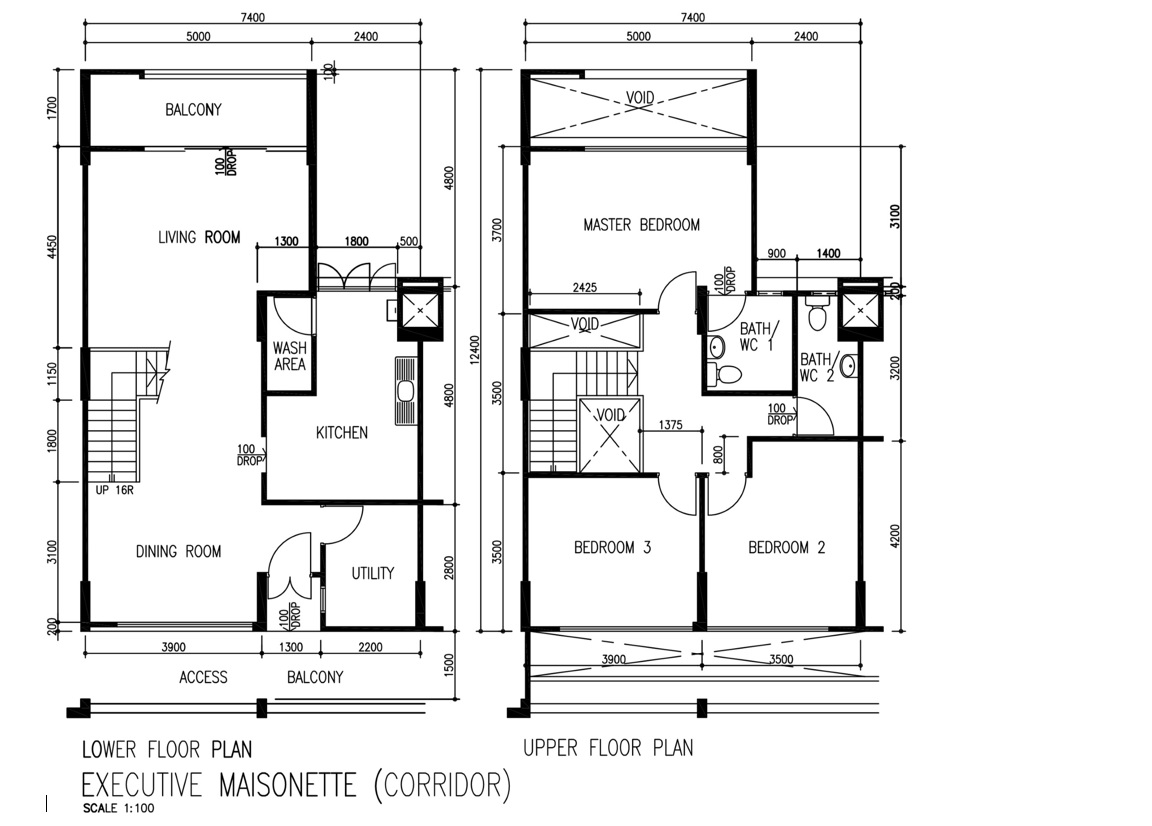

The bedrooms are located on the upper floor while the living and dining area is on the lower floor. This unique design provides more privacy to the home owners, especially when there are guests around. Also, while this isn’t exactly a huge deal breaker, executive maisonettes come with three bathrooms, which is more than your typical HDB flats. They also come with balcony space.

Since HDB executive maisonette flats come with two floors, they’re also noticeably larger; executive maisonettes usually range between 1,527 to 1,700 sq ft, making them popular among couples or larger families who require more room.

There are also ‘penthouse’ maisonettes – these are executive maisonettes that are located on the highest floor, and therefore feature an open terrace design. The penthouse-like design of these flats gives an exposed view of the surroundings. These HDB maisonettes with sky terraces can be found in estates like Bishan, Pasir Ris or Hougang and can go up to 2,314 sq ft. But know that these start from $800,000, which is more expensive than some of the freehold condos in Singapore!

Executive Maisonette vs Jumbo Flats vs 3Gen Flats

But executive maisonettes aren’t the only large flat type by HDB. In fact, if you’re looking for a flat design that has more space, then you might also consider jumbo flats and 3Gen flats. But like executive maisonettes, these unique flats don’t come cheap!

Here’s a quick comparison between all the flat types:

|

Flat type |

Size |

Price |

Locations |

|

Executive maisonette |

1,527 to 2,314 sq ft |

$750,000 to $1 million |

Ang Mo Kio, Bishan, Bedok, Bukit Panjang, Bukit Batok, Choa Chu Kang, Hougang, Pasir Ris, Queenstown, Serangoon and Sembawang |

|

Jumbo flats |

1,582 to 2,142 sq ft |

$480,000 to $1 million |

Ang Mo Kio, Bishan, Bedok, Hougang, Jurong East, Pasir Ris, Tampines, Woodlands, Yishun |

|

3Gen flats |

About 1,237 sq ft |

$300,000 to $500,000 |

Punggol, Tampines, Yishun |

Looking to live in one of these spacious flat types? Find executive maisonettes, jumbo flats and 3Gen flats for sale on PropertyGuru now.

Executive Maisonette Floor Plan: Here’s What It Looks Like

Jumbo Flat Floor Plan: Here’s What It Looks Like

3Gen Flat Floor Plan: Here’s What It Looks Like

What to Consider Before Buying an Executive Maisonette

Before committing to buy an executive maisonette, ask yourself the following:

1. Do You Need the Extra Space?

An HDB maisonette might give you a lot more space and look swanky with proper interior design, but if you don’t plan to have any kids then you’ll likely have spare bedrooms that will go to waste. In this case, it might be better to buy a home according to your needs, especially when you have property tax and financial health to consider.

2. Figuring Out Your Loan

Speaking of money, figuring out how much you can borrow from HDB is crucial (i.e. loan amount). The amount you can borrow will depend on factors such as your age, income and your financial standing. Read this article for more information about HDB loans and eligibility.

If you need financial advice on your mortgage repayments and loans, get in touch with PropertyGuru’s Finance Advisors.

3. Can You Afford the Down Payment?

Remember, while the maximum loan amount you can get from HDB is 90%, you have to pay the remaining 10% via cash, CPF or both.

Say if you’re buying an executive maisonette that costs $600,000, you need to have at least $60,000 at hand. This doesn’t include other costs including renovation, which could be at least $20,000.

Of course, if money is no object to you, then you shouldn’t worry.

Recommended Article: Home Loan Downpayments: How Much Must You Pay Upfront for HDB vs Private Property?

Other FAQs About Executive Maisonettes in Singapore:

Is Executive Maisonette Better Than Other HDB Flats?

Well, it depends. Executive maisonette does hold some advantage over the typical HDB apartment such as bigger size, two-storey layout and a balcony space that is usually seen only in condos.

Is Executive Maisonette a Good Investment?

There are a few reasons that make executive maisonettes a good housing investment.

- The sheer size of it is one of them, which makes it suitable for large families.

- The two-storey layout also makes it feel as though you are staying in a landed without the large price quantum of a landed property.

- Now that executive maisonettes are no longer in production, it makes executive maisonette HDB flats a rare commodity in the HDB market. Basic economics knowledge tells us that when supply is limited and demand goes up, the price of executive maisonettes will go up.

Recommended Article: Property Investment in Singapore: How to Get Started, Calculate Rental Yield and More

What is EM HDB?

EM, or Executive Maisonette, is an HDB flat type that is no longer in production. Unlike the typical HDB flat, EM HDB flats span across two storeys with a large floor area of up to 2,615 sq ft.

What is Executive HDB Flat?

Executive HDB flat, or executive apartment, is another type of HDB flat that is not to be confused with executive maisonette. They come with an additional set of room that can either act as a study room, or an extension of the living room space. Some executive apartments also come with their own balcony space, just like executive maisonettes in Singapore.

Can Singles Buy Executive Maisonette?

Under the Single Singapore Citizen Scheme, any single above the age of 35 can purchase an executive maisonette HDB flat from the resale market. But do note that executive maisonette HDB flats are typically more expensive than the 3-room, 4-room flats because of its sheer size.

Recommended Article: Your Definitive Resource on HDB’s Housing Grants, Policies, and Programmes

Ready to Buy an Executive Maisonette?

Check out executive maisonettes for sale on PropertyGuru now. You can also check out some of these executive mansionettes that are selling for less than $650k.

For more property news, resources and useful content like this article, check out PropertyGuru’s guides section.