Housing has become a hot topic of late. Cooling measures, redevelopment of sites in Alexandra and Mount Pleasant, and announcements in the increase in the number of BTO flats launches and private property supply have stirred up discussions on various social media channels.

But we can’t forget what sparked it all: the launch of HDB’s first batch of Prime Location Public Housing (PLH) model flats in Rochor, launched during the recent BTO November 2021 exercise.

From debating if flats released under the PLH model were too expensive to wondering if demand would shoot right through the roof due to the flats’ central, convenient location, the topic of PLH BTO flats was on everyone’s lips.

Let’s take a look at the application rates for the November 2021 BTO exercise:

Source: HDB

The Nov 2021 Rochor BTO flats, River Peaks I and II, had an overall application rate of 3.1 for three-room flats and 10.3 for four-room flats. No surprise that there was more interest in the four-room flats as four-room flats are typically the most popular size.

A total of 6,976 applicants competed for the 680 available four-room Rochor BTO units. But what was shocking was the second timers application rate for the Rochor four-room flats was 104.7. However, some might argue this is ‘nothing’ compared to the August 2021 Hougang BTO flats; over 11,400 applicants vied for the 459 four-room units.

To get a better understanding of how Singaporeans may react to future launches released under the PLH model, we listened to the ground sentiment and asked those who applied (or refused to apply) for the Nov 2021 (Central) Rochor BTO PLH flats.

Pros and Cons of the PLH Flats

There’s been a lot of talk about the PLH flats made by those on the sidelines (i.e. those who already own homes). But let’s hear from the horse’s mouth, shall we?

In general, those we spoke to are aware of the restrictions of the Rochor PLH BTO flats, but had other compelling reasons that encouraged their application. Meanwhile, those who refused to apply for this project during this exercise had their reasons too.

|

Nov 2021 Rochor PLH BTO flats |

Pros |

Cons |

|

Completion time |

More time to accumulate CPF money |

Long wait of more than 6 years (completion in Q2 2028) |

|

Price and available subsidies |

Additional subsidies, on top of the existing Enhanced Housing Grant |

Subsidy clawback of 6% of resale price or valuation (whichever is higher) upon sale of flat |

|

Size of unit |

Okay for small families or couples with no children |

MIght be too small for larger families |

|

Convenience of location |

MRT at your doorstep, central location with 2 other MRT lines within walking distance |

High human traffic, could be noisy, crowded |

|

Amenities within the area |

Good food, retail, recreation amenities within easy reach |

May not have neighbourhood clinics around, childcare and primary/secondary schools not in the vicinity |

|

10-year Minimum Occupancy Period |

Doesn’t bother those who buy for own stay |

Cannot sell till 2038 if the family decides that the flat is unsuitable etc., might impact those who implied through MCPS |

|

Rental yield |

Allowed to rent out rooms in the flat under PLH model |

Unable to rent out whole flat, even after MOP |

|

Resale value |

Price expected to appreciate, especially by 2038 |

Restricted pool of future buyers, due to income ceiling for future buyers even if there’s demand and appreciation |

1. Completion Time

The Rochor BTO project is slated for completion in the second quarter of 2028. Barring any additional construction delays due to the ongoing COVID-19 situation, that’s more than six years from when it was launched.

For couples in their 30s who plan to have children soon, waiting for their home to be ready before doing so might not be ideal. This was a major dilemma some, like Carrie, faced.

Carrie says: “The completion time is longer than other BTOs. Considering that we plan to get married and have a family soon due to our age range, the long wait time was making us reconsider this project.”

Related article: 5 Best Neighbourhoods in Singapore for Families with Young Children (2021)

However, having had unsuccessful BTO balloting results for her applications at Bidadari and Kovan, the Rochor BTO launch proved to be her lucky star.

She shares, “When we got pretty decent ballot results, we decided to go ahead with it (the Rochor BTO). We are still considering our accommodation options such as staying at our parents’ place or renting a place outside first as the finances can be quite costly to rent a place for the next six years.”

Adds Aloysius, 29: “From a practical standpoint, the longer completion time gives me more time to accumulate CPF funds for the down payment of my house.”

Related article: How Much to Budget for A New Home: A Complete Breakdown of Payments

2. Price and Available Subsidies

Naturally, even a public housing project in such a prime location would command ‘prime’ prices. Here’s what the Rochor BTO flats cost at launch:

|

Unit type |

River Peaks I & II Central Area (Rochor) BTO Price (Nov 2021) |

Resale flat prices in the area |

|

3-room |

From $409,000 to $474,000 |

From $370,000 to $558,000 |

|

4-room |

$582,000 to $688,000 |

From $450,000 to $900,000 |

Comparing the prices of the Nov 2021 Rochor BTO flats and the existing resale flat prices in the area that have already seen lease decay, we can see that HDB is giving quite a good upfront subsidy on the new flats. This is in addition to the existing grants, such as the Enhanced Housing Grant.

Given that Rochor is in the Central region, the flat prices are still comparable to the city fringe projects, such as those in the Kallang/Whampoa area, where a 4-room unit is going from $511,000 (Nov 2021 BTO launch).

The catch? HDB has imposed a 6% subsidy clawback for when the Rochor BTOs are sold on the resale market in the future.

However, the launch price is still high nonetheless, for applicants such as Mr Ang, 26, who only has the budget for flats in non-mature HDB towns. In addition, as he and his wife have been working for five years or less, they are still unable to pay off the bulk of the flat with their CPF funds, even after an extended completion time.

He says, “The Rochor BTOs are indeed impressive, but I’d rather spend half the amount and get a flat in a non-mature estate. We may be able to support the mortgage as of now, but who knows what will happen in the future? So it’s better to be frugal and live within our means.”

“We won’t even know exactly how the 6% subsidy clawback will work in practice, as that would only be seen in 2038. So I’d rather play safe for now. Maybe in the future, I might change my mind,” he adds.

3. Size of Unit

The size of a three-room unit at River Peaks is about 66sqm, while that for a four-room flat is estimated to be 88sqm. That’s slightly smaller than current HDB units, which hover around 68sqm and 91sqm respectively.

Related article: Just How Much Smaller Are New Condos and HDB Flats Getting?

Second-time applicant Andrea, 43, is hardly bothered by the size. She says, “My son is going into his twenties soon, and when the flat is completed, he might already be married and have a place of his own. It’s a comfortable size for me and my husband to live till after retirement, in an area we like.”

However, Wilson, 31, who has two active boys and another on the way, gave the Rochor BTO flats a miss and opted for a five-room flat in Tengah. “I think my sons will be bouncing off the walls, and there’ll be hardly any space for them to run and jump around. 88sqm is hardly enough for our soon-to-be family of five.”

4. Convenience of Location

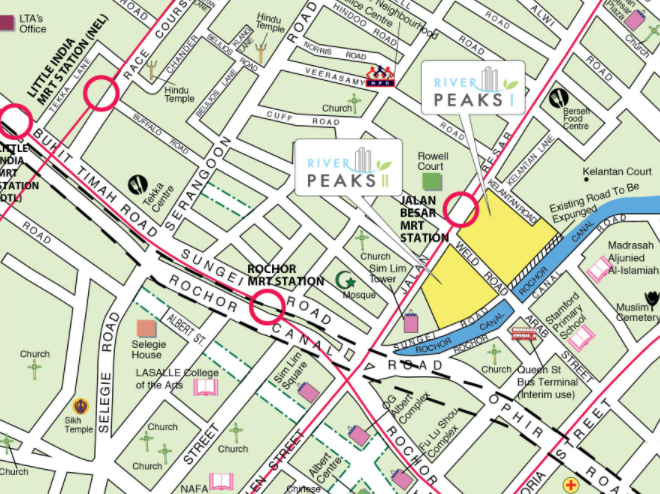

Location of River Peaks I & II November 2021 Central Area (Rochor) BTO flats, located along Kelantan Road and Weld Road. Source: HDB

Everyone we spoke to unanimously agreed that the Rochor BTO flats were in a very convenient location. Some respondents mentioned they worked nearby the site. Yet that is not a major pull factor for Meiling, 34, as she feels “everywhere in Singapore is convenient, lah.”

She adds, “Most of us will live within walking distance to an MRT station soon, and our bus network is so good already. Anyway, Singapore is very small, even if I hail a Grab daily, it’s still alright. Doesn’t matter if I live in Tengah, it will also be near an MRT station eventually.”

Carrie chimes in, “In our previous BTO applications, we’ve always been seeking accessible projects with the MRT station close by, so the Rochor BTO matches our needs.”

5. Amenities Within the Area

There’s no end to the many amenities in the Rochor area, especially for foodies and shopaholics. At River Peaks’ doorstep is Mustafa Centre, Jalan Besar Plaza, Berseh Food Centre, Tekka Centre, Sim Lim Square, OG Albert Complex, Fu Lu Shou Complex, Selegie House, Tekka Centre, Raffles Hospital, Kallang Polyclinic, Jalan Besar Sports Centre, Bugis+, Bugis Junction… you name it.

Those who frequent the area like Andrea see sense in moving close by. “I’m regularly shopping or eating in this area, so it makes total sense for me to live here instead of travelling down so often. Am looking forward to having supper without incurring high cab fare charges in the future,” says Andrea.

However, for applicants like Mr Ang, the lack of schools for little ones in the area can be a deterrent. He says: “Maybe the area will be more developed for young families when the Rochor BTO is up, but seeing how dense and packed everything is, parents living there will need to look for schools in a larger radius.”

Related article: Would You Move House to Live Nearer to a Choice Primary School? We Ask 6 Parents

Near the Rochor BTO flats, you’ll find Stamford Primary School, Singapore School of the Arts, LASALLE College of the Arts, NAFA and Singapore Management University – many of which are tertiary institutes.

6. 10-year Minimum Occupancy Period

One restriction that comes with the new PLH model is that flats now have a Minimum Occupation Period (MOP) of 10 years. The rationale behind the extended MOP from the usual five years is to discourage applicants who intend to use the flat as an investment property and flip it for profit. Ideally, the applicants who apply for the Rochor BTO flats have the intention of living there long-term.

This is indeed a long time, and many things can change, says Wilson. He adds, “Maybe you realise you don’t love the neighbourhood or neighbours as much, or you need to move for some other reason. While I don’t see any issue living someplace nice for a decade, it’s important to have options as well, just in case.”

For Carrie, the long MOP impacts her parents as well, as she applied for the Rochor BTO under the Married Child Priority Scheme (MCPS). She says: “This would also mean that our parents have to stay within the 4km radius for the next 17 years until the house reaches MOP.”

However, she is determined to stay put, and likewise, her parents have no plans to move either.

7. Rental Yield

For these PLH model flats, the new regulation stipulates that the homeowner cannot rent out the whole house, even after MOP. This limits the rental yield of the flat to spare rooms alone, which is precisely the reason for the new policy – to provide housing for applicants looking for a home, not an investment vehicle.

Mr Ang, although not keen on the Rochor BTO flats, notes that the rental yield in prime areas is generally good, even if just renting out a spare room. “There should be good appreciation in the Rochor area as there are a lot of offices around,” he says.

8. Resale Value

The property appreciation is also likely to extend to the Rochor BTO flats’ resale value, which should be significant when the flats’ MOP is up, in 2038.

Meiling observes, “With inflation, everything will go up. Although based on trends I’ve seen, property in city fringe regions tend to appreciate quicker, as well as those in ‘hot’ non-mature estates. The property appreciation in the central region is quite gradual.”

Aloysius adds, “The pool of buyers will be limited, not only because the flat will be a bit older when it can be sold on the resale market, but also there’s an income cap on the buyer profile. The price is likely to be at the max cap, due to the 6% subsidy clawback – and I’m sure no one wants to sell the property at a loss.”

Who Are the PLH Flats Likely Most Suitable For?

That said and done, the PLH model exists for a reason – to prevent the gentrification in Singapore’s downtown core and to calm the lottery effect of prime area housing.

There’s a worrying trend of HDB transaction prices seeing double-digit year-on-year growth; and if this continues to keep pace, it could become commonplace to see million-dollar HDB flats. With housing affordability in Singapore becoming an increasingly hot button topic, it will be interesting to see how the PLH model plays out.

For Younger Couples Who Want to Live in the Area Long-term

This group is likely unable to afford the high prices of PLH model flats and would go for more wallet-friendly housing in non-mature estates. Their ideal budget would be $300,000 to $400,000, which at best, can net them a 3-room unit in a prime area. Younger couples would also probably want larger flat types for their future family needs.

Younger couples may use the proceeds of selling their first HDB flat to upgrade to a condo or a larger HDB flat. The long 10-year MOP of the PLH model flats targets those who want “forever homes” as the earliest selling date would be in 2038.

Nevertheless, if you’ve got the youth, the budget (these flats are for couples who are likely earning a dual income anyway) and the staying power, go for it.

For Older Folks

As observed from the application rates, there was a surge of second-time applicants (those who already own a flat) for the Rochor BTO flats.

These second-timers tend to be older, and their offspring grown. By the time the Rochor BTO flats are ready in 2028, their children might have gotten married and/or moved out. And by the time they reach MOP and are ready to sell, they’ll be close to retirement and can use the proceeds to fund their golden years as they downsize to a smaller place, or a resale flat in a more affordable area – perhaps near their adorable grandkids.

Related article: Monetising Your HDB Flat for Retirement in Singapore: 4 Ways to Unlock Your Property’s Value

More FAQs about the PLH Model

What are the Prime Areas in Singapore?

Prime areas denoted under the PLH model will be the city centre and its surroundings, including the upcoming Greater Southern Waterfront.

What is Prime Location Housing?

According to HDB, “the PLH model is a public housing model that aims to keep HDB flats in central locations affordable, accessible, and inclusive”.

Can Singles Buy PLH Model Flats?

No. The PLH model flats are for households of at least one Singapore Citizen applicant that form an eligible family nucleus.

For more property news, resources and useful content like this article, check out PropertyGuru’s guides section.

Are you looking for a new home? Head to PropertyGuru to browse the top properties for sale or rent in Singapore.

Already found a new home? Let PropertyGuru Finance’s home finance advisors help you with financing it.

This article was written by Mary Wu, who hopes to share what she’s learnt from her home-buying and renovation journey with PropertyGuru readers. When she’s not writing, she’s usually baking up a storm or checking out a new cafe in town.