In the wee hours of 11.45 pm on Wednesday (Dec 15), the government dropped the news of a fresh round of cooling measures slated to take effect from Thursday (Dec 16).

The Additional Buyer’s Stamp Duty rates were raised by 5% to 15%, the Total Debt Servicing Ratio threshold was tightened to 55%, and the Loan-to-Value limit for HDB loans was lowered to 85%.

How will the new cooling measures impact the property market?

Higher ABSD

The new cooling measures introduced a heavy-handed increase of Additional Buyer’s Stamp Duties (ABSD) for non-entities by about 5% to 15%. This is a much steeper increase compared to previous rounds of 5% to 10% increments in the 2013 and 2018 cooling rounds.

| Types of Buyers | ABSD from 8 December 2011 – 11 January 2013 | ABSD from 12 January 2013 – 5 July 2018 | ABSD from 6 July 2018 – 15 December 2021 | ABSD on or after 16 December 2021 | |

| Singapore Citizens | First residential property | 0% | 0% | 0% | 0% |

| Second residential property | 0% | 7% (+7%) | 12% (+5%) | 17% (+5%) | |

| Third and subsequent residential property | 3% (+3%) | 10% (+7%) | 15% (+5%) | 25% (+10%) | |

| Permanent Residents | First residential property | 0% | 5% (+5%) | 5% (unchanged) | 5% (unchanged) |

| Second residential property | 3% (+3%) | 10% (+7%) | 15% (+5%) | 25% (+10%) | |

| Third and subsequent residential property | 3% (+3%) | 10% (+7%) | 20% (+5%) | 30% (+10%) | |

| Foreigners | Any residential property | 10% (+10%) | 15% (+5%) | 20% (+5%) | 30% (+10%) |

| Entities | Any residential property | 10% (+10%) | 15% (+5%) | 25% (Plus additional 5% for housing developers (non-remittable)) (+15%) | 35% (Plus additional 5% for housing developers (non-remittable)) (+15%) |

This may cause a pullback in foreign demand for properties, with the ABSD for foreigners being increased by 10% to hit a whopping 30% in ABSD.

The Core Central Region (CCR) with the highest concentration of prime properties will see the most impact of foreign demand on properties. In 2021, it commanded a higher foreign demand of private non-landed purchases, leading with 9%, followed by 4% in the Rest of Central Region (RCR) and 2% in the Outside Central Region (OCR).

With this increase in ABSD, foreign buying demand will be dampened, especially when overseas buyers gradually start to return with VTLs and the relaxation of border measures.

Simon Yio, Chief Operating Office of OrangeTee & Tie:

“The new set of cooling measures is more targeted at foreigners. Singaporean owners are impacted less from the measures, and there are already ongoing solutions from the previous rounds of cooling measures in 2018. As per most cooling measures, it is possible to see a short term dip for 3-6 months. The demand should still be strong for Singaporean upgraders or first-time buyers.”

Kelvin Fong, Executive Director of PropNex:

“The cooling measures will have more of an impact on the CCR, where foreigners may have more holdback when purchasing another property due to the increase in ABSD.”

Rex Tan, Executive Group District Director, Huttons Asia:

“This round of cooling measures mainly penalises those purchasing their second property and foreigners. Foreigners purchasing properties only consists of less than 5% of private transactions in 2021; hence we do not expect this implementation to rock the boat.”

Pow Ying Khuan, Head of Research at 99.co, illustrates the impact of the ABSD hike, taking the median price of a resale condo at $1.275 mil in 2021YTD. Here is the new additional ABSD payable for non-entities:

| Types of Buyers | ABSD from 6 July 2018 to 15 December 2021 | ABSD on or after 16 December 2021 | Additional ABSD in SGD | |

| Singapore Citizens | First residential property | 0% | 0% | S$0 |

| Second residential property | 12% | 17% (+%5) | S$63,750 | |

| Third and subsequent residential property | 15% | 25% (+%5) | S$127, 500 | |

| Permanent Residents | First residential property | 5% | 5% | S$0 |

| Second residential property | 15% | 30% (+15%) | S$191,250 | |

| Third and subsequent residential property | 15% | 30% (+15%) | S$191,250 | |

| Foreigners | Any residential property | 20% | 35% (+15%) | S$191,250 |

“Given that majority (>90%) of the private residential buyers are locals and PRs for the past few years who usually choose the OCR and RCR regions due to their relative affordability, the impact from this round of cooling measures may be more keenly felt by overseas buyers who traditionally prefer the prime districts, CCR home sellers and developers with significant stock in CCR,” says Pow.

The 10% hike in ABSD will force potential buyers eyeing their second property as an investment piece to think again.

However, genuine homebuyers (Singapore citizens and permanent residents) purchasing their first residential property remain unaffected as their ABSD rates remain the same at 0%.

Tighter TDSR

The Total Debt Servicing Ratio (TDSR) threshold was tightened by 5% to 55%, down from the previous 60%. This means the monthly loan repayments of borrowers cannot exceed 55% of their monthly income.

Borrowers with existing property loans granted before Dec 16 will not be affected by the revised TDSR threshold when refinancing their loans, according to the authorities.

With the hike in ABSD coupled with the tightening of TDSR, investor demand is expected to experience a significant dive. This is attributed to potentially higher capital costs and tighter financing conditions.

This might be a pre-emptive move by the government to lower the ability of homebuyers to obtain a bigger loan, thus encouraging them to be prudent with their finances. With the TDSR being tightened, it ensures that households will not be over-leveraged and financially stretched in the event that interest rates increase.

Simon Yio, Chief Operating Office of OrangeTee & Tie:

“The new cooling measures are to keep the consumers aware that the government wants a sustainable real estate market instead of a speculative one. It has lowered the TDSR, as they recognise that consumers have more liquidity due to Quantitative Measures. These measures encourage financial prudence, which is beneficial to everyone. In reality, the measures have only just been announced last night (Dec 15), so at this point in time, it is too early to draw conclusions.”

Kelvin Fong, Executive Director of PropNex:

“For first-timers, I don’t see a big problem because the difference in margin is not a lot, especially in today’s market where the market price is still very strong and considered affordable. Looking back at 2018 and the pandemic, the drop is only 1%. We can see that property prices are still holding. After that, it has subsequently gone up again.”

What does this mean for developers?

There is significant added pressure for developers, with the increase in ABSD for entities from 30% (25% remissible + 5% non-remissible) to 40% (35% remissible + 5% non-remissible). This is likely to have a trickle-down effect on en-bloc sale prospects, with developers thinking twice about large-scale projects.

With the new 35% ABSD rate, developers face higher risks when bidding for land as they are required to complete and sell all units within the 5-year deadline in order to meet the stringent requirements for ABSD remission. As a result, developers may exercise more caution when planning to execute new projects.

“Developers still have to bid at a reasonable price for land. If they don’t bid for land, they will have no property to sell, and there’ll be no margin for the company. It’ll be hard for them to answer to their shareholders.” states Kelvin Fong.

Too early to tell the impact

Pow thinks prospective buyers may adopt a wait-and-see approach to reassess their buying decisions and observe any changes in market conditions before making a move.

“As a result, at least for the next three to six months, we would expect a more muted market in terms of transaction activities. We are, however, not convinced that there will be significant price corrections in the housing market, even as we keep an eye out on other risks such as any surprise rate hikes.

All in all, we expect private residential prices to stabilise around current levels, as asking prices might remain sticky, with a view that transaction volumes might experience some slowdown at least for the next few quarters.”

Kelvin Fong echoes the same sentiments, stating, “Buyers can still purchase properties for reasonable prices because sellers will be cautious and stable and won’t increase the prices without reason.

This is a window of opportunity for many buyers. They should take advantage of this market and observe what price they can buy in at. Any owners looking to sell their property may not be looking to increase the price due to the new measures.”

–

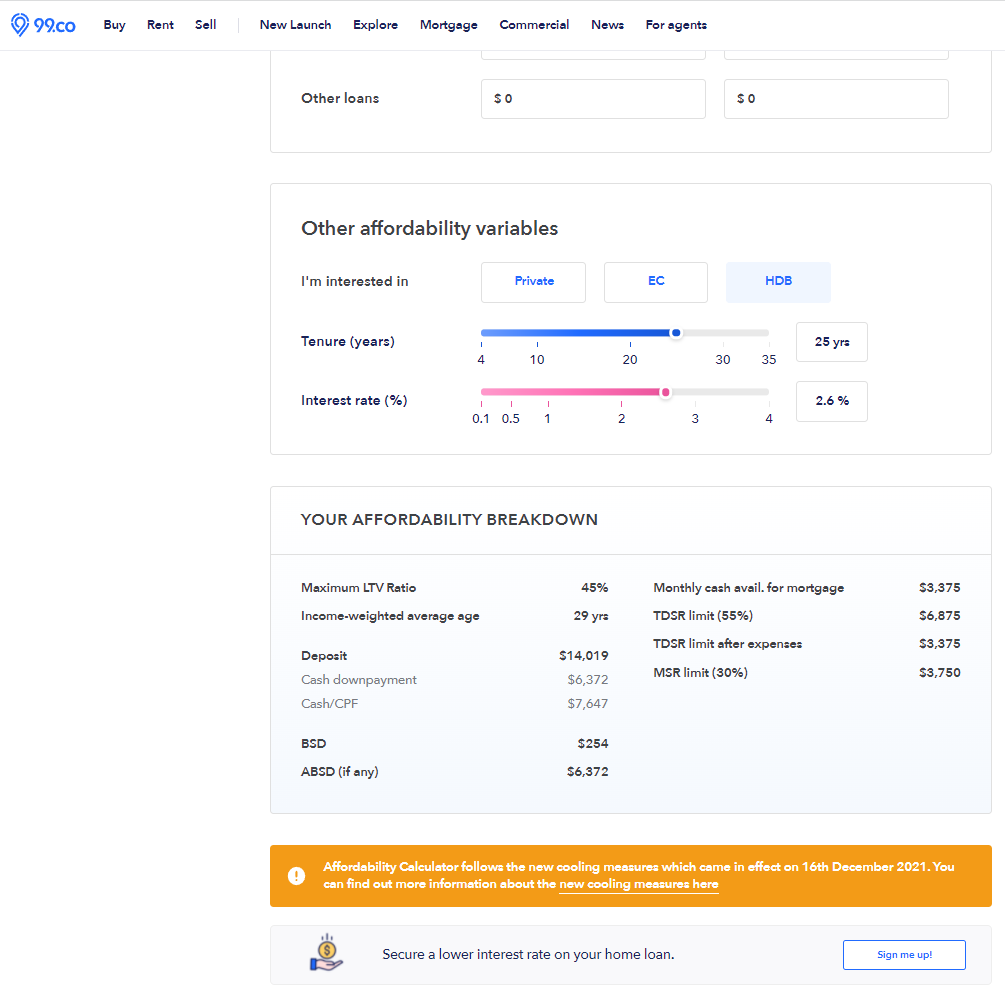

Calculating affordability with the new 2021 cooling measures in place

99.co has updated our affordability calculator with the new cooling measure rules. Feel free to enter different aspects about yourself and/or your partner/spouse (single owner or joint owner) and highlight your profiles – Singaporean, Singapore Permanent Resident (SPR), foreigner or entities.

Input information like the number of properties each of you already own, respective monthly income, current debt and expenses and the type of property you’re purchasing. You can also input the tenure and interest rate of the property.

This will generate a summarised affordability chart for you so that you can make a more informed decision on your financial commitments should you go ahead and choose to purchase a particular residential property in Singapore.

What are your thoughts on the latest round of cooling measures? Let us know in the comments section below or on our Facebook post.

If you found this article helpful, 99.co recommends checking out 5 things every on-the-fence homebuyer must do if new cooling measures are suddenly announced and New 2021 cooling measures announced.

Looking for a property? Find the home of your dreams today on Singapore’s fastest-growing property portal 99.co! If you would like to estimate the potential value of your property, check out 99.co’s Property Value Tool for free. Meanwhile, if you have an interesting property-related story to share with us, drop us a message here — and we’ll review it and get back to you.

The post How will the new cooling measures affect property activity? appeared first on 99.co.