The government has announced a package of cooling measures for private residential and HDB resale markets effective from midnight 16 December 2021. The announcement follows the government’s close monitoring of the property market for several quarters. The private residential and HDB resale markets have been buoyant despite the economic impact of COVID-19.

In its release, it noted that private housing prices have risen by about 9% since Q1 2020, while HDB resale prices have recovered sharply after a 6-year decline, rising 15% over the same period. The concern raised is that even though House Price-to-Income ratios remain below historical averages, the upward momentum in terms of home prices is worrying.

If left unchecked, prices could run ahead of economic fundamentals and run the risk of a destabilising correction.

The signs for this cooling measure seem to have been indicative, albeit subtle.

Just ten days ago, MAS warns Singapore households on rising mortgage debt ahead of potential interest rate hikes. The Monetary Authority of Singapore even advised homebuyers to exercise prudence, as household debt in Singapore has grown over the past year, driven mainly by housing loans.

Here then is the list of new measures:

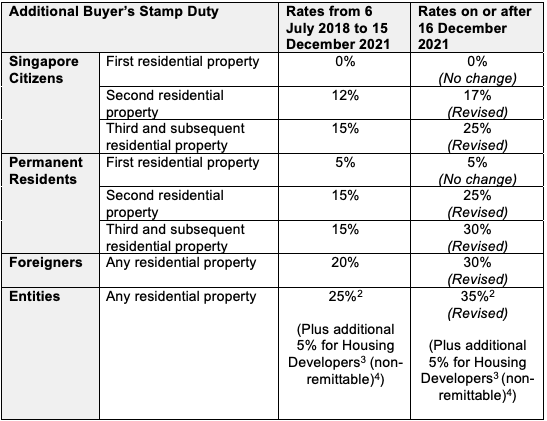

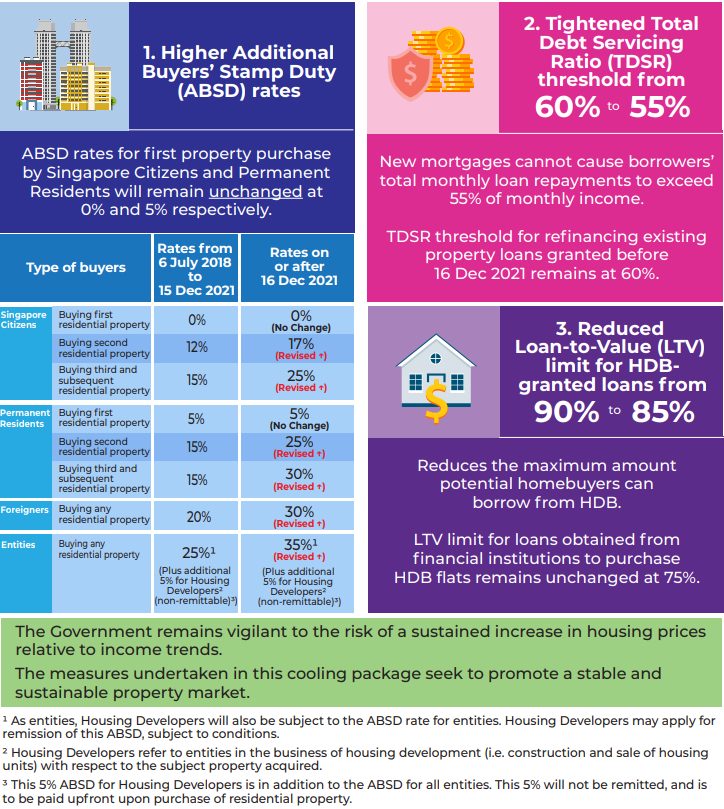

Raising Additional Buyer’s Stamp Duty (ABSD) Rates for 2nd and subsequent properties for SCs, PRs, and 1st for foreigners, entities and developers

First, there are no ABSD changes for Singapore Citizens and Singapore PRs buying their very first residential property, which remains at 0% for SCs and 5% for PRs. Phew…

But if you’re in the market to buy a 2nd or subsequent property from 16 December 2021, or you’re jointly buying a property with a partner who isn’t a Singapore Citizen, things may be different.

- ABSD rate to be raised from 12% to 17% for Singapore Citizens buying their 2nd residential property

- ABSD rate to be raised from 15% to 25% for Singapore Citizens buying their 3rd and subsequent residential properties

- ABSD rate to be raised from 15% to 25% for Singapore PRs buying their 2nd residential property

- ABSD rate to be raised from 15% to 30% for Singapore PRs buying their 3rd and subsequent residential property

- ABSD rate to be raised from 20% to 30% for foreigners buying any residential property, including their first

- ABSD rate to be raised from 25% to 35% for entities buying any residential property, including their first

- ABSD rate to increase from 30% to 35% for housing developers purchasing any residential property. This 35% may be remitted under the Stamp Duties (Non-licensed Housing Developers)(Remission for ABSD) Rules and the Stamp Duties (Housing Developers) (Remission of ABSD) Rules, subject to conditions. On top of this 35% ABSD rate, the non-remittable component remains unchanged at 5%.

For purchases made jointly by two or more parties of different profiles, the highest applicable ABSD rate will apply.

So if you are a Singapore citizen and your partner/spouse is a foreigner, and you’re jointly buying your 1st or 2nd residential property together, the ABSD rate is 30% for both, not 0% or 17% respectively. However, depending on your profiles, do see ABSD remission rules further below.

Also, if your partner/spouse is a citizen from the USA, or a citizen or PR from Iceland, Liechtenstein, Norway or Switzerland, as per the ABSD remission rule under the Free Trade Agreements (FTAs), then he or she will be accorded the same Stamp Duty treatment as Singapore Citizens – which means 0% or 17% respectively.

Based on the revision above, it seems that the biggest impact would be felt if you’re a Singapore Citizen buying your 3rd (or subsequent) property, a PR buying your 2nd property (or subsequent), OR you’re a foreigner (non-FTA ones) or an entity buying any residential property in Singapore.

ABSD Remissions for Married Couples with at least one Singapore Citizen

ABSD remission is applicable only if the couple buying the property is married and at least one of them is a Singapore Citizen.

If they jointly purchase a 2nd residential property, they can apply for a refund of ABSD, subject to conditions. These conditions include selling their first residential property within 6 months after:

- the date of purchase of the 2nd property if this is a completed unit, or

- the issue of the Temporary Occupation Permit (TOP) or Certificate of Statutory Completion (CSC) of the 2nd property, whichever is earlier, if the 2nd unit is not completed at the time of purchase.

For married couples with at least one Singapore Citizen spouse (eg. married to an SPR or foreigner) who are buying their 1st residential property in Singapore, they can also apply for a refund of the ABSD, subject to conditions. If you’re confused, don’t be. This handy PDF chart from IRAS should be useful.

The ABSD currently does not affect those buying an HDB flat or Executive Condo (EC) from property developers with an upfront remission, if any of the joint acquirers/purchasers is a Singapore Citizen. According to MND’s release, there will be no change to this.

Note that ABSD does not count properties you own overseas – only the ones you own – wholly or jointly – or has a share of in Singapore.

The revised ABSD rates will apply to cases where the Option to Purchase (OTP) is granted on or after 16 December 2021. There is also a transitional provision where the previous ABSD rates before 16 December 2021 will apply for cases that meet the following conditions:

- The OTP is granted by sellers to potential buyers on or before 15 December 2021;

- This OTP is exercised on or before 5 January 2022, or within the OTP validity period, whichever is earlier; and

- This OTP has not been varied on or after 16 December 2021.

Also, the Additional Conveyance Duties for buyers of equity interest property-holding entities (basically an entity with at least 50% of its total tangible assets comprising of immovable properties in Singapore) will be raised from up to 34% to up to 44%.

Tightening Total Debt Servicing Ratio Threshold (TDSR) for loans, including refinancing

Besides revising the ABSD for property purchases, the TDSR threshold will be tightened from 60% to 55%. This will apply to loans for the purchase of properties where the OTP is granted on or after 16 December 2021. Not only that, this includes mortgage equity withdrawal loan applications made on or after 16 December 2021 – ie. if you’re refinancing your home loan.

Note that TDSR is currently waived for borrowers who refinance their owner-occupied housing loans. For borrowers refinancing their existing investment property loans, MAS has provided a temporary TDSR waiver for borrowers affected by COVID-19 – otherwise, the previous 60% TDSR applies.

In other words, borrowers with existing property loans granted before 16 December will not be affected by these revised TDSR thresholds when refinancing their loans, but if you’re planning on refinancing after 16 December, the new cooling measure (TDSR threshold of 55%) probably will apply.

Tightening Loan-to-Value (LTV) Limit for HDB housing loan for both new and resale HDB flats

Furthermore, the LTV limit for HDB housing loans will also be tightened from 90% to 85%. This revision does not affect loans granted by financial institutions (ie. banks), which remains at 75%.

The new 85% LTV limit for HDB home loans will apply if you’re buying new flats for sales exercises launched after 16 December 2021 (eg. for the February 2022 BTO sales exercise). It also applies for completed resale applications received by HDB from 16 December 2021 onwards.

Note that a complete resale application means HDB has received both sellers’ and buyers’ portions of the resale application. In other words, if you’ve just bought a resale HDB flat and you’ve submitted your resale application before 16 December (but your seller has not), the LTV limit of 85% still applies.

Increasing housing supply

With these cooling measures, the government shares that it will increase the supply of both public and private housing, where additional info will be provided soon. It hopes that these measures will help promote a stable and sustainable property market.

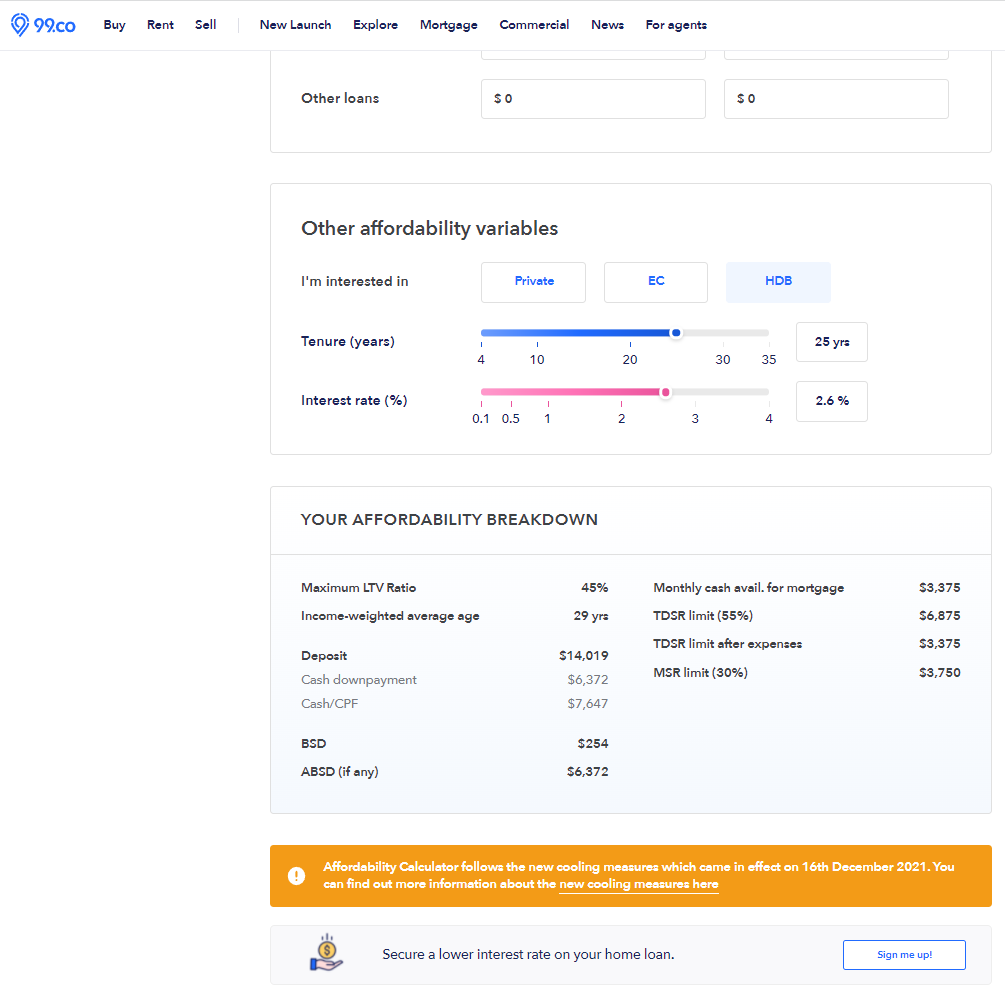

Calculating Affordability with New Cooling Measures in Place

99.co has updated our affordability calculator with the new cooling measure rules. Feel free to enter different aspects about yourself and/or your partner/spouse (single owner or joint owner) and highlight your profiles – Singaporean, Singapore Permanent Resident (SPR), foreigner or entities.

Input information like the number of properties each of you already own, respective monthly income, current debt and expenses and the type of property you’re purchasing. You can also input the tenure and interest rate of the property.

This will generate a summarised affordability chart for you so that you can make a more informed decision on your financial commitments should you go ahead and choose to purchase a particular residential property in Singapore.

–

What are your thoughts on this round of cooling measures? Let us know in the comments section below or on our Facebook post.

If you found this article helpful, 99.co recommends 5 things every on-the-fence homebuyer must do if new cooling measures are suddenly announced and New property cooling measures in Singapore: a cause and effect analysis.

Looking for a property? Find the home of your dreams today on Singapore’s fastest-growing property portal 99.co! If you would like to estimate the potential value of your property, check out 99.co’s Property Value Tool for free. Meanwhile, if you have an interesting property-related story to share with us, drop us a message here — and we’ll review it and get back to you.

The post Cooling measures announced – ABSD, TDSR and LTV – effective from midnight 16 December 2021 appeared first on 99.co.