In September, a 25th floor unit at Yong An Park unit in River Valley was transacted for S$12.5 million. Given that the sellers had bought the unit for S$3.8 million back in 2000, they earned a whopping S$8.7 million in profit with the sale. The sale also made it the most profitable deal by quantum in Q3 2021.

Spanning 6,577 sq ft, the unit was sold for S$1,091 psf, up from S$578 psf around 21.5 years ago.

Business Times reported that this was based on data provided by Edmund Tie Research, which studied caveats of transactions with prior purchase history and ranked them as the top profit- and loss-making deals.

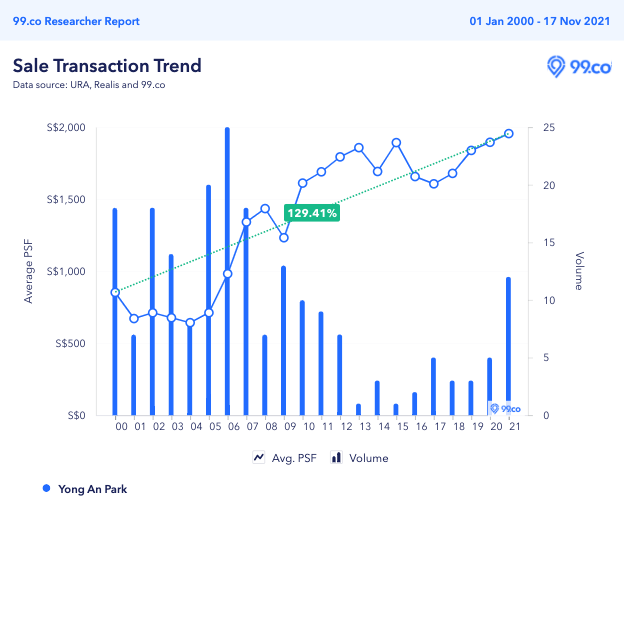

Looking at our Researcher data, prices of Yong An Park units have appreciated by 129.41% over the past 21 years.

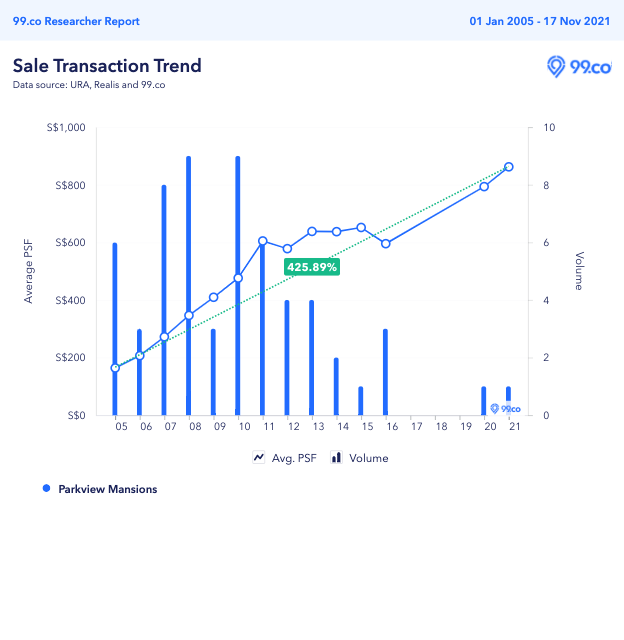

Percentage-wise, the most profitable deal in Q3 was for a resale unit at Parkview Mansions in Jurong East, having sold for S$965,000 in July. The ninth floor unit was bought for S$220,000 back in 2005, translating to a gain of nearly 340%.

Measuring 1,119 sq ft, the price psf went up from S$197 to S$862.

Based on our Researcher data, Parkview Mansions has seen a price appreciation of a whopping 425.89% over the past 16 years.

What’s interesting is that Parkview Mansions had tried for en bloc twice back in the en bloc cycle in 2018. The condo owners had initially put it up for collective sale in March that year for S$320 million, before relaunching it in December 2018 at a lower price of S$250 million.

Overall, Edmund Tie Research found that the five most profitable deals by percentage in the quarter were units that have been held for at least 15 years. Four out of five were freehold as well. In terms of quantum, the most profitable ones came from the CCR, with four out of five being freehold.

At the same time, Business Times quoted Edmund Tie’s senior director (research and consulting) Lam Chern Woon saying, “In Q3 2021, profitable sales by quantum came predominantly from District 10 whilst loss-making sales came predominantly from District 9.” He added that the average holding period for the loss-making units was 10 years, lower than the average of 18 years for the profit-making units.

Out of the five loss-making transactions by quantum, four of them were held between 10 to 14 years. All but one of them were freehold and located in the CCR. On this, Lam noted this was because most units were bought during the 2007 property cycle peak.

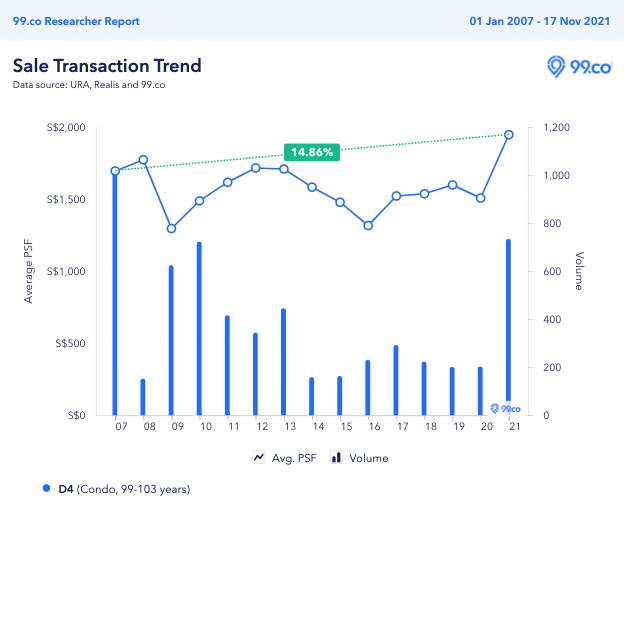

The deal with the largest loss by quantum was for a 7,050 sq ft leasehold unit in District 4 in the RCR, sold for S$11 million (S$1,560 psf) in September. The owners had bought it back in 2007 for S$17.95 million (S$2,546 psf).

Looking at the average price psf of District 4 units, the price psf of leasehold condos has been fluctuating over the past 14 years, with an overall price increase of 14.86%.

In terms of percentage loss, the biggest loss-making deal was for a 829 sq ft leasehold unit in District 16. Initially bought for S$1.1 million (S$1,327 psf) in 2018, it was later sold for S$525,000 (S$633 psf). This translates to a 20% annualised loss over three years.

Over the past three years, leasehold condos in District 16 have a price increase of 0.24%.

How long will you hold your unit before selling it? Let us know in the comments below or on our Facebook post.

If you found this article helpful, 99.co recommends Les Maisons Nassim penthouse sold for S$75m, possibly the most expensive apartment ever sold in Singapore and 5 things every on-the-fence homebuyer must do if new cooling measures are suddenly announced.

Looking for a property? Find the home of your dreams today on Singapore’s fastest-growing property portal 99.co! If you would like to estimate the potential value of your property, check out 99.co’s Property Value Tool for free. Meanwhile, if you have an interesting property-related story to share with us, drop us a message here — and we’ll review it and get back to you.

The post Yong An Park unit is the most profitable resale unit in Q3 2021, earning S$8.7m in profit appeared first on 99.co.