These days, CPF may as well stand for Causing Persistent Fights. Nothing sours the mood faster than bringing up this sore topic. The only way to make it worse is to discuss how CPF is used for home loans. Here’s some clarity on the common issues:

1. You can only use your CPF for HDB loans

The truth is, you can use your CPF Ordinary Account (CPF OA) funds for both HDB loans and private bank loans. Note that you’re subject to some restrictions, such as withdrawal limits (see point 6), when you use CPF for your home loan.

2. If you sell your house at a loss, you have to top up the difference to CPF

You do need to return the money used from your CPF savings when you sell your house. This is to prevent people from extracting their CPF via a loophole (e.g. buy a house and then sell it, so you effectively withdraw your CPF money). After all, the CPF savings are designed to be used for your retirement.

However, you only need to refund the principal amount and any grants used, plus any interest you would have gotten. If for some reason you sell your house at a loss, you don’t need to top up the difference.

For example, if you’re required to refund S$600,000 to your CPF (inclusive of the interest you would have accrued), but sell your flat at market value for just S$580,000, you would just need to return S$580,000 to your CPF account.

3. Once you turn 55, you can no longer pay for your house with CPF

If you’re still working and earn an income, you can pay for your housing loan through your CPF OA contributions. This is regardless of whether you meet the applicable Retirement Sum.

Alternatively, you can reserve your OA savings before you turn 55 to pay for housing. For example, say you need to set aside S$186,000 for your minimum sum. You can put S$93,000 in your minimum sum, and set aside the other half to keep paying for your house.

However, you should talk to a qualified financial advisor before doing this. Setting aside money this way will cause your retirement payouts to be lower.

4. You must use all your CPF OA savings when taking an HDB loan

This is no longer true. As of August 2018, buyers can now set aside up to S$20,000 in their OA when taking an HDB loan.

Many of the financial advisors we spoke to suggested setting aside six months of your mortgage repayments or S$20,000, whichever is higher. This ensures your home loan remains paid during times of financial difficulties, such as a loss of income due to retrenchment.

5. You can always use your CPF to pay for conveyancing fees

Not really, this is a bit of a half-truth.

Conveyancing fees tend to cost around S$2,500 to S$3,000, and are incurred when purchasing a house or refinancing. Now with some law firms, you can pay for these fees with your CPF. However, it’s not true of all law firms. You’ll have to check with the law firm in question.

To compound the issue, only some law firms will be accepted by your bank. It’s a bit of an annoying search process, to find a law firm that’s cheaper, accepted by the bank, and also lets you pay through CPF. We suggest you ask a mortgage broker to do it for you to save the hassle.

This is not an issue with HDB properties, as you can just use HDB’s appointed law firm (whoever they may be at the time), and it can be paid with CPF.

6. You can always use all of your CPF to pay for the house

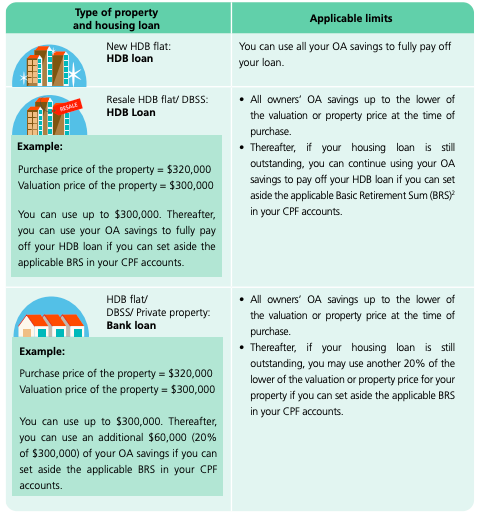

From 10 May 2019, the limit on how much you can use your CPF OA savings depends on the type of property and housing loan.

Here’s a summary of the limit.

If you’re taking a bank loan, the withdrawal limit will be 120% of your home’s Valuation Limit (VL), if you set aside money for the Basic Retirement Sum (BRS) in your CPF. The VL is the lower of your property valuation or purchase price, at the time you bought it.

For example, say you purchase your property at S$600,000, while the valuation was S$580,000. Your VL is thus S$580,000. Your withdrawal limit is thus S$696,000. Once you have withdrawn S$696,000 for your house, any outstanding amount will have to be paid in cash.

Don’t assume this will never happen. Remember that, after factoring in interest rates, it’s quite possible to end up hitting the withdrawal limit.

Another thing to note is that if the remaining lease of the property doesn’t cover the youngest owner till age 95. The limit on how much you can use your OA savings will be prorated based on their age.

7. Your CPF can/cannot be used to pay stamp duties

This one is a common source of confusion, with different people claiming both to be true. To clarify:

For taxes such as Buyer’s Stamp Duty (BSD) or Additional Buyer’s Stamp Duty (ABSD), you can be reimbursed from your CPF OA. But you pay the stamp duties first, and apply to get it reimbursed from your CPF account later. That means you must have the cash ready when the stamp duties are due (within two weeks of concluding the sale).

For properties that are under construction, however, you can pay the stamp duties directly from your CPF.

What most confuses you about using your CPF for housing? Let us know in the comments section below or on our Facebook post.

If you found this article helpful, 99.co recommends Estimated monthly instalment for November 2021 BTO flat and Quick Guide to BTO and Resale HDB Grants for Couples [2021 Edition].

Looking for a property? Find the home of your dreams today on Singapore’s fastest-growing property portal 99.co! If you would like to estimate the potential value of your property, check out 99.co’s Property Value Tool for free. Meanwhile, if you have an interesting property-related story to share with us, drop us a message here — and we’ll review it and get back to you.

Frequently asked questions

What can my CPF savings be used for when it comes to housing?

You can use your CPF OA savings to pay for the downpayment, housing loan and stamp duties. Depending on the law firm, you may use it to pay for your legal fees as well. If you’re paying your home loan with CPF, your Home Protection Scheme (HPS) premium is paid with your CPF savings.

How much can I use my CPF for housing?

The limit depends on the type of property and housing loan. For instance, if you’re buying a new HDB flat with an HDB loan, there’s no limit to how much CPF savings you can use. If you’re taking a bank loan, the limit is 120% of the property valuation.

Can I refund the CPF used for housing even if I don’t sell my house?

Yes, you can do so under CPF’s voluntary housing refund. You can refund any amount, capped to the principal amount and accrued interest.

The post 7 common misconceptions about using your CPF for housing appeared first on 99.co.