Stamp duty – it’s one of the many additional but often-overlooked costs associated with buying property.

Stamp duty refers to the tax relating to the purchase or lease of a property. In Singapore, it is payable to the Inland Revenue Authority of Singapore (IRAS).

Since 2018, stamp duty has been used as one of many property cooling measures to ensure Singapore’s continued stable and sustainable property market.

Here’s what you need to know about Singapore’s stamp duty:

There are three types of duties payable on the sale, purchase, acquisition or disposal of properties in Singapore:

1. Buyer’s Stamp Duty (BSD) – payable on the purchase or acquisition of all properties and is calculated on the property’s purchase price or market value (whichever is higher). Since 2018, the top marginal BSD rate for residential properties has been 4%.

Here’s an IRAS example of the BSD payment due for a condominium unit purchased in 2018 at $2,500,550 (reflective of the market value):

| Market Value of the Property | BSD Rate | Calculation |

| First $180,000 | 1% | = $1,800 (1% x $180,000) |

| Next $180,000 | 2% | = $3,600 (2% x $180,000) |

| Next $640,000 | 3% | = $19,200 (3% x $640,000) |

| Remaining $1,500,550 | 4% | = $60,022 (4% x $1,500,550) |

| BSD Payable | = $84,622 ($1,800 + $3,600 + $19,200 + $60,022) | |

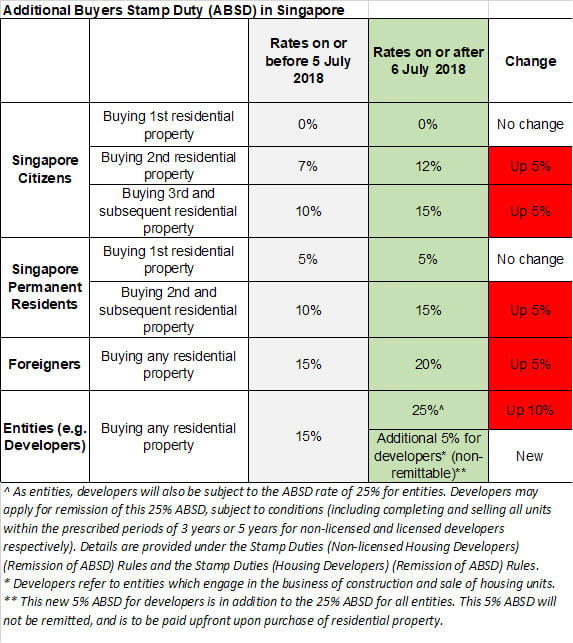

2. Additional Buyer’s Stamp Duty (ABSD) is payable for the second or subsequent properties. It is payable in addition to the BSD, where the amount payable varies according to the buyer’s residential profile. The ABSD rates were last revised in 2018 as a cooling measure to stabilise the residential property market for local Singaporeans and avoid the risk of a more drastic price correction – meant to discourage foreigners and entities from purchasing residential properties.

ABSD applies to different residential profiles as follows:

- Singapore Citizens: ABSD will be levied on the second (12%) and subsequent (15%) property purchases

- Singapore Permanent Residents (PRs): First purchase is levied at 5%, while second and subsequent purchases will be 15%

- Foreigners: 20% ABSD for any property purchase

- Entities (companies or associations): 25% for each property

Exceptions and remissions:

Nationals and PRs of Iceland, Liechtenstein, Norway or Switzerland, as well as US Nationals (as in this example) are accorded the same Stamp Duty treatment as Singapore Citizens. As such, these individuals may apply for remission of ABSD when buying their first residential property in Singapore.

Remission of ABSD may be applicable for married couples who purchase a second residential property jointly. To learn more, click here.

3. Seller’s Stamp Duty (SSD) – this tax duty is payable on properties sold within the three-year holding period after buying a property (on or after 20 February 2010).

The SSD is taxed on early sellers to avoid a property market with inflated prices as a result of property flipping. It’s a way to curtail the abuse of abundantly available deferred payment schemes (eg. downpayment of 20% of the purchase price, pay remaining 80% two years later).

The SSD is a percentage of the valuation or price of the property being sold (whichever is higher). The earlier you sell, the higher the SSD.

Other property price cooling measures include the Total Debt Servicing Ratio (TDSR) – which allows homebuyers to borrow only up to 60% of their gross monthly income. It has been in the works since 2013 to prevent home buyers from borrowing too much to finance the purchase of a property, as it affects the amount that can be borrowed for subsequent properties.

Property owners or home purchasers can borrow up to 75% of the property value through a bank loan. For the second property, this loan-to-value (LTV) ratio drops to 45% for loan tenures up to 30 years, or 30% if the loan tenure goes beyond 25 years or the owner’s 65th birthday, meaning that buying a second property needs a lot more cash than the first property.

Cash downpayments can also be made using the CPF savings account, but depends on:

- Type and value of the property being bought

- Whether you have an existing housing loan

- Tenure of the new loan (capped at 25 years for HDB flats and 30 years for private properties)

- The loan-to-value loan limit of the property

Finally, stamp duty is also payable on rental tenancy agreements, to be paid when an individual rents a property or signs a contract to renew or extend their current lease.

The amount payable is dependent on the Average Annual Rent (AAR), which is computed based on the monthly rent and lease period.

So assuming the monthly rent is S$3,000 and the lease period is 24 months, the AAR and lease duty rates would be:

AAR: $3,000 x 24 months = $72,000

Lease duty rates: 0.4% x 72,000 = S$288

–

Do you have any queries on stamp duty? Let us know in the comments section below or on our Facebook post.

If you found this article helpful, 99.co recommends Property Jargon of the Day: Buyers Stamp Duty (BSD), Property Jargon of the Day: Additional Buyers Stamp Duty (ABSD) and Property Jargon of the Day: Sellers Stamp Duty (SSD).

Looking for a property? Find the home of your dreams today on Singapore’s fastest-growing property portal 99.co! If you would like to estimate the potential value of your property, check out 99.co’s Property Value Tool for free. Meanwhile, if you have an interesting property-related story to share with us, drop us a message here — and we’ll review it and get back to you.

The post Singapore’s Buyers’ and Sellers’ Stamp Duty: What you should know appeared first on 99.co.