As of 2020, there are more than 300,000 condominium and private apartment units in Singapore, of which 16% of our resident population reside. It also means that every month, these households are paying anywhere between S$250 to S$1,000 in maintenance fees a month.

We often hear friends who complain that their condo maintenance fees are too high and whether they’re paying equal fees compared to their peers. Landlords, who collect rent and pay these fees, do not really get to use the condo facilities as much as their tenants. With the pandemic, some may have been forced to lower rent while still paying for maintenance.

So how much is too much? How do you determine if what you’re paying to the funds managed by the MCST is fair?

Several 99.co readers shared their average monthly fees, inclusive of sinking funds, so we’ve compiled them into a convenient chart:

| Property | District | TOP and Tenure | No. of Units | Land Size | Facilities | Monthly Maintenance for Typical 3-Bedroom Units as of Q3 2021 |

| Laguna Park | D15 (Bedok) | 1978 / 99 years | 516 | 678k sq ft | BBQ Pits, Gym, Parking, Playground, Security, Swimming Pool, Tennis Court | S$224 (1453 sq ft) |

| The Anchorage | D03 (Queenstown) | 1997 / Freehold | 775 | 613k sq ft | BBQ Pits, Clubhouse, Fitness Corner, Gym, Parking, Playground, Sauna, Security, Squash Court, Swimming Pool, Tennis Court, Wading Pool | S$276 (1421 sq ft) |

| The Palette | D18 (Pasir Ris) | 2016 / 99 years | 892 | 460k sq ft | BBQ Pits, Clubhouse, Fitness Corner, Gym, Jacuzzi, Lap Pool, Parking, Playground, Security, Steam Room, Tennis Court, Wading Pool | S$322 (1163 sq ft) |

| Twin Waterfalls | D19 (Punggol) | 2015 / 99 years | 728 | 271k sq ft | BBQ Pits, Clubhouse, Fitness Corner, Gym, Lap Pool, Playground, Tennis Court, Wading Pool | S$327 (1119 sq ft) |

| D’leedon | D10 (Bukit Timah) | 2015 / 99 years | 1723 | 840k sq ft | Aerobic Pool, Basketball Court, BBQ, Clubhouse, Fitness Corner, Gym, Jacuzzi, Jogging Track, Lap Pool, Multi-Purpose Hall, Playground, Retail Shops, Sculpture, Spa Pavillion, Swimming Pool, Tennis Court | S$433 (1399 sq ft) |

| The Pearl @ Mt Faber | D04 (Mt Faber) | 2005 / 99 years | 192 | 114k sq ft | BBQ Pits, Basketball Court, Clubhouse, Gym, Jacuzzi, Parking, Playground, Security, Swimming Pool, Wading Pool | S$500 (1398 sq ft) |

| Cairnhill Residences | D09 (Orchard) | 2009 / Freehold | 97 | 42k sq ft | BBQ Pits, Clubhouse, Fitness Corner, Gym, Jacuzzi, Lap Pool, Parking, Playground, Sauna, Security, Lounge, Fountain, Waterfall, Pool Deck, Jacuzzi, Fun Pool | S$500+ (1200 sq ft) |

| The Berth By The Cove | D04 (Sentosa) | 2006 / 99 years | 200 | 174k sq ft | BBQ Pits, Clubhouse, Fountain, Gym, Jacuzzi, Lap Pool, Parking, Security, Steam Room, Swimming Pool, Wading Pool | S$1,000 |

| The Coast at Sentosa Cove | D04 (Sentosa) | 2009 / 99 years | 249 | 276k sq ft | BBQ Pits, Clubhouse, Gym, Jacuzzi, Lap Pool, Security, Steam Room, Wading Pool | S$1,100 (2077 sq ft) |

Based on the data, it’s clear that no one factor determines a condo’s maintenance fee. However, at first glance, it is safe to presume that if the property’s larger, in an exclusive area (eg. on Sentosa Island or the central region like Orchard), newer and has more facilities, the maintenance fee is generally higher. If it’s older, smaller, has many units within the development and has lesser facilities, it’s expected to be much lower.

For example, the maintenance fee for a 3-bedroom 1453-sqft apartment at Laguna Park is half the fee of a 3-bedroom 1398-sqft apartment in The Pearl @ Mt Faber. The former occupies a much larger tract of land, has more units in the development and is much older. Interestingly, perhaps due to their respective quantum of units, the same apartment at The Pearl pays roughly the same amount in fees as a 3-bedroom 1200-sqft apartment at Cairnhill Residences (Orchard).

Comparatively, a 4-bedroom 1600-sqft apartment at Waterfront Waves (Bedok) pays an average of S$352 in monthly fees, which is almost similar to what a 3-bedroom 1119-sqft unit at Twin Waterfalls (Punggol) pays. The former was completed in 2011, 4 years before Twin Waterfalls.

How are the condominium’s maintenance fees calculated?

Your monthly fees, which are usually paid every quarter, are determined by a few factors:

- The management fund

- The sinking fund

- Your condo apartment’s share value

- The total number of units in the condominium

- The types of facilities at the condominium

- What happens during the first and subsequent Annual General Meetings (AGM)

Management and sinking funds, and share value

The monthly or quarter maintenance fees usually comprise two components: the sinking fund and management fund.

The sinking fund (also called the reserve fund in other countries) is a sum of money set aside for emergencies and long-term structural costs. They are used for less predictable maintenance work, like roof replacements, large-scale repaint jobs and revamp of common facilities. It could be used for unplanned lift repairs, pest problems, gantry fixes (yep, those get knocked down quite a lot), pneumatic waste disposal chokes (yep, another perennial problem) and so on.

Sinking funds should grow larger over time as they’re not meant to be used often until the property wears down. But don’t be surprised if some sinking funds dry up earlier because residents (or guests) aren’t careful in how they treat their common facilities. For instance, no one at Alexandra’s The Crest condo expected a bunch of wild otters to show up uninvited and eat up all their expensive koi fish.

Expect the unexpected – otters swimming in your condo pool and eating up your decorative fishes. (Post credit: R/Singapore Reddit)

On the flip side, the management fund (also called the fund for operating expenditures) covers the regular day-to-day upkeep of the condo’s facilities. These are for predictable, recurring costs, like regular payments to service providers, contractors, insurance companies, staff, etc.. They’re the ones maintaining facilities like your swimming pool, gym equipment, clubhouse’s air-conditioning, security, vending machines, EV charging stations in your carparks, landscaping works, shared Wi-Fi and yes, plumbing and waste disposal.

The amount of maintenance levy you have to pay is determined by the share value of your apartment and the cost of maintenance every year. Share value is a numeric representation of the value of your home relative to others and the shared facilities within the same development. It is a critical number, especially when used to vote on say, an en bloc sale.

Contrary to popular belief, share value is not allocated by the Management Corporation Strata Title or MCST. In fact, prior to the sale of the property, the developer must engage a professional surveyor to carry out the task of allocating the share value of each unit and submit it for the Commissioner of Building’s (COB) approval. The general principle in allocating share value is based on “perceived usage of common facilities”, hence the term ‘share’ and ‘value’.

So if a unit is ‘perceived’ to use more of the common facilities (eg. a penthouse or large-sized apartment with presumably more occupants and maybe a pet), it will be allotted a higher share value and thus, contribute a higher maintenance levy. In other words, if you or the occupants in your apartment, are not using the swimming pool, BBQing, or going to the gym enough, then your household’s really not making full use of the facilities after paying the maintenance levy.

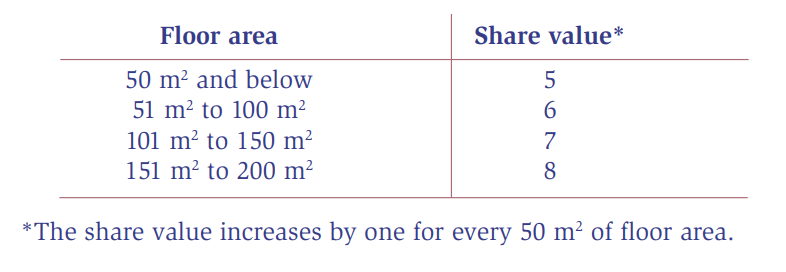

Based on the Building and Construction Authority’s (BCA) guidelines, and set by the Commissioner of Buildings (COB), a recommended share value table is as follows:

If the apartment is part of a mixed development comprising of residential units, offices and shops, different weight factors are used to account for the unequal usage of common facilities. Shops usually incur a higher percentage of maintenance because they use more air-conditioning and facilities like escalators.

Note that the share value of a strata lot cannot be changed once the strata title application is registered. However, the Registrar of Titles may allow changes only if:

- There is an error in the entry

- The value was fraudulently assigned

- There is a subdivision of a lot or an amalgamation/combination of two or more lots

Total number of units at the development

As with any development, the greater the number of units, the greater the usage of shared facilities by more residents, which in theory, should result in lower maintenance fees for everyone. As with the chart above, large developments like D’leedon is able to maintain a sub-S$450 maintenance fee for a 3-bedder. One reason could be due to its sheer size.

The downside, of course, is that not everyone will have access to the shared facility anytime they want as more people will want to use it (eg. the gym, pool or function room).

Contrast this with The Pearl @ Mt Faber, where a same-sized apartment has to pay S$500 in monthly maintenance to upkeep a much smaller, older (and far more exclusive) development.

If you’re a landlord contemplating between developments with more units or lesser, it is often better to go with one with lower maintenance fees, as long as rent and demand are equal for both. The tough part is knowing how much the fees are prior to buying a new property as they will be impacted by different factors. Most landlords usually gauge based on total units, exclusivity and types of facilities. Knowing the current fees based on different condo profiles help (like the chart above).

Types of facilities at the development

A common phrase we hear during show flat sales is “full condominium facilities”. What does it cover exactly? Generally, it infers that the condo has at least a swimming pool, tennis court, BBQ pits, function rooms, gym, a sheltered/underground parking lot per unit and security. Condo security should be clarified – while most condos have security at the main gate, some do not have secured card/recognition access to apartment lifts – meaning once cleared for entry, any visitor or delivery person can access any block and level within the compound.

Some newer condos include concierge services or free bus services to nearby malls or transportation hubs, which may or may not be useful to all residents, especially the ones who drive. Newer condos like Clavon, Irwell Hill Residences and Pasir Ris 8 now feature co-working facilities, which could be popular due to work-from-home.

Then there are condos with elaborate water fountains or waterfall features, which may look aesthetic for ‘Feng Shui’ purposes but do not serve any other functional use. Residents living in condos with excessive facilities and features that they don’t really need or use should pay close attention to their maintenance costs when they receive the audited financial statements annually.

They can then raise these concerns during the next AGM and see if other residents feel the same way, enough to take a vote and make a decision that benefits everyone.

What happens during the AGM

During the first AGM, usually held after the first 12 months from the day the Management Corporation (MC) is constituted, one agenda will be to determine the contributions for the management fund and sinking fund. In other words, the first AGM sets the stage for residents to learn and understand how much exactly is needed for the maintenance of the condo’s common facilities and why they’ll need to pay the levy (based on their share value) every quarter.

Subsequent AGMs will then focus on reviewing how the previous year’s management fund and sinking fund have been utilised, how much is left and whether additional contribution increases are required (subject to a vote). Subsequent AGMs are useful because they allow residents to voice out if the previous MC has used the funds inappropriately or carelessly. They can then put up a motion and vote to elect new council members or change the Managing Agent (MA), who runs the day-to-day operations.

An MC may also decide (ie. by special resolution) to give a rebate to residents if the maintenance contribution is paid before the due date. This is a useful incentive in situations where the MC or MA finds it hard to get all residents to pay their maintenance levy in time, especially for larger developments.

The last thing residents want is delayed contributions by a rogue few, impacting the management fund, which in turn affect the MC’s or MA’s ability to service expenses and debts.

–

How much are you paying in monthly maintenance fees? Tell us in the comments below or on our Facebook post!

If you found this article helpful, 99.co recommends Why a good managing agent is important to your property value (and how to spot one) and 4 reasons why you shouldn’t default on your condo maintenance fees.

Looking for a property? Find the home of your dreams today on Singapore’s fastest-growing property portal 99.co! If you would like to estimate the potential value of your property, check out 99.co’s Property Value Tool for free. Meanwhile, if you have an interesting property-related story to share with us, drop us a message here — and we’ll review it and get back to you.

–

How much are condo residents paying in maintenance fees every month?

As of 2020, there are more than 300,000 resident condominiums and private apartments in Singapore, of which 16% of our resident population resides. It also means that every month, these households are paying anywhere between S$250 to S$1,000 in maintenance fees a month.

What factors determine the monthly or quarterly maintenance fee?

Your monthly fees, which are usually paid every quarter, are determined by a few factors: – The management fund – The sinking fund – Your condo apartment’s share value – The total number of units in the condominium – The types of facilities at the condominium – What happens during the first and subsequent Annual General Meetings (AGM)

What is share value?

Share value is a numeric representation of the value of your home relative to others and the shared facilities within the same development. It is a critical number, especially when used to vote on say, an en bloc sale.

The post Condo maintenance fees and unit sizes: how much is too much? appeared first on 99.co.