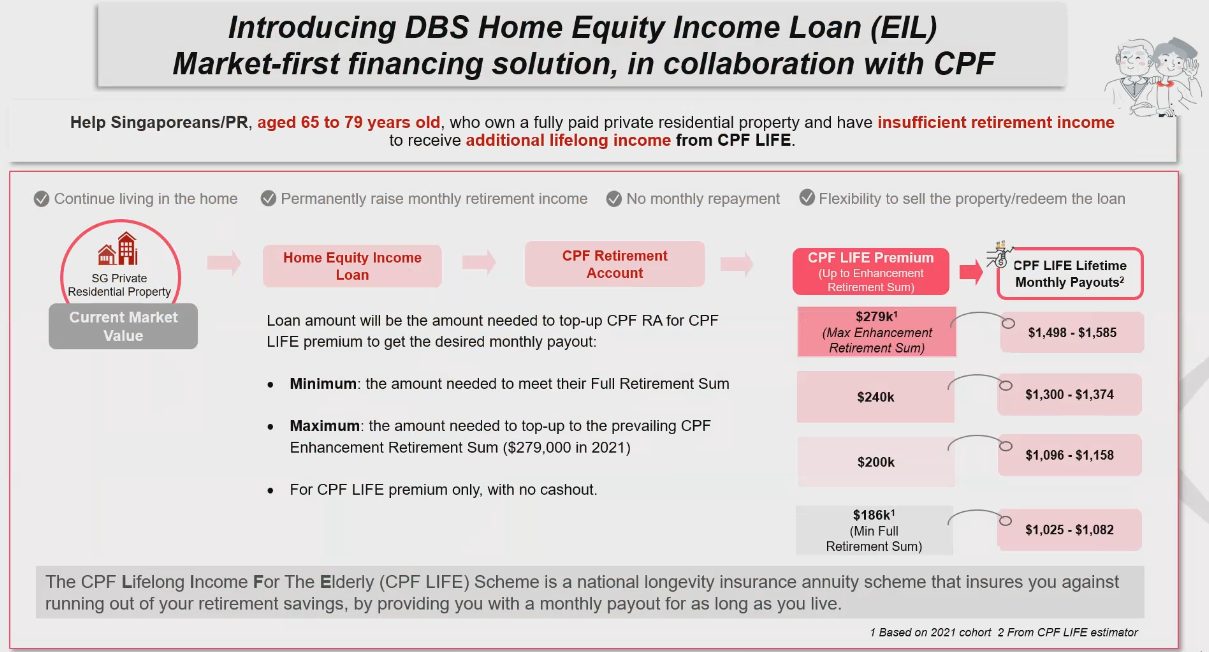

In mid-August 2021, DBS announced its Home Equity Income Loan (EIL), which allows Singaporeans and PRs aged 65-79 with a fully paid private housing asset in Singapore to obtain up to a 30-year loan that tops up their CPF Retirement Sums so they can receive higher monthly payouts through CPF Life.

While the housing asset is put forth as collateral for the loan, the DBS Home EIL promises no monthly loan repayments until loan maturity. So you apply for the loan, you receive higher monthly CPF Life payouts without worrying about repaying the loan.

However, once the 30 years are up, or when the youngest borrower reaches 95, or when the owner sells the house early (eg. to earn a tidy profit), whichever is earlier, the loan and its fixed interest (2.88% p.a.) will need to be repaid.

There are a few safeguards:

- If the value of the property/collateral declines during the loan period, no top-up is required.

- If the borrower outlives, passes on before or becomes bankrupt during the loan maturity, there is no risk of foreclosure. The bank will work with the borrower (or his/her estate) on alternative terms of repayment.

- Borrowers are required to set up a Lasting Power of Attorney if they do not already have one.

- The interest rate of 2.88% p.a. is fixed throughout the loan period.

The loan quantum is based on the prevailing CPF Retirement Sum (which is between the Full S$186k and Enhanced S$279k limits if applied in 2021). What’s interesting is that the loan contribution also earns the interest rate (4% base interest p.a.) that CPF Life earns.

So for retirees whose CPF Retirement Account (RA) savings can barely meet the Basic Retirement Sum (S$93k in 2021), the EIL is really targeted at them. Instead of receiving a monthly payout of say, S$450-650 at age 65, they can potentially receive S$1,300 per month with the top-up.

If the borrower passes on, his or her beneficiary receives the borrower’s CPF Life premium balance and remaining CPF savings, which includes the remaining loaned amount and accrued interest.

We should also mention that you are only eligible for the DBS EIL if you own AND stay in a private residential property in Singapore that is fully paid up AND does not own any other property in and/or outside of Singapore.

In other words, that property must be your one-and-only home in your name. Furthermore, if the private property is a leasehold, its remaining tenure must be at least 30 years.

At the time of writing, DBS is the only bank working with the CPF Board to offer a reverse mortgage (or what we would call an asset-rich, cash-poor retirement scheme) for private homeowners. We won’t be surprised if other banks jump on the bandwagon to offer something similar or compelling eventually.

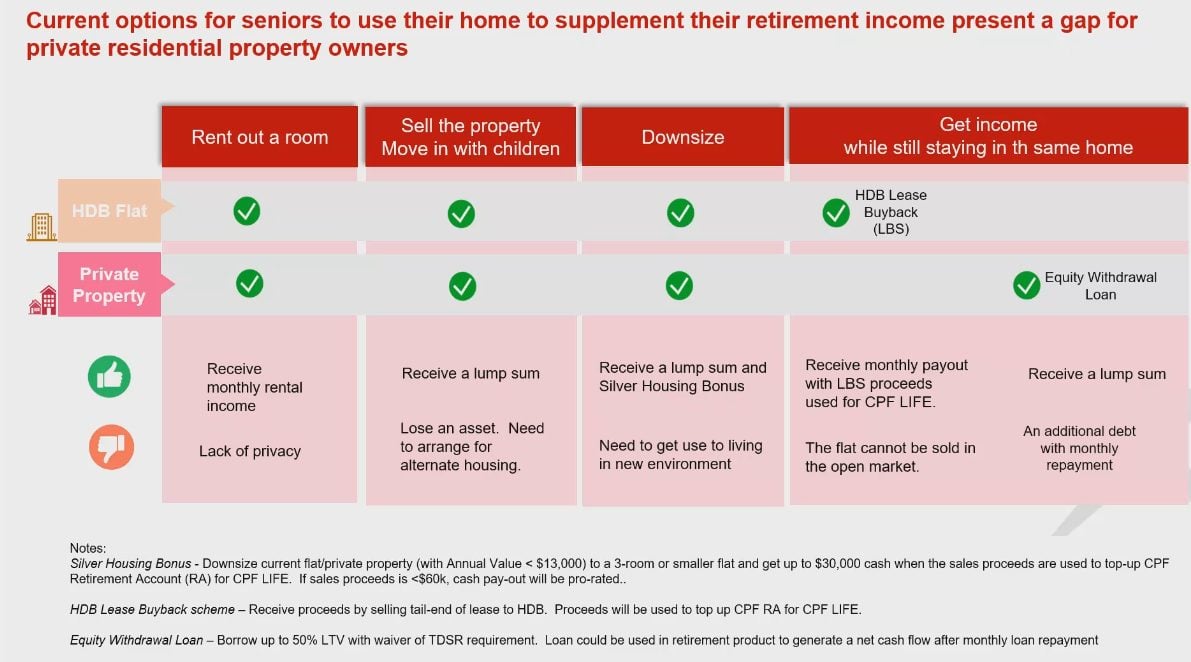

For HDB flat homeowners, the DBS Home Equity Income Loan wouldn’t apply to them since it’s only for homeowners living in paid-up private homes (or privatised Executive Condominiums).

However, HDB owners looking for something similar already have the Lease Buyback Scheme, which was introduced in 2009 and enhanced in 2015. An alternative would be to downsize to a smaller flat via the Silver Housing Bonus scheme. Homeowners who can’t decide between the two can reference our comparison.

Sentiments from Singaporeans

99.co spoke to three different Singaporeans with private homes to better understand their sentiments since the DBS Home EIL surfaced and how a programme like that could potentially affect or change their retirement plans.

Ronald Hee, who turns 57 this year, lives at St. Francis Lodge in District 12 (Toa Payoh / Serangoon / Balestier) for the past 17 years. While his freehold condo apartment is not fully paid up yet, Ronald is confident it will be by the time he turns 65.

“I think the DBS Home Equity Income Loan is a good option to have as the HDB Lease Buyback Scheme does not apply to private property owners,” he shared. “It’s definitely useful for owners who are financially not as fortunate, and in similar predicaments as HDB owners who are unable to unlock the value of their flats.”

Ronald believes the loan will work for a specific category of asset-rich, cash-poor property owners. “For those with limited options, this would be ideal.”

While Ronald is in favour of such a scheme, he is ambivalent on whether he would take it up himself when the time comes. One reason is the restrictive nature of liquidity when it comes to taking up another loan.

“There are more terms and conditions than I would like. I think for many homeowners who are in a position of wanting or needing more cash in their 60s, their kids have long left the nest, so their homes are bigger than what they need.

“With the additional space, yes, they could rent out their additional rooms but I think many are not comfortable renting out. Most just want peace and quiet in a place they can call their own. So, many end up selling and moving to something smaller, either private or public.

“With the immediate sale of their property, which they’ve bought decades ago, the cash proceeds would likely nett them at least a few hundred thousand in cash, which they’re free to spend or re-invest with. Personally, I think that’s a far more attractive situation to be in, rather than a monthly payout that they (or their beneficiaries) have to pay back eventually.”

Another Singaporean, Mr. Lim, who is in his mid-40s and lives in a 3-bedroom private condominium at Marine Parade with his wife and 2 sons, recalls similarities between this reverse mortgage with a different form of reverse mortgage, also known as cash-out refinancing or equity withdrawal loan, which he took years ago.

“I had a private property purchased back in 2006, where 60% of the mortgage was already paid up. As the property had already appreciated significantly, I was able to get a significant lump sum from a bank as a downpayment for the current property I’m staying in, which is bought under my wife’s name.”

The difference, of course, is that a reverse mortgage like the DBS Home EIL pays you a monthly payout (through CPF Life premiums) until the tenure ends, while cash-out refinancing gives you a lump sum upfront which you’ll need to repay monthly.

“The DBS EIL scheme does sound like a good plan for asset-rich-cash-poor retirees, especially those without children or those that don’t intend to leave the property with the children,” Mr. Lim said.

“Personally, my wife and I do intend to keep the property for our children. Of course, our children can decide if they want to sell the property away or continue to stay after we move on. The challenge with the DBS Home EIL comes when we pass on and our children prefer to stay on in the property instead of selling. They are then burdened with paying back this loan plus the accrued 2.88% per annum interest.

“This is not a small amount and most likely our children will resort to selling the property. For example, if I reach 65 years old and I take up a S$100k loan (ie. to reach a retirement sum limit) for 30 years at 2.88% per annum, the loan repayment amount will be about $237k at maturity. The odds that my children will have this liquidity by that time are most likely low.

“Assuming my children are determined to keep the house and not sell it, they’re potentially “inheriting” the S$237k loan. Who knows? Maybe my insurance payout could repay this loan, provided there’s enough.

“It’ll be disastrous if my children are forced to sell the house and do not have enough capital to purchase a property of their own. It’s also highly likely my children will be in an age group where they are setting up families with increased financial burdens by that time.

“So, since we intend to leave our property to our children and there’s still uncertainty ahead, it’s unlikely we will consider the EIL as an option for our retirement. However, in the event that we have to, it is extremely necessary for my wife and me to discuss with our children to make sure they fully understand what they will be getting into if we sign up for this programme.

“As parents, the last thing we want is to surprise our children with an additional financial burden after we pass on.”

Finally, a third Singaporean, Mdm. Tan, who is widowed and turns 80 this year, lives in a fully paid, semi-detached landed house in Upper Bukit Timah.

While she doesn’t speak much English, her son was able to translate some of her thoughts with us when we asked her about this scheme.

“While the loan idea is good, the loan quantum may be too low and comes attached with a high-interest rate,” she said. “The implementation could be better, where if something happens to me, my children will not be forced to sell the house to repay the loan.”

DBS did stress that it will work with the estate beneficiaries on possible repayment terms and solutions if the borrower passes on. But a loan is still a loan – if it’s inherited, it needs to be repaid in some way eventually.

Ronald also shared that the loan wouldn’t work if the potential borrower (eg. someone like Mdm. Tan) is already quite CPF-rich, meaning his or her savings are already above the Full Retirement Sum limit. It may mean a much lower loan quantum (and monthly payout difference), which may not be that significant to really make that much of a difference.

“It’s good to have the option,” he added, “but only if you’re someone with limited choices, for example, you’re unable to move out and sell your property, afraid of selling your house and getting scammed, or prone to blow your windfall at the MBS gambling tables, then yes, this scheme may be for you.”

–

Are you considering the DBS Home Equity Income Loan? Let us know in the comments section below or on our Facebook post.

If you found this article useful, check out What you need to know about the enhanced Lease Buyback Scheme and Selling versus reverse mortgage: which should you use?

Looking for a property? Find the home of your dreams today on Singapore’s fastest-growing property portal 99.co! If you would like to estimate the potential value of your property, check out 99.co’s Property Value Tool for free. Meanwhile, if you have an interesting property-related story to share with us, drop us a message here — and we’ll review it and get back to you.

–

–

What is the DBS Home Equity Income Loan?

In mid-August 2021, DBS announced its Home Equity Income Loan (EIL), which allows Singaporeans and PRs aged 65-79 with a fully paid private housing asset in Singapore to obtain up to a 30-year loan that tops up their CPF Retirement Sums so they can receive higher monthly payouts through CPF Life.

How much can you loan for the DBS Home Equity Income Loan?

The loan quantum is based on the prevailing CPF Retirement Sum (which is between the Full S$186k and Enhanced S$279k limits if applied in 2021). What’s interesting is that the loan contribution also earns the interest rate (4% base interest p.a.) that CPF Life earns.

Are there any other banks offering similar products?

At the time of writing, DBS is the only bank working with the CPF Board to offer a reverse mortgage (or what we’d call an asset-rich, cash-poor retirement scheme) for private homeowners. We won’t be surprised if other banks jump on the bandwagon to offer something similar or far more compelling eventually. For HDB flat homeowners, the DBS Home Equity Income Loan wouldn’t apply since it’s only for homeowners living in paid-up private homes (or privatised ECs). For HDB owners, there’s the Lease Buyback Scheme introduced in 2009 and enhanced in 2015. An alternative would be to downsize to a smaller flat via the Silver Housing Bonus scheme. If you can’t decide between the two, we’ve done a comparison.

The post Asset-rich, cash-poor scenarios: Singaporeans review DBS’ Home Equity Income Loan appeared first on 99.co.