SIBOR and SOR are synonymous with property loans and bank interest rates. But what is SORA and how does it change the way we look at home loans?

The three most common terms related to housing loans in Singapore are Singapore Dollar Swap Offer Rate (SOR), Singapore Interbank Offered Rate (SIBOR), and now, Singapore Overnight Rate Average (SORA), which will be adopted as the main benchmark interest rate for Singapore’s financial rates going forward.

99.co shared their differences 2 years ago but as the deadline approaches for the transition to SORA (end-2021 for SOR and 2024 for SIBOR), it’s best to be prepared and know the reasons behind the switch.

SOR, SIBOR and SORA are floating interest rate benchmarks that local banks use to determine the cost of borrowing when pricing local housing and/or mortgage loan interest rates.

These benchmarks serve as a gauge of a bank’s cost of funds and help determine how much to charge borrowers or how much interest to pay out to customers.

SIBOR is the rate at which each of the 20 banks in Singapore that form the panel of the Association of Banks in Singapore (ABS) can borrow money from each other via the interbank market, making SIBOR the most widely used reference rate for home loans, government and corporate bonds, derivatives and corporate loans.

ABS’ banks are polled for the interbank lending rates that they expect to get when calculating a loan (before 11 am Singapore time).

These rates are ranked in order, the top and bottom quartiles are removed, and the remaining rates are then averaged to set the SIBOR. An increase in the SIBOR component of the home loan directly increases the home loan repayment for that month.

For instance, if your home loan interest rate is pegged to the 3-month (3M) SIBOR, the rate will fluctuate over the three month period and the interest will be charged according to the average SIBOR over those three months.

Home loans have been pegged to SIBOR since 2017 after SOR was discontinued due to the extreme volatility of the latter’s USD component, rendering it a less than ideal trait for a reference rate.

SOR measures the cost of borrowing USD and then converting it to SGD through a foreign currency swap in order to get better interest rates. But as SOR is completely dependent on the US economy, it used to be much more volatile than SIBOR, despite resulting in the same direction. While banks have ceased offering home loans pegged to SOR since 2017, it’s been used for commercial and wholesale loans.

In July 2020, ABS called for SIBOR to be discontinued by the end of the year and completely phased out by 2024, due to the LIBOR scandal which saw several banks using fixed interest rates to manipulate the financial markets to their advantage.

Furthermore, with interest falling globally since the start of the pandemic, SIBOR has been declining too (see graph below), thus requiring a more viable alternative instrument to peg home loans to, which has been identified to be SORA.

The Monetary Authority of Singapore (MAS) describes SORA as the volume-weighted average rate of borrowing transactions in the unsecured overnight interbank SGD transactions brokered in Singapore between 8 am and 6.15 pm each day.

Commonly monitored as a reflection of daily conditions in SGD money markets, SORA is underpinned by a deep and liquid overnight funding market, making it a suitable alternative to SOR. Compared to SIBOR, SORA also measures Singapore’s interbank lending rate for unsecured loans, but as it is based on the average rate of all interbank lending transactions, it is less complicated and more transparent.

Overview of the three key benchmark interest rates

| Singapore Dollar Swap Offer Rate (SOR) | Singapore Interbank Offered Rate (SIBOR) | Singapore Overnight Rate Average (SORA) | |

| Used For | Commercial loans and derivatives | Commercial & syndicated loans, trade & working-capital financing, housing loans | Commercial and housing loans |

| How Their Rates are Determined | Effective rate of borrowing SGD synthetically by borrowing USD and subsequently “swapping” to SGD by using an FX Swap | Daily reference rate based on the interest rates at which banks offer to lend unsecured funds to other banks | Average rate of all unsecured overnight interbank SGD transactions brokered in Singapore |

| Methodology & Inputs | Volume-weighted average rate of USD/SGD FX swap transactions, with USD LIBOR as an input | Forward-looking term rates from the top 20 banks are compiled and ranked. The top and bottom quartiles are removed. The final rate is the average of the rates offered by the 10 remaining banks | Volume-weighted average rate of transactions reported by Reporting Banks in Singapore to MAS |

| Governing Body | Association of Banks in Singapore (ABS) | Monetary Authority of Singapore (MAS) | |

| Loan Tenure | Overnight, 1-month, 3-month, 6-month | 1-month, 3-month, 6-month, 12-month | Overnight |

Source: Association of Banks in Singapore

According to ABS, there are several benefits of SORA as an interest rate benchmark. The most important points to remember about SORA are:

- SORA is a robust interest rate benchmark based on the average rate of unsecured overnight interbank SGD transactions brokered in Singapore.

- SORA is thus an accurate reflection of daily conditions in Singapore’s money markets.

- SORA has been published by MAS since 1 July 2005, meaning that the availability of the long historical time series allows market participants to analyse and use the past model trends for risk management, asset-liability pricing and trading purposes.

- Administered and calculated by MAS, SORA is more predictable and more stable than SIBOR since the latter is forward-looking (ie. SIBOR is more unpredictable as banks can hike or drop interest rates without warning). On the other hand, compounded SORA rates are backward-looking, making future predictions by taking into account the interbank transactions trends that have already taken place in the past.

- SORA will be a better long-term decision for Singapore’s financial markets as forward-looking term rates have more exposure to market factors such as a quarter or year-end volatility.

- A SORA-centred SGD interest rate market will put a stop to market fragmentation, ensure transparency, make it less complicated for consumers to compare loan prices and foster the development of a deep and efficient SGD financial market.

- As home loans go, SORA is considered more stable since the 3-month (3M) Compounded SORA is the average of SORA rates published in the last 3 months based on actual daily transactions, compared to the 3M SIBOR, which is an average of SIBOR rates published in the last 3 months by ABS, where transactions may or may not have occurred.

- SORA’s floating interest rates are based on yesterday’s actual interbank lending transactions, compared to SIBOR’s floating interest rates, which are based on a poll of rate forecasts by the ABS’ 20 member banks.

- SORA is also considered more transparent and easier to calculate as its rates are published daily on the MAS website at 9 am; while SIBOR rates are published on the ABS website only a week later.

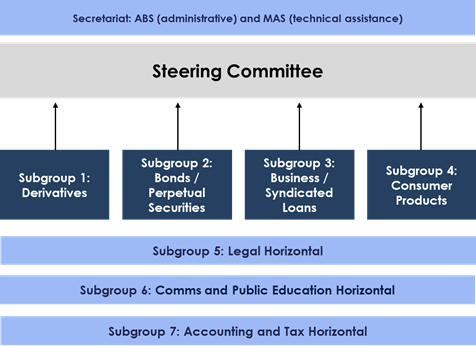

Although SORA-pegged loans are still in the infancy stage, MAS has formed the Steering Committee for SOR & SIBOR Transition to SORA (SC-STS).

The committee’s role is to gradually move industry participants, commercial and retail customers (like homeowners with bank loans pegged to these rates) to SORA by the end of 2021 (for SOR-benchmarked products) and end-2024 (for SIBOR-benchmarked products). You can read the documentation details here (note that these timelines may change).

The structure below shows the different technical subgroups involved in the committee, covering a gamut of different types of loans and financial products.

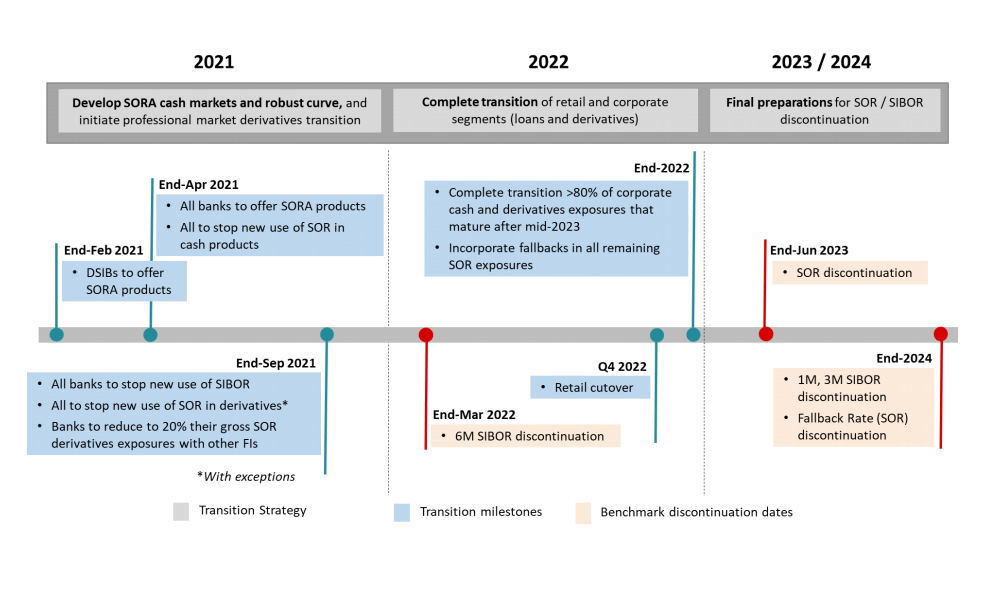

Here’s a roadmap for the transition from SOR and SIBOR to SORA:

Based on the timeline, we can see that all cash products benchmarked against SOR have ceased since April 2021 (derivatives to stop by end-September 2021 with exceptions). The same will happen for SIBOR by end-September 2021 and the discontinuation of the 6M SIBOR by end-March 2022 and 1M/3M SIBOR by end-2024. All pre-existing or legacy SOR-benchmarked products should cease by end-June 2023.

Expect to see further education and reminder letters from banks on the cut-over dates as they wind down the remaining use of SOR and SIBOR in the following months and years ahead. If you’re in the process of applying or renewing your home loan based on say, the 1M/3M or 6M SIBOR, but you’re worried that the eventual switchover to SORA may affect you, it’s always good to check with your bank or financial consultant (or visit 99.co’s mortgage assistant) for additional assurance and guidance.

–

Are you planning to renew your home loan but worried about potential changes in the interest rate? Let us know in the comments section below or via our Facebook post.

If you found this article helpful, 99.co recommends SIBOR: What is it, and how can you get the cheapest home loan out of it? and Should You Choose an FHR Loan or a SIBOR Loan?

Looking for a property? Find the home of your dreams today on Singapore’s fastest-growing property portal 99.co! If you would like to estimate the potential value of your property, check out 99.co’s Property Value Tool for free. Meanwhile, if you have an interesting property-related story to share with us, drop us a message here — and we’ll review it and get back to you.

–

What is SOR, SIBOR and SORA?

SOR, SIBOR and SORA are floating interest rate benchmarks that local banks use to determine the cost of borrowing when pricing local housing and/or mortgage loan interest rates. These benchmarks serve as a gauge of a bank’s cost of funds and help determine how much to charge borrowers or how much interest to pay out to customers.

Why is SORA different from SOR and SIBOR?

Commonly monitored as a reflection of daily conditions in SGD money markets, SORA is underpinned by a deep and liquid overnight funding market, making it a suitable alternative to SOR. Compared to SIBOR, SORA also measures Singapore’s interbank lending rate for unsecured loans, but as it is based on the average rate of all interbank lending transactions, it is less complicated and more transparent.

Why are we moving away from SOR and SIBOR to SORA?

As SOR is completely dependent on the US economy, it used to be much more volatile than SIBOR. In July 2020, the Association of Banks in Singapore (ABS) called for SIBOR to be discontinued by the end of the year and completely phased out by 2024, due to the LIBOR scandal which saw several banks using fixed interest rates to manipulate the financial markets to their advantage. Furthermore, with interest falling globally since the start of the pandemic, SIBOR has been declining too, thus requiring a more viable alternative instrument to peg home loans to, which has been identified to be SORA.

The post 9 things about SORA for home loan interest rates (before it replaces SOR and SIBOR) appeared first on 99.co.