Optimise credit score? What does it even mean?

Optimise credit score which takes time to build

Optimizing your credit score is one of those things you don’t know you have to do, until it is too late. Good credit history takes time to build, while late payments and defaults blot your record for up to five years. Start today to ensure that you have access to credit when you really need it.

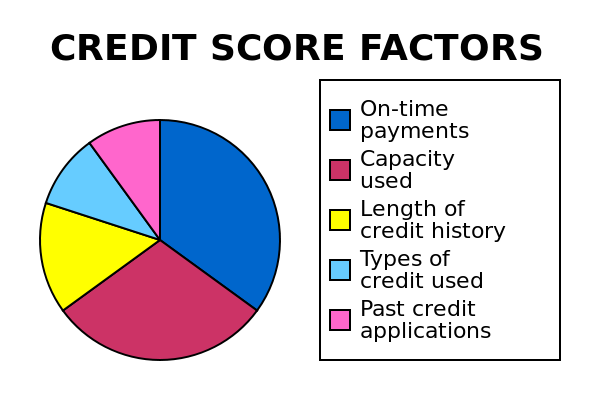

The premise of the credit score is that punctual repayment of debt is a good habit. People who pay their bills on time are more likely to continue paying their bills on time, barring exceptional circumstances. To improve your credit standing, start by applying for credit facilities such as credit cards.

Making use of credit facilities such as credit cards will start the ball rolling on your credit history. Conversely, consumers who have never applied for credit facilities before may find their credit score to be sub-optimal due to the lack of data on payment habits. Late or non-payment of bills will also negatively affect one’s credit score.

How do I optimise credit score?

Besides maintaining a squeaky clean credit history, here are three other things you can do to improve your credit standing:

Avoid taking up too many credit facilities in a short period of time.

The number of credit applications is tracked in the credit score. A large number of credit applications could signal that a consumer is credit hungry and thus counts negatively towards the credit score. Should you find yourself in a financial hardship, sign up for a Debt Management Programme (DMP) offered by Credit Counselling Singapore (CCS).

Keep your credit utilization low.

Your credit balance is measured against your credit limit to calculate your credit utilization. A higher credit utilization could indicate that you are spending more on debt payments and increases your risk of defaulting on your payments. Strategies to improve your credit utilization include paying down the debt, refinancing with a personal loan (ideally at a lower interest rate), asking for a higher credit limit and/or applying for another card. Just be mindful to manage your expenses if applying for another card.

Monitor your Credit Report for Material Changes

Identity theft and fraud, when successful, allow perpetrators to apply for credit in your name, potentially wrecking your credit history. Getting regular credit report from Credit Bureau Singapore (CBS) is one way to stop this in its tracks. Now with My Credit Monitor (MCM), this process is even simpler.

In addition to sending you a quarterly report, MCM will alert you to material changes to your credit report so that you are always kept up to date with your credit standing. Subscribe now for peace of mind.

Optimise credit score using My Credit Monitor (MCM)

There are several benefits in using MCM to monitor your credit. MCM is an important step in your endeavor to fight against identity theft by detecting any suspicious activities or changes that can affect your credit reputation.

It acts as your third eye to monitor your credit report, looks out for predetermined activities and notifies through your email as soon as the lender uploads your information into your credit file thus providing the earliest possible indicator.

- Preventing Identity Theft – Keeps you informed whenever a perpetrator assumes your identity to apply for credit or skips a payment.

- Put Your Mind at Ease – Safeguard your personal finance and credit information without having to leave home.

- Manage Your Credit Reputation – Ensures the correctness of information uploaded onto your credit file.

Mr Paul Ho, chief officer at iCompareLoan, said: “Lenders may use your credit score as a tool to assess your credit worthiness to decide if a loan should be granted. If your credit score is in good standing, your loan may be approved faster, with higher line assignment and lower pricing.”

Lenders will also take into consideration other factors such as the individual’s income, application documentations, existing banking relationship with the lender, the lender’s risk appetite, etc before extending credit to the individual. One thing to note on is, CBS does not play a part in the lender’s lending decision.

Credit repair is possible. A score is a “snapshot” of your risk at a particular point in time. The bureau score is dynamic and it changes as new information is added to your credit file such as taking up a new HDB loan with the bank. Your score is a reflective behaviour of your repayment history and it changes gradually as you change the way you handle credit. For example, a good credit score is derived from paying your credit card bills on time, all the time.

If you apply for multiple credit applications within a short period of time, it may have a negative impact on your credit score. So, if you want to optimise credit score, looking for new credit can equate with higher risk. Always approach credit in moderation.

If you have a joint credit account, these items could affect a score if they appear on your credit report. It is important that joint account holders understand that his or her repayment behaviour impacts the other joint account holder’s credit score.

A credit account held solely in the name of your spouse cannot impact your credit score if it is not a joint account.

PRICE OF MCM

| TENURE | PRICE (INCLUSIVE OF GST) |

FREE REPORTS* |

|---|---|---|

| 3 months | $10 ($10.70) |

2 |

| 6 months | $28 ($29.96) |

3 |

| 12 months | $45 ($48.15) |

5 |

*The first credit report will be sent to your registered email address upon successful subscription and subsequent credit reports will be sent on a quarterly basis.

MCM NOTIFICATION ALERTS

Credit Enquiry – Enquiries made on your credit report by any lenders in response to your application for new credit facilities. This alert also acts as an identity theft alert when an unknown individual has compromised your ID to apply for a credit facility.

- Details of the alert include enquiry date, name of bank, enquiry type, product type and account type.

Self Enquiry – When an enquiry is made on your own credit file either through yourself or an individual that has been authorized by you. This alert also helps to keep you notified for any identity theft should the search be unauthorized and unknown to you.

- Details of the alert include enquiry date, enquiry type, product type and account type.

Adverse Information – Provides new and updated status on Bankruptcy Proceedings and Default records.

- Details of a bankruptcy proceedings alert include bankruptcy number, order date, petition date, original order date, gazette date and nature of order.

- Details of a default alert include name of bank, product type, outstanding balance, status, status change date and date loaded.

Deteriorating Account Status Change – Deteriorating account status assigned to any of your credit facilities (e.g. from ‘A’ to ‘B’ status)

Details of the alert include name of bank, product type, date loaded, account status, full payment status and cash advance status.

Example of a detailed Alert being triggered due to “An Account Status Change”

| Client | ABC Bank |

| Product Type | Credit Card |

| Product Reference | 102665 |

| Status Change Date | 07/01/2019 |

| Date Loaded | 08/01/2019 |

| Cycle Account Status | Current: “B” Previous: “A” |

| Cycle Full Payment Status | Current: “N” Previous: “N” |

| Cycle Cash Advance Status | Current: “N” Previous: “N” |

Litigation Proceedings – Notifies when a writ of summon is filed against you. Details of the alert include case number, case sequence, court code, date of writ, nature of claim, status, claimed amount and plaintiff name.

MOBILE SMS NOTIFICATION – MONITORING MADE EASY.

Your MCM monitoring can now be made easier even if you do not access your email account regularly.

With the new mobile SMS notification, you will no longer miss any important MCM activity alerts that have been delivered to your registered email account.

The new feature pushes out the notification to your Singapore-registered mobile number upon the successful transmission of the MCM alert to your mailbox.

The second layer of notification channel not only provides an effortless monitoring experience but also allows you to be notified in the event whereby internet connection is denied or your access to the email account is not frequent.

The post Optimise credit score before it is too late to get best loans appeared first on iCompareLoan.