Less than two years ago, we covered a story on why you should pick a regular condo over an executive condominium (EC).

In the article, we shared advantages a regular, private condo has over an executive condominium, such as the ability to generate rental immediately, flexibility to sell, buying restrictions and capital appreciation. Note also that with private condos, depending on your financial profile, you have the option to select either a freehold or a 99-year leasehold condo. With executive condominiums, it’s 99 years.

These are all still valid and remain as mainstay reasons to do so.

What’s interesting however is the price gap between the two types of 99-year leasehold condominiums.

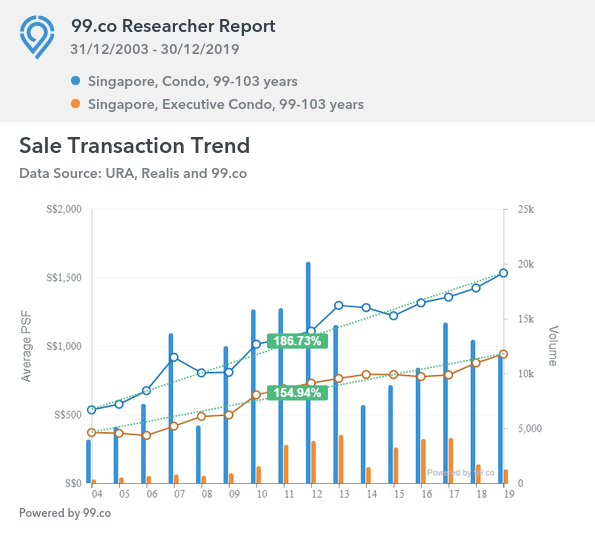

Based on recorded URA transactions between 2004 and 2019, private condos had a significant price appreciation over ECs. The term ‘narrowing the price gap’ between EC and private condo – new and resale – was debunked.

What’s really changed is capital appreciation between the two.

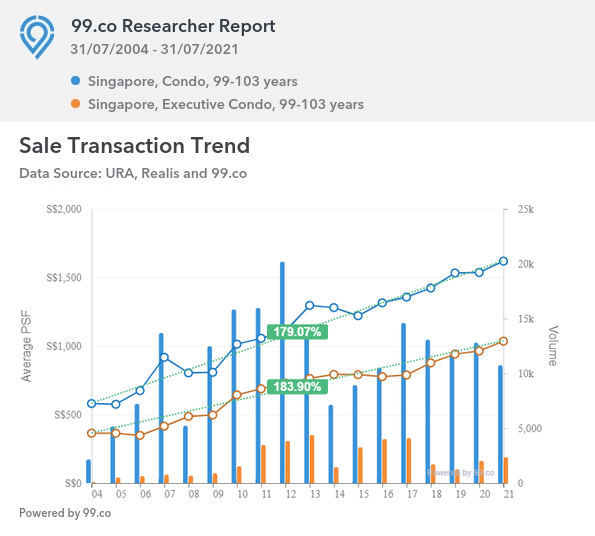

In 2019, the difference in average PSF price appreciation between private condos and executive condominiums (2004-2019) was 31.79%. If we stretch the time period till today, ECs have flipped private condominiums in average PSF price appreciation by 4.83%.

What’s also interesting from this chart is the pattern of sales volume for ECs. Between 2010 and 2013, there was a volume uptrend (due to our recovery from the 2009 Global Financial Crisis). The uptrend resumed between 2014 and 2017 (after the cooling measures in 2013/2014). This time, as we round out 2021, will we see a similar uptrend in sales volume?

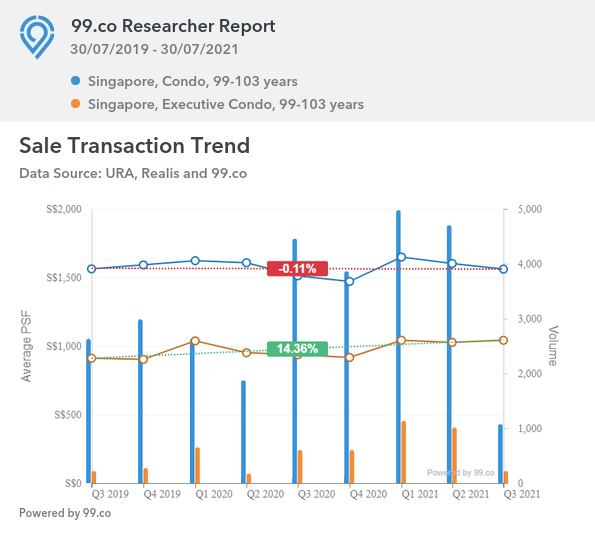

If we zoom in to just the past two years, the details become more telling:

Between Q3 2019 and mid-way through Q3 2021, while the average PSF price for private condos moved downwards by 0.11% (with intense volume since Q3 2020), the average PSF price for executive condominiums is up by 14.36%. Notice the 1000-unit volumes for ECs in Q1 and Q2 this year.

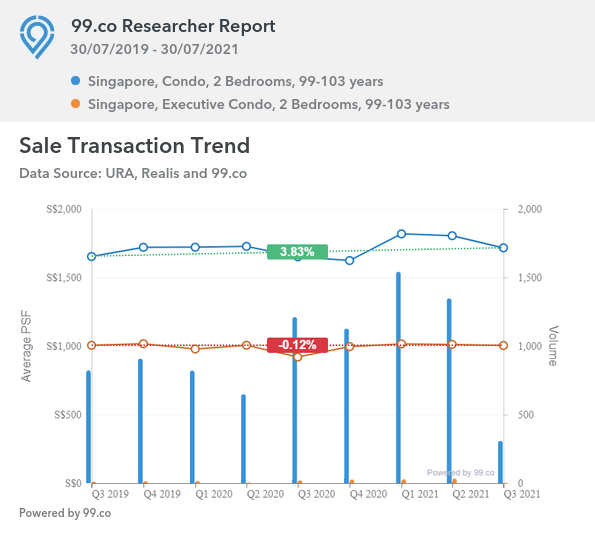

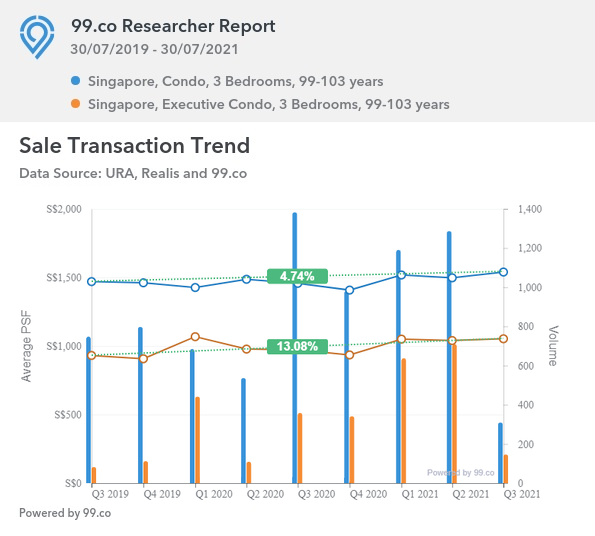

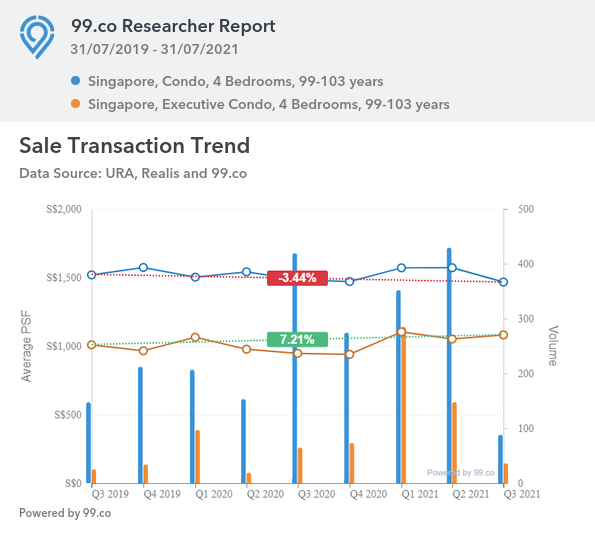

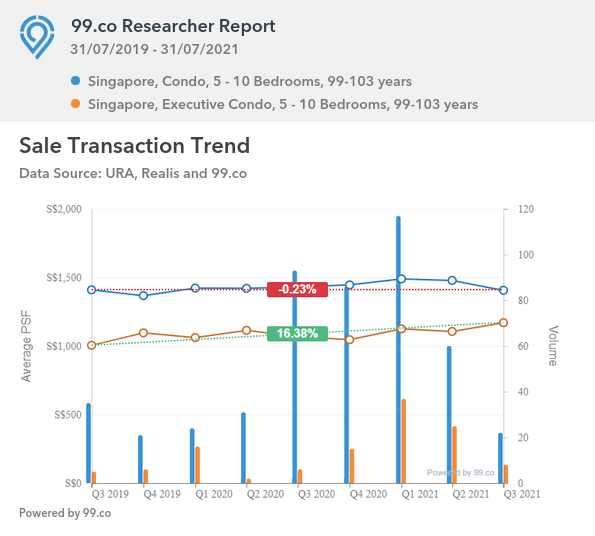

If we compare similar metrics for 2-, 3-, 4- and 5-bedroom apartment condos, we can identify where the increases lie:

A few factors could have contributed to the average PSF price increases and appreciation in executive condominiums:

- The COVID-19 situation in 2020 and 2021 has made many prospective homeowners (especially the ones with larger families) more cautious when paying for a home – some might have initially wanted a private condo but opted for an executive condominium instead.

- One possible reason was the September 2020 clampdown on the re-issuance of Option to Purchase (OTP) for new condominiums. In the past, the buyer will sign an OTP to lock in his interest. However, he may face delays in selling his HDB flat to avoid paying the Additional Buyer’s Stamp Duty (ABSD). The developer will then re-issue a new OTP with a new expiry date. With an EC, HDB upgraders can avoid this since they do not need to pay ABSD as long as they dispose of their current flat within six months of taking possession of the completed EC.

- As ECs are hybrids of public and private housing, buyers are able to apply for government grants and housing schemes – another cashflow saving consideration due to the pandemic.

- Most ECs are in suburban neighbourhoods with hypermarkets and amenities – which are ideal for Singaporean families wanting a home away from the city. There’s also the knock-on effect as more of us Work from Home.

- Compared to private condominiums, ECs are in lower supply.

- Several new launch ECs went on sale in 2019-2021, such as:

- Piermont Grand (July 2019; TOP: 2023)

- Parc Canberra (Feb 2020; TOP: 2023)

- Ola (March 2020; TOP: 2024)

- Parc Central (Jan 2021; TOP: 2024)

- Provence Residence (May 2021; TOP: 2026)

- and the upcoming Parc Greenwich (showflat on 26 August 2021; TOP: 2026).

7. Many executive condominiums had their minimum occupation periods (MOP) end in 2020 and 2021, meaning they could be resold to Singaporeans and PRs, such as:

- Twin Waterfalls

- The Tampines Trilliant

- Blossom Residences

- The Rainforest

- 1 Canberra

- Forestville

- The Topiary

- Twin Fountains

- CityLife @ Tampines

- Waterbay

- Waterwoods

- Heron Bay

In conclusion, the price gap between private and executive condominiums have indeed narrowed. What would be interesting is when some of these executive condominiums go private after ten years (ie. foreigners can buy them) – maybe we’ll do another lookback comparison then.

Watch this space.

–

Have any other tips we missed out on? Let us know in the comments section below or on our Facebook post.

If you found this article helpful, 99.co recommends Why are Executive Condos located so far away? and Buying resale EC vs new launch: The key differences you need to know.

Looking for a property? Find the home of your dreams today on Singapore’s fastest-growing property portal 99.co! If you would like to estimate the potential value of your property, check out 99.co’s Property Value Tool for free. Meanwhile, if you have an interesting property-related story to share with us, drop us a message here — and we’ll review it and get back to you.

The post Has the price gap between private and executive condominiums changed? appeared first on 99.co.