Resilient private home sales In June 2021 amid tighter Covid-19 measures and lack of new launches says PropNex

Overall private new home sales fell slightly in June 2021 compared to the previous month, as developers held back on new launches amid the tighter safe management measures under the Phase 2 Heightened Alert from 16 May to 13 June 2021.

Resilient private home sales considering heightened alert measures stretched into mid-June

Mr Paul Ho, chief officer at iCompareLoan, said: “Considering we were still in Covid-19 heightened alert measures up till mid-June, we must consider private home sales resilient.”

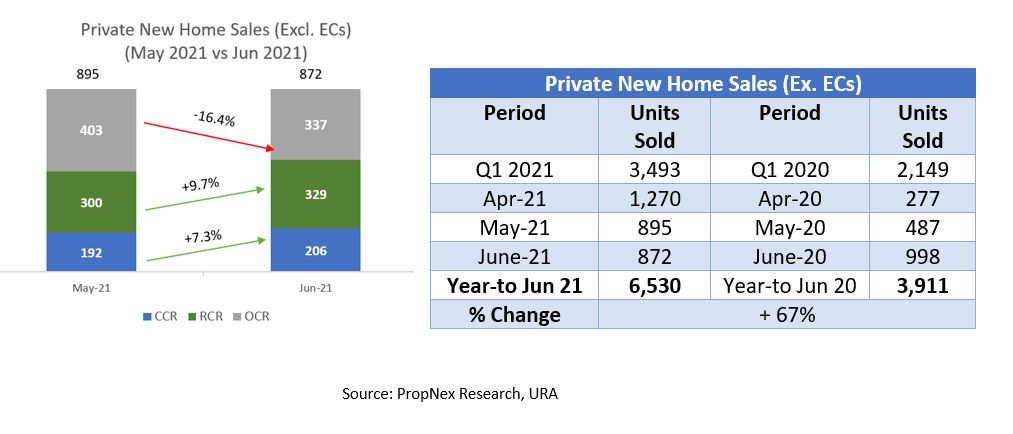

Developers sold 872 new private homes (excluding Executive Condos) in June 2021 – down by 2.6% from the 895 units transacted in the previous month. When compared to June 2020 – which marked the start of the reopening of the economy after the 2-month Circuit Breaker from 7 April 2020 to 1 June 2020 – new home sales last month were 12.6% lower than the 998 units transacted then.

New homes sales in the Outside Central Region (OCR) declined month-on-month by 16.4% in June, but still led sales for the month, selling 337 units – boosted by transactions at Treasure At Tampines (80 units). This was followed by the Rest of Central Region (RCR) and Core Central Region (CCR) where 329 and 206 new homes were transacted respectively. The RCR and CCR sold 9.7% and 7.3% more units respectively in June 2021 compared to the previous month. The CCR sales were boosted by Hyll on Holland which sold 87 units – the project’s strongest monthly sales since its launch in October 2020. Meanwhile, Normanton Park remained the top-seller in the RCR, with 62 units transacted in June.

In the EC segment, developers sold 90 new units in June 2021 – more than 73% down from the 339 new ECs transacted in the previous month, where sales were driven by the launch of Provence Residence EC. In June 2021, Ola was the best-selling EC project, moving 29 units at a median price of $1,150 psf.

In terms of units launched, developers placed 815 new private homes (ex. ECs) on the market in June – 58% more than the 516 units (ex. ECs) launched in the previous month. All of the units placed on the market in June were from previously launched projects, including Treasure at Tampines (203 units), Midwood (120 units), Hyll on Holland (100 units), amongst others.

Mr Ismail Gafoor, CEO of PropNex, commenting on the resilient private home sales in June 2021 said: “New home sales were quite resilient in June 2021, despite the stricter safe management measures and the fact that there were no new project launches at all during the month.”

In view of these circumstances, we think developers’ sales in June were actually very decent, driven by projects that have already been put on the market. The June sales figures are generally comparable to previous new home sales numbers for the month of June prior to the pandemic.

Without any fresh launches in June, buyers picked up units from existing launches. Freehold development Hyll on Holland in the CCR was the best-seller last month with an attractive median price of $2,387 psf, while mega projects Treasure At Tampines and Normanton Park continued to sell units steadily, with a median price of $1,411psf and $1,821psf respectively.

Despite the absence of new launches and tighter Covid-19 measures under Phase 2 Heightened Alert, we observed that new home sales have held up relatively well this time, compared to the drastic drop in transactions during the circuit breaker period last year, where sales plunged in April and May to 277 and 487 units, respectively. We think consumer confidence has improved vastly since last year amid the economic recovery as well as the government’s clear roadmap towards re-opening and the ramping up of the national vaccination programme.

For the whole of 2021, we project that new private home sales (ex. ECs) could reach 11,000 to 12,000 units, barring any unforeseen events and new cooling measures.”

Mr Ismail Gafoor, CEO of PropNex

Wong Siew Ying, PropNex’s Head of Research and Content, commenting on the resilient private home sales In June 2021 said: “New home sales are expected to rebound in July where several projects are slated to hit the market, ahead of the Hungry Ghost month in August.”

Upcoming launches in the weeks ahead include: Pasir Ris 8, Watergardens at Canberra, and Parc Greenwich EC in Fernvale in the OCR; Klimt Cairnhill and Perfect Ten in CCR; and Bartley Vue in the RCR. Given the limited OCR launches recently, the new projects in Pasir Ris, Canberra and Fernvale should attract strong interest from owner-occupiers, including HDB upgraders.

According to caveats lodged, Normanton Park was the best-selling private residential project in 1H 2021, selling 923 new units. The project was launched this January and its sales figure is about 2.4 times that of the second top-selling project Midtown Modern, which moved 384 units. Half of the top 10 best-selling projects in 1H 2021 were located in the OCR, and we expect this sub-market to do well this year, with the new launches still to come.”

Wong Siew Ying, PropNex’s Head of Research and Content

Ms Pearl Lok, Director for Capital Markets for Singapore at Colliers International, commenting on the resilient private home sales In June 2021 said: Property purchase is a long-term commitment, the homebuying activities remain healthy through the Phase 2 (Heightened Alert) period, reflecting the underlying positive outlook of the economy.”

The Core Central Region (CCR) or a proxy to high-end segment made up (excl. ECs) of 23.6%, compared to 21.5% in May 2021.

The Rest of Central Region (RCR) or city fringe projects made up (excl. ECs) 37.7%, compared to 33.5% in May 2021.

The Outside Central Region (OCR), viewed as a proxy to the mass-market segment made up 38.6% of total sales (excl, ECs), compared to 45% of total sales in May. The slight decline saw homebuyers shifting their focus towards RCR and CCR in June 2021.

46.1% of the total developer sales (excl EC) in June 2021 were priced at the median price of SGD1,500 to 1,999 psf, while 30.3% of the total developer sales (excl EC) were priced at the median price of SGD2,000 to 2,499 psf.

As Singapore continues to step up on the roll-out of vaccination and allowing COVID-19 measures to be further relaxed, we could expect more homebuying activities. Going into 2H 2021, we expect OCR and RCR to have more homebuying activities as most of the projects in the pipeline are in these localities, with UOL announcing earlier the launch of The Watergardens at Canberra, located within OCR in July.

The month of July is likely to see healthy sales, which could continue through 2021, as new launches are expected to continue in 2H 2021. Private home prices could rise 6% in 2021, tracking GDP growth.

Pearl Lok, Director for Capital Markets for Singapore at Colliers

The post Resilient private home sales in June 2021 despite tighter Covid-19 measures appeared first on iCompareLoan.