Whether it’s buying a BTO or resale flat, we usually look at the amount of CPF grants we can get and try to maximise it. Most of us would also use CPF to pay for the downpayment of a house. Some of us may even tap into our Ordinary Account (OA) savings to pay for our mortgage instalments.

In fact, some may even use the OA savings to pay for stamp duties and legal fees.

But here’s the thing about using your CPF monies for housing: You need to refund the amount used if you sell the house. Plus the 2.5% accrued interest. Accrued interest is the amount of interest that you would have earned if the money wasn’t withdrawn from the account.

(Yes, we know it’s our own money. But it’s also the money that’s intended for retirement.)

On the other hand, what many people don’t know is that you can actually refund the CPF monies used to pay for your house, even if you don’t have plans on selling it. It can be done through a scheme called the CPF Voluntary Housing Refunds.

What is the CPF Voluntary Housing Refunds?

It’s a scheme that allows you to refund your CPF monies used to fund your house. You can refund any amount at any point in time, up to the full principal amount withdrawn for the property with the accrued interest. The money goes back to your OA.

Let’s say you’ve bought a BTO flat at S$400,000 and received a grant amount of S$25,000 under the Enhanced Housing Grant (EHG). And you’ve used S$40,000 for the downpayment from your OA savings account.

If you have some cash on hand, you can refund as much as you like, up to S$65,000 plus the accrued interest.

This is also something that more and more people are doing over the past few years. In fact, CPF saw 14,980 members making voluntary housing refunds last year.

Why should you refund your CPF monies used for housing?

There might come a time when you decide that you want to sell your house. Maybe it’s because you want to have a bigger space, so you want to upgrade to a bigger house. Or maybe you want to take advantage of the robust resale flat market. Whatever the reason, once you sell it, you need to refund the CPF used plus the accrued interest.

This interest is calculated from when you withdraw the money and is compounded yearly. So the longer the money is in the account, the more interest you’ll earn. This also means that the longer the money is out of the account, the more interest you’ll lose out. So the amount that you need to refund will be higher if you decide to do it later.

Let’s say you decide to sell your house 10 years after you bought it. Using the same figures as above, this means that you’ll have to return the S$65,000 CPF monies plus the accrued interest of 10 years.

With the 2.5% compound interest, this will translate to a total of S$83,205.50 that you have to refund. It will eat into your cash proceeds as well.

So the earlier you refund the money, the better.

Let’s say you’re refunding your CPF monies earlier, in five years. This translates to a total of S$73,541.53. It’s still quite a lot of money, but the difference is nearly S$10,000.

Plus, you could earn S$10,000 more in interest within five years. Compared to traditional savings accounts, it’s a good way to earn returns if you’re risk-averse.

Even if you can’t refund the entire sum, you can still make a partial refund first. Doing so helps you to reduce the amount of interest owed. So when you decide to sell your house in future, the amount you have to return will be lower.

How to find out the accrued interest owed?

The good thing is that you don’t have to search for an online calculator to do your own calculations. You can simply head over to the CPF website to find out the amount.

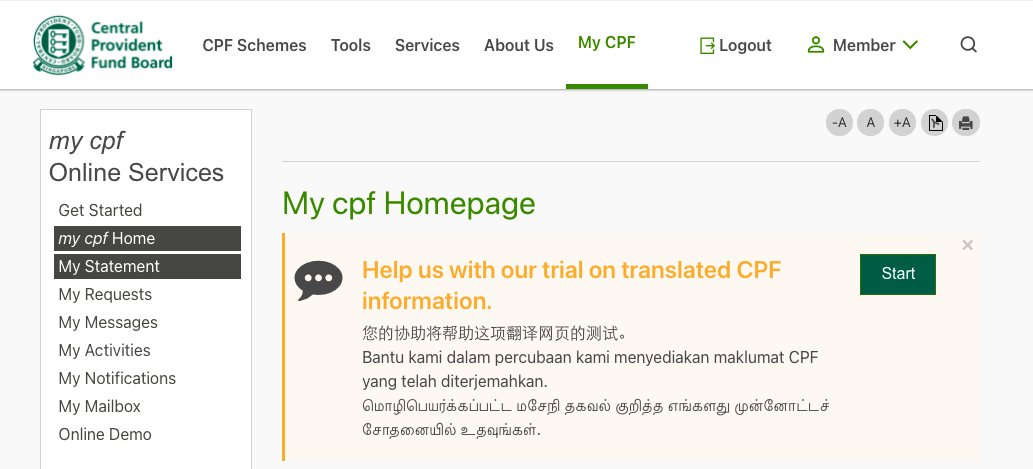

- Log in to your CPF account. On the homepage, click “My Statement”.

2. Scroll down to “Section C”. Under the “Property” section, you can find the net amount used and accrued interest. The sum of the net amount used and accrued interest is the amount to return to your CPF account when you sell your house.

How to make a CPF Voluntary Housing Refund?

The process is simple and can be done online via the CPF website.

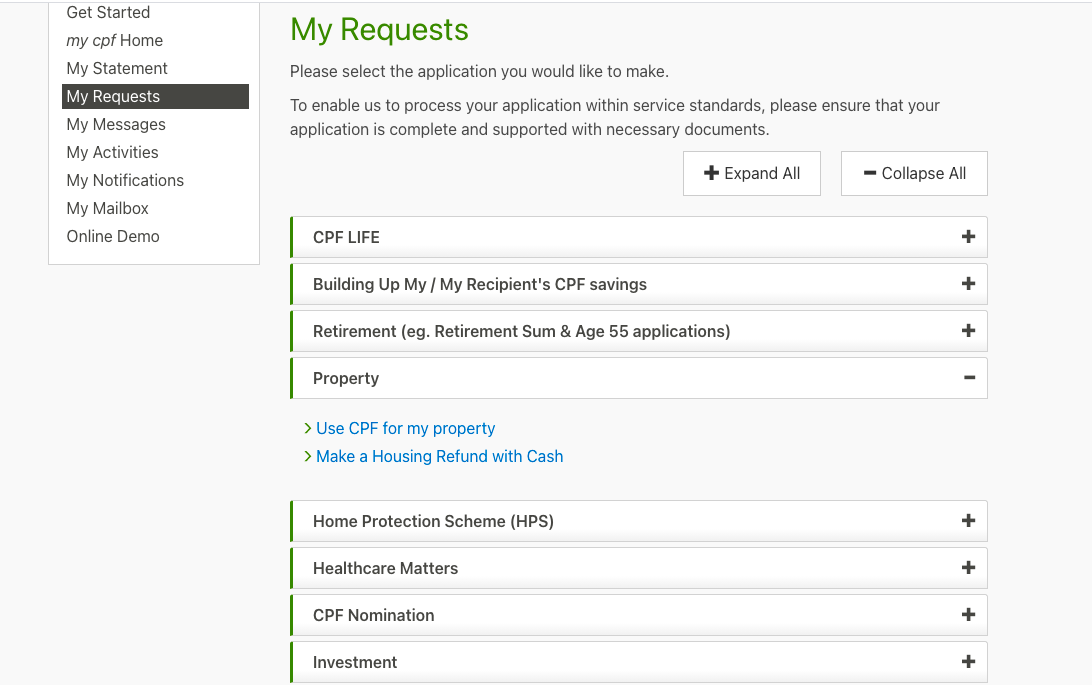

- Under “My Request”, click on “Property”.

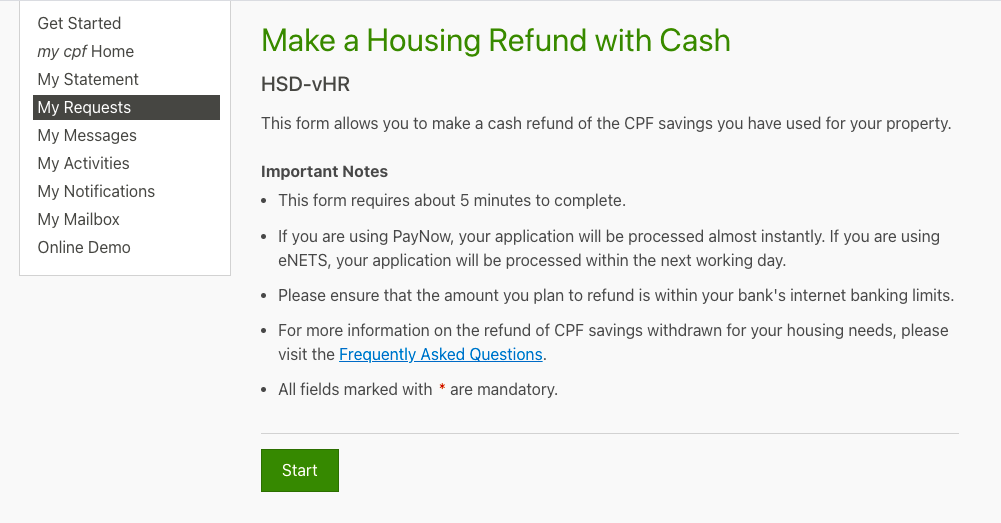

2. Select “Make a Housing Refund with Cash”. It will take you to this page.

You can either use eNETS or PayNow for the refund. Do note that if you’re using eNETS, the refund will take one working day to be processed. But if you’re using PayNow, it will be processed almost immediately.

You can also do it via the myCPF mobile app, which you can download here (via App Store) or here (via Google Play Store).

For more information about the CPF Voluntary Housing Refund, head over to CPF’s FAQ.

Will you make a CPF Voluntary Housing Refund? Let us know in the comments section below or on our Facebook post.

If you found this article helpful, 99.co recommends How your HDB sale proceeds might get “taken” by CPF and What happens if your housing loan deductions reach your CPF Basic Retirement Sum (BRS)?

Looking for a property to buy or rent? Find your dream home on Singapore’s largest property portal 99.co! If you have an interesting property-related story to share with us, drop us a message here – we’ll review it and get back to you.

The post You can refund your CPF monies used for your house even when you’re not selling it. Here’s how. appeared first on 99.co.