If you’re planning to purchase your first home, you probably know how confusing things can get when you don’t have a good grasp of financial terms and jargon about housing matters. In your course of research, you’ve likely come across the term In-Principle Approval (IPA) or Approval-in-Principle (AIP).

But what is it exactly? And is it worth the effort getting one before purchasing a home?

In short, an IPA is a communication from a bank (usually verbal or via email) detailing how much they’re ready to loan you if you purchase a home within a certain validity period. As a rough gauge, the time for approval usually takes about a week or so. There are many ways getting an IPA can help you get one step closer to your dream home. By giving you a better idea of your finances, you’ll also be better able to budget and plan for an upcoming property purchase.

#HomeSweetLoan: Searching for a new home loan? There’s no better time than now! From 10 May to 9 July 2021, secure a new home loan through PropertyGuru Finance and stand a chance to win $9,000 to spend on renovations! Find out more here.

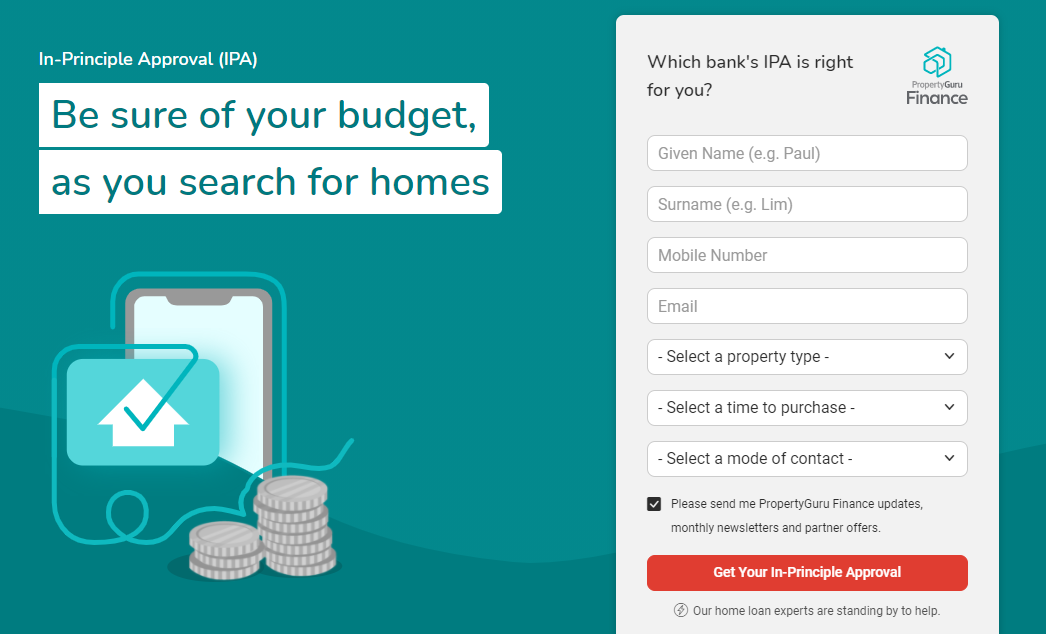

If you need an In-principle Approval (also known as Approval-in-Principle), PropertyGuru Finance can help you with it too.

How Do I Apply for an In-Principal Approval (IPA)?

The usual process of IPA application involves first sourcing for banks and comparing loan interest rates to find which one suits your situation best. Apart from being time consuming, it can also be a source of stress for those who aren’t familiar with finance jargon and technicalities. But don’t panic just yet!

Thankfully, PropertyGuru Finance has a completely free and fuss-free IPA service to help you get started. By applying on our page, you’ll be able to get expert recommendations and advice about home loans from different banks without having to do all the heavy research yourself. Phew

Sounds too good to be true? We know. But we can assure you that it’s really as easy as it sounds. Here’s how it works:

1. Share your Details with us to Get Started

Simply visit our IPA page and let us know your contact details, along with the type of property you intend to purchase, and when you’re looking to purchase one.

2. Wait for us to Get in Touch

Once you’ve completed the necessary steps, simply sit back and wait! A home loan advisor will get back to you within the day to discuss your situation and needs. They’ll then recommend the best banks to apply with based on your purchase timeline, financial profile and loan amount required.

3. Choose Your Preferred Bank

Once you’ve decided on the bank and loan type, our advisor will then guide you through document submission and even help track the application for you. Some financial documents that are typically required for an IPA application include pay slips, CPF contribution history, credit card statements, and any existing housing loans you may have.

4. Review the Results

Banks typically take about a few days to a week to get back to you on the outcome of your IPA. Once you receive it, your advisor will review the results together with you and address any concerns you may have.

Benefits of Getting An In-Principle Approval (IPA)

Sounds simple enough! But just how useful is an IPA?

Now that you’re aware of the steps involved in getting an IPA, you’re probably wondering just how useful it really is. Well, here’s how it can help you.

1. It Helps You Choose a Home You Can Afford

First and foremost, having an IPA will help you understand exactly what you can and cannot afford, assuming you’re using a bank loan to finance your home. So while that dream house of yours may be perfect in every way, it may be several thousands of dollars out of your budget.

An IPA will let you know how much a bank is willing to loan you, so that you can narrow your search down to properties that fall within your financial reach while combing through listings. This is especially useful as banks assess your loan based on factors like your income, credit history and whether you and your spouse are Self Employed Persons (SEPs).

2. It Gives you a Better Gauge of your Finances to Plan your Downpayment Amount

As an IPA tells you exactly how much a bank is willing to loan you, you’ll be able to make the necessary calculations to ascertain if you would be able to pay the loan back within your targeted time frame. You could also use that as a gauge to decide if you wish to make a high downpayment at the start, to lower your monthly repayment amount later on.

As a note, buyers taking out a bank loan would be required to pay at least 25% of the purchase price upfront, of which up to 20% can be paid with cash and/or their CPF Ordinary Account savings, and the remaining 5% in cash.

3. It Minimizes the Risk of Losing Your Option Fee

Perhaps the reason why a lot of buyers seek out an IPA is to prevent losing their Option to Purchase (OTP) fee. An OTP is a legal agreement between the buyer and seller (or developer) to purchase a property from the seller in future.

In other words, it’s a way to ‘chope’ that dream house of yours.

When signing an OTP, the buyer is required to pay an option fee to “reserve” the property. So if you do back out from the agreement, you forfeit the amount paid. Typically, the OTP is something you can negotiate with the seller about. It is usually 1% for most properties and 5% for under-construction buildings (BUCs), but may be higher for unusual circumstances (for example, longer option period). For HDB resales, the fee is usually not more than $1,000. Find out more about OTP here.

Most of the time, buyers don’t back out of a property transaction because they are indecisive or change their minds. But in the event that they do, it’s usually because they later realise that they can’t actually afford the property.

As mentioned previously, having an IPA on hand allows you to gain a better understanding of your finances from the get-go so the chances of you making an offer you might later regret are slimmer. That way, you avoid losing money before you’ve even purchased a property. An IPA ‘assessment’ will also help you understand what parts of your income the financial institutions ‘recognise’.

Finally, is there Anything Else I should be Mindful of?

So as you see, despite being an ‘optional’ step in the housing purchase process, an IPA can be very useful and can inch you closer to that property you’ve been eyeing. On this note, we should also mention that should you wish to still do your research and approach banks directly, you may come across the term ‘pre-qualification’ in some of their marketing materials.

Related video:

Unlike an IPA, which is a form of ‘pre-approval’, a pre-qualification is not a commitment from the bank that you will get the loan you require. It is instead, just a rough gauge of how likely you will be to get your hands on the loan you require based on various criteria. To prevent unnecessary confusion, we’d again recommend using the PropertyGuru IPA service to clarify any doubts you may have.

That said, an IPA is no doubt a great first step in getting closer and achieving that dream home you so desire.

More FAQs About In-Principle Approval (IPA) for Home Loans

What Is The Meaning of In-Principle Approval (IPA)?

An in-principle approval (IPA) is the same as an approval-in-principle (AIP), which is basically an informal communication from the bank regarding how much they are willing to lend you for your home loan.

Who Can Apply for In-Principle Approval (IPA)?

Anyone! If you’re shopping for a home loan in Singapore and want to understand your borrowing eligibility better, then you can and should apply for an IPA – apply through PropertyGuru Finance here.

Does An In-Principle Approval (IPA) Speed Up Your Home Loan?

This depends on each bank’s internal processes, but while we can’t say it will speed up or increase the chances of your actual home loan approval, it definitely can’t hurt. We always recommend applying for an IPA – you can do so through PropertyGuru Finance.

Disclaimer: Information provided on this website is general in nature and does not constitute financial advice.

PropertyGuru will endeavour to update the website as needed. However, information can change without notice and we do not guarantee the accuracy of information on the website, including information provided by third parties, at any particular time. Whilst every effort has been made to ensure that the information provided is accurate, individuals must not rely on this information to make a financial or investment decision. Before making any decision, we recommend you consult a financial planner or your bank to take into account your particular financial situation and individual needs. PropertyGuru does not give any warranty as to the accuracy, reliability or completeness of information which is contained in this website. Except insofar as any liability under statute cannot be excluded, PropertyGuru, its employees do not accept any liability for any error or omission on this web site or for any resulting loss or damage suffered by the recipient or any other person.