It’s an open secret that buying a Build-to-Order (BTO) flat directly from HDB is almost as good as getting “free money”, because these flats are sold to Singaporeans at a discount to market value.

In recent times, we’re increasingly hearing the term “windfall effect” or “lottery effect”, which describes the significant profit that BTO flat owners get when they sell their new-ish flats upon completion of the five-year Minimum Occupation Period (MOP).

Such profits have been most attention-grabbing where it concerns flats in prime locations.

In fact, transaction figures at or above the million-dollar mark are fast becoming the norm with 87 such transactions in the first five months of 2021 alone.

So, perhaps unsurprisingly, the government has begun seriously considering countermeasures to stop Singaporeans from profiteering excessively from public housing while it continues to build flats in prime areas, in order to keep our society “egalitarian and inclusive.”

This time, before deciding to implement a policy, the government has chosen to consult the general public via a comprehensive survey. And lo and behold, the questions in the survey actually reveals, in significant detail, what the government could already be planning up their sleeve.

So let’s get to the chase.

The survey by the Ministry of National Development (MND), titled “Public Consultation on Public Housing in Prime Locations”, revealed three main ways in which the government is planning to curb the “windfall effect” in HDB BTOs in prime locations such as the city centre and Greater Southern Waterfront.

In total, the respondent is presented with 11 “scenarios” in which the windfall effect and equality can be addressed with public housing in prime locations. While the ministry is careful to say that these scenarios are not indicative of the final policies, the specific nature of these scenarios will definitely provide a guide to decision-making in the upcoming months.

Firstly, the respondent is presented with four scenarios “that can potentially improve the affordability of new HDB flats in prime locations”.

- Longer Minimum Occupation Period

- Additional Subsidies

- Shorter Lease

- Smaller Flats

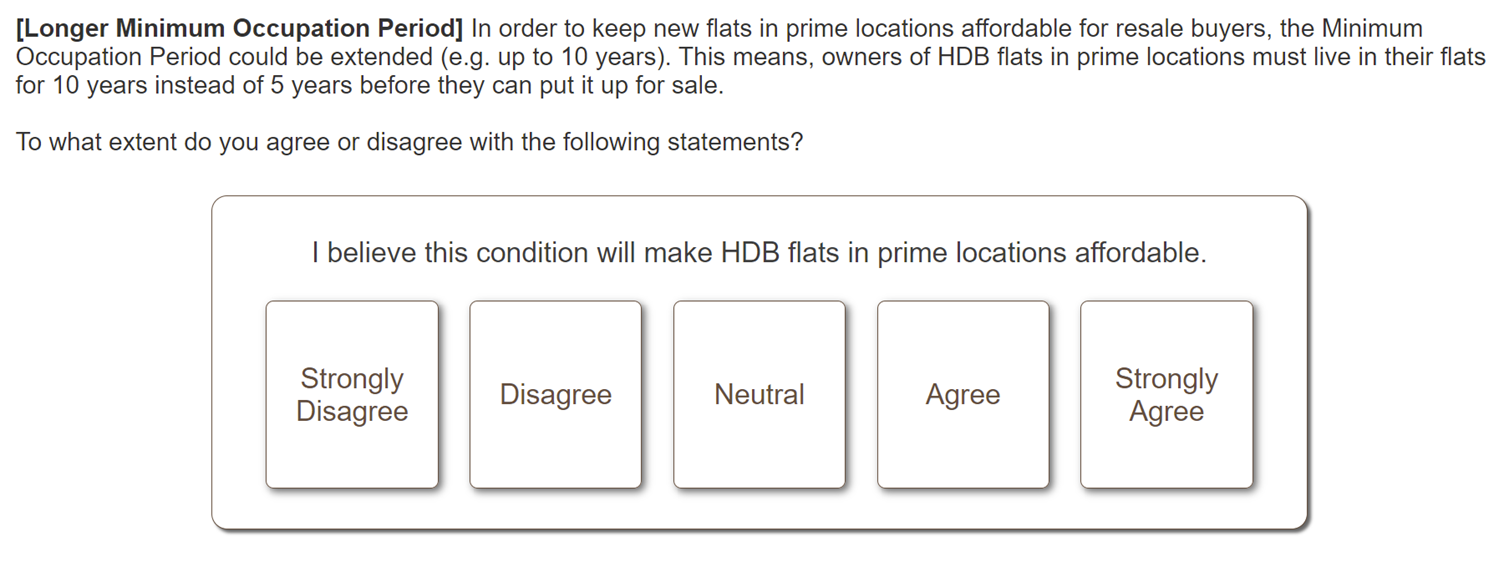

Scenario #1: Longer Minimum Occupation Period

What the survey says: In order to keep new flats in prime locations affordable for resale buyers, the Minimum Occupation Period could be extended (e.g. up to 10 years). This means owners of HDB flats in prime locations must live in their flats for 10 years instead of 5 years before they can put them up for sale.

What we say: This could be a case of “kicking the can down the road”, because extending the MOP could simply mean a delayed windfall effect. Profits after a ten-year period could also be more pronounced. In addition, a longer MOP could also prevent owners with real needs, such as a growing family, from relocating to a more suitable home.

Our verdict: There is little to indicate that a longer MOP will improve affordability, or that buyers will be put off by a longer MOP when submitting a queue number for a prime location BTO flat.

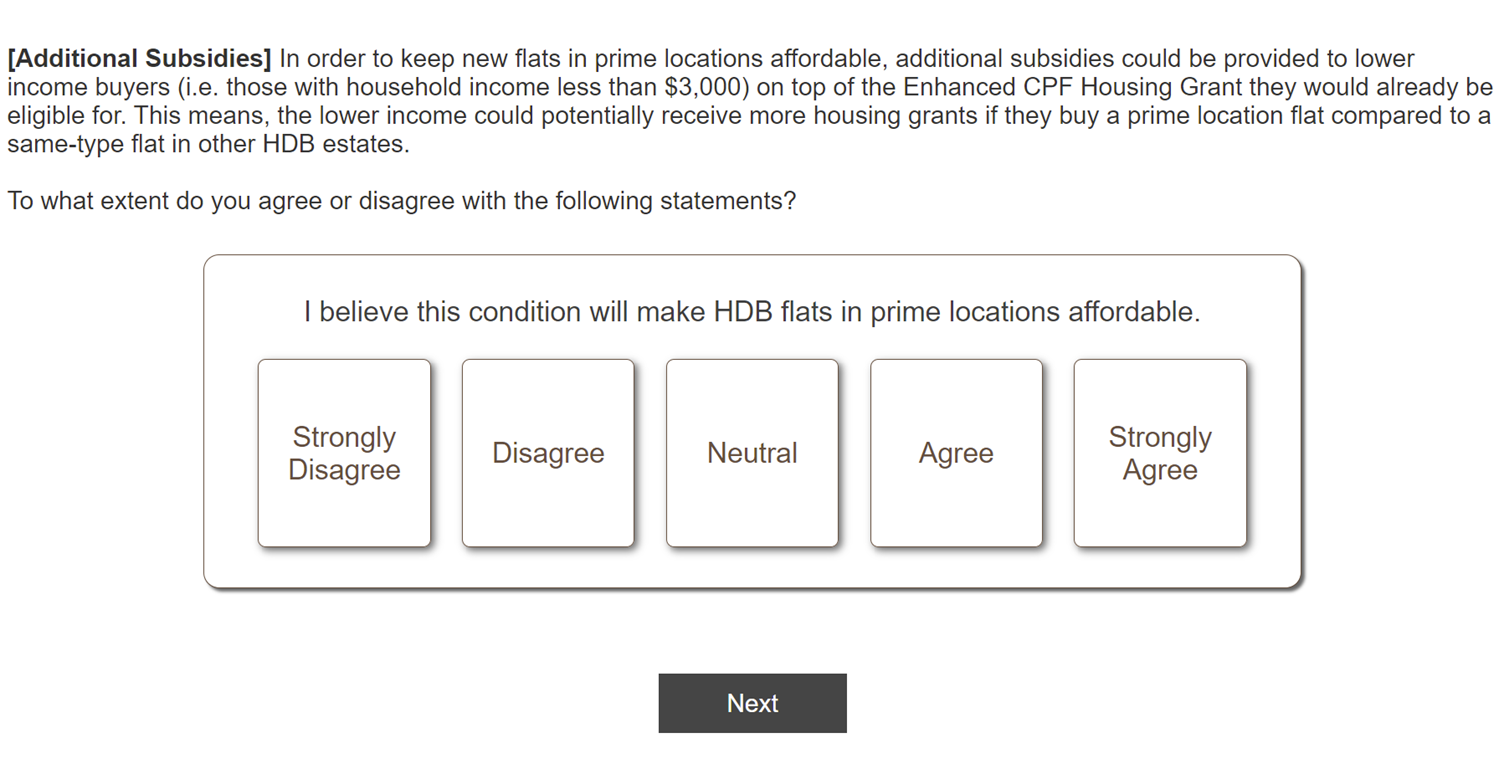

Scenario #2: Additional Subsidies

What the survey says: In order to keep new flats in prime locations affordable, additional subsidies could be provided to lower-income buyers (i.e. those with household income less than S$3,000) on top of the Enhanced CPF Housing Grant they would already be eligible for. This means the lower-income could potentially receive more housing grants if they buy a prime location flat compared to a same-type flat in other HDB estates.

What we say: Subsidies like the Enhanced CPF Housing Grant (EHG) aren’t a free lunch; they are subject to CPF accrued interest. Many buyers do not fully grasp the implications of accrued interest, which can cripple lower-income buyers in adverse and contingency situations, such as when they have to make a negative sale.

Besides, we feel that the current grant amounts of up to S$160,000 for resale HDB flats are adequate, and while more grants for lower-income families in prime locations might make such flats more affordable in a relative sense, it would have the effect of further distorting the real market value of these prime flats.

Worse, giving more income-based grants for prime location flats might encourage lower-income buyers to bite off more they can chew and forgo housing options that are more realistic and sensible, simply because more grants are available.

For instance, lower-income buyers might go against their better judgment by offering a higher cash-over-valuation (COV) because they feel that the total quantum will somehow be offset by more grants. This can create cash-flow problems.

Also, an unintended effect is that non-prime resale flats will lose their value because of lower demand from lower-income buyers, whereas the prices of prime flats continue to increase because sellers know that buyers are willing to pay more because of higher grant amounts. The warning is that tinkering too much with grant amounts might lead us to a dreadful slippery slope.

Our verdict: Nope, we’re not in favour of this. Conversely, why not consider reducing grants for prime location flats for those who earn more?

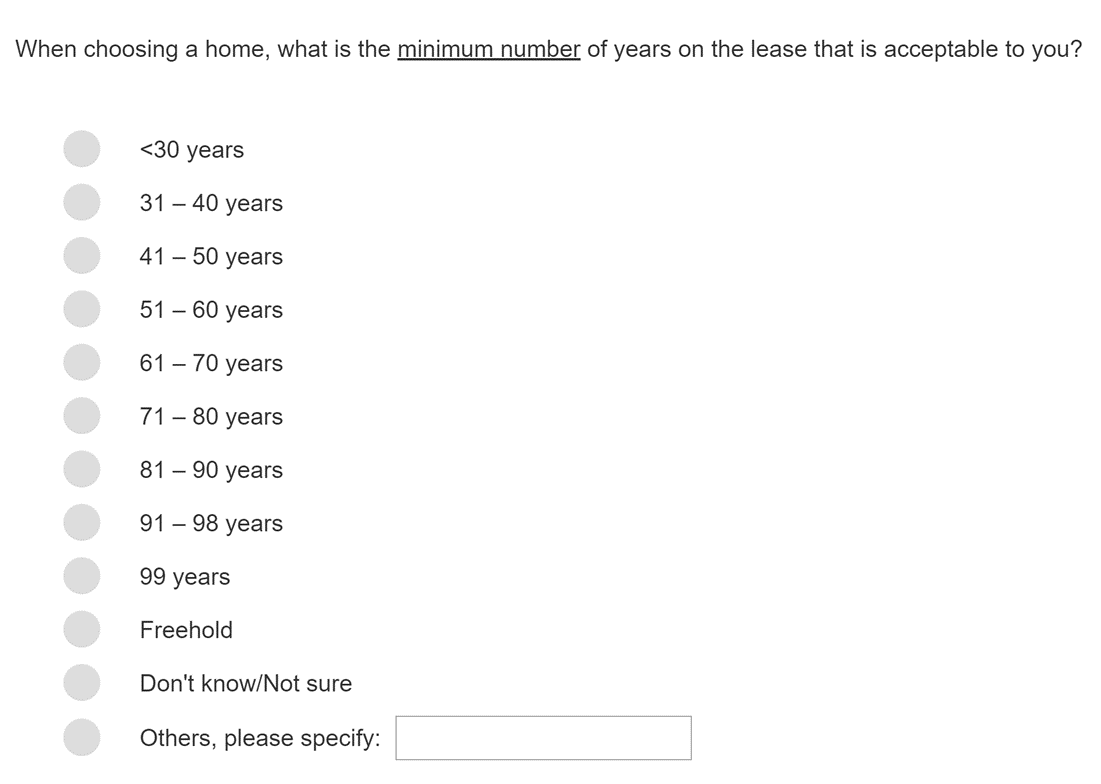

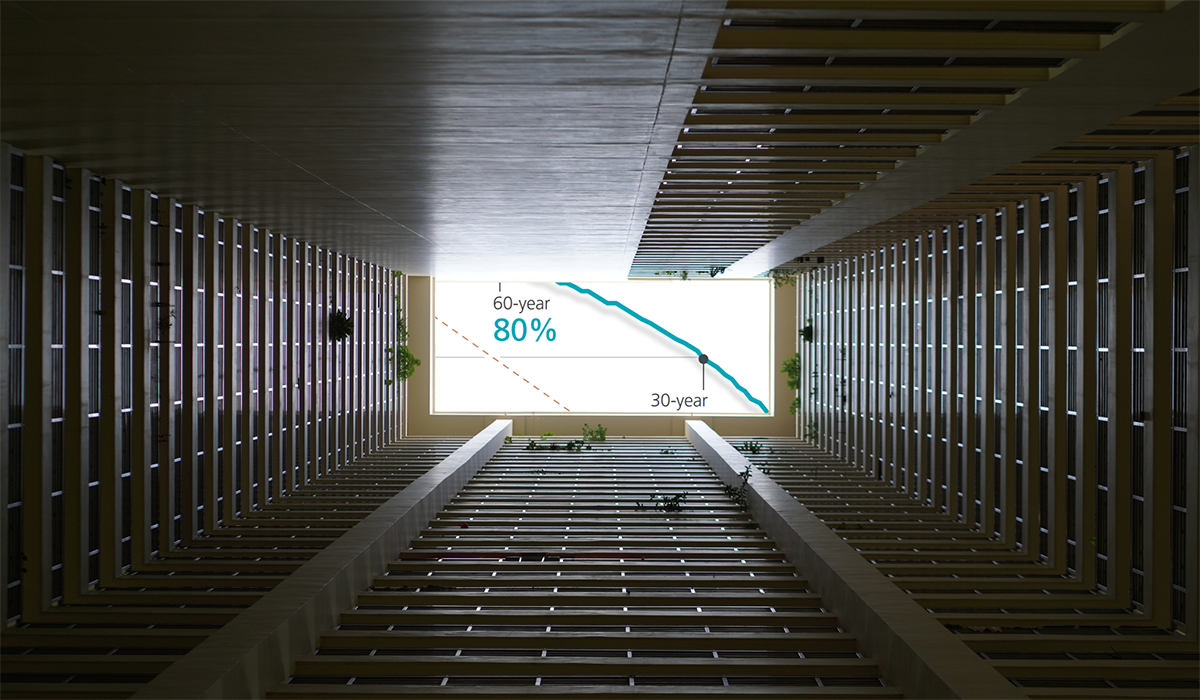

Scenario #3: Shorter Lease

As a prelude to the actual survey, respondents are asked what is the minimum number of years of an HDB lease is acceptable to them:

What the survey says: In order to keep new flats in prime locations affordable, they could come with a shorter lease compared to HDB flats in other locations. For example, this could mean, each new flat may be sold on a 75-year lease compared to the current 99-year lease. This could potentially reduce the cost of the flat by about 8%.

What we say: This is the most direct and sure-fire way to lower the price of prime location flats in the resale market, simply because flat value tends to be increasingly sensitive to lease decay after the 20-year mark of a 99-year lease, as we’ve discussed in this previous article. Furthermore, 75 years appear to be the sweet spot to optimise affordability while ensuring that flat buyers have a long enough lease to last their whole life.

However, there’s still a drawback to this measure. While it improves affordability on a quantum basis, these cheaper prime location flats will be even more appealing to profit-hungry Singaporeans looking to upgrade to a second property while retaining the prime location HDB flat for rental yield. Being cheaper, the flat will fetch an even higher rental yield than regular 99-year leasehold prime flats.

The knock-on effect is, of course, an increase in demand from opportunistic flat buyers for shorter-lease prime flats, the effect of which is high resale prices especially if rents and rental demand in the area are high.

In other words, a shorter lease will still give rise to a windfall effect in a different form: rental yield. If the government wants to counter this, the shorter-lease period can be implemented in combination with the “no renting out of whole flat” restriction.

Our verdict: A shorter lease wouldn’t work well on its own. (Sorry in advance for giving the government ideas.)

Scenario #4: Smaller Flats

What the survey says: In order to keep new flats in prime locations affordable, each type of flat could be smaller than same-type flats in other mature estates. This means an HDB 4-room flat in a prime location could be 5% smaller than a typical HDB 4-room flat in other HDB mature estates but at a similar price.

What we say: While in theory, a smaller floor area should equate to a lower price, in the real world there is a lot of evidence to the contrary. The truth is that buyers do not mind a smaller floor area, especially when it’s just a difference as unnoticeable as 5%.

And if HDB decides to take it further by reducing floor area by about 20 to 25%, then it is a question of which part of the unit the floor area will be reduced. And that in itself will invite a lot of issues.

If HDB decides to downsize a unit type by taking away the bomb shelter/service yard or making areas such as the kitchen or common toilet smaller, we foresee that such decisions will have a minimal impact on the eventual resale price because such areas of the home tend to be of lower importance among home buyers today.

On the other hand, if HDB decides to downsize a unit type by taking away space from an area that is perceived to be important to homeowners (such as the living room or master bedroom), then it will be seen as pursuing affordability at the expense of liveability, which is somewhat going against its own values and could also cause flat owners to become unsettled and hasten to sell their flat rather than giving them an incentive to stay put.

With standard 4-room flats averaging 1,000 sq ft. In theory, here’s a simple illustration of how smaller flat sizes could backfire, with standard-sized, 5% smaller, and 20% smaller flats as an example:

| Flat description | Effect among buyers | HDB’s price upon launch (hypothetical) | Open market transaction value upon MOP (hypothetical) | Profit (hypothetical) |

|---|---|---|---|---|

| Standard 1,000 sq ft 4-room flat | – | S$500,000 | S$800,000 | S$300,000 (60%) |

| 950 sq ft 4-room flat | Likely zero | S$475,000 | S$800,000 | S$325,000 (88.2%) |

| 800 sq ft 4-room flat with reduced areas in: – Bomb shelter – Service yard – Common toilet (only one toilet instead of two) – Kitchen |

No real perceived decrease in liveability | S$400,000 (adjusted proportionately according to lesser floor area) | S$700,000 | S$300,000 (75%) |

| 800 sq ft 4-room flat with reduced areas in: – Living and dining room – Master bedroom – Common bedroom |

Perceived decrease in liveability | S$400,000 (adjusted proportionately to lesser floor area) | S$650,000 | S$250,000 (62.5%) |

Our verdict: So, in reducing floor area to achieve greater affordability, HDB could be putting itself in a difficult situation: pushing out smaller and cheaper flats without compromising liveability could result in magnifying the subsequent resale windfall effect, whereas compromising on liveability would mean that HDB is acting against home buyer interest, which is a big negative.

Following the previous four scenarios meant to increase affordability, the respondent is then presented with a further four scenarios that, according to the survey, are “meant to minimise cases of large resale profits and help ensure public housing in prime locations remain affordable to subsequent buyers”.

In short, these ideas are specifically designed to limit profits:

- Capital gains tax

- Government buyback

- Recovery of Additional Subsidies Provided

- Resale proceeds to CPF Special Account

Scenario #5: Capital gains tax

What the survey says: In order to minimise large resale profits and ensure resale prices are affordable for subsequent buyers, the Government could impose a new capital gains tax. This means that owners have to pay a certain percentage (e.g. 10%) of their sales profits as tax.

What we say: This would be a radical move, as Singapore is well-known in the world for having no capital gains tax whatsoever.

If a capital gains tax is unevenly applied to an asset class (e.g. housing), it’s easy to see how this can backfire. For instance, a capital gains tax specifically targeting public housing in prime locations would simply cause owners to increase asking prices to ‘recoup’ part of the tax they have to pay.

And if demand for such flats is high, which will likely be the case, then transaction prices for these flats will average higher than if there had been no capital gains tax, defeating the whole purpose of keeping the flats affordable in the resale market and further increasing the windfall effect.

Our verdict: For a capital gains tax to work, it should be uniformly applied to all flats. (Again, apologies in advance for giving the government ideas.)

Scenario #6: Government buyback

What the survey says: In order to minimise large resale profits and ensure resale prices are affordable for subsequent buyers, owners can only sell their flats back to the Government. The Government will set the buyback prices and re-offer the flats for sale to subsequent buyers.

What we say: This will be tricky to implement. First of all, there will be question marks as to how exactly the government will compute buyback prices.

If it’s to be pegged to market value transactions, then the glaring problem is there will be no similar flats available for an accurate comparison because none of them can be transacted in the open market as per this rule—creating a Catch-22 situation.

That being said, government buybacks will mean that subsequent buyers pay lower prices for the flats, which ensures affordability throughout the flat’s lease period.

Secondly, mandating government buybacks won’t exactly curb speculation, because buyers wanting to upgrade to another property (e.g a condo unit) will want to minimise the cash outlay for the new home irrespective of the flat’s price, hence, HDB must be prepared to buy back a lot of flats when owners are looking to capitalise on good condo deals en masse in a downmarket or nascent upswing.

Faced with this, the cost and administrative burden for HDB will be massive, depending on how many flats the government has classified as buyback-only.

Also, if the government can’t clearly account to Singaporeans how buyback prices would be computed, demand for prime location flats would decrease and likely shift to the resale market. The side effect of higher resale prices elsewhere goes against the affordability objective.

Our verdict: While a “government buyback only” policy for new prime location flats would ensure affordability and limit profits throughout the flats’ lifespans, the government must be prepared to face a surge of sellers and be committed to a transparent method of determining buyback prices in order for this to be a success.

Scenario #7: Recovery of Additional Subsidies Provided

What the survey says: In order to minimise large resale profits and ensure resale prices are affordable for subsequent buyers, the Government could require owners to return any additional subsidies provided upon selling the flat.

What we say: This is a strange one, because existing rules already require flat sellers to return any grants and subsidies to their CPF account with accrued interest. This is the case for any form of housing subsidy disbursed via CPF.

For recovery in the form of cash, there’s also the resale levy, which is a significant cash lump sum payable to HDB if a seller of a subsidised flat wishes to buy another flat directly from HDB, or a new executive condo unit.

A straightforward method might be to extend the resale levy such that flat buyers upgrading to private property (while still owning the flat or within 30 months of selling the flat) are also liable to pay HDB a cash lump sum.

Such a move to extend the resale levy may be highly unpopular, but it would surely limit profits.

Our verdict: Without additional information of what the additional subsidies for new prime location HDB flats will look like, it’s hard to evaluate if this will be a good idea.

Scenario #8: Resale proceeds to CPF Special Account

What the survey says: In order to minimise large resale profits and ensure resale prices are affordable for subsequent buyers, all resale proceeds could be channelled to the owner/s’ CPF Special Account which is set aside for retirement. This means that owners do not receive their resale profits in cash immediately*.

*Neither can they use the proceeds for their next property purchase, which is what would be possible if the proceeds were channelled to the CPF Ordinary Account instead.

What we say: Although reducing the cash profits for sellers of prime location flats will curb speculation, we argue it won’t impact the pricing of these flats in the open market because we foresee that Singaporeans won’t mind complying with a mandatory rule to channel a portion of profits to the CPF Special Account (CPF-SA), especially considering the higher interest that this account generates compared to the CPF-OA.

And when you consider the goals of “fairness and equality”, channelling profits to the CPF-OA will worsen the situation in the long-run, because those who once owned prime location flats will be enjoying a higher CPF balance upon their retirement, compared to those who haven’t had the privilege or luck to do so. It’d still be a case of the haves versus have-nots.

Our verdict: This is likely to be ineffectual, for reasons mentioned above.

Finally, the survey presents three scenarios, outlining measures that could be implemented to “ensure a balanced mix of Singaporeans from different socio-economic backgrounds in prime locations”.

- Disallow renting of the whole flat

- Remove Married Child Priority Scheme

- Limiting resale buyers only to those who meet the BTO eligibility conditions

Scenario #9: Disallow renting of the whole flat

What the survey says: In order to ensure that HDB towns in prime locations have a balanced mix of Singaporeans from different socio-economic backgrounds, and to encourage homeowners to live in their own homes, owners would not be allowed to rent out the whole flat even after the Minimum Occupation Period. This means that the flat has to be occupied by its owner for the entire duration of ownership.

What we say: This is perhaps the most effective mechanism with the least possible unintended negative consequences. Disallowing rental of whole flats would prevent Singaporeans from leveraging prime location flats as cash cows for rental yield, which is an act of hoarding housing stock and depriving homebuyers of opportunities to live in prime location flats.

And because the supply of prime location flats isn’t reduced by rent-seeking behaviour and upgraders will have no option but to sell their flats, resale prices for these flats are likely to be more affordable because of consistently buoyant supply and competition among sellers.

Our verdict: This measure should take priority over the others, given how straightforward it is to implement.

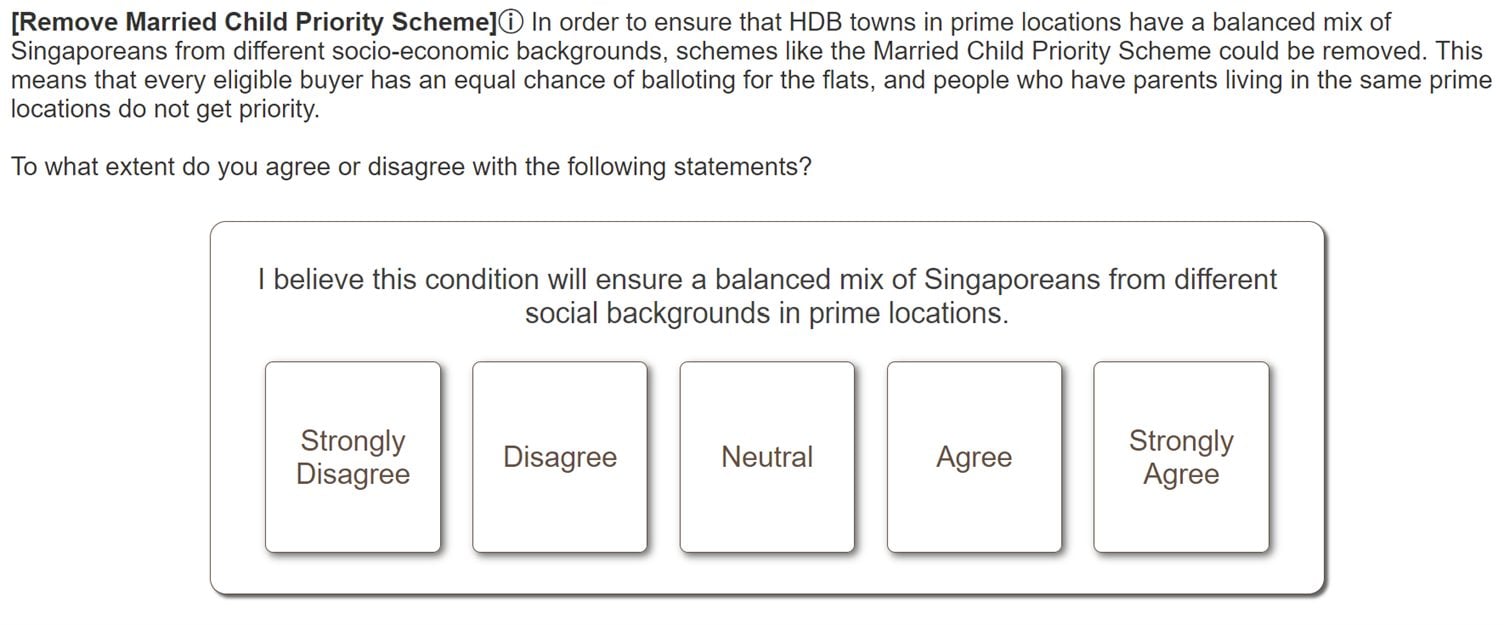

Scenario #10: Remove Married Child Priority Scheme

What the survey says: In order to ensure that HDB towns in prime locations have a balanced mix of Singaporeans from different socio-economic backgrounds, schemes like the Married Child Priority Scheme* could be removed. This means that every eligible buyer has an equal chance of balloting for the flats, and people who have parents living in the same prime locations do not get priority.

* The MCPS scheme gives priority to a married child to live with or close to the parents when they apply for a flat.

What we say: Another good suggestion because anecdotal evidence suggests that some schemes tend to distort the playing field when it comes to applying for BTO flats. Scrapping the MCPS, as well as other schemes such as the Third Child Priority Scheme, would allow everyone to have a fair shot at getting a queue number for a prime location BTO flat regardless of their background and demographics.

Our verdict: Removing schemes is one way to ensure a balanced mix of Singaporeans from different socio-economic backgrounds in prime locations. That said, HDB can also consider introducing a new scheme that gives priority for lower-income households that have failed a certain number of times in getting a BTO queue number.

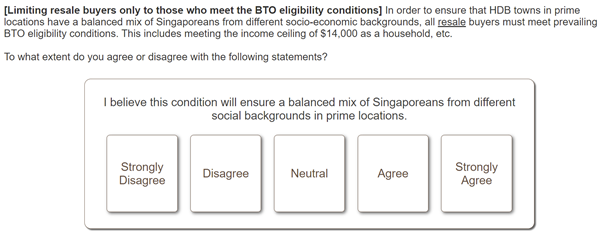

Scenario #11: Limiting resale buyers only to those who meet the BTO eligibility conditions

What the survey says: In order to ensure that HDB towns in prime locations have a balanced mix of Singaporeans from different socio-economic backgrounds, all resale buyers must meet prevailing BTO eligibility conditions. This includes meeting the income ceiling of $14,000 as a household, etc.

What we say: The goal of the government in limiting resale buyers to BTO eligibility conditions is to moderate resale prices, because of the assumption that such conditions would lower buyer demand competition for resale units while preventing well-off buyers from inflating resale prices. Theoretically, prime location HDB flats with such eligibility restrictions will be more affordable in the open market.

But there are too many variables in between that may affect the desired outcome. For instance, a Singaporean couple who exceeds the income ceiling can simply decide to earn less for a period of time to be eligible to buy the prime location flat, before increasing their income again once the flat is secured.

Also, low income doesn’t mean low wealth. A young Singaporean couple earning less than $14,000 can offer big bucks for a prime location flat if they are cash-rich or have assistance from their parents. Likewise for buyers who are near retirement or have retired.

BTO eligibility restrictions other than the income ceiling can also come into play, such as limiting buyers to first-timers and putting in place restrictions for second-timers or private property owners to purchase prime location resale flats. This will have a bigger impact on making flats more affordable and ensuring a good socio-economic demographic mix in the long run.

That being said, the government needs to recognise the possible side effects of putting restrictions in place. A negative consequence may include a more drastic fall in the value of such flats when they age, due to the effects of lease decay.

Our verdict: Applying some form of additional restrictions on the purchase of prime location flats in the resale market can help make these flats more affordable in the resale market and provide housing opportunities to demographics who need it more. However, the government should consider lifting such restrictions after a certain number of years of lease lapse (e.g. 20 or 25 years).

What else stood out from the survey

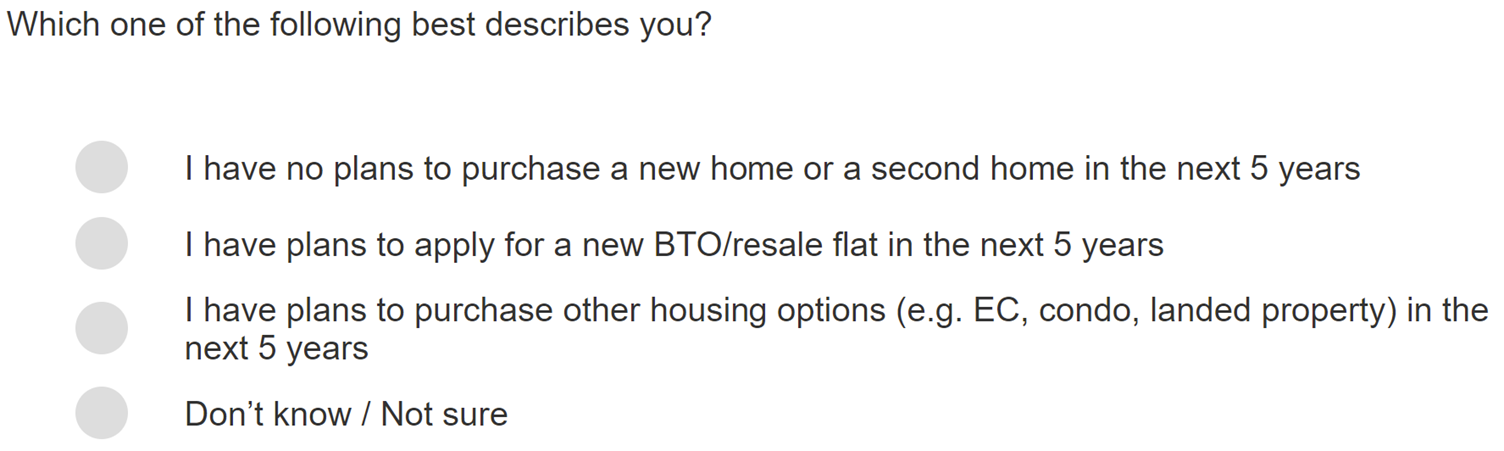

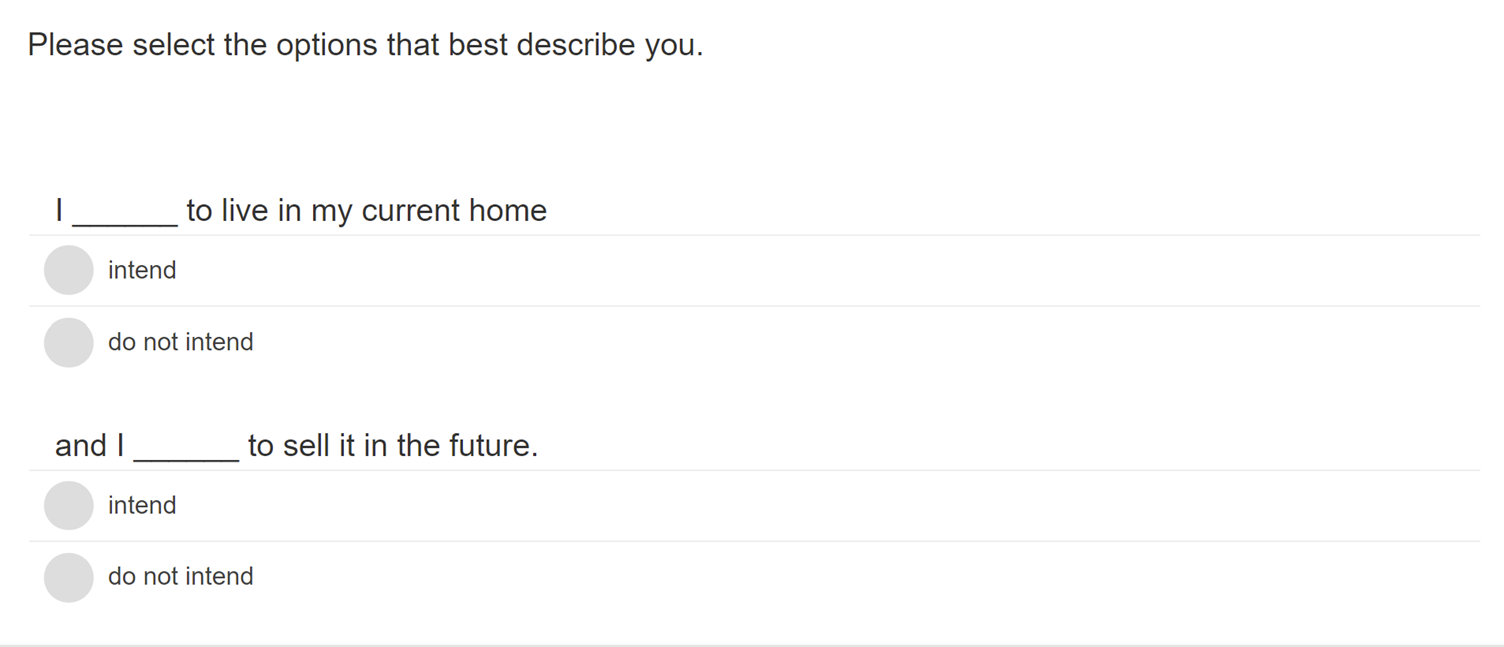

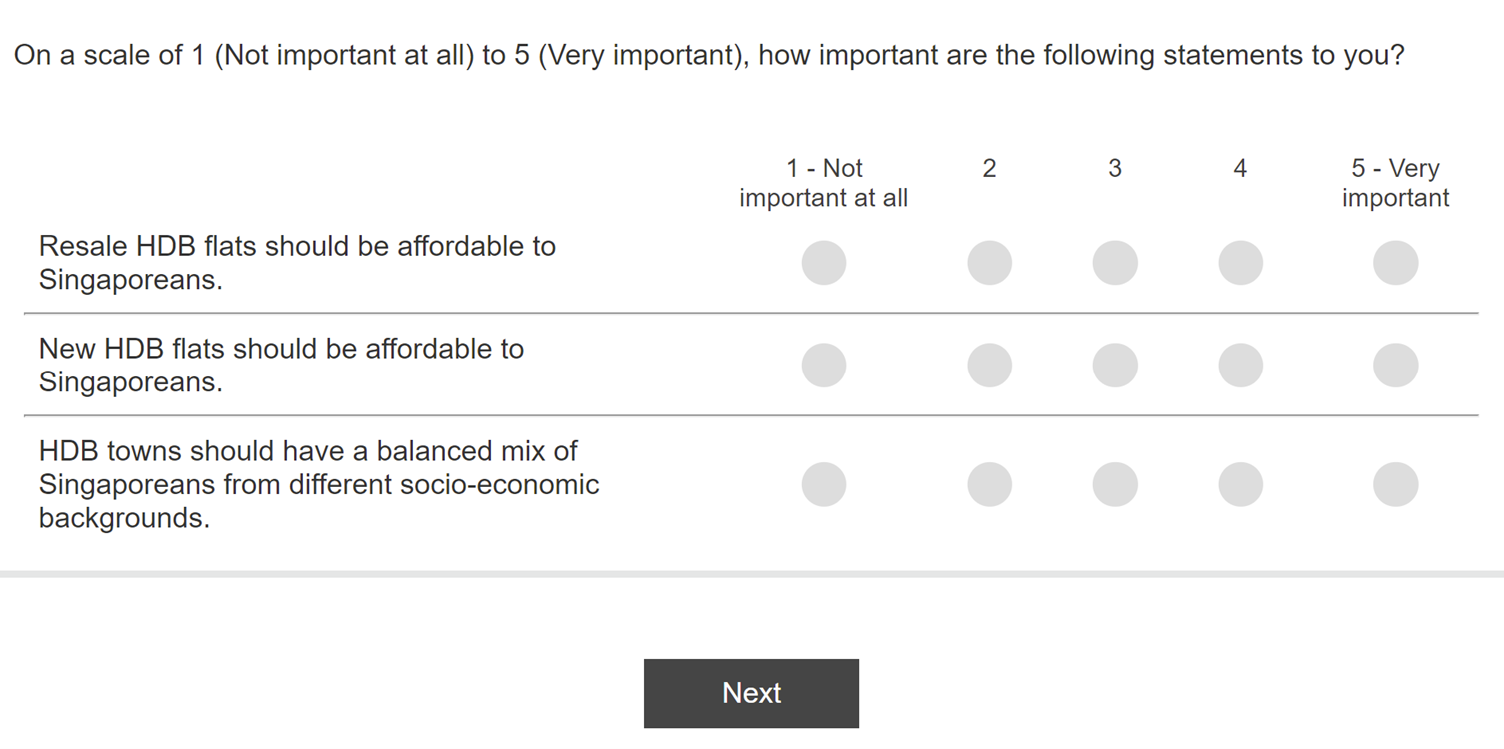

Before and after the survey actually begins, the respondent is asked several questions that tries to gauge the mindset of the respondent as a homeowner, such as:

Perhaps, the government would be more inclined to implement new measures and clawbacks if too many respondents indicate an intention to upgrade and sell their homes, especially if it’s “just to make profits”.

Respondents are also asked about their beliefs regarding the affordability of public housing prior to the actual survey:

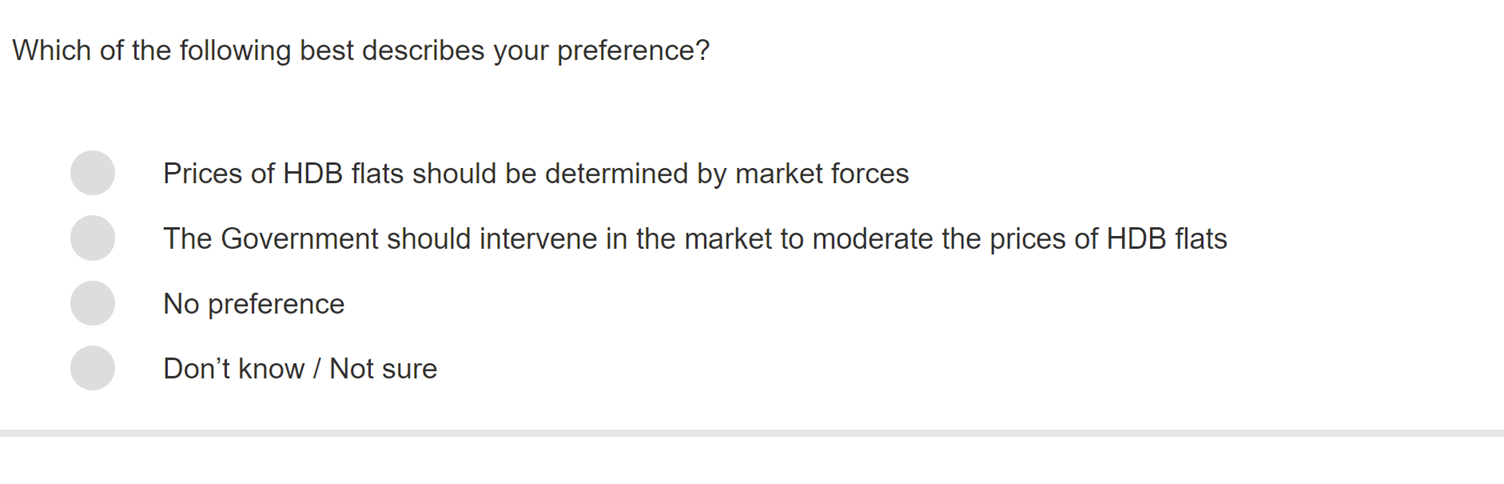

There’re also questions where respondents have to choose between two extremes:

Definition of prime locations not set in stone

From the survey, it also appears that the government is prepared to be flexible in defining what qualifies as a prime location, which could mean that the proximity to the city centre won’t be the sole factor that results in an HDB project being classified as a prime location project and subject to additional rules.

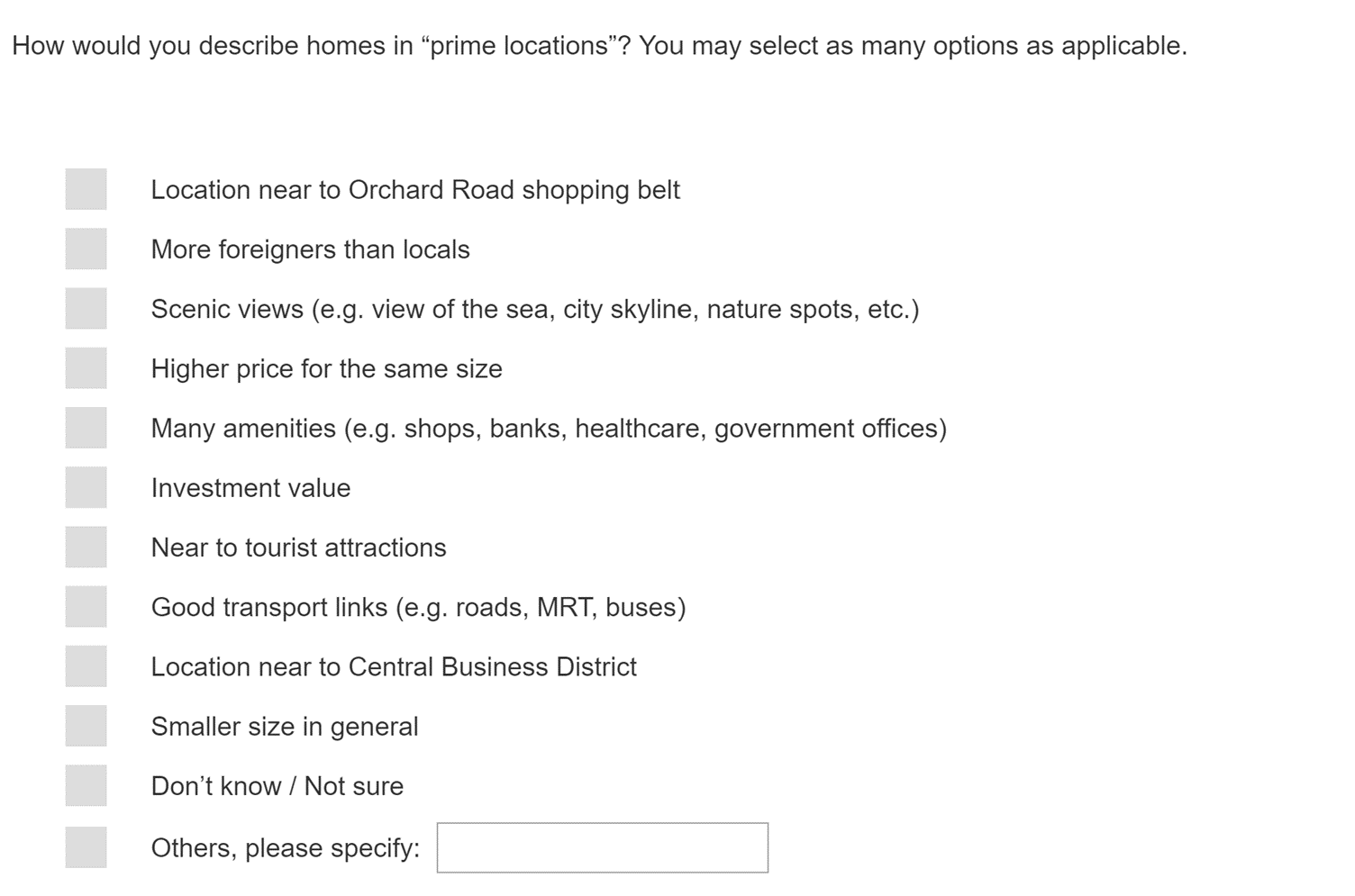

First off, the survey asked respondents how they would describe homes in prime locations:

Presumably, if enough respondents answer “smaller size in general”, HDB might prioritise lowering the size of future prime location HDB flats, which can conceivably lower the demand for such flats and hence dampening the windfall effect.

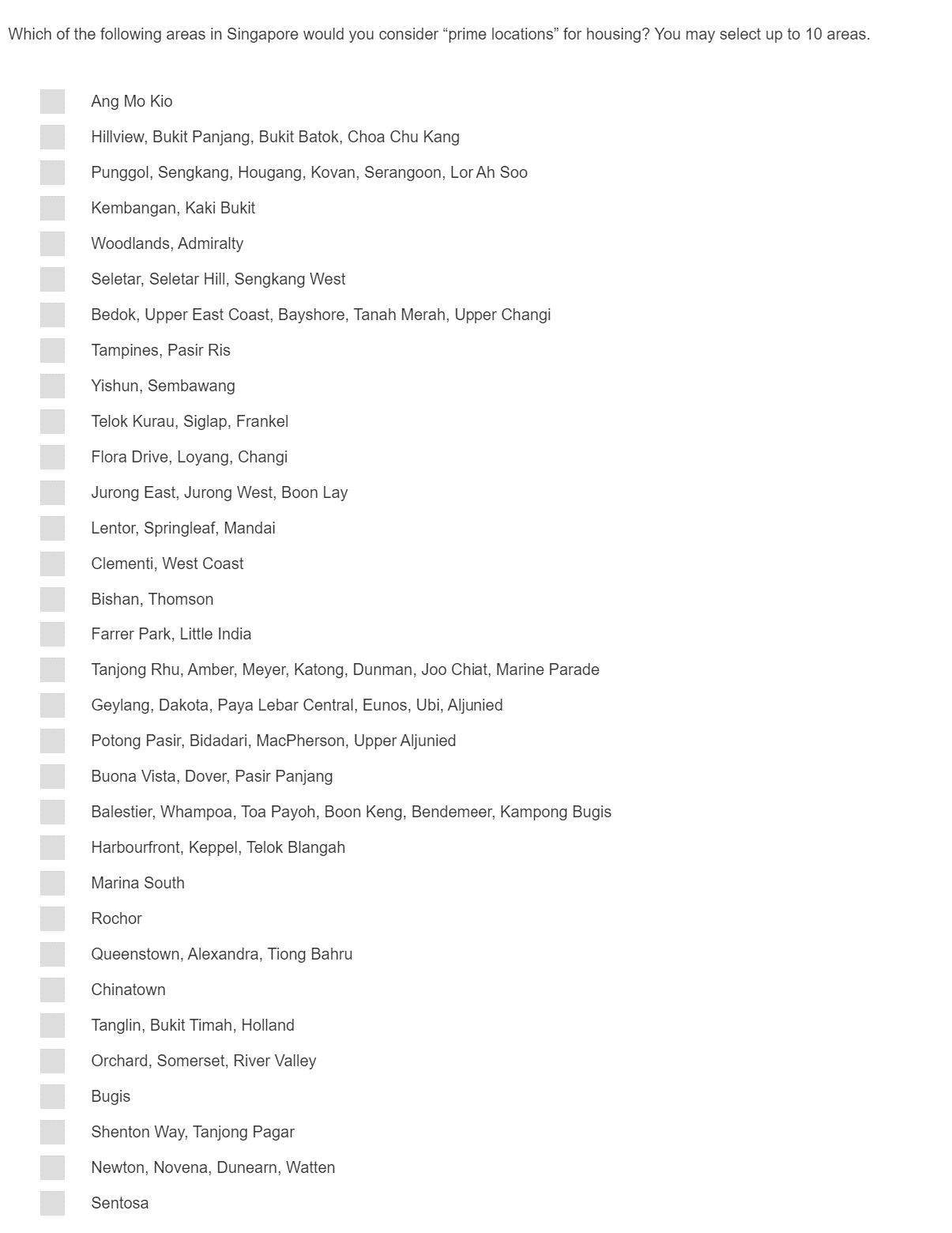

Secondly, respondents are asked which specific areas they would consider as prime locations. Even locations that are remote, such as Seletar, are included in the list:

Admittedly, things can get quite messy. Something as subjective as ‘a good view’ can determine the prime location status of a flat, whereas enough Singaporeans might consider Tampines as a prime location when it clearly isn’t from a real estate and land value point-of-view.

It’s also conceivable that an HDB flat might eventually be considered a “prime location” if it’s located near to an MRT station, even if it’s at a non-central location such as Tengah.

So, a real concern from these questions is whether the government will eventually arbitrarily assign “prime location” to HDB flats without a transparent and well-defined system in place.

Hopefully, the ministry takes responses from the general public with a pinch of salt and that common sense and restraint will prevail when it comes to labelling HDB projects as “prime location” flats. For instance, the fact that a Clementi resale flat has attained million-dollar status shouldn’t cause a knee-jerk reaction in classifying all new Clementi flats as prime location flats.

The point is that to ensure fairness and consistency, the government should use fixed and transparent criteria to determine the classification of prime location flats in the future, such as absolute distance from the border of the CBD.

How should the government regulate prime location HDB flats?

Looking at the list of 11 scenarios/measures, there seems to be plenty of room for bad decisions to be made and very little room for effective ones. The ministry certainly knows this, and recognises that each measure has its “merits and trade-offs” and some of these trade-offs may be unexpected or end up worse than initial expectations.

And while it’s great that the government has taken the effort and initiative to solicit views and opinions from the general public, the voices from experts, data scientists, and academics in the field also need to be heard, and perhaps given more consideration, bearing in mind that the most popular decision is seldom the most effective one, and it takes one bright mind to originate an excellent idea that no one has ever thought of.

All said and done, some of us might advocate keeping things unchanged and maintain the status quo. Since non-mature-estate BTO flats are also reaping their fair share of profits, why the hate for prime location flats?

Do you have a suggestion for prime location HDB flats that the government hasn’t mentioned in their survey? Let us know in the comments below!

–

If you found this article helpful, 99.co recommends MND really wants your suggestions on public housing in prime locations like the CBD and 5 little-known condos and HDB blocks with NDP fireworks views.

Looking for a property to buy or rent? Find your dream home on Singapore’s largest property portal 99.co! If you have an interesting property-related story to share with us, drop us a message here – we’ll review it and get back to you.

The post MND survey reveals how the government could regulate prime location HDB flats appeared first on 99.co.