339 new EC units were sold in May 2021 – 4 times more than the 80 new EC units transacted in the previous month

Developer home sales volume fell by almost 30% in May 2021 compared to the previous month, on the back of limited new launches as well as the tightening of safe management measures to tackle the rising number of COVID-19 community cases. Starting from 16 May 2021, Singapore entered Phase 2 Heightened Alert, which affected developers’ launch activities and show flat turn-ups.

Developers sold 891 new private homes (excluding Executive Condos) in May 2021 – down by 29.7% from the 1,268 units transacted in the previous month. When compared to May 2020 – which was midway through the Circuit Breaker – new home sales last month were 83% higher than the 487 units transacted then.

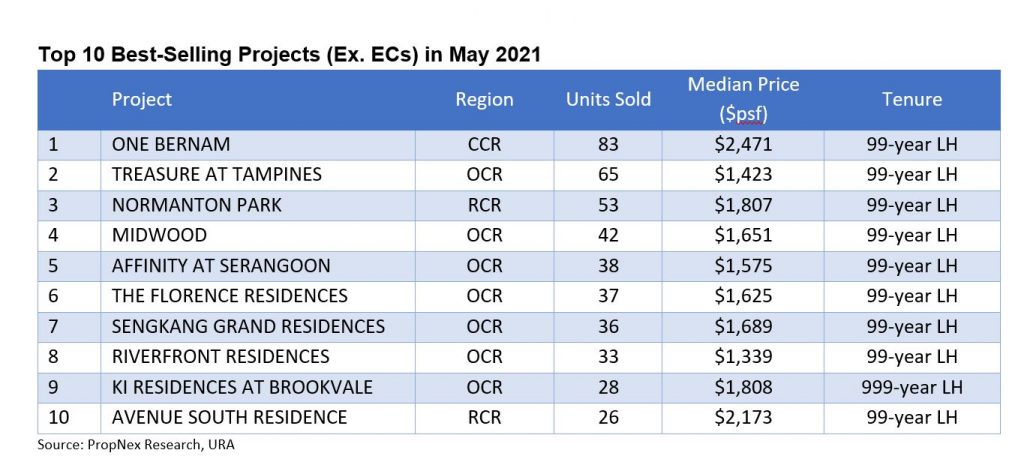

Despite a dearth of new launches in the Outside Central Region (OCR), the sub-market led May’s sales, selling a total of 401 units – boosted by sales at Treasure At Tampines (65 units). This was followed by the Rest of Central Region (RCR) and Core Central Region (CCR) where 299 and 191 new homes were transacted respectively.

The CCR featured two new launches during the month – One Bernam and Park Nova – which sold 83 and 12 units respectively. The two projects collectively accounted for about 11% of the monthly total. One Bernam, in particular, accounted for 43.5% of sales in the CCR. Meanwhile, Normanton Park remained the top-seller in the RCR, with 53 transactions.

In the Executive Condominium (EC) segment, developers sold 339 new EC units in May 2021 – more than quadrupled from the 80 new EC units transacted in the previous month.

The newly-launched Provence Residence EC, which hit the market on the 13th May weekend, was the best-selling EC project during the month, moving 229 units at a median price of $1,155 psf.

In terms of units launched, developers placed 514 new private homes (ex. ECs) on the market in May – twice lower than the 1,038 units (ex. ECs) launched in the previous month.

Ismail Gafoor, CEO of PropNex, said, “Private home sales slowed considerably in May 2021 from the previous month, and this is not entirely unexpected. We believe there were two main reasons for the weaker sales performance: a rise in COVID-19 community cases and the resulting tightening of safe management measures; as well as the relatively limited new launches in May 2021.”

“With the Phase 2 Heightened Alert in place and the cap of two visitors per group (including agent) at project sales galleries, most developers with unlaunched projects have pushed back their launch activities till after June 13, some even to July. In addition, some prospective buyers may also prefer to stay at home as much as possible to reduce transmission risk. We think these factors have had some impact on sales – albeit mitigated somewhat by the use of digital tools and virtual tours.

“In addition, compared to some of the earlier CCR launches this year, the new projects One Bernam and Park Nova have fewer units in the development, at 351 and 54 units respectively. They are also likely to appeal to different segments of the market, for instance the super posh Park Nova would be more attractive to high net worth individuals looking for a large-format up-scale home in town.

“Looking at June, we expect sales could remain muted, largely due to the absence of major launches. We anticipate that new home sales should rebound from July, where we will potentially see more projects being launched: Pasir Ris 8 and The Watergardens at Canberra in the OCR; Klimt Cairnhill and Perfect Ten in CCR; and Parc Greenwich EC. We can expect a favourable response to most of these projects, especially those in the OCR where there are signs of pent-up demand for more affordably-priced mass market units from owner-occupiers, including HDB upgraders. Based on our observations, consumer confidence is intact and home buying interest is still keen.

“For the whole of 2021, we project that new private home sales, excluding ECs, are likely to cross 10,000 units, barring any unforeseen events and new cooling measures.”

Wong Siew Ying, PropNex’s Head of Research and Content, added: “Based on the caveats lodged, buyers continued to gravitate towards larger homes amid more widespread adoption of telecommuting and flexible work arrangements. In May 2021, the number of new non-landed private homes sold (ex. ECs) that were 1,200 sq ft and above accounted for 19.4% of the sales, up from 14.7% in April and 11% in March.

“Meanwhile, Singaporeans remained the main driver of new homes sales in May 2021, accounting for about 83.2% of the non-landed new private homes transactions (ex. ECs) – slightly up from 81.3% in April 2021. The proportion of non-landed new private homes bought by foreigners inched up from 4.5% in April to 5% in May.

“We expect there should be growing interest among foreign buyers for Singapore homes, with several launches still to come in the CCR and RCR.”

Paul Ho, chief officer at iCompareLoan, said: “more people are becoming aware of EC units these days. Most Singaporeans are familiar with HDBs and private properties. But mention Executive Condo in Singapore and you will realise that less of us are familiar with them. This is partly due to the smaller quantity of Executive Condo compared to HDBs or private residential properties.”

The hybrid nature of Executive Condo also makes explaining it a tad more difficult. Executive Condo in Singapore are considered HDB flats at the point of purchase and they somewhat follow HDB financing and affordability rules. After 5 years, Executive Condominiums become quasi-private residential condominiums whereby Singaporeans and Singapore PR can buy and sell as though they are private condominiums.

After 10 years, executive condominiums will be considered full pledge private residential condominiums and can be bought and sold to Singaporeans, Singapore PR as well as foreigners.

In order to be eligible to buy an Executive Condo, the usual eligibility criteria for a HDB applies. For instance, you need to be at least age 21 and qualify under one of the 4 eligible schemes (Public Scheme, Fiancé/Fiancée Scheme, Orphans Scheme or Joint Singles Scheme). You also need to have zero interest in an overseas property

Apart from those usual eligibility criteria, there is an added income ceiling criterion. Your average gross monthly household income cannot exceed $14,000.

Getting an EC units in Singapore allows you to get the same range of amenities as a private condo. However, you do not need to pay the same price as a private condo. Instead, you get to buy it at a fraction of the cost. According to past transactions, an Executive Condo is around 20-25% cheaper than private condos of similar size and location.

Just like an HDB, an Executive Condo will be eligible for both HDB loan and private bank loan. So, you have the flexibility of choosing between forking out more down payment and borrow at a lower interest rate or pay less down payment and borrow at a relatively higher interest rate.

The post EC units saw brisk sales in May despite modest private apartment sales in same period appeared first on iCompareLoan.