As we see higher HDB resale prices over the past few quarters, cash over valuation is also back in the spotlight. While people are willing to pay more for resale flats, there’s also a growing number of people who find them becoming more unaffordable.

What is cash over valuation (COV)?

Cash over valuation, or COV in short, refers to the difference between the transacted price and the actual valuation by HDB. When the valuation is lower than the transacted price, you’ll have to pay this difference in cash. And hence the name.

Let’s say you’re buying a flat for S$600,000. If the valuation is S$550,000, you’ll have to pay the S$50,000 difference in cash.

Many years ago, buyers and sellers used valuations as a base price to negotiate the price. So this negotiated price usually exceeded the valuation. HDB also used to publish the COV, so paying the COV was commonplace.

But this also made housing become more unaffordable. It even got to a point where a maisonette in Bishan was sold for a COV of S$250,000 in 2013.

So in March 2014, HDB stopped publishing the COV. They also come up with new rules to minimise the high COV. Now, buyers and sellers have to agree on the transaction price first. Once they settle on a price and sign the Option to Purchase (OTP), they can then get a valuation report from the HDB. Since then, paying above the valuation has become rare. That is, until the past few months.

Why have people been willing to pay for COV?

Along with the robust resale market, more people are now paying the cash over valuation. These days, it can range from S$10,000 to S$50,000. Some have even been willing to pay between S$100,000 and S$200,000.

A major factor driving these COV transactions is the higher resale demand brought by the construction delay. With BTOs getting delayed for up to one year, more are opting for resale flats.

With fewer flats being launched in mature estates, people are also more willing to pay a premium for them. Likewise, rare flat types such as jumbo flats and executive apartments tend to come with higher COV.

While valuations are based on transactions in the area, they’re usually based on past data; the new transactions haven’t been recorded yet. So valuations tend not to follow the current market price. This leads to the huge gap between valuations and the actual transaction prices.

What happens if the valuation is lower than the agreed price?

As mentioned earlier, you’ll have to pay the difference in cash. But it’s not just this higher cash outlay that you’ll have to prepare.

Having a lower valuation also affects the amount of financing you can get. Since the loan-to-value limit is based on the property value, having a lower valuation means that you’ll have a lower amount you can borrow.

And if you decide to back out because of the high COV, you’ll have to forfeit the option fee. This is because you’ll need to pay this option fee when signing the OTP before getting the valuation report. The option fee is usually S$1,000 for HDB flats.

Having a COV may not be a good thing for sellers either. If the property is paid using CPF and the amount is more than the cash proceeds from selling the flat, they’ll also need to fork out cash to return their CPF money.

How to avoid cash over valuation

Technically, it’s very hard to avoid cash over valuation, since you only know the valuation of the flat after you’ve agreed on the transaction price. That is unless you back out of the deal and lose the S$1,000 option fee.

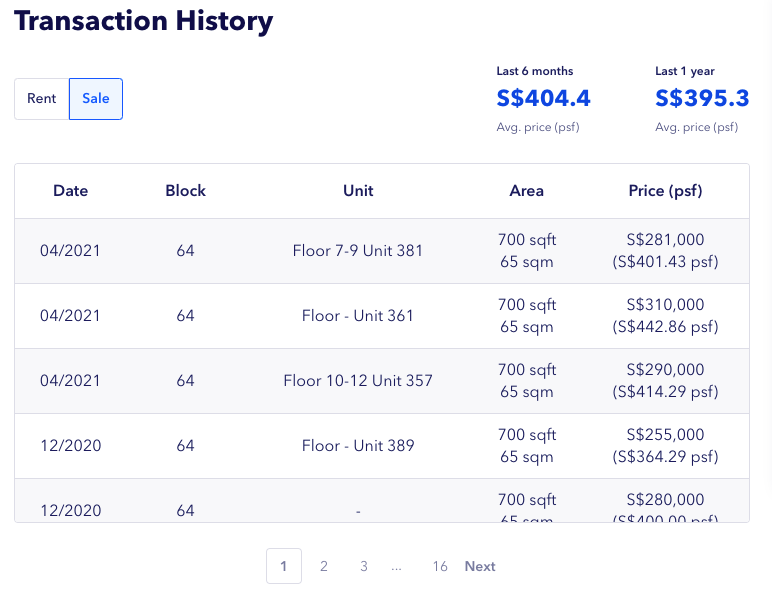

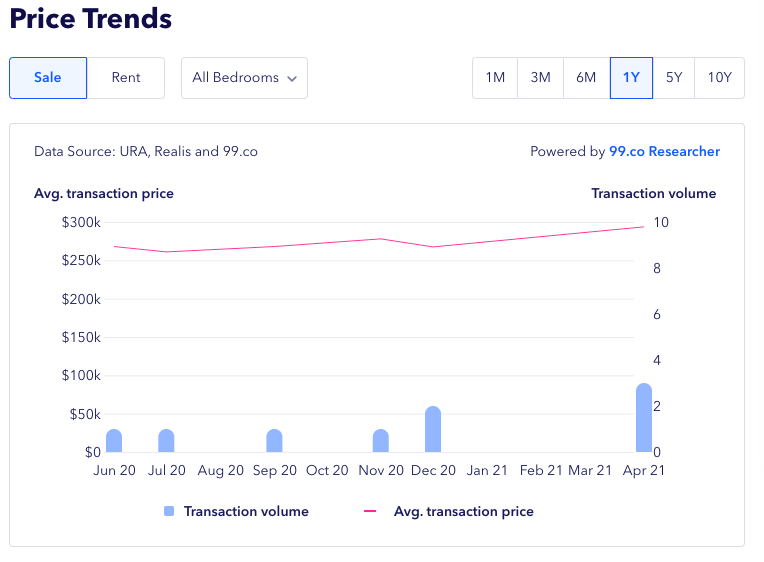

What you can do is minimise the amount of COV you can pay by doing your research. For starters, look at the past transactions around the area. HDB may have stopped publishing the COV, but they regularly publish resale transactions that you can look at.

You can also look at the transaction history and price trends of a particular block when you check out a listing of an HDB flat at 99.co.

But if you die die also want to avoid the COV, then the best way is to wait for the next BTO launch in August. On the other hand, BTOs are facing construction delays these days. Although they’re still cheaper, the wait will be longer. Alternatively, another option is to consider renting while waiting for the price to drop.

–

If you found this article helpful, 99.co recommends BTO is delayed: What are your housing options in the meantime? and Tenants, here’s an effective 7-step plan to negotiate rent in SG.

Looking for a property to buy or rent? Find your dream home on Singapore’s largest property portal 99.co! If you have an interesting property-related story to share with us, drop us a message here – we’ll review it and get back to you.

The post With the recent surge in home resale prices, is it possible to avoid high cash over valuations? appeared first on 99.co.