Renting in Singapore has been catching on amongst single millennials. With more of us staying home due to the COVID-19 pandemic, the wish for more space or privacy has fuelled the desire to move out. Shifting values and wanting to be independent are some other reasons quoted for wanting to rent.

For those who have just ventured into the working world, chances are you’re not earning big bucks. However, if you’d like to move out on your own, it’s not entirely impossible on a modest salary.

In this article, we’ll cover the steps required to rent your place, the legal documents involved and the necessary fees you have to pay. Also, we’ll throw in advice on budgeting and managing your expenses, so you’ll be better equipped to deal with renting in Singapore.

Which Area to Rent in Singapore

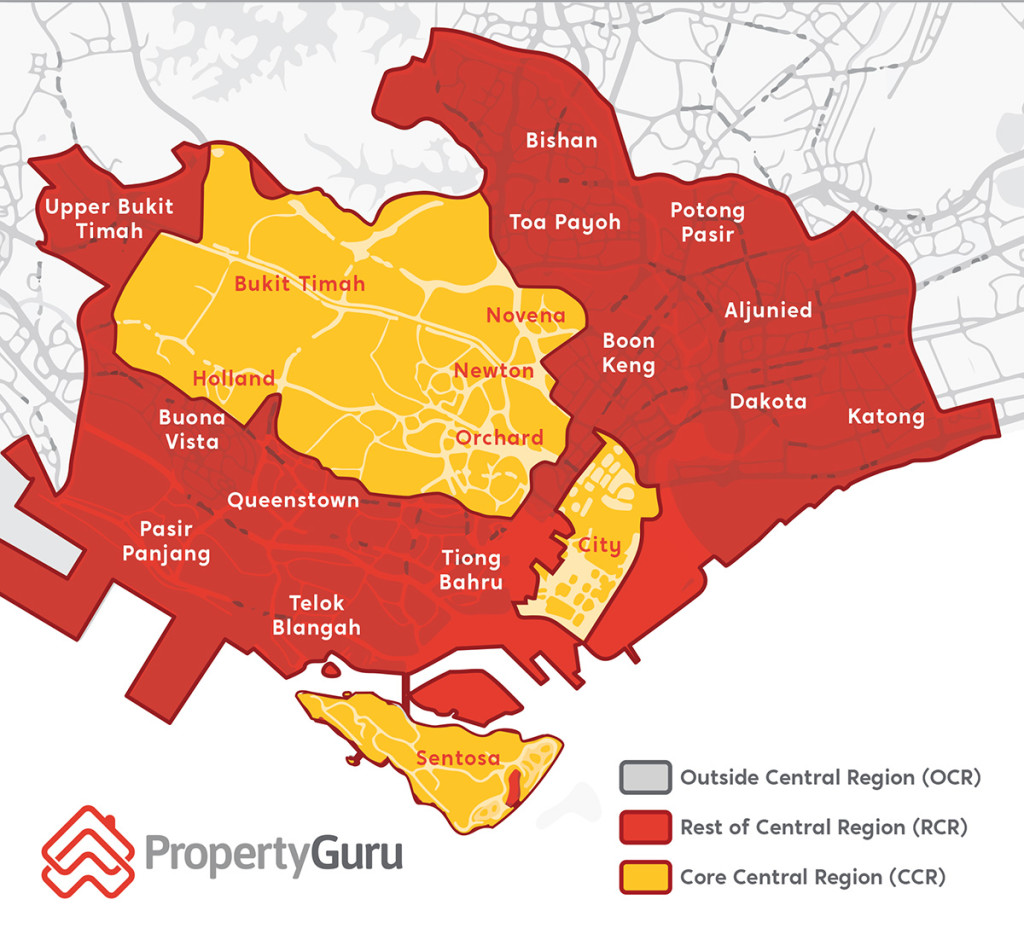

Use this Singapore District Map to learn more about the CCR, RCR and OCR by Districts

If you’re renting on a $2,500 salary, you probably can’t afford apartments in the Core Central Region (CCR) areas such as Orchard and Novena. For example, the monthly rental for this 160 sq ft studio apartment is listed at $1,599.

If that’s not something you can afford, consider the Rest of Central Region (RCR) or Outside Central Region (OCR) instead. The monthly rental for an apartment may be similar—i.e. you can still expect to spend at least $1,500—but it is cheaper per square foot, which means more space for the same price. You can also consider flat-sharing to cut costs further.

You can rent a room in city fringe areas such as District 14 (Geylang, Dakota, Paya Lebar, Eunos, Ubi, Aljunied) and District 12 (Balestier, Whampoa, Toa Payoh, Boon Keng, Bendemeer, Kampong Bugis). These areas are popular as they still afford renters a short commute to the Central Area at a more affordable price.

Mature estates such as Clementi, Jurong East, and Serangoon are worth considering too—especially for the budget-conscious. Although they are further away from the city, they are well-serviced by MRT lines and offer excellent connectivity.

How to Find a Room For Rent in Singapore

To search and set up viewings for apartments, you can connect with agents via the PropertyGuru website or scroll through PropertyGuru for-rent listings. When taking a look at your potential home, pay attention to things such as the amount of sunlight and ventilation the house receives, surrounding amenities, and proximity to parks if you like living near nature.

Hiring a Property Agent

Searching for a suitable apartment and liaising with various agents for viewings is a time-consuming process. Those who have no bandwidth to do so might want to engage a property agent through PropertyGuru. All you have to do is follow your agent’s instructions and show up to viewings.

However, engaging an agent means having to pay them a commission. While there are no hard and fast rules surrounding this amount, the unspoken standard for leases under $3,500 is to pay your agent half a month’s rent for every year of the lease. For example, if you sign a two-year lease for a room that costs $800 per month, give your agent $800.

Searching for a Place On Your Own

Should you decide to go down the DIY route, make the process easier for yourself by including the following information when contacting agents:

- Nationality

- Gender

- Number of people renting

- Date of lease commencement

- Occupation

- Length of lease

Though there are no ethnic quotas imposed on rentals, reports of racial discrimination against certain ethnicities and nationalities unfortunately still exist. It is not uncommon for agents and landlords to request a prospective tenant’s race/ethnicity during the initial screening phase.

While PropertyGuru does not allow racial discrimination on ads listed on our portal, we are unable to supervise conversations that happen offline.

Tenancy Agreement for SG Room Rental: What to Include

The Tenancy Agreement should be signed before moving in

So after several viewings, you’ve found a place to rent. To seal the deal, you have to sign a tenancy agreement. The Tenancy Agreement is a document that “covers the terms and conditions of the renting of a property, offering clauses relating to the main aspects of the tenancy to protect and balance the interest of both landlords and tenants.”

At this stage, clarify any rental clauses and matters you’re unsure of. Read our guide to understand what should be included in Rental Tenancy Agreements.

How Much to Set Aside for Rent in Singapore Before Moving In

The rule of thumb is to cap your rent at 40% of your disposable salary. For someone earning $2,500 per month, your take-home pay is $2,000 after CPF deductions. So, $800 is the maximum you should spend. Ideally, this $800 should cover wifi and utility costs ($50 to $80).

Your First Downpayment

After successfully making a bid for your house, you will be asked to transfer the landlord the good faith deposit and, if requested to, sign a Letter of Intent. This sum amounts to your first month’s downpayment. Before moving in and after signing the tenancy agreement, you’ll also have to pay a two-month deposit (which will be returned at the end of your lease) and tenancy stamp duty for rental units.

Tenancy Stamp Duty

Tenancy stamp duty is 0.4% of the total rent for the period of the lease (if the lease period is four years below), or four times the Average Annual Rent (if the lease period is more than four years). Typically, your agent or the landlord’s agent will help you process this stamp duty. If not, you can pay for it through the IRAS e-Stamping portal.

Rent Buffer and Furnishing Money

Aside from the taxes and deposit, you want to have enough for at least a three-month rent buffer should anything happen. And unless your place is already fully furnished, you’ll need cash for furniture and kitchen appliances. So be prepared to do a lot of saving up before your big move.

Assuming you intend for your monthly rent to be $800 for a two-year lease, this is how much you should have before moving out:

|

What to Pay |

Cost ($) |

|

Good Faith Deposit |

800 |

|

Two-month Deposit |

1,600 |

|

Three-month Rent Buffer |

2,400 |

|

Tenancy Stamp Duty |

76.80 |

|

Furniture, Appliances, etc. |

500 |

|

Total |

5,376.80* |

*This figure is for illustrative purposes only. The final figure may vary based on your lifestyle needs. If you engage a property agent, set aside money for agent fees (see the section below).

How Much to Spend on Rent: Expenditure Breakdown

When you’re earning $2,500 and paying rent, you have to track your money closely to make rent. An example of how you can budget your $2,000 take-home pay looks like this:

|

Item |

Cost ($) |

Percentage of Take-home Pay (%) |

|

Rent |

800 |

40 |

|

Wifi, Utilities, Handphone Bill |

150 |

7.5 |

|

Public Transport |

100 |

5 |

|

Groceries |

250 |

12.5 |

|

Eating Out |

200 |

10 |

|

Savings |

150 |

7.5 |

|

Emergency Cash |

100 |

5 |

|

Spend-however-you-want |

50 |

2.5 |

Rooms for Rent in Singapore

Still, we recognise being able to rent in Singapore as a single millennial remains a privilege; not everyone has the extra cash and can afford to move out of their parents’ house. Renting is a deeply personal choice, and you should only do it if it makes sense for you.

Ultimately, the experience of renting before purchasing a property is a great way to learn the how-tos of owning and maintaining a home. By renting, you are more likely to be prepared for homeownership and purchase a property that truly suits your needs. Happy renting!

More FAQ on Renting in Singapore

What Is the Average Singapore Rent?

Depending on the location, type of property and number of people sharing the room, rent can start from a few hundred dollars to several thousand dollars. Check out our rental listings.

Is Renting Better than Buying Singapore?

Renting and buying each has its pros and cons so learn more by reading our article on renting vs buying. Generally, renting is cheaper in the short run, but buying is more cost-effective in the long run.

Can a Foreigner Rent an Apartment in Singapore?

Yes, you can rent a private property (minimum three months; no maximum) and an HDB flat (minimum six months; maximum two to three years, depending on your country of origin).

Can You Negotiate Rent in Singapore?

Yes. If you have a longer lease and have a rapport with the landlord or their agent, the landlord might be willing to accept a lower rent price.

For more property news, resources and useful content like this article, check out PropertyGuru’s guides section.

Are you looking to buy a new home? Head to PropertyGuru to browse the top properties for sale in Singapore.

Already found a new home? Let PropertyGuru Finance’s home finance advisors help you with financing it.

This article was written by Cheryl Chiew, Digital Content Specialist for PropertyGuru. Cheryl likes bread and cats, especially when cats tuck in their limbs so they look like bread. Drop her an email that hopes to find her well at cheryl@propertyguru.com.sg.