If you are even thinking about owning a property in Singapore, you need to pay attention to SIBOR. Scan through any home loan offerings here in Singapore and you’ll likely come across packages where the interest rate is listed as “1M-SIBOR or 3M-SIBOR + x.xx%”. These are SIBOR-pegged floating-rate home loans.

Right away, you can see that an increase in the SIBOR component would also increase your monthly mortgage payment. Consider that in the context of an average home loan tenure of 30 years—it can add up to tens or even hundreds of thousands of dollars.

In this article, we will explain the following about SIBOR rate:

- What is SIBOR

- Why it’s so important (it’s far deeper than just mortgages)

- Which factors to consider when choosing SIBOR-pegged home loans.

We’ll also discuss SIBOR’s unpopular cousin, SOR rate, and the newly introduced SORA in a similar manner.

SIBOR vs SOR vs SORA (an Overview)

|

Rate |

Description |

|

SIBOR rate (Singapore Interbank Offered Rate) |

The rate that Singaporean banks can borrow money from each other via the interbank market. |

|

SOR rate (Swap Offer Rate) |

The cost of borrowing SGD if you had done so by first borrowing USD and then swapping it to SGD using a foreign exchange derivative. |

|

SORA rate (Singapore Overnight Rate Average) |

The volume-weighted average rate of unsecured overnight interbank SGD transactions brokered in Singapore. |

What is SIBOR (Singapore Interbank Offered Rate)?

SIBOR stands for the Singapore Interbank Offered Rate, and it is the rate that Singaporean banks can borrow money from each other via the interbank market. There are four SIBOR tenures: one, three, six, and twelve months.

The global banking system follows a fractional reserve model, meaning banks don’t actually have 100% of the deposits you and I put in them on hand. Most of it is already lent out as loans. So, when banks face liquidity (immediate cash) shortages—for instance, the amount of loans they must disburse that day exceeds their cash—they borrow from other banks. SIBOR is the rate at which Singaporean banks can do so.

Each business day, each of the 20 banks that form the panel of the Association of Banks in Singapore (ABS) submit a rate at which they think they could borrow funds on the interbank market. After removing the top and bottom quartiles, SIBOR is then set as the average of the remaining submissions. You can track the daily rate on the ABS site here.

What is SOR (Swap Offer Rate)?

SOR stands for the Swap Offer Rate, and explaining it is a little more complex. But to keep it simple, it is the cost of borrowing SGD if you had done so by first borrowing USD and then swapping it to SGD using a foreign exchange derivative. It is also calculated by the ABS.

Unlike SIBOR, however, for the purposes of assessing home loans, you can pretty much ignore it. While SOR was once also a popular reference rate, it has been completely phased out. Because of the USD component in its calculation, it is far more volatile compared to SIBOR—not an ideal trait for a reference rate.

SOR Rate to be Replaced by SORA (Singapore Overnight Rate Average) Rate

As such, the last SOR-pegged home loan was taken off the market in July 2017. In August 2019, the ABS announced that it would gradually shift away from using SOR as a reference rate in all markets. And in March 2020, it was announced that the financial industry broadly supports the move from SOR to SORA—the Singapore Overnight Rate Average—as a new reference rate.

This transition is necessary as the USD LIBOR, which SOR relies on, will be discontinued by end-2021.

What is SORA (Singapore Overnight Rate Average) Rate?

SORA is the volume-weighted average rate of unsecured overnight interbank SGD transactions brokered in Singapore. According to ABS, the transaction-based benchmark is commonly monitored as a reflection of daily conditions in SGD money markets and is underpinned by a deep and liquid overnight funding market, making it a suitable alternative to SOR.

SOR Rate vs SORA Rate

|

SOR rate |

SORA rate |

|

|

Definition |

Effective rate of borrowing SGD synthetically, by borrowing USD and swapping for SGD |

Average rate of unsecured overnight interbank SGD transactions brokered in Singapore |

|

Methodology and inputs |

Volume-weighted average rate of USD/SGD FX swap transactions, with USD LIBOR as an input |

Volume-weighted average rate of transactions reported by brokers in Singapore to MAS |

|

Administrator |

ABS Benchmarks Administration Co |

Monetary Authority of Singapore (MAS) |

|

Tenor |

Overnight, 1-month, 3-month, 6-month |

Overnight |

Source: ABS

Other benefits of SORA include the fact that it has been published by MAS since 1 July 2005, which means there is a long historical time series that market participants can analyse and use to model trends for risk management, asset-liability pricing and trading purposes.

Additionally, compounded SORA rates are backward-looking overnight rates, which are considered more stable compared to forward-looking term rates like SOR (and in fact, SIBOR).

Though SORA is new, banks are already launching their SORA-pegged home loans to offer homeowners more home loan choices. Homeowners can expect more options as banks start to explore new SORA-pegged home loans.

Why SIBOR, SOR and the New SORA Rates Matter

SIBOR, SOR and SORA are reference rates, and they are used to determine the final interest cost on floating rate loans. They serve as a gauge for a bank’s cost of funds, so for banks to be profitable, they must charge a spread on top of that.

SIBOR is a widely used reference rate for home loans, but also for derivatives, corporate loans, as well as government and corporate bonds. Essentially, a move in SIBOR doesn’t just affect the interest cost of home loans, but hundreds of billions more in other financial instruments as well.

Unlike SIBOR, however, for the purposes of assessing home loans, you can pretty much ignore SOR since it’s being phased out. As for SORA, Singapore is still transitioning from SOR to SORA (you can check out the road map here), and there is currently only one SORA package on the market.

Should You Choose a SORA-Pegged Home Loan?

Since there aren’t many SORA packages on the market yet, it’s hard to say. In July 2020, OCBC launched Singapore’s first SORA home loan package for buyers of completed private properties with a minimum loan size of $1 million.

OCBC’s 90-day SORA home loan uses the simple average of the daily SORA rates over the past 90 calendar days, ahead of the loan repayment period. The rate is updated monthly (instead of every three months).

with the exception of a short period in March 2020, when US made their first emergency rate cut of the year. The average difference between the rates (over the period) is 0.35%. It’s worthy to note that while SORA appears lower, the rate also appears to be more volatile.

That said, the SORA options are very limited at the moment, which is why SIBOR-pegged home loans are still worth considering.

Want to save more on your existing mortgage? Compare the best mortgage rates from DBS, Citibank, CIMB, Bank of China (BOC), Hong Leong Finance and more. Or, check out PropertyGuru Finance for more personalised advice and recommendations:

Should You Choose a SIBOR-Pegged Home Loan?

There are two components to this question. Firstly, should you choose fixed-rate or floating-rate home loans, and secondly, should you choose a SIBOR-pegged loan over other floating rate loans?

Fixed vs Floating-Rate Home Loans

In a fixed-rate loan, you lock in your interest rate for the duration of the loan—decades. This means if interest rates rise, you will benefit as you will still pay the lower rate. But if interest rates fall, you will lose out since you could have paid the lower rate. In a floating rate loan, it is the other way round.

Ultimately, there is no right or wrong answer to this question. In the corporate loans market, billion-dollar multinational corporations must routinely choose between fixed or floating rates. Sometimes their decision saves them money. Other times it is the opposite.

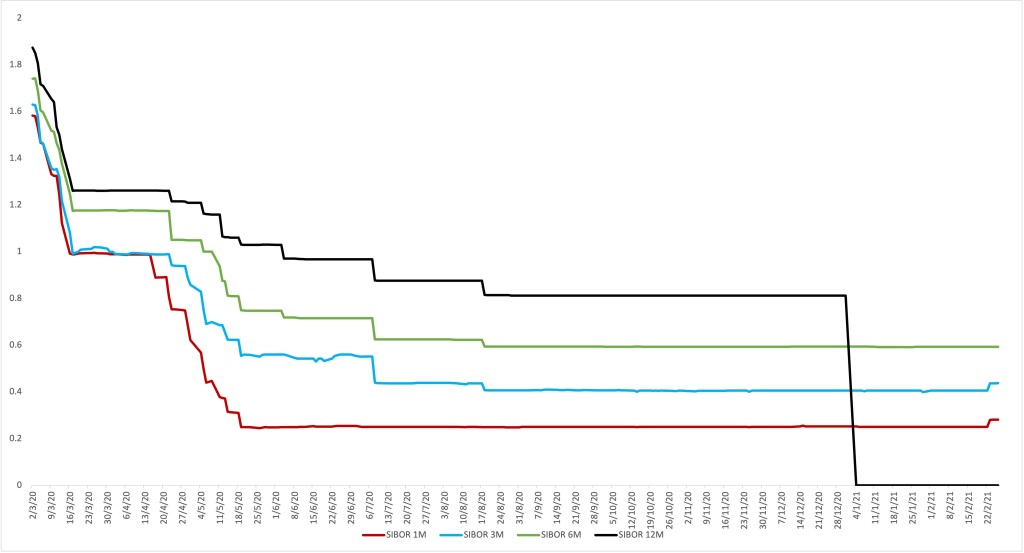

However, one thing to note is that interest rates have fallen substantially globally. This is because a common central bank response to help combat economic recessions—such as the 2008 global financial crisis and the one from COVID-19—is to slash interest rates. And SIBOR has indeed been on the decline since the COVID-19 crisis started.

Source: ABS website

Keep in mind that if you pick a 12-month SIBOR option, it’s possible to enjoy slightly more stability, like in a fixed rate loan. For example, if you choose a home loan pegged to the 12-month SIBOR, the interest rate is essentially fixed for one year. That said, most SIBOR-pegged home loans use the 3-month SIBOR as a reference rate (based on the first business day of the month).

SIBOR-Pegged Loans vs Other Floating-Rate Home Loans

Fixed rate loans aside, if you have decided upon a floating rate mortgage, then SIBOR is the most transparent option. No one bank can influence the rate. Second, because the spread each bank charges over SIBOR is clear to see, it is easy to compare home loans against one another.

The alternatives are board (interest rate fixed internally by a bank) and FD rates. The former has zero transparency as they are solely at the bank’s discretion, while FD rates vary by bank, making an apple-to-apple comparison more difficult.

That said, it is worthy to note that most banks have a floor rate that protects them in case the benchmark interest rate (SIBOR, in this case) falls too low. How this works is that if SIBOR fell below that minimum rate, your final interest rate would be based on that minimum rate plus the bank’s spread (instead of SIBOR plus the spread). Back in April 2020, CIMB revised their minimum rate for their 1M SIBOR, 3M SIBOR and 3M SOR packages from 0.1% to 0.9%. For obvious reasons, this was controversial, which is why the bank decided to delay the move until 2021.

More Home Loan Related Guides for Homeowners:

- 6 Questions to Ask Yourself Before Getting a Home Loan

- What are the Home Loan Options for HDB Properties?

- Guide to Mortgage and Housing Loans in Singapore

- Singapore Home Loans 101: Breaking Down the Basics – PropertyGuru Finance

- Housing Loans Guide: “Chim” Mortgage Jargon, Compiled and Explained for Beginners

Get the Best Home Loan Rates on PropertyGuru Finance

Financing is a major part of purchasing property, whether for investment or own-stay purposes.

At PropertyGuru Finance, we partner with all the major banks in Singapore to give you access to the best rates possible—whether SIBOR-pegged or otherwise—and limited-time bank promotions.

You can also speak to one of our Home Finance Advisors for in-depth and independent advice to help you navigate the market or read more informative articles on home financing.

More FAQs Related to SIBOR, SOR and SORA

What is SORA Rate?

The Singapore Overnight Rate Average (SORA) is the volume-weighted average rate of unsecured overnight interbank SGD transactions brokered in Singapore, between 8am to 6.15pm.

How is SIBOR Derived?

On every business day, each of the 20 banks that form the panel of the Association of Banks in Singapore (ABS) submit a rate at which they think they could borrow funds on the interbank market. After removing the top and bottom quartiles, SIBOR is then set as the average of the remaining submissions.

What is the Current SIBOR Rate?

You will be able to track the daily rate on the ABS site here. You can check the SIBOR rate and SOR rate today, be it the 1M SIBOR rate today or the 3M SIBOR rate today. You can even access the 6M SIBOR and 12M SIBOR rate.

What is 3M SIBOR?

A 3M SIBOR rate is a rate that is adjusted every three months. 1Ma, 6M and 12M SIBOR rates are adjusted every month, six months and 12 months respectively.

Should I Refinance My HDB Loan?

If you can afford it (meaning more cash on hand), you should definitely consider a bank loan as the interest accumulated will be lower. Read here to find out how you can refinance your HDB loan to a bank loan.

This article was written by Ian Lee, an ex-banker turned financial writer who hopes to use his financial background and writing skills to help raise people’s financial literacy levels – a necessity in our modern world.

For more property news, resources and useful content like this article, check out PropertyGuru’s guides section.

Are you looking to buy a new home? Head to PropertyGuru to browse the top properties for sale in Singapore.