March 26, 2021

With all the news about HDB flats selling for a million dollars over the past few years, you might be wondering if you can sell your property way above the price you bought it for. Is there a way to increase the property value, especially if it’s not in a popular location? Factors like location,...

The post 15 ways to dramatically increase the value of your property before selling it appeared first on 99.co.

Singapore homes are known to be small and expensive, so space is considered a premium. Unfortunately, landed homes and condominiums are too expensive for most. If you’re looking to upgrade to a bigger home without breaking the bank, one type of home to consider is the HDB executive maisonette.

Though they were discontinued in 1995 and thus have shorter remaining leases, executive maisonettes (or EMs) in Singapore are still highly sought-after among home buyers because of their rarity and unique attributes that set them apart from regular HDB flats. In fact, resale executive maisonettes can reach up to $1 million. An executive maisonette at Bishan Street 13 for example, was sold for $1.09 million in 2014. Recently, an executive maisonette in Toh Yi Drive was sold for $1.21 million.

Without further ado, here is what you need to know about HDB maisonette homes in Singapore and what makes them highly desirable.

What are HDB Maisonette Flats?

HDB executive maisonettes (or sometimes pronounced as mansionette) are a type of HDB flat that are no longer in production, and were replaced by the executive condominium (EC) scheme. As such, there is a limited supply of executive maisonettes left in Singapore, mostly in mature estates such as Ang Mo Kio, Bishan, Bedok, Bukit Panjang, Bukit Batok, Choa Chu Kang, Hougang, Pasir Ris, Queenstown, Serangoon and Sembawang.

How are Maisonettes Different from Regular HDB Flats?

|

Typical HDB flats |

HDB executive maisonette flats |

|

One-storey |

Two-storeys |

|

Typical size |

147 to 160 sqm, which is around 1.5 to 2 times the size of typical HDB flats |

|

No/small balcony |

Large balcony space |

|

Two bathrooms |

Up to three bathrooms |

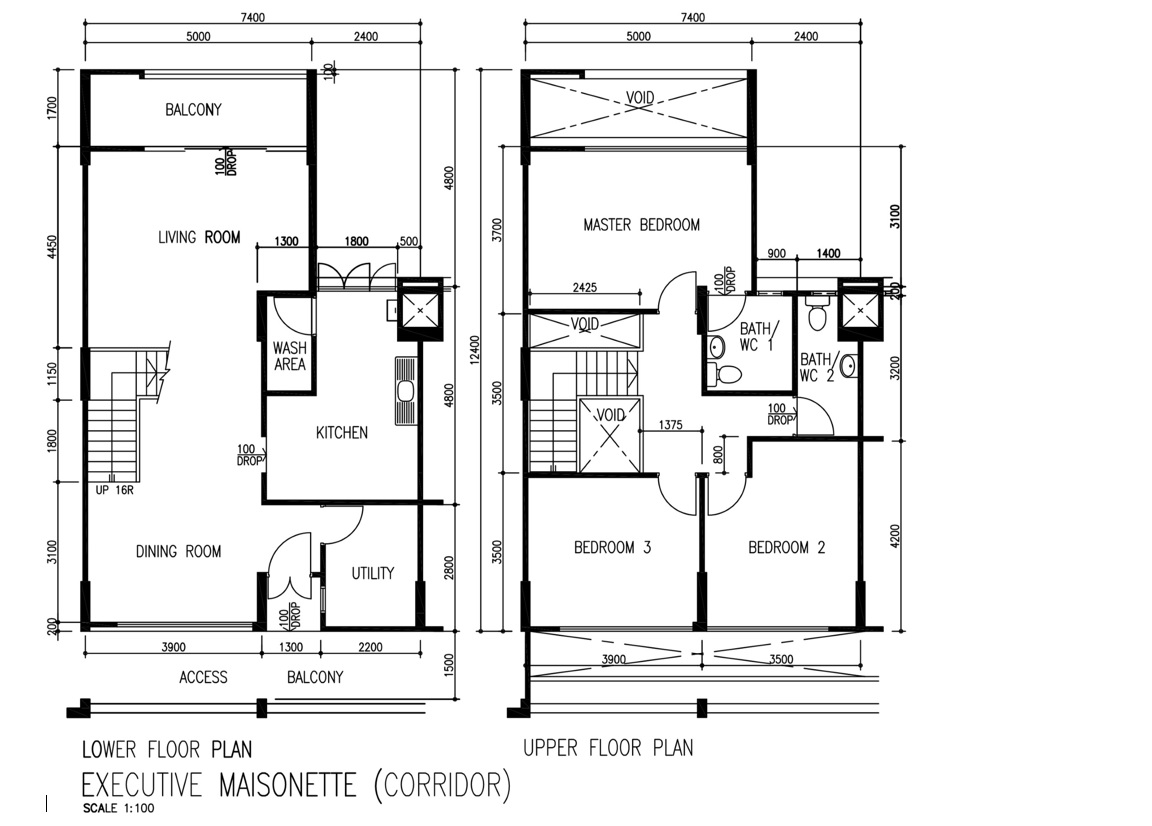

The most notable feature of executive maisonette flats is that they have two floors of space. Yup, that’s right. Executive maisonettes are essentially small, two-storey HDB flats.

The bedrooms are located on the upper floor while the living and dining area is on the lower floor. This unique design provides more privacy to the home owners, especially when there are guests around. Also, while this isn’t exactly a huge deal breaker, executive maisonettes come with three bathrooms, which is more than your typical HDB flats. They also come with balcony space.

Since HDB executive maisonette flats come with two floors, they’re also noticeably larger; executive maisonettes usually range between 1,527 to 1,700 sq ft, making them popular among couples or larger families who require more room.

There are also ‘penthouse’ maisonettes – these are executive maisonettes that are located on the highest floor, and therefore feature an open terrace design. The penthouse-like design of these flats gives an exposed view of the surroundings. These HDB maisonettes with sky terraces can be found in estates like Bishan, Pasir Ris or Hougang and can go up to 2,314 sq ft. But know that these start from $800,000, which is more expensive than some of the freehold condos in Singapore!

Executive Maisonette vs Jumbo Flats vs 3Gen Flats

But executive maisonettes aren’t the only large flat type by HDB. In fact, if you’re looking for a flat design that has more space, then you might also consider jumbo flats and 3Gen flats. But like executive maisonettes, these unique flats don’t come cheap!

Here’s a quick comparison between all the flat types:

|

Flat type |

Size |

Price |

Locations |

|

Executive maisonette |

1,527 to 2,314 sq ft |

$750,000 to $1 million |

Ang Mo Kio, Bishan, Bedok, Bukit Panjang, Bukit Batok, Choa Chu Kang, Hougang, Pasir Ris, Queenstown, Serangoon and Sembawang |

|

Jumbo flats |

1,582 to 2,142 sq ft |

$480,000 to $1 million |

Ang Mo Kio, Bishan, Bedok, Hougang, Jurong East, Pasir Ris, Tampines, Woodlands, Yishun |

|

3Gen flats |

About 1,237 sq ft |

$300,000 to $500,000 |

Punggol, Tampines, Yishun |

Looking to live in one of these spacious flat types? Find executive maisonettes, jumbo flats and 3Gen flats for sale on PropertyGuru now.

Executive Maisonette Floor Plan: Here’s What It Looks Like

Jumbo Flat Floor Plan: Here’s What It Looks Like

3Gen Flat Floor Plan: Here’s What It Looks Like

What to Consider Before Buying an Executive Maisonette

Before committing to buy an executive maisonette, ask yourself the following:

1. Do You Need the Extra Space?

An HDB maisonette might give you a lot more space and look swanky with proper interior design, but if you don’t plan to have any kids then you’ll likely have spare bedrooms that will go to waste. In this case, it might be better to buy a home according to your needs, especially when you have property tax and financial health to consider.

2. Figuring Out Your Loan

Speaking of money, figuring out how much you can borrow from HDB is crucial (i.e. loan amount). The amount you can borrow will depend on factors such as your age, income and your financial standing. Read this article for more information about HDB loans and eligibility.

If you need financial advice on your mortgage repayments and loans, get in touch with PropertyGuru’s Finance Advisors.

3. Can You Afford the Down Payment?

Remember, while the maximum loan amount you can get from HDB is 90%, you have to pay the remaining 10% via cash, CPF or both.

Say if you’re buying an executive maisonette that costs $600,000, you need to have at least $60,000 at hand. This doesn’t include other costs including renovation, which could be at least $20,000.

Of course, if money is no object to you, then you shouldn’t worry.

Recommended Article: Home Loan Downpayments: How Much Must You Pay Upfront for HDB vs Private Property?

Other FAQs About Executive Maisonettes in Singapore:

Is Executive Maisonette Better Than Other HDB Flats?

Well, it depends. Executive maisonette does hold some advantage over the typical HDB apartment such as bigger size, two-storey layout and a balcony space that is usually seen only in condos.

Is Executive Maisonette a Good Investment?

There are a few reasons that make executive maisonettes a good housing investment.

- The sheer size of it is one of them, which makes it suitable for large families.

- The two-storey layout also makes it feel as though you are staying in a landed without the large price quantum of a landed property.

- Now that executive maisonettes are no longer in production, it makes executive maisonette HDB flats a rare commodity in the HDB market. Basic economics knowledge tells us that when supply is limited and demand goes up, the price of executive maisonettes will go up.

Recommended Article: Property Investment in Singapore: How to Get Started, Calculate Rental Yield and More

What is EM HDB?

EM, or Executive Maisonette, is an HDB flat type that is no longer in production. Unlike the typical HDB flat, EM HDB flats span across two storeys with a large floor area of up to 2,615 sq ft.

What is Executive HDB Flat?

Executive HDB flat, or executive apartment, is another type of HDB flat that is not to be confused with executive maisonette. They come with an additional set of room that can either act as a study room, or an extension of the living room space. Some executive apartments also come with their own balcony space, just like executive maisonettes in Singapore.

Can Singles Buy Executive Maisonette?

Under the Single Singapore Citizen Scheme, any single above the age of 35 can purchase an executive maisonette HDB flat from the resale market. But do note that executive maisonette HDB flats are typically more expensive than the 3-room, 4-room flats because of its sheer size.

Recommended Article: Your Definitive Resource on HDB’s Housing Grants, Policies, and Programmes

Ready to Buy an Executive Maisonette?

Check out executive maisonettes for sale on PropertyGuru now. You can also check out some of these executive mansionettes that are selling for less than $650k.

For more property news, resources and useful content like this article, check out PropertyGuru’s guides section.

As the biggest financial commitment you’ll likely make, the act of buying a property involves many legal processes to ensure both the buyer and seller are well-protected throughout. In Singapore, property buyers require the services of a conveyancing lawyer to execute the legal processes of private property transactions.

The legal fees, also known as conveyancing fees, typically range from $2,500 to $5,000 and can be broken down into the following:

Types of Conveyancing Fee in Singapore

|

Type of conveyancing fees |

Whom is it payable to? |

|

Professional fees |

Lawyer |

|

Solvency/ bankruptcy searches on vendor and purchasers |

Ministry of Law |

|

Road line plan search |

INLIS via Singapore Land Authority (SLA) |

|

MCST certification |

SLA |

|

Mortgage stamping fees |

IRAS |

|

CPF lawyer fees and expenses |

CPF Board |

|

Title searches |

SLA |

|

Legal requisitions |

Seven government bodies |

|

Purchaser and bank caveat lodgement for transfer and mortgage |

SLA |

|

Transfer registration fee |

SLA |

|

Mortgage registration fees |

SLA |

|

Bank’s fee for issuance of cashier’s order |

Bank |

The above-mentioned fees are for private property transactions. For HDB flat or executive condominium (EC) purchases, HDB acts as the buyer’s legal representative, and defines its own costs and fees, which can be calculated here.

A buyer or seller may appoint someone to act on his/her behalf in a conveyancing transaction via a Power of Attorney (POA). For the uninitiated, a conveyancing transaction refers to the transfer of ownership from one party to another. This includes the granting of encumbrances (i.e. a claim on the property by another party) such as mortgages.

If you are making a conveyancing transaction through a POA, the duration of a POA typically lasts two to six years whereby an appointed individual can sign on the appointor’s behalf in a property transaction.

Option-to-Purchase (OTP) and Hiring a Conveyancing Lawyer

Suppose you’ve found a condominium unit you want to buy, obtained a home loan Approval In-Principle from the bank, and your offer has been accepted by the seller. You’ll need to:

- Enter into a valid and binding legal contract in written form with the seller. This contract, known as the Option to Purchase (OTP) gives you the exclusive rights to purchase at an agreed purchase price.

- You will need to pay pay directly to the seller 1% of the agreed upon purchase price (aka Option Fee) in exchange for the OTP.

The issuing of the OTP also means the seller ends any negotiations with other potential buyers during its 14-day validity period.

You should have a conveyancing lawyer in mind once you receive the OTP, so you can promptly engage his/her services. When you receive a quote from the law firm, be sure items such as mortgage stamping, CPF fee, Law Society fee and GST are included in the total cost (i.e. the quoted price applies to the full conveyancing transaction).

One of your lawyer’s first tasks would be to vet the OTP, which needs to be exercised within 14 days from the date of issue. In the meantime, your lawyer may assist you in getting your home loan approved. You should also receive a clear timeline with a list of deadlines up until completion.

Lodging a Caveat

When you are ready to exercise your OTP, your lawyer will proceed to lodge a caveat against the title to the property to notify the public and/or any other interested third parties that you have a valid claim or interest in the said property. In other words, a caveat prevents the property from being sold multiple times.

Upon exercising the OTP, you’ll have to pay the seller a minimum 4% of purchase price as down payment. This amount is paid to your lawyer to a conveyancing account (i.e. holding account) where it will be paid to the seller upon completion, along with other sums pertaining to the transaction. The conveyancing account can be:

- A conveyancing account specially opened by the lawyer’s law firm to receive such monies;

- The Singapore Academy of Law’s Conveyancing Money Service; or

- An escrow account jointly owned by the buyer and seller’s lawyers.

The purpose of the conveyancing account? To ensure that no one can run away with the money during the transaction, between now and the completion of the sale.

After exercising the OTP, your lawyer will proceed to send out legal requisitions to seven government arms including PUB, LTA, NEA and IRAS. This is done to ensure that the seller has a ‘good root of title’, meaning there are no outstanding issues, such as unpaid property tax, that would otherwise prevent the property’s title from being transferred without incurring damage or negative consequence for the new owner.

There are nine such requisitions sent to seven government bodies:

|

Government body |

Requisitions |

|

PUB (Water Reclamation Network) Department |

Sewage and drainage |

|

LTA (Survey and Lands Department) |

MRT works |

|

|

Street works |

|

LTA |

Road line plan |

|

Building Control Authority |

Alterations/additions made to the property |

|

National Environment Agency (Environmental Health Department) |

Outstanding issues regarding mosquito breeding, drain chokage, etc |

|

National Environment Agency (Central Building Planning Unit) |

If property is affected by the current drainage scheme |

|

Inland Revenue Authority of Singapore (IRAS) |

Outstanding property tax |

|

Urban Redevelopment Authority (URA) |

Ascertain the master plan zoning, any decision on proposals to develop the site, etc |

Only when all the requisitions have come back satisfactorily should the sale proceed to completion. Unsatisfactory requisitions may be remedied by the seller in order to facilitate the sale, and the sale may be called off by the buyer if an encumbrance cannot be released (the buyer will only lose the 1% booking fee for the OTP).

Pre-Completion

Upon exercising the OTP, you and the seller would also have agreed upon the date of completion for the sale, typically in about 10 to 12 weeks’ time. During this period, a formal valuation of the property will also be carried out by your bank’s appraiser.

If the seller is still paying mortgage for the property that you are buying, your lawyer needs to work in tandem with the seller’s lawyer to release the property from the encumbrance of the seller’s mortgage and facilitate the passing over of the property’s title from the financing institution to you, the new owner.

On your part, prepare to submit any necessary documents to your lawyer, who will liaise with the CPF Board and/or the financing institution to ascertain that your required loan amount and CPF amounts are ready for drawdown for the successful completion of the sale within the agreed time window.

The timely completion of the above steps is crucial, as a delay in the completion date can lead to unintended consequences, such as additional bank administrative fees and interest charges of 6% per annum on the sale price payable to the seller. (The reverse is applicable for the seller, who has to pay the buyer 6% per annum in interest charges on the sale price to the buyer.)

The 10- to 14-week time gap between the exercising of the OTP and completion also allows the seller to move out of the property, if they haven’t already, and to ensure that old furniture is disposed of, or agreed repairs completed. This naturally depends on the agreed sales terms – if you are purchasing the property in “as-in” condition or “vacant” possession.

Near to completion, the seller will grant vacant possession to the buyer when the property in question is in occupying condition. When that happens, you can inspect the property for any defects, and should any defect be found, you can raise it to the seller then and there for it to be rectified before completion. (Take note there’s no defects liability period for resale properties.)

If the inspection is satisfactory, your lawyer and seller’s lawyer will finalise the transaction, including the handing over of keys for completion and exchange of cashier’s orders.

Completion of Your Resale Property and Key Collection

Upon completion, you’ll receive the keys to your new home, the property’s certificate of title, as well as a transfer form for the new ownership. Your lawyer would have already followed up on transferring the remaining 95% to the seller, which includes your balance downpayment. At this point, the property transaction is legally complete.

You can then expect your lawyer to notify IRAS (and any other relevant authorities) that you’re the new owner of the property. This means that maintenance fees, property taxes and other charges associated with the property will take effect from this date of completion.

Summary of Steps Involved When You Are Buying Your Dream Property in Singapore

Let’s take a small step back to see how conveyancing fits into the steps in getting your dream home in Singapore.

|

Steps to your dream property in Singapore |

What does it involve? |

|

Finding your dream home |

Research, browse and shortlist your dream home on PropertyGuru. |

|

Offer accepted by the seller |

Get into an agreement on the selling price with the seller. |

|

Engage a conveyancing lawyer |

Hire a conveyancing lawyer to handle the property conveyancing for you. |

|

Vetting OTP and conduct background check |

Let your conveyancing lawyer vet the OTP while you conduct your own series of background checks on the seller just to make sure that there are no issues with the property or the seller |

|

Exercise the OTP |

You have 14 days from the moment the OTP is issued to exercise it. Once exercised, you are confirming that you will buy the property at the agreed price |

|

Lawyers perform checks for title deed validity |

Legal requisitions will be made with seven government bodies. Your conveyancing lawyer will also lodge a caveat on the property while helping you liaise with the bank and CPF on financing the property purchase |

|

Final inspection |

You do a final inspection of the property and ensure that all things are in place for the purchase to take place |

|

Purchase completion |

“Officially” complete the purchase of your dream home |

|

Notify IRAS |

The conveyancing lawyer will notify IRAS of the new property ownership under your name |

I’m a Seller. Are There Any Differences in the Property Conveyancing Process?

If you’re selling a property, your conveyancing lawyer will check on whether you have an outstanding mortgage and, if so, whether there is any penalty payable for early redemption under the mortgage. They should also check if CPF funds have been used, and how much needs to be repaid to your CPF account plus accrued interest.

Once that’s done, the seller’s lawyer will submit necessary notice to the bank for redemption (total discharge of mortgage) and CPF board for discharge of CPF charge. The lawyer will prepare proof that all miscellaneous charges are paid up. So this includes things like property tax, MCST charges and dues.

Seller’s lawyers will also draft an inventory list of furnishings, fixtures and furniture that would be included in the sale, to avoid misunderstanding and potential disputes. The seller’s lawyers will also inform you about your sales proceeds and answer any questions you may have along the way.

A Seller’s Sales Proceeds for a Private Property Are as Follows:

- Price sold

- Less outstanding mortgage loan plus any outstanding instalment and interest

- Less CPF used plus accrued interest

- Less property agent’s commission

- Less property tax up to the date of completion.

- Less seller stamp duty (if applicable)

- Less legal fees from lawyer acting for seller in the conveyancing

- Less maintenance and service charge payable to the MC (if applicable) up to the date of completion

Want to Know How Much You Can Borrow for Your Property Purchase?

Read our Loan-To-Value Ratio For Singapore Property: A Complete Guide, or if you need help with refinancing your home, speak to our Home Advisors at PropertyGuru Finance for free.

Other FAQs About Property Conveyancing in Singapore:

Do I Need a Conveyancer to Buy a Property?

If you are planning to buy a property, don’t skimp on the property conveyancing fees because it can get you into trouble. So, in short, the answer is yes.

RECOMMENDED ARTICLE: A Guide To The Conveyancing Process In Singapore

How Much Do Conveyancing Lawyers Charge?

For HDB, you can expect to pay up to $2,000 on average. You can also check HDB’s conveyancing fee calculator for a more accurate view of the conveyancing fees payable.

For condos, the conveyancing fee is slightly higher. You can expect the fees to be from $2,300 to $3,200.

What Are the Steps in Conveyancing?

As outlined in the article, there are four steps in property conveyancing:

- Signing the Option-to-Purchase (OTP) and hiring a conveyancing lawyer

- Lodging a caveat

- Pre-completion

- Completion of your resale property and key collection

What is HDB Conveyancing Fee?

To check HDB’s conveyancing fee, you can enquire about the amount on HDB’s legal fees enquiry facility.