Property in Singapore is a prized asset be it for your own stay or as an investment, but there’s no such thing as a free lunch! Owners have to pay their share of property tax every year, and the amount of tax depends on whether the property is owner-occupied, rented out or vacant.

How is property tax calculated?

If however, you are an inquisitive fellow and aren’t afraid of numbers, then here is how the math goes down:

The annual property tax are calculated by multiplying the Annual Value (AV) of your property by the appropriate property tax rate. In a formula it would look something like this

Annual value X Property tax rate = Property tax payable

The Annual Value (AV)

The Annual Value comprises the sum of money you could earn by renting out your property for a year, minus any furniture rental cost and general maintenance costs. (We explained Annual Value in detail in this article here.)

The annual value of a property might vary from year to year, hence so will your property taxes. It’s worth noting that when areas get new amenities and rental prices go up, so will your annual value and property tax. Similarly, when the market is down your annual value will go down too, and along with it the amount of property tax you have to pay.

Whenever your Annual Value has changed, the Inland Revenue Authority of Singapore (IRAS) will send you a notification regarding the changes that are made. Other than that, simply log on tothe IRAS My-Tax-Portal, and check up on the value at any time.

If your AV is reassessed, and you disagree with it, then you can submit an objection. You should do so within 30 days from the date of the valuation notice. You cannot however object the tax rate itself.

If you wish to view the annual Value of a property before you buy it, and as such before you bought it, you can use the e-Valuation List; and alas, no free lunch here either, because it is $2.50 per search.

Property Tax Rate

Your tax rate is dependent on factors such as your annual value and whether you live in your property yourself. Basically, the higher the AV of your home, the higher the tax rate.

In other words, the tax rate is progressively tiered. The higher your property value, the higher your annual value would be, and so would be your tax rate.

The idea is to tax the wealthy more. Hence, properties that are not owner-occupied have a higher progressive tax rate. This is logical as those who own property they don’t live in (whether it’s rented out or vacant) are deemed to be wealthier.

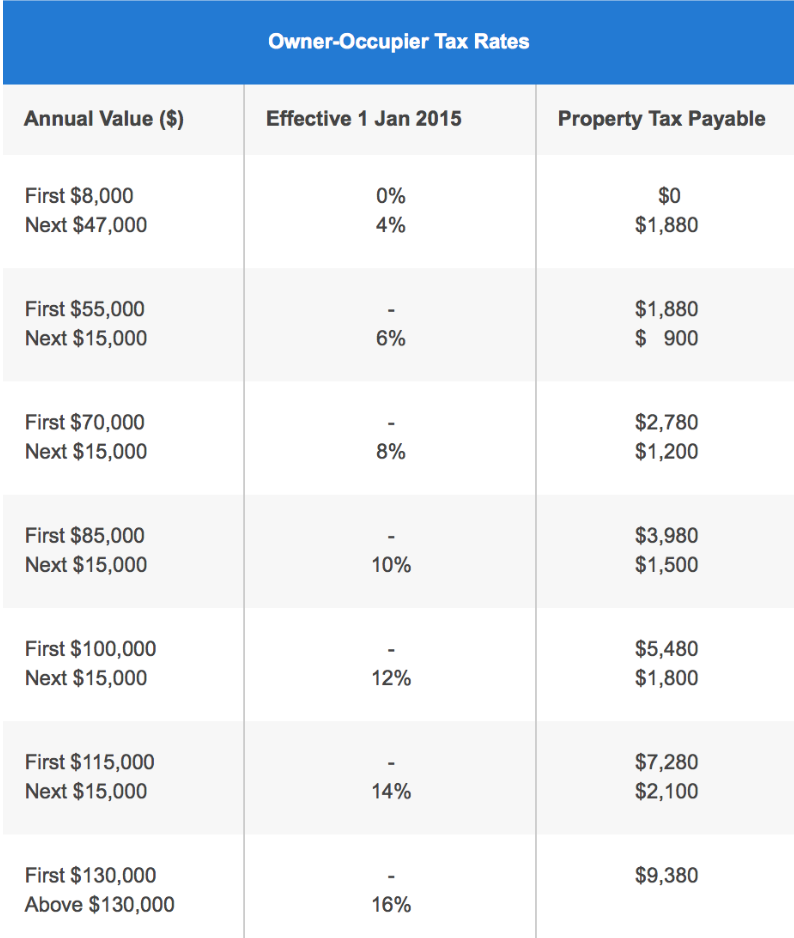

Let’s get down to the numbers. If you are an owner-occupier, the following tax rates apply to you:

Owner-occupier property tax rates range from 0 to 16%. If the above table is a bit confusing, let us explain which tax rate you should use as an owner-occupier:

If your property’s AV is $35,000

- First $8,000: 0% = $0

- Remaining AV to be considered: $27,000

- Remaining $27,000: 4% x $27,000 = $1,080

- Total property tax payable: $1,080

If your property’s AV is $105,000

- First $8,000: 0% = $0

- Remaining AV to be considered: $97,000

- Next $47,000: 4% = $1,880

- Remaining AV to be considered: $50,000

- Next $15,000: 6% = $900

- Remaining AV to be considered: $35,000

- Next $15,000: 8% = $1,200

- Remaining AV to be considered: $20,000

- Next $15,000: 10% = $1,500

- Remaining AV to be considered: $5,000

- Remaining $5,000: 12% = $600

- Total property tax payable: $1,880 + $900 + $1,200 + $1,500 + $600 = $6,080

So, based on the above examples, you’ll find that the home that has three times the AV ($105,000 versus $35,000) pays about 5.63 times more in property tax.

Owner-occupied homes with an annual value of $8,000 or below are exempted from paying property tax.

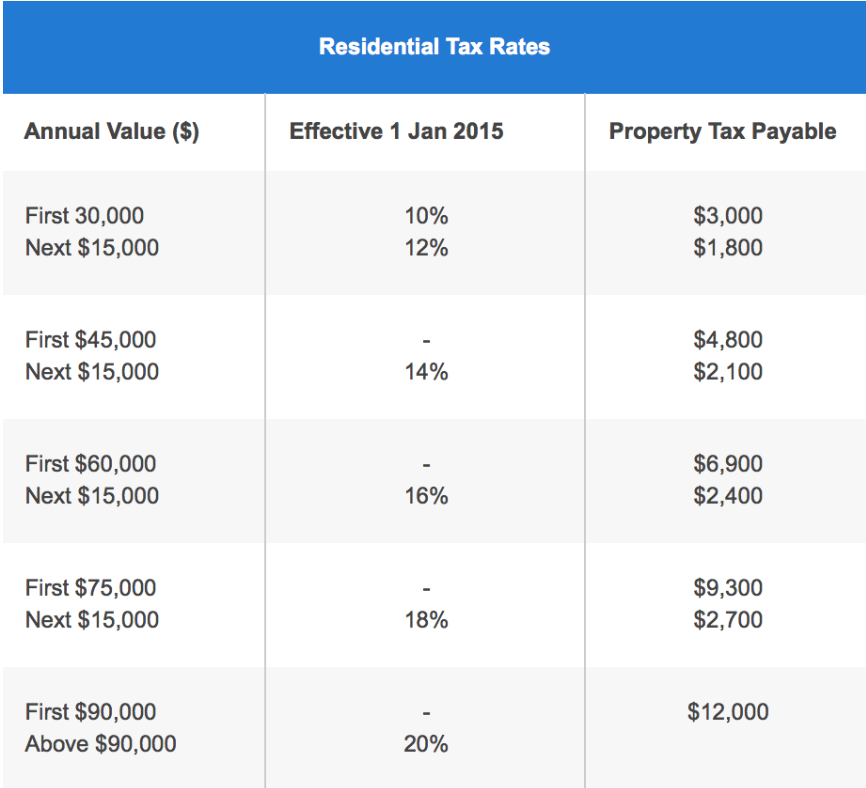

If you own property within which you do not reside yourself (be it rented out or vacant), then these higher tax rates apply to you, the non-owner-occupier:

Non-owner-occupier property tax rates range from 10 to 20%. In case you’re wondering if you can be the owner-occupier of two homes, the answer is no, you can only be listed as the owner-occupier in one home, and this is the address that is listed on the back of your NRIC.

And don’t try to outsmart IRAS. For a married couple who chooses to decouple and own two properties under individual names the owner-occupier tax rates will still only apply to ONE property.

On a more sombre note, a property owned by a person who is deceased is technically considered a non-owner-occupied property. However, IRAS will apply owner-occupier tax rates for an extended period of up to either two years from the owner’s passing or the date of transfer of the property, whichever is earlier. Further requests for extension may be submitted on appeal.

A person who owns both a HDB and a private property, and rents out the private property while still claiming that they live there as owner-occupier, may be subject to investigation and prosecution if they are found to be deliberately falsifying information to avoid a higher tax.

In any case, once you have rented out a property, IRAS will know because the stamp duty of the rental has been paid. The owner-occupier tax rates are no longer applicable for that property from the date of rental.

Exceptions to the progressive property tax

While most types of residential properties fall under these tax schemes, there are a few exceptions where instead of progressive tax, a flat tax of 10% is applied.

- Accommodation facilities within any sport and recreational club

- A Chalet

- A child care centre, a student care centre, or a kindergarten

- A Welfare home

- A hospital, hospice, place for rehabilitation, convalescence, nursing care, or any institutions aimed at similar purposes.

- A Hotel, a backpackers’ hostel, a boarding house or guest home

- A Serviced apartment

- Staff quarters that are part of any property exempted under s6(6) of the property Tax Act

- A Student’s boarding house or hostel

- A Workers’ dormitory

Eh, what if I shift house or buy a new property? Must I update IRAS?

According to IRAS, owner-occupier tax rates will automatically apply to the following:

- Buyers of HDB, DBSS Flats and Executive Condominiums (EC)

- If you buy a new or resale HDB, DBSS flat or new EC, you do not need to apply for the owner-occupier tax rates.

- Buyers of Private Residential Property (from 1 Jan 2011 onwards)

- If you are a Singapore Citizen or Singapore Permanent Resident who has purchased a new or resale private residential property, the owner-occupier tax rates will be automatically applied when you or your spouse is not currently enjoying owner-occupier tax rates on any other residential property.

If the property is not intended for owner-occupation, please notify IRAS to withdraw the owner-occupier tax rates by using the e-Service “Apply/Withdraw for Owner-Occupier Tax Rates”. Penalties may apply for homebuyers who fail to notify IRAS about the non-owner-occupier status of a property purchase.

Is there a quicker way to find out how much in property tax I have to pay?

Yes. Just point your browser to IRAS’s e-Service “View Property Dashboard“, login using your Singpass and select the intended property address you wish to check.

Are there any property tax rebates or reliefs?

While IRAS considers the lower tax rate for owner-occupiers a “rebate”, the measures to reduce property taxes at the moment are mostly for commercial properties, and have to do with addressing the impact of Covid-19.

A notable property tax rebate applies to those who have recently purchased land for the construction of an owner-occupied house. This is called the ‘Property Tax Remission for Land Under Development for an Owner-Occupied House’. More details and eligibility criteria is available on this IRAS page. A property tax remission is also available for homeowners who choose to demolish their old home to rebuild a new one.

As property tax rebates or reliefs may change regularly, check out this IRAS page for the latest updates.

When is the deadline for property tax in Singapore?

Property tax are due, every year, on 31st January.

- In the event that you are late, a 5% penalty is imposed on the unpaid tax. For any ad-hoc bills, due to for instance a new assessment or reassessment, you are given one month to settle the tax.

- In the event that you have failed to pay tax even after the penalty has been issued, the government has the power to get the tax from wherever it can; your bank account, your payroll, anything. Basically, unless you hide all your money in an old sock in the attic, they will get to your money. Your default might also dent your credit score. You won’t wanna get to that point, so better just pay your property tax on time!

One final note about property tax

Buying a property is always a bit of a leap in financial committment, and being informed about taxes payable is always vital. As can be seen from the property tax calculations above, even when you own a modest home, taxes will likely amount to about $2,000.

So, if you fail to budget for property tax when you are considering the home you can afford, you’re going to have to endure a slight shock to your wallet every year!

If you found this article helpful, 99.co recommends What is ABSD? and Stamp Duty for Property in Singapore.

Looking for a property? Find your dream home on Singapore’s largest property portal 99.co!

The post Property tax for homeowners: How much to pay + Rebates + Deadline [2021 update] appeared first on 99.co.