Loan qualification will be easier if you have a good credit score allowing you to own your dream home or start your own business

If used responsibly, credit cards are a great loan source but can cause undue hardship to those who are not aware of the costs. They are not considered to be sources of longer-term financing. However, they can be a great loan qualification tool and source for those who need money quickly and intend to repay the borrowed amount in short order.

If used responsibly, credit cards are a great loan source but can cause undue hardship to those who are not aware of the costs. They are not considered to be sources of longer-term financing. However, they can be a great loan qualification tool and source for those who need money quickly and intend to repay the borrowed amount in short order.

If an individual needs to borrow a small amount of money for a short period, a credit card (or a cash advance on a credit card) may not be a bad idea, and may be a great loan source. After all, there are no application fees (assuming you already have a card).

But use that card improperly and future loan qualification will be that much more difficult.

Credit cards can be both a boon and a great loan qualification tool, as well as a curse if you are not careful with credit card interest rates. If you’re strapped for cash and really want to make that purchase, you can charge it and pay it off later. And if you have a rewards card, it may be even better because you can collect points or cash back. But, if you’re prone to carrying a balance, you’ll have to wait longer to pay it off because of the hefty interest that some companies charge.

High credit card interest rates means carrying a balance on your card can be very costly. Pay off your credit card balance entirely. With the astronomical credit card interest rates companies charge, it simply does not make sense, if you have savings elsewhere, to carry a balance. If you can’t completely pay off your balance, at least increase your monthly payment, even a little bit. It will be more profitable in the long run.

If you get a credit card, you should plan to pay the full amount owed every month. That way you avoid the exorbitant credit card interest rates charge, and you also benefit from the grace period (which in effect enables you to borrow money for a few weeks for free).

The Four Things That May Affect Your Credit Score Without You Knowing

It’s a number that indicates how likely an individual is to repay his or her debt. Having a good credit score will make it easier for you to obtain credit by loan qualification, allowing you to own your dream home or start your own business.

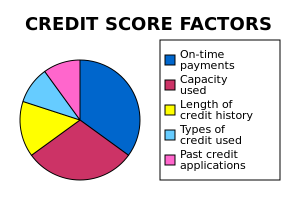

You would probably know that failing to make your payment on time or defaulting on a bad debt is a big no-no when it comes to keeping a good credit score. However, there are many other factors which you might not know that can hurt your credit. Here are four things for you to look out for!

- Not using credit at all

Not using credit cards at all may seem to be a good way to keep yourself out of debt, and by doing so you would probably be thinking that you will have scored that perfect credit score.

However, it does not work that way. There needs to be sufficient credit activity in your credit file in order to have a credit score. If there’s insufficient credit activity, it would be unable to derive a score and you would see a non-scored risk grade of CX in your Credit Bureau Singapore (CBS) credit report instead.

Keep your credit active. Use your card, but in moderation. Over time, the good payment records will help you build up and boost your credit score. - Closing down old credit accounts

With so many credit cards offerings in the market these days, you may start finding your old credit cards to be unattractive and be tempted to terminate them. However, these old credit accounts could actually be helping your credit scores. They provide data on how long you have been using credit, and how often you have paid your bills on time. By closing off your old credit accounts and leaving only your new ones open, it could affect the age of your credit history and result in an immature credit history. This generally indicates credit risk uncertainty to the lenders and may eventually affect your credit score. Keep at least one or two old credit accounts open and active, and maintain good payment history with them. Establishing a healthy age of credit history will help you when lenders assess your credit risk. - Making minimum payment only

Many may think that as long as they make the minimum payment stated on their credit cards statements on time, it will still be deemed as a good payment record. That is hardly the case. On top of the hefty interest charges the rollover balance will incur, the payment pattern of whether a full payment has been made for your credit card monthly is reflected in your credit report too. Payment history is an important factor in determining your creditworthiness. Hence, strive to make the payment not only on time, but also in full. - Identity theft

Identity theft is the fraudulent practice of using someone else’s identity, usually as a method to gain a financial advantage or obtain credit and other benefits. With the widespread use of internet and advanced technology nowadays, identity theft is a growing threat throughout the world. Increasingly sophisticated and unpredictable methods are created and used to steal valuable personal information, such as phishing and mail theft. Stolen personal information is most often used to perform credit fraud, which involves using the victim’s personal information to access credit in his or her name. It can be in the form of making unwanted purchases to opening fraudulent credit accounts. Credit fraud may not only hurt you financially but also destroy the reputation you have built with banks and lenders. Hence, it is important to be alert and discover identity theft early before it causes major damage to your credit score.

The post Loan qualifications can be hurt by your credit score appeared first on iCompareLoan Resources.