For the whole of 2020, HDB resale prices climbed by 4.8%, posting the largest annual price growth since 2012

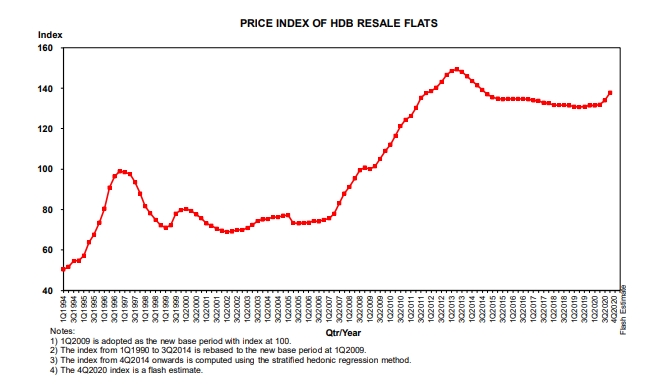

Housing and Development Board’s (HDB) flash estimate of the 4th Quarter 2020 Resale Price Index (RPI) is 137.8, an increase of 2.9% over that in 3rd Quarter 2020. Based on the flash estimate, HDB resale prices have risen 4.8% for the whole year of 2020.

The RPI provides information on the general price movements in the resale public housing market. The transacted prices of individual flats (by block and flat type) can be found via the e-services on HDB InfoWEB.

HDB resale prices climbed by 4.8% in 2020

Commenting on the flash estimate released which showed that HDB resale prices rose by 2.9% in Q4 2020, PropNex noted that this is the steepest quarterly increase in the HDB resale price index in over nine years, since the 3.8% price growth achieved in Q3 2011.

“For the whole of 2020, HDB resale prices climbed by 4.8%, posting the largest annual price growth since 2012, where resale flat values rose by 6.5%,” it said.

Wong Siew Ying, PropNex’s Head of Research and Content, said: “The HDB resale market continued its stunning recovery, with resale prices climbing by 2.9% in Q4 2020, according to the flash estimate from the HDB. This is the highest quarterly price growth since Q3 2011 and it has helped to push HDB resale prices up by 4.8% for the full-year 2020.”

“The increase in resale flat values in 2020 – supported by healthy owner occupier demand – marked the second straight year of price growth in the HDB resale market following the 0.1% rise in 2019. We believe HDB resale prices could see further growth of 2% to 4% in 2021, given the anticipated higher demand.

“The HDB resale volume will likely exceed 23,000 units in 2020 and we expect transactions to increase by 3% to about 24,000 units in 2021. Factors that will help to drive demand for resale flats include the affordability of resale flats (with up to $160,000 in housing grants for first-timers) and the delays in the completion of new HDB flats channeling buyers with more immediate housing needs to the resale market. In addition, with the ongoing global pandemic and macroeconomic uncertainties, some buyers may want to exercise financial prudence by opting HDB flats rather than costlier private homes.

“The HDB resale market could benefit from both the upgraders and downgraders segments – those who are upgrading to a bigger flat as the family size grows or need a more spacious home due to telecommuting arrangements. Meanwhile, some buyers may be downgrading from private residential properties to HDB flats amid the weak job market and employment outlook.

“An estimated 25,530 HDB flats could reach their 5-year Minimum Occupation Period (MOP) in 2021 and 31,325 flats in 2022 – higher than the 24,163 flats in 2020. This rising supply of flats attaining MOP will help to stimulate demand and support prices, likely helping to steer the HDB resale market toward a more positive outlook over the next two years.”

Mr Paul Ho, chief mortgage officer at iCompareLoan, said: “Although demand and HDB resale prices have been muted since new cooling measures were implemented in 2018, the market showed a renewed interest in HDB resale flats over the past few months. The recent increase in buying activities for the HDB resale flats market will bring much cheer to home owners.”

Mr Ho added, “For the buyers of HDB resale flats, this is also the best time to opt for bank loans as the interest rates are much lower than HDB loans. The key in getting the best home loans is to compare each and every mortgage carefully to see if you are getting the best deals. If buyers have no time to diligently compare rates, they should engage the services of mortgage brokers to find them the best deals. It is worth it to go this route in finding the best home loans as the services of mortgage brokers are free.”

Despite the pandemic and rising flat supply, HDB resale prices rose, stunning market watchers with its stellar performance in 2020. More flats changed hands at higher prices year-on-year as well.

OrangeTee and Tie’s head of research and consultancy Christine Sun said she expected HDB resale prices to rise another 2 to 5 per cent this year as the Singapore economy gradually recovers in the second half of 2021.

“Couples who are still doing well in their jobs may proceed with their upgrading plans, while those who are still affected by the pandemic may downgrade from private housing to HDB flats. This may result in more flats being put on the market as well as more flats changing hands in the coming months,” she said.

The long completion period for recent Build-To-Order (BTO) launches and rising private home prices may also divert some demand to the HDB resale market, she added.

A record 72 HDB resale flats were sold for over $1 million in the first 11 months of 2020. It exceeded the previous full-year record of 71 units transacted in 2018 and 64 units in 2019. This include a HDB resale flat at Pinnacle @ Duxton that was sold for a record price of $1.258 million in September last year.

The RPI for the full quarter, together with more detailed public housing data, will be released on 22 January 2021. In February 2021, HDB will also offer about 3,700 Build-To-Order (BTO) flats in Bukit Batok, Kallang Whampoa, Tengah and Toa Payoh. This includes the new Community Care Apartments in Bukit Batok.

In May 2021, HDB will offer another 3,800 BTO flats in Bukit Merah, Geylang, Tengah and Woodlands. More information on the BTO flats will be made available on the HDB InfoWEB. HDB said that given the economic uncertainty due to COVID-19, it is monitoring the housing market closely and will calibrate the supply if required.

The post HDB resale prices climbed by 4.8% in 2020 shows index appeared first on iCompareLoan Resources.