While a majority of Singaporeans say that property prices are too expensive, most still say that they have high purchasing power, based on the latest survey by PropertyGuru.

While the cooling measures of July 2018 were expected to exert a dampening influence on property prices, the majority of Singaporeans still think that properties in Singapore are priced too expensively—according to PropertyGuru’s latest Consumer Sentiment Survey conducted in the first-half of 2019.

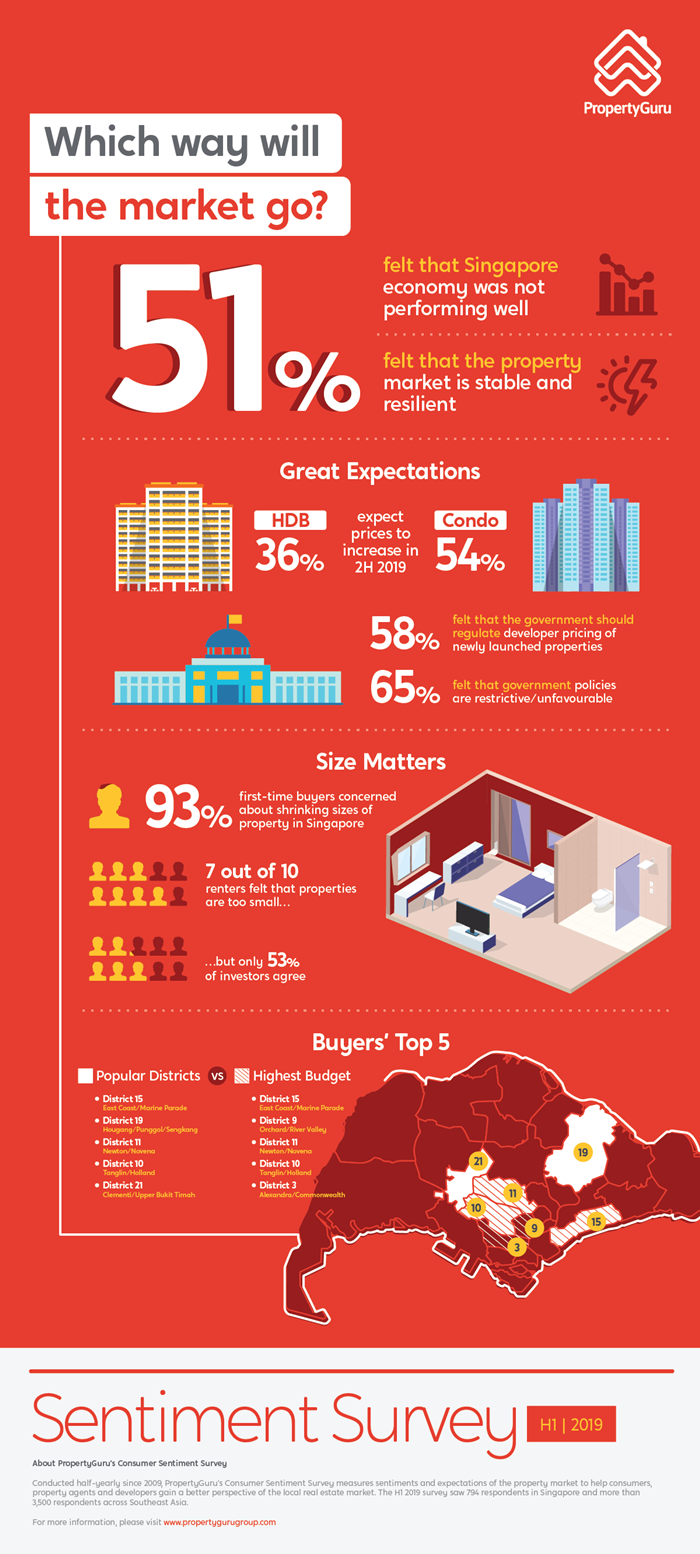

Out of the 794 respondents surveyed, roughly 8 out of 10 (82%) think property prices are too expensive/overpriced. Size was the second biggest source of dissatisfaction among Singaporeans: 67% think properties are too small.

Calling for Government intervention

In response to whether the government is doing enough to make housing more affordable, 58% of respondents felt the government could do more to regulate developer prices of new launches, compared to 49% from the previous survey. Half of the respondents also said that there should be more subsidies given to first-timers for new projects.

These responses determined the outcome of the Property Purchase Intent index for the first-half of 2019 (1H 2019). The index, which measures the likelihood of respondents buying a property in Singapore in the next six months, now stands at an all-time low, falling to 38 from 41 half a year ago.

High purchasing power indicates wait-and-see mindset

The low Purchase Intent Index score has little to do with declining purchasing power. Although the majority of those surveyed feel that property prices are expensive, 64% nonetheless have indicated an “ability to buy a property” based on their current level of income (% unchanged from 2H 2018). Only 6% felt that they were unable to afford a property in the current climate.

Based on this finding, it would appear that high buyer purchasing power, on top of perceptions of property being overpriced, have translated to a low purchase intent that could worry developers, who have little wiggle room when it comes to pricing because of the high bids placed and won before the July 2018 cooling measures were announced.

Something might have to give. “As there were 60 projects awaiting launch at the beginning of 2019, property buyers expect developers and sellers to moderate their pricing accordingly,” observes Tan Tee Khoon, Country Manager at PropertyGuru.

In lieu of any concession, the Singapore property market is clearly locked in a wait-and-see stalemate, where the buyer is clearly king.