Why is Singapore sometimes close to the top of global comparisons of housing prices when it has one of the highest rates of home ownership in the world? Are we missing something? The answer is in the detail…

By David Dickinson

It’s one thing to compare the prices of a carton of milk or gallon of petrol from country to country, but housing can be tricky as it’s not uniform.

Which geographic market should the comparison be made on, the country as a whole, just cities, or only the capital city? Obviously this is not an issue for Singapore. Should we look at one form of housing such as apartments or perhaps landed properties? Do we look at the average or median price? What should the measure be, price per square foot (psf) of land or building area, or the total price of a dwelling? The price psf will of course tell you much space you can buy, though it is not necessarily a good indicator of the costs of putting a roof over your head. Some reports might focus on user groups or segments such as expatriates or prestige property.

As housing is so important, governments around the world intervene in the market in many ways. They can control use of housing, restrict its ownership, impose more or less taxes, offer subsidies, or simply, to build them. Most countries have some form of “public housing” and Singapore is of no exception.

ALSO READ: What Does A Cutback In New Condo Supply Mean For The Market?

In Singapore, roughly 75% of the housing stock is called “public housing”. Its provision is managed by the Housing Development Board (HDB), a government agency. It is available as-of-right to Singaporeans for purchase, and grants are available to first time buyers on sliding scales up to household incomes of S$144,000 per annum. The remaining 25% or so of housing is called “private housing” which anyone can buy, except for some segments including landed properties that are also largely reserved for Singaporeans to own.

You can probably see where I am going with this. Many international comparisons of housing costs do not include “public housing”. Hence, if only private housing sales are used to calculate averages or medians in Singapore, it might not be very accurate if only a quarter of the tradable[i] stock is in the calculation.

Let’s see how things change when I include HDB in a measure of Singapore’s housing prices. Here I look at the resale prices because many new sales are “forward purchases” made several years in advance of completion. Hence, resale housing prices reflect the cost of a dwelling I can occupy today. I also use median prices, because averages will be skewed by small numbers of very high-priced properties, such as en bloc sales to developers.

Table 1: Singapore Median Resale Housing Prices by Type, 2018

*Including strata landed. Sources: URA for private housing sales including Executive Condominiums. HDB resale prices sourced via: https://data.gov.sg/

In Table 1 the median resale price across all property segments in Singapore in 2018 was S$563,000 with HDB and Executive Condominiums sales accounting for about 63% of all resale transactions in 2018. Meanwhile, the median private non-landed resale price was S$1.3 million, or more than twice the overall resale median.

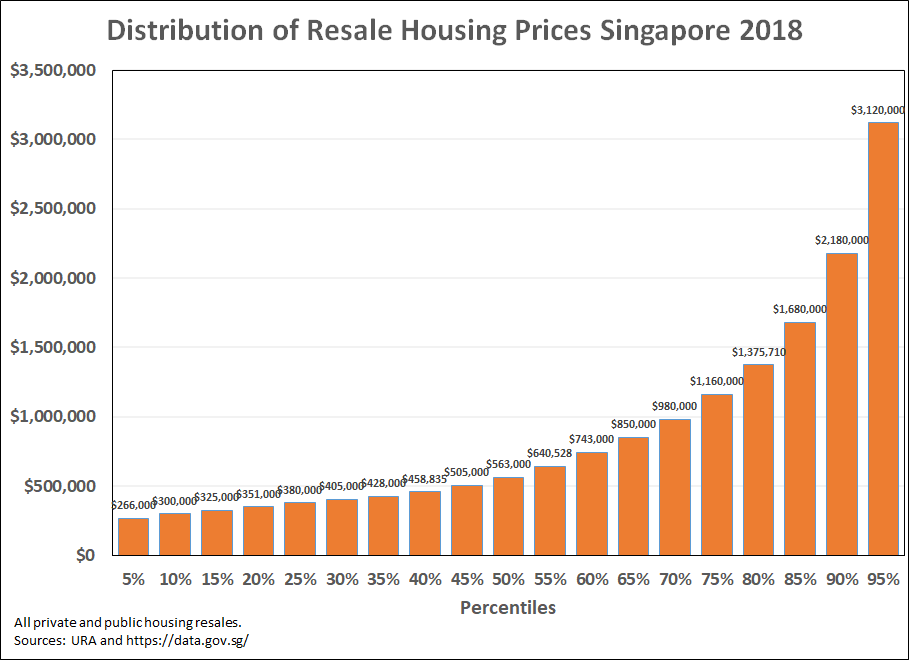

Figure 1 provides more information on the distribution of resales in 2018 and shows that a little over 70% of all sales were below S$1 million.

Therefore, in my view, excluding public housing sales leads to very biased results, and probably a conclusion that Singapore has one of the most expensive housing markets in the world.

Figure 1 – Distribution of Resale Housing Prices Singapore 2018

Figure 1

If an international comparison is to compare prices in a segment such as landed property, or on the square foot cost rather than the overall user cost of housing, then perhaps fair enough, so long as this is made clear. If the comparison is meant to only cover housing that foreigners can purchase then there may be justification to exclude public housing in Singapore, though most foreigners[ii] coming here to work choose to rent housing, and they are able to rent either public or private housing.

Some readers will no doubt question my approach; yes the public housing market is subsidised and highly regulated, and no, prices don’t reflect additional stamp duties. I could go on, but at the end of the day some expediency is necessary because it is very difficult to get a perfect apples-to-apples comparisons of the capital cost of putting a roof over your head across countries.

However, it is possible to be in the right ballpark, and some researchers do measure housing prices in Singapore more correctly than others when making international comparisons. For example, Demographia[iii] and Jones Lang Lasalle[iv] both use prices close to the median that I show here.

So, when you next read that Singapore has some of the highest housing prices in the world, make sure you read the fine print. If there isn’t any, then take the results with a large grain of salt. Till next time.

Notes:

[i] By tradable I mean much of the stock is owned by individuals and can be sold, though there can of course be restrictions and/or taxes on sales.

[ii] Here I am mostly referring to Employment Pass holders who would have the financial resources to rent or perhaps buy housing, though S-Pass holders might also rent housing.

[iii] Demographia, “Annual International Housing Affordability Survey 2018”, http://www.demographia.com/dhi2018.pdf

[iv] Jones Lang Lasalle, “The global housing market: Singapore is leading the pack”, April 2019. While the median price is not stated the report, they calculate home price to income ratios that reflect public and private housing.

Disclaimer

The views and opinions expressed in this article are those of the author and do not constitute investment or financial advice. Whilst every effort has been made to ensure that the information provided is accurate, individuals must not rely on this information to make investment or financial decisions.

The author and PropertyGuru do not give any warranty as to the accuracy, reliability or completeness of information which is contained in this article. Except insofar as any liability under statute cannot be excluded, the author, PropertyGuru and its employees do not accept any liability for any error or omission in this article, or for any resulting loss or damage suffered by any person or organisation.

Home buyers looking for Singapore Properties may like to visit our Listings, Project Reviews and Guides. Also read more about the hottest areas to live in with PropertyGuru’s AreaInsider