2020 is around the corner. Not only that: a new decade is about to begin. The PropertyGuru Property Market Outlook 2020 looks at the factors that have shaped the local real estate landscape in the past decade, and examines the state-of-play of the Singapore property market today. Bringing together data, trends and expert insights in our report, we cast an eye on the year and the decade ahead so consumers can make confident property decisions.

Key Highlights of the Singapore Property Market Outlook 2020

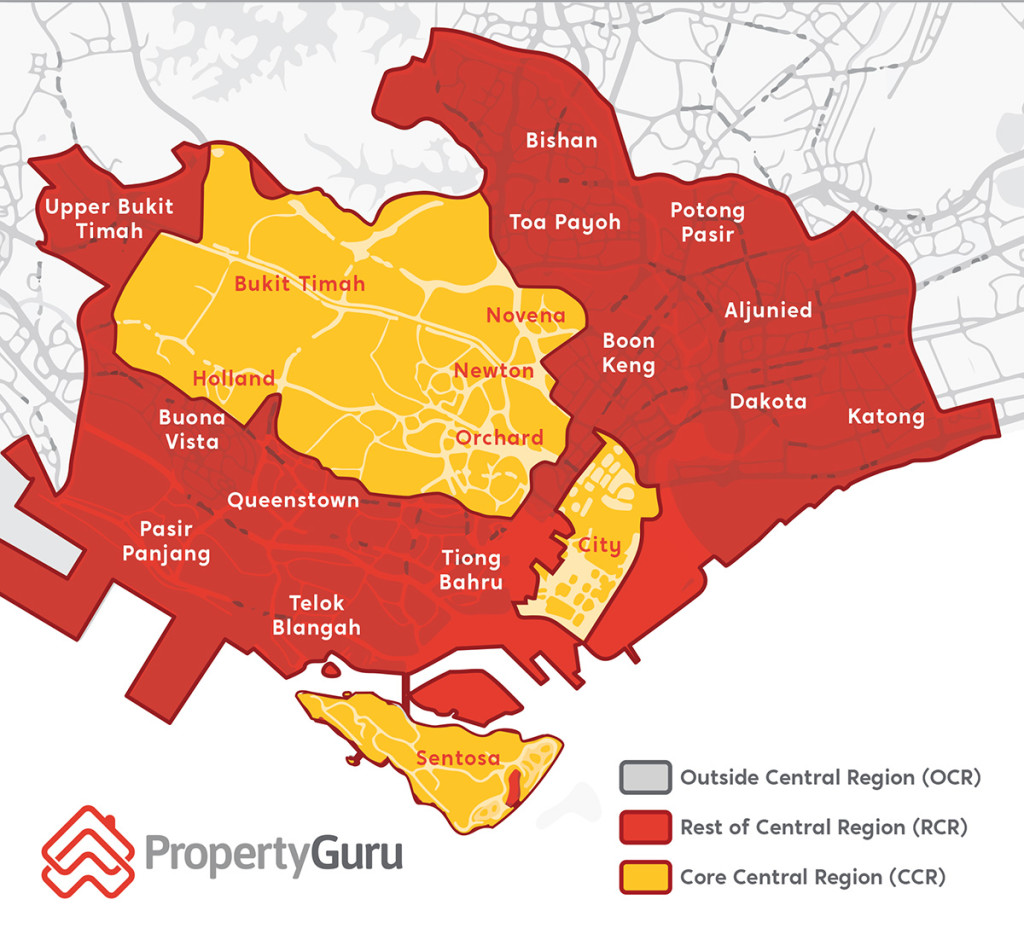

- The rise of the city fringe, known in Singapore as the Rest of Central Region (RCR), is a key theme of our Property Market Outlook. With government decentralisation and urban renewal plans, Singapore is experiencing a second wave of city-building in RCR areas such as Paya Lebar. New developments and supporting amenities create upside in property value, which is already being realised in several RCR districts. Several key trends, as described in the report, also point toward a bright future for the RCR.

RECOMMENDED ARTICLE: Defining The CCR, RCR And OCR In Singapore

- The Outside Central Region (OCR) also shows great promise, in particular locations along the Thomson-East Coast MRT line (TEL), which will open progressively from this year onwards. Of particular interest is Woodlands, which is primed for transformation with a new upcoming regional centre surrounding new TEL stations and also the much-anticipated Singapore-Johor Bahru Rapid Transit System (RTS).

- The Core Central Region (CCR), in the meanwhile, is undergoing an expansion and we foresee it will retain its prestige appeal even as upscale RCR properties enter the fray. District 7 (Bugis, Rochor, Beach Road) is in the limelight for the successive upscale residential projects launched in the area, which have boosted residential prices to a level that could see it overtake District 9 as the most expensive district in Singapore. The Outlook reveals whether the traditional prime districts of 9, 10 and 11 will hold up as quality residential offerings in the city area diversifies.

- HDB has pledged to build thousands of new flats in mature estates such as Queenstown and Bishan, the Property Market Outlook reveals how the HDB resale market is likely to be impacted.

- PropertyGuru data shows that, over the past three years, median per square foot (psf) asking prices of non-landed private property increased by 12%, while wage growth (gross monthly income from work) has only increased by 7 to 8%. That said, interest rates have been on a favourable downtrend this year, which may buoy buyer sentiment. But how will other macroeconomic concerns affect the property market?

Regardless of whether you’re a property buyer, owner, seller, landlord or renter, or just curious about the trajectory of the property market, the 20-page Singapore Property Market Outlook 2020 augments trends with data and sheds a new, analytical light on real estate in the year ahead—and beyond.