Special Advertising Feature: Starting at $6XX psf, units at CT FoodChain present an attractive value proposition for both business owners and retail investors seeking to diversify their portfolio beyond residential properties.

Words by Michelle Yee

It is not often that you come across industrial properties that offer a combination of easy accessibility, spaces that are both flexible and modular, as well as an attractive pricing threshold that makes ownership within reach for both business owners and retail investors.

Which is why, the recently-launched B2 food industry property CT FoodChain, makes such an attractive find. Developed by Chiu Teng Group, units at the 10-storey B2 food industrial development comes with a 64-year lease and are priced from an affordable $6XX psf. Purpose-built for the F&B industry, the development offers 98 units spanning between 1,700 and 3,500 sq ft and is conveniently located in the middle of the mature Pandan Food Zone in the West Region.

With that, comes an easily-accessible transportation network that includes proximity to Jurong East MRT station and the future Pandan Reservoir MRT station. For those who drive, the development is located near the West Coast Highway and Ayer Rajah Expressway (AYE), which offers convenient access across the island.

Forward-looking facilities

Specially designed to cater to the needs of those in modern food manufacturing, processing, packaging as well as commercial central kitchen operations, the development is equipped with a slew of facilities that will ensure an efficient, effective and seamless operation for businesses.

CT FoodChain offers four different types of unit configurations to cater to different needs. They are:

- The grand mezzanine

These are ground-floor units spanning between 3,186 sq ft and 3,531 sq ft. They are equipped with both a mezzanine and a 6.825m floor-to-floor height.

- The premier mezzanine

Those seeking more flexibility in terms of layout configuration may consider this unit type. Boasting spacious mezzanine layouts and open spaces (about 3,477 sq ft), these units are perfect for business owners who run large scale kitchen operations and are looking to incorporate automation and technology into their processes.

- The classic module

These units span roughly 1,765 sq ft. They offer all the essentials of a F&B industrial space and can be configured to suit specific requirements.

- The sky module

They’re roughly 1,798 sq ft in size and are built with soaring floor-to-floor heights of 6.825m and 7m respectively. This is ideal for modern distribution centres such as a central kitchen, as they typically require higher ceilings to accommodate for larger-scale equipment. Some examples include refrigerated storage, planetary cookers, blast freezers and vacuum packing machines.

All units offer individual exhausts and waste chutes and sampling sump to facilitate contamination sampling checks; all units are pre-fitted with LPG gas pipes; there are separate lifts for raw and cooked food to prevent cross-contamination; and loading and unloading bay that can accommodate 20-foot container trucks.

Plausible investment option for both business owners and investors

The government’s move to curb exuberant home prices in the previous year has tampered the prospects of residential properties as attractive investments. In a bid to cool the red-hot residential property market, Additional Buyer’s Stamp Duty (ABSD) rates have been raised for some categories of residential property purchases, while Loan-to-Value (LTV) limits on residential property purchases have been lowered, all with effect from July 6, 2018.

In response to this, some retail investors looking for alternative property types are observed to be diverting their attention to industrial properties, as they are not subjected to the latest round of purchase or sales restrictions or encumbrances such as ABSD.

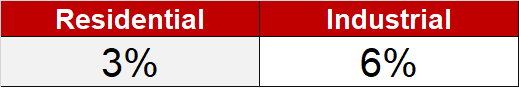

In the near-term, overall industrial capital values are expected to stay stable before picking up due to stronger rents, according to a research by Colliers international. According to the report, rents for industrial properties are expected to uptrend at an annual average of 6% between 2018 and 2023. This is compared to the average rental yield of just above slightly 3% for residential properties.

- Avg rental yields for residential and industrial properties

Source: Colliers International

It is for these reasons that properties such as CT FoodChain are especially attractive for investors, not just for their yields, but also due to their affordable pricing quantum.

To start, the average price for a unit at CT FoodChain is around $6xx psf. Units are priced between $1.5 million and $3.3 million, which is significantly lower than the other handful of food factories currently available in the market, as shown below:

- Pricing comparison for food factories currently in the market

Note:

Business 1 (B1) sites are usually intended for light and clean industrial use, while;

Business 2 (B2) sites may be used for heavy industries that have a greater environmental impact.

Why it’s a good time to invest in food kitchens now

Demand for central kitchens is becoming increasingly robust, especially at an age where F&B operators are seen to be flocking towards setting up central kitchens to deal with the overall labour crunch, as well as to minimize food preparation areas.

Popular food delivery service providers in Singapore such as Foodpanda and Deliveroo have also jumped onto the central kitchen bandwagon to better serve the needs of their customers, which makes spaces such as CT FoodChain an attractive buy, due to the rarity of such project types and the increasing demand for them.

There are currently only four to five of such assets in the market today — which makes the likes of CT FoodChain much highly sought-after. As testament to its popularity – the development was first launched on 4 July 2019, and has already sold more than half of its available units, with 47 out of 98 available units sold as of 27 August 2019.

Moving forward, demand for central kitchens in industrial properties are expected to be spurred by the rising popularity of food delivery services and e-commerce, the need for F&B operators to streamline their retail spaces, as well as the government’s push for greater productivity and innovation in Singapore’s food industry.

For more information, visit www.chiuteng.com.sg